Course Overview

To make sure you are one of the 1% of PE applicants that gets the job, this course contains 15+ hours of LBO modeling tests, detailed information about the industry, interview Q&As, and networking tips. By the end of this, you will know how to build connections and ace interviews!

Who is this Course for?

Motivated investment bankers, consultants, and MBA students looking to break into private equity

Professionals looking to prepare for the recruiting process and transition to a career in private equity

Key Outcomes

Show Your Mastery in LBO Modeling Tests

In this course, you will master the theory and practical skills behind the different LBO modeling tests required to ace your private equity interview.

Unlocking the Door to Private Equity Success

After completing the Private Equity Interview Course, you'll have a strong edge over other candidates in landing a position in private equity.

Boost Your Confidence and Earnings Potential

Once you finish this course, you'll feel more confident in your private equity interviews, which will increase your odds of a move to the buy-side and earning a higher salary.

This course has helped our students and young professionals land and thrive at positions across all top Private Equity firms, including:

WHAT’S INCLUDED

A step-by-step course to help you ace your Private Equity Interviews

Module 1: Interview Questions

In this module, we cover three crucial question categories: Technical, Fit, and Brainteasers. This module also includes our proprietary Flashcards feature to gain access to 30,000+ interview questions filtered by firm, group, and much more.

Module 2: LBO Modeling Tests

In this module, we'll help you master all the types of LBO modeling tests that you can expect in your PE interviews. We take you in-depth through multiple LBO modeling tests to ensure you get the reps in to excel at them.

Module 3: Case Studies

We teach you how to create an LBO model using the information provided (such as an annual report and due diligence reports) in an interview and present the outcome in a PowerPoint presentation and ace the case study portion of your interview.

Module 4: Interview Process Support Materials

In this module, we teach you various important concepts (such as the various kinds of debts and valuation methods) to help you show your interviewers that you have in-depth knowledge of the private equity industry.

Module 5: Recruiting Overview

In this section, we are going to talk about the different career paths that you can pursue within private equity. Whether you're starting with an undergraduate degree or planning to pursue an MBA and beyond, there are exciting paths to explore.

Module 6: PE Deal Lifecycle

In this module, you'll discover the intricacies of a PE deal lifecycle. From the standard deal process to deal selection, deal funnel, and deal lifecycle, this module content equips you with the knowledge to excel in the dynamic world of private equity.

Module 7: PE Industry Backdrop

In this module, we focus on how the PE industry evolved and developed over time. We also take a closer look at the industry's structure, including the various types of PE firms, and examine the different types of PE deals that shape this sector.

Don’t Take Our Word For It

Hear From Our Students

Wall Street Oasis has trained over 63,000 students at elite corporate and educational institutions for over a decade.

I am not sure how it compares to other LBO courses in terms of value for money (if there are even other LBO online courses out there), but I do want to emphasize that it is an extremely dense course compared to most other online/MOOC courses so the price (probably) scales accordingly compared to standard online course prices from other services.

WSO has reinvented the ecosystem within finance in attaining the once out of reach careers for 99% of the population. Their courses and resume services are the bedrock for those that want to succeed within the industry, and position the hungry career go-getters with their best foot forward to out-preform within a highly competitive landscape of candidates.

Far from a gimmick, those that use the service are taken care of by the best professionals within the industry seeking to give back young professionals and provide the advice they wish they themselves had once recieved. The company goes above and beyond in supporting their customers from start-to-finish in their careers, and in every step in the navigation, of what is far from a strait-line, for its success.

I'd highly recommend the service to every college student, lateral, career changer, or those simply seeking to brush up prior to a job change. It is the grand equalizer for those looking to make a career move, and the best decision you can make for your professional growth.

The teacher explain complex topics in a simple way.

There are questions at the end of each section that could be improved upon, but it's a modeling course not exam prep so it is understanable.

Overall, I would recommend this course to someone interested in learning LBOs.

Modeling practice and cases were extremely helpful.

Received this as part of a bundle (fantastic value, I might add), and this was the perfect walk through for someone that knows theoretically what an LBO is, but wants a nuts and bolts perspective. Very accessible and quickly brings you up to speed. A very high yield course.

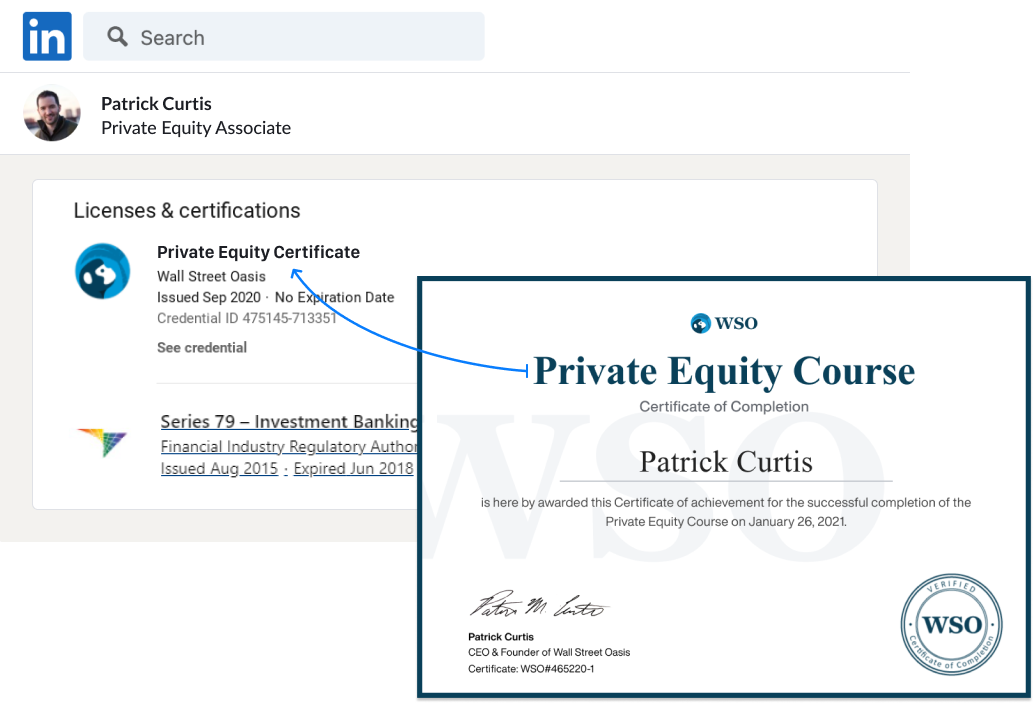

Certificates

Get The Private Equity Interview Course Certification

After completing the course, all students will be granted the WSO Private Equity Interview Course Certification. Use this certificate as a signal to employers that you have the knowledge required to add value to your team immediately.

Demonstrate that you have put in the work outside of university courses to master LBO models and understand the private equity industry in depth. Easily share to LinkedIn and other social media sites to highlight your skills and strengthen your profile as a candidate.

Course Benefits

How much is the Private Equity Interview Course Worth?

What You Get |

Value |

|---|---|

Private Equity Interview Course 180+ video lessons across 7 Modules , and 15+ hours of video lessons. To Help You Get into PE... |

$497 |

Bonus 1: Full WSO Company Database Access 12 Months Access - 24,681+ interview insights, 51,233+ exclusive salary and bonus datapoints + 20,127 company reviews... |

$297 |

Bonus 2: WSO Video Library 50+ hours of PE specific videos: webinars, sample deals, 10+ PPT & Excel Templates and more... |

$399 |

Bonus 3: Networking Master Guide 150+ copy & paste questions to ask on your interviews, 14 templates for LinkedIn, Email & Cold-Calling, 3 proven WSO Resume Templates and more... |

$349 |

Total Value |

$1,542 |

Consider this your first investment in a long career...

After all, you've likely already spent tens of thousands of dollars on college (and perhaps tens of thousands more on an MBA)...

When you start your coveted finance job, you'll be making well over $200,000...

...over $350,000 if you have an MBA...

And that's just the beginning of a long and very lucrative career that could easily net you millions...

Even at thousands of dollars and your ROI would still be huge…

At a fraction of that price, the ROI is even better... When you do the math, it's a no brainer.

And that doesn't include the time you'd have to spend figuring all of this out and the hours of sleep these courses will save you.

Even if you used the free info online, you'd still have to find it, organize it, vet it and test it to get it to work. That would take months… and at that point, you may have missed your window.

The WSO Private Equity Interview Course gives you everything you need to be super-efficient and get ready for your Private Equity interview… quickly and easily.

But we're not going to charge you thousands...

We won't even ask for half of that...

Get Unlimited Lifetime Access To The Private Equity Interview Course For

This offer (+bonuses) is limited-time only

12 Month Money-Back Guarantee

Your investment is protected by our 12-Month Risk-Free Guarantee -- easily the most generous in the market.

If, for any reason (or no reason), you don't think the WSO Private Equity Interview Course is right for you, just do the following within 365 days of your enrollment:

- Email [email protected] letting us know

- That's it!

We'll refund every penny. No questions asked. We bear the risk and will eat the transaction fees because we're that confident you'll love it.

Course Reviews

Here’s what professionals like you think of the course.

I am not sure how it compares to other LBO courses in terms of value for money (if there are even other LBO online courses out there), but I do want to emphasize that it is an extremely dense course compared to most other online/MOOC courses so the price (probably) scales accordingly compared to standard online course prices from other services.

Received this as part of a bundle (fantastic value, I might add), and this was the perfect walk through for someone that knows theoretically what an LBO is, but wants a nuts and bolts perspective. Very accessible and quickly brings you up to speed. A very high yield course.

The teacher explain complex topics in a simple way.

FAQ

Answers to popular questions

About

Yes, although PE firms used to recruit strictly from IB, they have opened up recruiting for consultants over the past decade. However, you'd have to work a lot harder to make up for the gaps in your IB/MBB experience.

Yes, most PE funds want to see your thought process as an investor. They want to learn how you think and if you are able to ask the proper questions when given some details on a potential investment opportunity. You need to be well prepared to answer these types of questions since they are very common and where most candidates slip up. Our interview course has all this covered along with several cheat sheets you can use to ace this section of the interview.

No, they are not. Private equity interviews are more than just LBOs and case studies. The problem is that most candidates now prepare well for these technical tests and ace them. Hence, interviewers go the extra mile to test you on a lot more than just technical skills. Some test you on your knowledge of the industry, while others throw in brain teasers and mental math.

ENQUIRIES

Any other questions?

We’re here to help.

We're confident you'll love the program and happy to answer any questions you have! E-mail [email protected] at any time and we'll get back to you within a few hours.