WSO CDO Quarterly Update: Q2-2011

Our Lending Club CDO had another good quarter without a single late payment (and no defaults, obviously). I've posted the actual results after the jump, but in a nutshell we're making a steady 11.87% and we've collected a little over $14 in interest on our initial $250 investment over the past six months.

Here's where things get interesting. Outside the WSO CDO, I actually have a good deal more invested with Lending Club, and I buy a few more notes each week. I'm pretty hands-on with the portfolio, because I know defaults can kill your NAR (Net Annual Return) pretty quickly. So during the past quarter, I had my first loan go late on a payment.

Before I go into what I did, let me explain a couple things about how Lending Club has changed over the past six months to a year. First and foremost, the number of investors has exploded. Where it used to take up to a week for a loan to get funded, it is now rare to see a loan take more than a day to be fully subscribed. You could look at this as a negative, because there's a great deal more competition for the best loans, but overall it's a good thing because the market has become much more liquid.

That liquidity has obviously spilled over into the secondary market for these loans as well. Before, you could list one of your notes for sale on the secondary market and you'd get an email six weeks later informing you that your listing had expired. That isn't the case any longer.

I had a note go into the Grace Period on me this past quarter. That means that for some reason the monthly payment wasn't made on time. I think there's a 10-day grace period before the borrower is charged a late fee, but I wasn't taking any chances.

It is my somewhat paranoid view that everyone who borrows from me is a sketchy individual looking to screw unwary investors. Now, I know that isn't even close to reality, but it's that kind of thinking that has kept me in the black year after year. So I'm gonna bail on a borrower at the first sign of trouble.

In this case, as soon as the note went into the grace period I listed it for sale on the secondary market. I'd paid $25 for the note and had received two payments totaling $1.68. At the time of the initial investment, the note was graded C-3 and was paying 13.43%. I knew it would look like the note was heading for default, so I knew I had to discount the note to get it sold.

I listed the note for $22 and it sold in a couple hours. So I paid $25 for it, collected $1.68 in payments, sold it for $22, and paid a $.22 transaction fee to get it done. Overall, I lost $1.10 on the note, but saved myself from a default that could have cost me $23.32.

There's actually a funny ending to that particular story. The secondary market lets you see what happens to the note you sold for at least a month after you sell it. So I got curious. It seems my borrower's note went into the grace period because he was paying it off in full. DOH! So I just cost myself a little over a buck by being too quick on the trigger finger. Still, I'd do the same thing again, and will each time it happens. I think it's better to be safe than sorry when it comes to private borrowers and non-recourse loans.

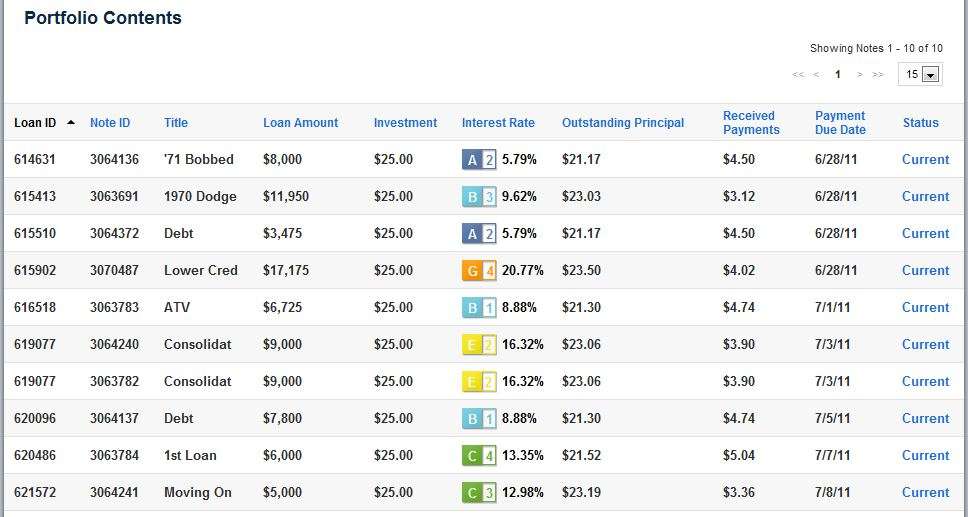

Anyway, here are the quarterly results for the WSO CDO for the second quarter of 2011:

Eddie,

I've been contemplating taking part in this myself and would like your opinion. Please correct me if I'm wrong. I believe LC has two options: 1) You can invest X dollars and pick one of three rates of returns and 2) choose individual bonds.

I'd like to hear your opinion on what you think one should invest in either situation. In other words, if I was going to choose individual bonds and actively manage, as it seems you do, what is your opinion on how much I should invest? $5k, $30k, more, less? Or, if I was to pick one of categories of rates of returns can you invest any amount?

Many thanks...

Tyrets,

I hand-select the loans I fund because it allows me at least the illusion of due diligence. But you're correct, Lending Club also offers ready-made portfolios based upon your risk preference. I've never used that service, so I can't say if it's better or worse than what I'm doing, but it really all comes down to math in the end and if you buy enough notes your diversification should even out the bumps in the road.

You can invest any amount you like, and Lending Club will either structure a portfolio for you or you can select your own loans. If you're going to invest $10,000 or more PM me and I'll put you in touch with Rob Garcia (he's one of the guys in charge over there) and he'll walk you through the process and probably throw you some bonus bucks.

Otherwise, if you want to start smaller the platform is pretty self-explanatory and of course I'm here to help you out if you have any questions. I'm also happy to discuss my personal strategy if you or anyone else is interested. My portfolio outside the WSO CDO has a NAR of 13.01%, so slightly better than the portfolio above.

"It seems my borrower's note went into the grace period because he was paying it off in full."

I haven't actually looked into the Lending Club, but isn't there any way you could have contacted your borrower and spoken to him? Or do you just assume that "It is my somewhat paranoid view that everyone who borrows from me is a sketchy individual looking to screw unwary investors" and no matter what they say will not change your opinion.

Just curious! Always enjoy reading your posts Eddie.

Getgo,

You never know who the borrowers are, so there's no way to contact them. The loans are completely unsecured, so there's really not even any collections options. That's why I've got a hair trigger when it looks like someone might be going sideways on me.

Eddie,

Love the updates on the LC portfolio. I dabble with an account of my own but after picking my initial loans, I've kind of left it untouched and haven't committed any new $$. I can definitely attest to the loans filling faster than before though. No defaults for me yet either!

what prevents someone from robbing you and then making a new account and going again?

Eddie - quick question. first thx for the update, i had briefly heard of the service @ the site's inception but obtained an account shortly after you provided more extensive exposure on WSO, so thx.

Have you had any issue with your LC portfolio being recognized as assets by your advisors (tax, financial, other) or for any other personal asset valuation purposes (line of credit etc)? I've heard rumors there are some kind of issues like this popping up.

@shorttheworld & @UFOinsider,

There's absolutely nothing to stop someone from doing that, provided they had the credit score to support their application. Once you default on an LC loan, though, I'm sure your SSN is blacklisted so you could only do it once. But you're right, it's certainly one of the risks and I'm ever mindful of that.

@Durban

Haven't heard of that being a problem, but I'm really beyond the point of needing my assets recognized by anyone. I can see where potential creditors might have an issue with your LC portfolio because it isn't liquid (the money is tied up for the period you've lent it out) so yeah, that might be a problem if you're wanting to list it as potential collateral. Like I said, though, I haven't personally run into the issue because I'm 100% cash and don't use debt.

thx Have you used their secondary trading platform at all and what kind of bids (as a % of par) have you seen? as an aside i'd expect bid offer to be pretty wide for now and probably hard to print big trades in many off-the run type / smaller size / less popular loans on the site.

Fugiat repudiandae quia possimus aliquid voluptatem eum aut. Sed alias quasi vel voluptatem laboriosam beatae hic. Ipsa architecto ad sequi ab amet est.

Rerum excepturi ipsa et numquam. Voluptate harum aperiam praesentium. Voluptas vel id sunt autem aut reprehenderit. Placeat nam sed dolores rerum neque eos hic. Minima ut doloribus corrupti et dolorem.

Ut incidunt culpa magni voluptatibus possimus animi neque. Nisi rerum voluptatem necessitatibus veniam libero omnis est. Vero ratione iusto at.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...