Fixed-Charge Coverage Ratio (FCCR)

A financial ratio used to measure a company's ability to cover its fixed expenses

What Is the Fixed-Charge Coverage Ratio?

The Fixed Charge Coverage Ratio (FCCR) is a financial ratio used to measure a company's ability to cover its fixed expenses, such as insurance, mortgage payments, interest, and auto and equipment loans.

It is a flexible ratio since it includes all fixed expenses, and preferred dividend payments can be incorporated into the calculation.

Banks and lenders often consider this ratio as it shows the company's cash flow and its ability to repay long and short-term debt obligations.

This ratio is calculated by adding earnings before interest and taxes (EBIT) and the fixed charge before tax (FCBT), such as lease expenses, interest expenses, and other fixed charges.

Then, divide the result by the subtotal amount of the fixed charge before interest and the interest.

Banks often avoid a company with a low ratio since it reflects a low company's ability to pay its debt obligations when they are due. A company with a low percentage is seeking an additional bank loan due to its low ratio.

A high ratio shows that the company has more than enough cash flow to cover its annual fixed expenses.

Suppose four companies in the same field apply for additional loans from a lender. The lender decides to give additional loans to only two of these companies.

The lender checks each company's FCCR to determine the company's ability to take on and pay for more debt and finds that the companies have a very close ratio.

Lenders will favor a business that can repay its fixed expenses at a faster rate than its competitors, as this indicates the company's profit growth. Even though this ratio helps lenders, banks, and investors in different areas, it also has some weaknesses.

Generally, banks and lenders determine the company's cash flow by using some financial information. The company's CFO could manipulate the financial information to make the financial statement look better.

This manipulation can lead to others not getting an accurate picture of the company's financial status.

Key Takeaways

- The fixed charge coverage ratio assesses an entity's ability to use its profit before interest and taxes to cover fixed charge obligations and interest costs.

- An increasing FCCR is an indication of increasing profitability and efficient debt management.

- The ratio varies from one company to another company:

- FCCR < 1: The firm has not enough EBIT to cover its fixed expenses

- FCCR = 1: The firm has just enough cash flows to cover the fixed costs.

- FCCR > 1: The firm has more than enough to cover its fixed costs.

- Some advantages are:

- It illustrates a company's standing throughout time. If the ratios rise, the company's profits are always larger than its debts.

- FCCR is compared with the industry average and peers to get a clearer idea of the company’s ability to cover its fixed charges.

- Some disadvantages are:

- The elimination of taxes gives an overestimation of a company’s cash flows.

- The company’s CFO can manipulate profits to make the company's status look better. Thus, an outsider wouldn’t get an accurate picture of the company's financial performance.

- It is essential to make a clear distinction between FCCR, DSCR, and ISCR:

- FCCR determines a company's capacity to pay off outstanding fixed charges, including debt obligations.

- DSCR determines the amount of cash that is available to pay the company's debt obligations.

- ISCR determines a company's capacity to cover the interest payments on its debt

the formula for Fixed-Charge Coverage Ratio (FCCR)

This ratio is a financial ratio that measures an entity's capacity to pay interest expenses and fixed charge obligations from its profit before interest and taxes

The most crucial components to consider while calculating these ratios are Earnings Before Interest and Tax, Fixed Charge Expenses (Gross), and Interest Expenses.

FCCR = (EBIT + FCBT) / (FCBT + i)

Where,

- EBIT: It stands for earnings before interest and taxes, used to determine a company's operating profit.

It can be calculated by subtracting revenue from expenses and eliminating tax and interest payments. It is also known as operating earnings, operating profit, and profit before interest and taxes. It can be found in the company income statement.

EBIT = Revenue - COGS - Operating expenses

EBIT = Net income + Interest expenses + Taxes

- FCBT: Fixed charge before the tax considers various recurrent costs, including but not limited to loan and lease payments, employee salary, and insurance premiums.

Fixed charge before tax is mostly in lease payments that can be found on the company's balance sheet. - i: Interest expense is calculated by multiplying the total dollar amount of outstanding debt by the interest rate being charged on the debt. It can be found in the company income statement.

This ratio determines how many times a corporation can cover its fixed costs annually. A greater value indicates better debt management, but a lower value reflects a worst-case scenario regarding company debt status.

- A ratio of less than 1 shows that a company's earnings are insufficient to cover its fixed expenses.

- A ratio of 1 shows that a company has sufficient net cash flow to pay its annual fixed charge once.

- A ratio over 1 indicates that a company is able to cover its fixed expenses and have extra left.

- A ratio of 2 indicates that a company can cover twice its annual fixed costs.

Examples of the fixed-charge coverage ratio (FCCR)

Understanding the fixed coverage ratio requires you to dive into some real-world examples to better understand how banks and lenders determine the company's ability to cover their fixed expenses.

Example 1: LYC is a shoe manufacturer planning to establish two new product lines due to the growth in operations. They decide to take an additional loan to launch this product line.

The financial information for LYC for the year ended December 31, 2021, is as follows:

- Profit Before interest and tax = $200,000.

- Lease payment = $300,000.

- Interest expenses = $18,000.

FCCR= Earnings before interest and taxes + Fixed charge before tax/ Fixed charge before tax + interest expense

FCCR = ($200,000 + $300,000)/ ($300,000 + $18,000) = 1.57

LYC's ratio is 1.57, meaning the company's earnings are 1.57 times greater than its fixed costs. While the company can cover every debt with its earnings, it has the potential risk of not being able to pay its future debt obligations.

Example 2: Tony has a business located in Toronto. He has an annual EBIT of $300,000. He incurs annual fixed charges of $50,000 in addition to annual interest payments of $30,000. His annual dividend from the corporation is $80,000.

What is Tony's FCCR?

FCCR= Earnings before interest and taxes + Fixed charge before tax/Fixed charge before tax + interest expense

FCCR = ($300,000 + $50,000) / ($50,000 + $30,000) = $350,000 / $80,000 = 4.38

Tony's ratio is 4.38, which means the company's earnings are 4.38 times greater than its fixed costs, which is considered good.

Tips to improve the FCCR ratio

An increase in operational efficiency with better debt, inventory & payables management will help improve the overall margins and thus will have a positive impact on the FCCR.

Improving the fixed charge coverage ratio is a crucial factor that enables companies to take as many loans as they need for company expansion or even in horrible times.

The following are three methods help to increase the ratio:

1. Increasing sales without high campaign costs

The owner of a company can evaluate the effectiveness of their marketing campaigns and reallocate marketing funds to areas where they will have a higher impact on sales.

A company might also focus on enhancing the sales strategies used by its personnel to get more agreements. They must follow intelligent techniques to reach as many customers as possible, like using social media appropriately.

Let's apply this suggestion to real-world examples to explain better how the current ratio can be improved. Shoe Inc. plans to establish two new product lines due to the growth in operations.

LYC companies can use social media influencers for advertising their new product lines to get exposed to a large audience. They should first determine their target audience, and then based on that, they select the best influencer.

They can launch a website for the new lines or open space on their official website that concentrates on their new lines, enabling clients to post their suggestions regarding shoe designs.

Clients often want the company they purchase from to listen to them. Companies that follow this procedure attract new customers and get customer loyalty. Therefore, the company will increase its sales rate as they get customer satisfaction.

2. Get better rental rates

Long-term tenants who have an excellent payment history can feel comfortable requesting a discount on their monthly rent cost.

Getting a great deal for a rental rate correlates with good payment history. All investors should make sure that they pay their rent on time as it gives them a chance to request decreasing rental rates in the future.

Paying rent at its proper time not only helps tenants ask for decreasing rental rates but also helps them find better rental agreements if the investor is willing to find a new place. The landlord often checks rentals to make sure that they will get paid.

Let's apply this suggestion to a real-world example. Tony has a business located in Toronto. He has an annual EBIT of $300,000. He incurs fixed yearly charges of $50,000 in addition to annual interest payments of $30,000.

Here, Tony must have a good rent payment history since it enables him to ask for a lower rent rate. Lowering rent rates helps him decrease the fixed charges resulting in increasing the current ratio, which is what all investors look for.

3. Refinancing higher interest rates

Interest costs can be reduced by moving high-interest loans into a single loan with a lower interest rate. Applying for a business loan is a popular strategy business will use to enhance their cash flow and debt management.

Let's apply this suggestion to the example mentioned above. To recap, Tony runs a business in Toronto with an annual EBIT of $300,000. The fixed yearly charges are $50,000 in addition to annual interest payments of $30,000.

Here Tony can consolidate his interest payment or apply for new loans with lower interest rates to pay off the interest payment of $30,000.

If Tony follows the previous two suggestions, he is qualified to apply for new loans as his fixed charge coverage ratio improves.

Advantages and disadvantages of FCCR

The fixed charge coverage ratio is a key metric that is used by banks or financial institutions to evaluate a company's capacity to meet its debt obligations.

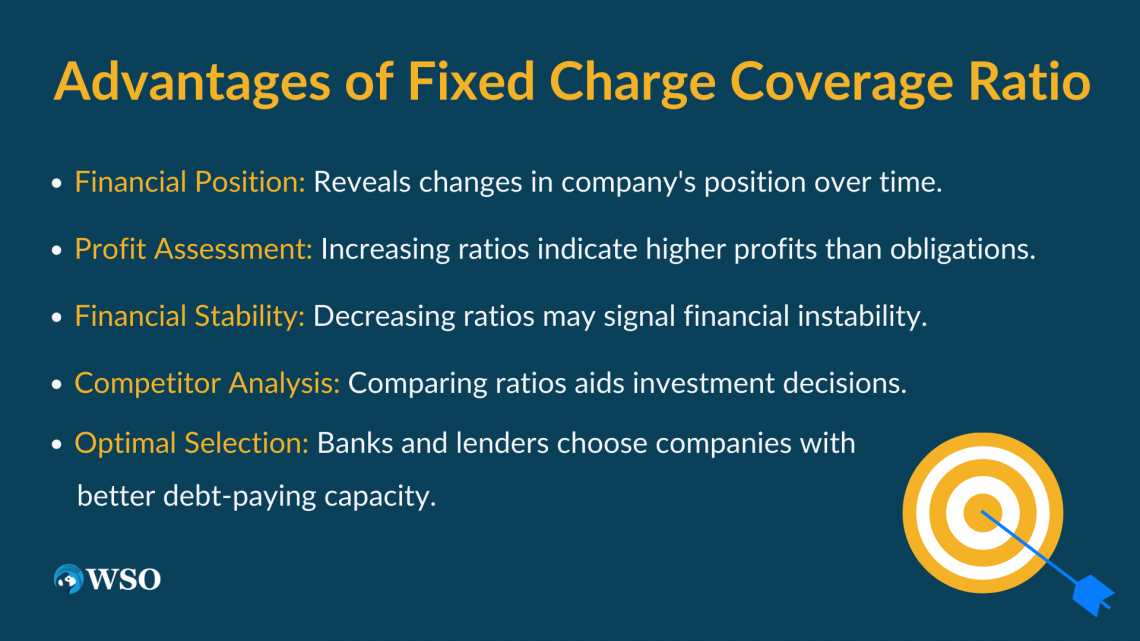

Some advantages of a fixed charge ratio are:

- It shows how the position of a company changed over the period. If the ratios are increasing, it means that the company's profits are always higher than its financial obligations.

- If the ratio goes down, it means that the company's profits are the same or lower than its debt obligations which means the company isn't financially stable.

- Comparing the fixed coverage ratio of competitors is an important procedure considered by financial institutions when they make investment decisions.

- Banks and lenders can determine what company is in a better or worse position to pay its debt when compared to its competitors. Therefore, they can easily select the company that best suits their requirements.

Even though a fixed charge coverage ratio benefits its users in various ways, it has some limitations, including the following:

- Banks and other lenders use financial information to determine a company's cash flow.

- The company's CFO could change the financial statement to make it look better. So, the other party won't get a true picture of how the company is doing financially.

- EBIT is calculated without considering tax expenses. As a result, the amount of profit considered is exaggerated because not all of this profit is available to fulfill the debt obligations; some will be utilized to pay taxes.

- This ratio also doesn't consider earnings that are used to pay an owner's draw or dividends to investors. This transaction fluctuates the ratio's inputs and hence leads to an inaccurate conclusion if other metrics aren't taken into account.

The difference between FCCR, DSCR, and ISCR

A company's fixed charge coverage ratio (FCCR), debt service coverage ratio (DSCR), and interest service coverage ratio (ISCR) are essential indications of the gearing level of debt in the company's capital structure.

The main difference between these ratios is whether they are trying to determine if the company can pay its fixed costs or if it has enough money to pay its debt with interest.

FCCR evaluates a company's capacity to pay off outstanding fixed charges, such as interest and lease expenses.

FCCR = Earnings before interest and taxes + Fixed charge before tax/Fixed charge before tax +Interest expense

The debt service coverage ratio (DSCR) indicates the available cash that can meet the financial loan payback obligations. It determines the amount of cash that is readily available to meet the debt obligations of the company.

When a corporation applies for a loan from a bank or financial institution, the provider will calculate the DSCR.

DSCR = Net operating income / Debt service

Debt Service= Principal repayment + Interest payments + Lease payments

Interest service coverage ratio (ISCR) is a metric that basically determines a borrower's ability to pay back the interest on any loans they take out.

A value of ISCR that is less than one indicates that the company's profits cannot cover both the interest on its debt and the total amount of its debt.

ISCR = Earning before interest and taxes / Interest expense

These ratios show how much the company is growing, so they can be considered important. If these ratios are lower than what is considered acceptable, the company must consider other ways to generate more money.

However, it is essential to make a clear distinction between these three ratios to avoid any confusion caused.

or Want to Sign up with your social account?