Unprecedented

MARKETS

- Trade: The U.S. and China are expected to sign a "phase one" trade deal today. Don't anticipate any "phase two" action until after the 2020 election.

- D.C.: The House will vote today to send the articles of impeachment against President Trump to the Senate, where Majority Leader Mitch McConnell said the impeachment trial will probably begin next Tuesday.

Want Morning Brew Daily Served Fresh to Your Inbox?

Drop Your Email Below...

SUSTAINABILITY

More Like GreenRock

Yesterday, BlackRock CEO Larry Fink said in his annual letter to CEOs that he plans to make confronting climate change a key component of his firm’s strategy.

- BlackRock is the world’s biggest asset manager and banks rely on its software to assess risk.

Fink said the economic consequences of climate change pushed him to make the decision. “The evidence on climate risk is compelling investors to reassess core assumptions about modern finance,” he wrote.

What it means

Fink said BlackRock will vote against boards and management that fail to a) account for climate risks or b) make progress on sustainability plans. Other BlackRock strategies are to...

- Pressure index providers to add more sustainable benchmarks

- Double its sustainable exchange-traded funds (ETFs) to 150

- Sell $500 million worth of investments in thermal coal producers by the middle of 2020

Here’s the catch: Neither Fink nor BlackRock can really flip that switch. Two-thirds of BlackRock’s almost $7 trillion under management is held in passive funds that follow market indexes wherever they may lead.

- Market compilers like MSCI and the London Stock Exchange’s FTSE Russell unit call the shots on those funds, not BlackRock.

- So BlackRock will have to lean hard on strategy #1 if it’s going to deliver on this goal.

Zoom out: Last year, protesters tried to persuade BlackRock to divest from its fossil fuel holdings. Now, BlackRock could lead other money managers in a pivot to sustainability. Earlier this month, it joined Climate Action 100+, a group of investors committing to the environment.

This is a watershed moment

The NYT’s Andrew Ross Sorkin writes Fink’s letter “could reshape how corporate America does business.” While many companies and investors like to tout their do-goodery, no money manager in BlackRock’s league has made a statement like this.

BANKING

JPMorgan Had Its Best Year Ever

The U.S.’ largest bank reported a 21% jump in profit in Q4 to close out 2019 with a record $36.4 billion in earnings.

What worked:

- Bond trading revenue rose 86% annually (though if you remember the financial markets in Q4 2018, they were a disaster).

- Debt underwriting fees increased 11% annually thanks to an especially busy bond issuance season.

- Chase credit card customers spent 10% more than a year earlier.

What didn’t work:

So where do you go from here? CFO Jennifer Piepszak laid out a few potential growth areas for JPMorgan, such as its credit card business, investment banking in “underpenetrated” locations, and branch expansion.

Looking ahead...CEO Jamie Dimon, 63, said retirement is at least five years away. That’s the same thing he said two years ago, so don’t read too much into it.

+ While we’re here: Let’s talk about other big bank earnings. Citigroup cruised past expectations while Wells Fargo was once again hamstrung by legal costs. Bank of America and Goldman Sachs are up today.

CYBERSECURITY

It's a Party in the NSA

In its first “Patch Tuesday” of the year, Microsoft disclosed a serious flaw in some versions of its Windows operating system. Microsoft doesn’t think hackers have exploited the flaw, and it provided patches to the military and other high-value targets ahead of yesterday's release.

Now for the actual news: The National Security Agency (NSA) tipped off Microsoft.

The NSA has helped companies identify vulnerabilities before, but this is the first time it’s taken credit. Going public is the first step in building trust with cybersecurity researchers.

The backstory: Microsoft security researchers have special reason to distrust the NSA. Years ago, the agency knew about a Windows vulnerability, but instead of saying anything, it built a hacking tool (called EternalBlue) for its own purposes instead.

- In 2017, hackers exploited that vulnerability, crippling networks around the world with WannaCry ransomware. The NSA faced criticism after people found out it could have been prevented.

Later that year, the government released a blueprint for intelligence agencies to follow when they identify flaws in consumer software.

ECONOMY

Tuesdays Are the New Mondays at the EU

The EU is allocating a quarter of its budget (~$1.1 trillion) this decade to green up its economy and meet a 2050 carbon neutrality goal set by European Commission President Ursula von der Leyen.

The details:

The EU will put up half, national governments ($111+ billion) and the private sector ($333+ billion) the rest.

An $8.3 billion seed expected to generate around $111 billion will help fossil fuel-dependent countries like Poland transition to a greener economy.

Countries will submit their economic restructuring plans to the European Commission for approval and funding.

What’s not in there: Tying funding to commitments that phase out coal or support for commercial nuclear power.

Speaking of nuclear...

The U.K., France, and Germany are not happy with Iran’s repeated violations of the 2015 nuclear deal after the U.S. pulled out. Yesterday, they asked as nicely as possible for Iran to step back into the agreement’s boundaries, triggering a 30-day window for the dispute to get resolved. If it doesn’t…

The dispute heads to the UN, which could reimpose sanctions that were lifted in 2015. And that would likely be the end of the deal.

MEDIA

Disney+ Launch "Unprecedented"

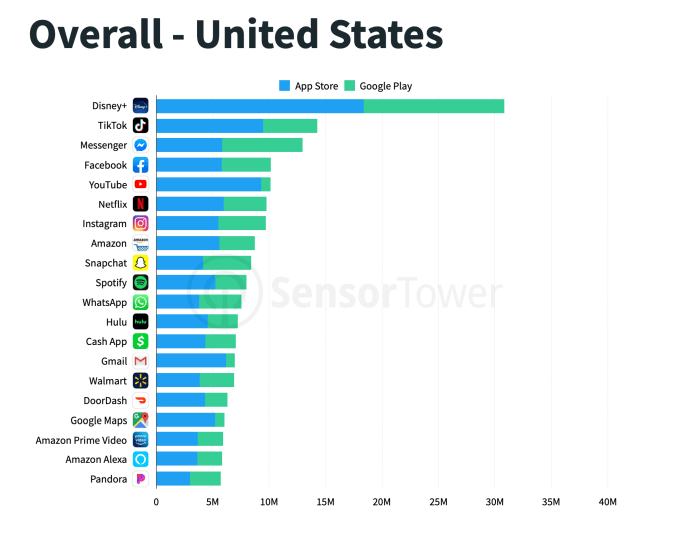

Disney’s November release of its new streaming service could be considered successful. According to new data from Sensor Tower, Disney+ topped 31 million downloads in Q4, more than double second-place TikTok.

WHAT ELSE IS BREWING

- Pinterest passed Snapchat as the third-biggest social media platform in the U.S. in 2019, per eMarketer.

- Amazon notified its third-party merchants that they can resume using FedEx's Ground network to ship Prime orders, reports the WSJ. Amazon instituted a ban almost a month ago.

- Boeing reported negative orders for 2019, meaning it had more orders canceled than placed. According to a spokesman, that hasn’t happened in at least 30 years.

- MGM Resorts will sell the MGM Grand and Mandalay Bay resorts and casinos in Las Vegas to a joint venture that includes private equity leader Blackstone.

- The WNBA and its players’ union have reached a tentative deal that would significantly boost salaries for top players.

JUST BE PATENT

IFI Claims does the gritty work of analyzing patents granted by the U.S. Patent and Trademark Office. Yesterday, it released numbers for 2019. Which company holds the top spot for patents granted? (Hint: It’s been No. 1 for the previous 27 years.)

Want Morning Brew Daily Served Fresh to Your Inbox?

Drop Your Email Below...

Just Be Patent

IBM

Dignissimos praesentium nesciunt tenetur unde aliquam quo dolore. Ducimus ad tempora laudantium cupiditate ullam quae. Aliquam omnis rem modi ut.

Vel commodi facilis quo tenetur sed ut explicabo. Ut iusto laudantium aut iste hic. Placeat et omnis enim quos veritatis aperiam. Temporibus ut est vel non consectetur quis quia. Consectetur repellendus enim similique quasi tenetur officia.

Sit quos quia sint provident dolores. Nemo veniam aperiam ducimus adipisci similique reiciendis. Officiis accusantium ut similique quisquam quo iste eveniet. Veritatis dolorum laborum voluptatem facilis sunt. Ut quis sed veritatis fugiat. Quasi velit quia sint voluptate ut dolorem quaerat. Quis eaque accusantium error nostrum exercitationem voluptas dolor.

Odio et commodi molestiae ut praesentium minus libero. Animi dolor odio asperiores soluta. Dolorem fugiat et excepturi eaque odit.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...