Want to Ace Your Interview? First You Have to Crack the Code...

Private equity is one of the most competitive industries in finance. You know it. I know it. Everyone knows it.

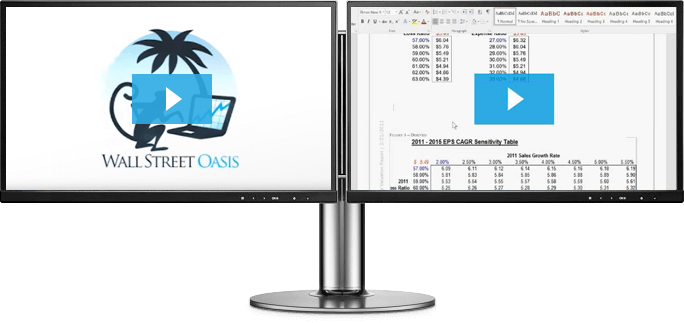

Not only does it promise huge salaries and bonuses (even more than investment banking), but it’s also less hours, less stress and more interesting work... the promised land where top investment bankers and consultants go to build a lucrative career.

But getting in the door is much harder than you think...

... because the PE industry can pick the best of the best and the secrets to getting in are guarded like Fort Knox.

Getting an Private Equity job is not about acquiring the skills to DO the job... It’s about acquiring the skills to GET the job.

And these are NOT the same thing.

Because what most buyside professionals will never tell you is that everything you’ve learned so far is practically useless when it comes to interviewing...

- Technical knowledge you learned in your IB interviews alone won’t cut it...

- Great deal experience on your resume and a high GPA isn’t enough...

- Great connections won’t get you the job you want...

- And even many of those in highly respected IB groups across the street still don’t make the cut...

Your interviewer’s job isn’t only to find the best candidates... It’s to weed out the worst. They’ll stress test you, confuse you and will do everything they can to quickly crack you so they can move onto the next eager professional in line.

- They’ll evaluate your technical acumen...

- Throw tough LBO Modeling tests and cases at you with almost impossible time limits...

- Hit you with complex brain teasers designed to trick you...

- Test your knowledge of the industry and their fund...

- And they’ll tax your ability to function under pressure and think on your feet...

They’ll probe everything about you:

- Your body language and voice tone...

- Assess your character...

- Judge your presentation skills and ability to sell an investment ...

- Your ability to both lead and follow...

- And they’ll decide if you’re high status enough to make it at their fund...

Quite simply, the private equity interview process is a nightmare that will eat you alive if you don’t know how to navigate it.

The Only Way to Crack This Code is to Learn It from Those Who Have Walked Your Path Before.

The best way to learn anything is to simply follow in the footsteps of those who have done it successfully. And not just a few people, but thousands of interviewers, analysts and private equity veterans who have successfully navigated this process and have gone on to lucrative careers across the top funds.

Only then will you know all of the little tricks, secrets and shortcuts to acing your interview and beating your competition: the tens of thousands of other finance “rock stars” who are competing for your job.

And once you have this knowledge, what seemed like a gauntlet will be a walk in the park.

Where others are confused and intimidated, you’ll be calm, cool and collected.

When others are cramming at the last minute, you’ll be totally prepared for anything they can throw at you.

And when others are working in the back office or stuck working 90 hour weeks, you’ll be climbing the ladder at a PE fund.

But first, a word of warning...

FACT:

Less Than 1% of Applicants Get a PE Job...

... Only Those with an EDGE Get In.

That’s right. Out of every 1,000 applicants, less than 10 will get the job. The other 99% will wash out and never be heard from again.

That’s 6x lower than the acceptance rate at Harvard. You do the math.

Think it can’t be you? Think again. These PE funds have access to thousands of motivated investment bankers, top consultants, technical geniuses and finance “rock stars”, all just like you... all beating down their door.

Most never get in.

Instead they end up left out in the cold, wandering the finance wilderness...

Dreaming of the buyside...

Thinking maybe they should start their own business... or jump to a corporate finance gig to escape, even if it means less pay...

And yes, still living with roommates until their late 20s to save money.

I’ve seen it more times than I can count.

And it’s all because they’re unprepared.

- Many relied on their technical abilities but didn’t have the network or the behavioral skills to make it through...

- Others had great pedigrees and connections but couldn’t solve the tricky brainteasers and complex deal mechanics that come up in every interview...

- Some even were top bucket analysts from the most prestigious investment banks in the country but found themselves forever looking in from the outside.

One of my best friends was a top ranked analyst at a prestigious bulge bracket, with a 3.9 from a target school. But he failed the PE interview process.

Even with a top MBA several years later, he still couldn't break in... Now he works in a corp fin group making half what the PE track would have landed him. He’ll never be a private equity professional, and he’ll live with the pain of regret for the rest of his life, wondering what if...

The Bottom Line is This:

To Land in Private Equity, You Must Know Everything...

... And That Means Going to the One Place That Has Everything.

Introducing...

The Wall Street Oasis Private Equity Interview Prep Course

The Insider’s Guide on How to Land the Most Prestigious Jobs on Wall Street...Including our famous PDF Guide, PE LBO Modeling Tests and So Much More...

Here’s Just Some of What You’ll Get in version 2.0:

Our customers have landed positions at all of the top PE megafunds, including:

don’t let one missed question cost you $250,000 ... get the course that will prepare you better than anything else.

The WSO Private Equity Interview Prep Course 2.0 takes you way beyond anything else. While others claim to give you everything you need, the truth is they only cover a handful of the most common questions and have basic LBO modeling tests. Even worse, they’re usually written by one guy who’s been out of private equity for years…

Hardly what we’d call “comprehensive”...

And there’s an even BIGGER problem with this approach:

It’s totally outdated.

Private equity is constantly changing. What worked even last year is no longer effective. Your interviewers are smart… and they’re constantly changing their questions and tactics for one reason: to put you under stress and see what you’re made of.

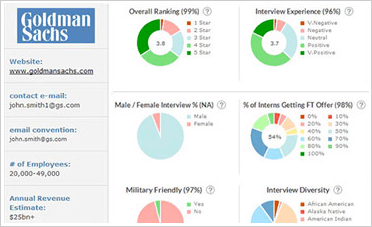

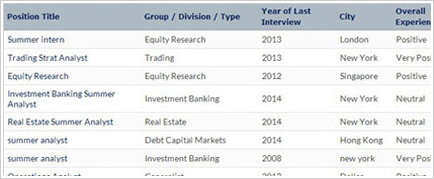

That’s why the WSO course is crowdsourced from thousands of currently practicing private equity professionals… people who live and breathe this industry - day in and day out… who can tell you what’s changing firsthand… and will keep you up-to-date on everything you need to ace the interview process and land that job.

And what you really need is this:

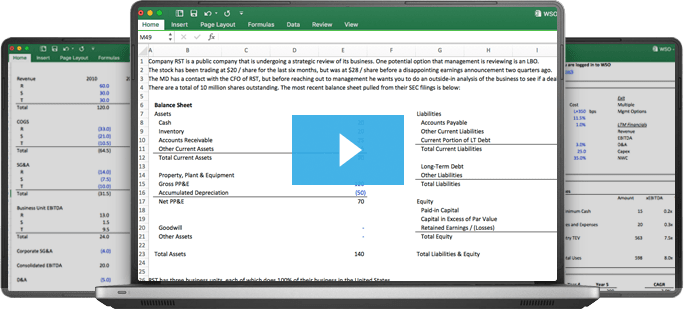

Module 2 9 LBO Modeling Tests - Realistic Practice

Technical and fit questions are only half the equation... Most candidates ignore the crucial LBO Modeling tests that help your interviewers answer one critical question: “Do you have the modeling chops to cut it?” But… this isn’t something can you fake. You have to demonstrate it - by not just getting the right IRR and MOIC on the test, but making your model shine and doing it fast. The only way to make sure you pull this off is to have realistic practice. These 9 LBO Modeling Tests will help you master this challenging part of your private equity interviews.

Module 3 networking mastery

Want to get the job? First you have to get in the door. But without a great network, nobody will know who you are. Even if your resume is great, it will end up lost in the pile of wannabe’s, and your chances of landing even an informational interview will be almost zero. In this 71-page guide, we’ll reveal everything we know about the fine art of networking… so you can meet the people who can get you what you want most: the job.

Don’t take our word for it

Here are just a few of the 1,000 candidates who have taken this course...

“I come from a non-target background and managed to make it into banking, but only after close to a year of networking and hustle. I knew that the odds were against me again for PE recruiting so I started networking and trying to land as many interviews as possible only after 1 year at a boutique investment bank. I had made it to 2nd and final rounds at a few funds, but no offer. The first interview after going through this course I made it to the final rounds and got an offer! I think this package made the difference - in fact, one of the LBO modeling tests I got in the 2nd round was almost identical to one of the 1 hour LBO ones in the package. Having that modeling practice and the confidence going into the interview is priceless.”

Result: Pre-MBA Associate @ MM Private Equity Fund in New York

“Excellent course for anyone hoping to break into the PE industry.”

Title: Vice President @ The Carlyle Group in New York

“This PE course provides a comprehensive, easy to understand review of not only the interview process, but, a background of Private Equity in general and the fundamentals involved. It makes a great transition from "big picture" concepts to detailed analysis in the LBO modeling tutorial. I came from a "non-traditional" background (consulting), and felt very prepared in my interview regarding industry knowledge, business model, and technical skill. I'm very pleased to report that I received an offer within 2 weeks of going through the course. It is easily worth the cost, and I will recommend it to close friends and colleagues. Thanks for an excellent resource.”

Chris R.

Result: Post-MBA Associate @ Elite PE Fund in Boston

"Most guides that try to demystify PE recruiting tend to be extremely utilitarian and focused which counter intuitively limits how useful they are. This guide provides spot-on advice as well as the industry context required for the advice to be useful. This is the single best resource I've seen for PE recruiting (And in fact a lot of the buy-side in general)"

Result: Investment Professional @ Sagard Capital

"WSO's private equity interview course is an essential competitive advantage for anyone trying to break into PE. It provides candidates with both the quantitative and the qualitative skills they need to stand out from the crowd. This is the one resource serious candidates shouldn't risk being without."

Result: Principal @ Hanover Partners

The guide has been extremely valuable to me. It got me from zero to sixty in PE knowledge to help me get a job in PE as a consultant who knew very little about the industry. Furthermore, I still keep referring to it as a PE professional to date when I want to see how some items get modeled out. Thanks for the guide and the great help. I'm an ambassador for the guide to all my friends and if I can ever help out let me know. Thanks

Result: Investor @ Growth Private Equity Firm in California

Your Choice is Simple.

If you’re reading this, you’re here for a reason: because you want to be one of the very few who gets an Private Equity job… and because you need help doing it.

Your opportunity really is limited… you have one good shot. If you don’t land a PE job, your chances of breaking into the buyside are slim to none, because the funds will know you’re damaged goods. Don’t believe me? Talk to my friend who is stuck in a corporate finance gig after he failed his PE interviews.

Because the hard truth is that Wall Street is literally flooded with millions of people just like you and me: college hot shots, finance wizards, math geniuses and even IB analysts at top banks with great live deal experience… and most of them still end up on the outside looking in.

The private equity funds have the pick of the litter, and only those who are superbly prepared, who have mastered all the concepts and who understand the subtle nuances of interviewing will get the job.

Do that, and you’ll gain entrance to a world few people will ever glimpse.

So…

What do you want to be doing? Living in a penthouse, working on multibillion dollar deals and climbing the elite ladders of finance?

Or living with your parents, selling mortgages in the suburbs and watching your friends having the lucrative career that should have been yours.

The choice really is yours. And your opportunity really is limited.

Don’t waste it. Click here to get instant access and get started on your career as a private equity investor.

1,000+ people can’t be wrong... Join the other successful candidates and get started:

Secure checkout

100% Unconditional Money-Back Guarantee