Available-for-Sale Securities

Available-for-Sale Securities (AFS) are investments in debt or equity securities that are not held for trading purposes nor held to maturity

What Are Available-for-Sale Securities (AFS)?

Available-for-Sale Securities (AFS) are investments in debt or equity securities that are not held for trading purposes nor held to maturity. Instead, these securities are held for longer periods but can be sold anytime, depending on the market conditions and/or if the company needs cash.

Available-for-sale securities are reported on a company's balance sheet at their fair market value.

Market conditions can cause the fair market value of AFS securities to fluctuate. Additionally, the unrealized gains or losses are reported in a separate section of the financial statement called the "Other Comprehensive Income" (OCI)

This is because the income statement only recognizes price action changes of these securities. So, instead, they are reported in a separate section of the financial statements.

Public and private companies can issue debt and equity securities that fall under this category. Companies looking to diversify their portfolios and earn extra income may consider available-for-sale securities as a potentially lucrative investment option.

Examples of Available-for-Sale Securities include:

- Stocks

- Privately held company shares

- Bonds and other fixed-income securities

- Mutual funds and exchange-traded funds (ETFs)

- Other forms of debt or equity securities that are not held for trading or until maturity, such as preferred shares or convertible bonds

Key Takeaways

- Available-for-Sale Securities (AFS) Securities offer flexibility in investment strategy and enable companies to invest in securities that may not align with their core business model.

- Available-for-Sale Securities can provide companies with revenue through dividends or interest payments while potentially increasing in value over time.

- Keep this in mind with AFS securities: Market fluctuations can impact a company's financial performance and stock prices.

- Accounting complexities associated with AFS securities may result in inconsistencies in reporting across different companies and make it easier for companies to report their financial performance accurately.

- AFS securities are attractive investment options for institutional investors with longer investment horizons, who can leverage their large-scale investments to negotiate better terms and conditions with issuers of AFS securities.

Advantages and Disadvantages of AFS Securities

Some of the most noticeable advantages of AFS securities are:

- AFS securities offer companies the benefit of having flexible investment strategies. What does that mean? It means that they can hold these securities for longer periods than HFT (held for trading) securities but can also sell them if market conditions change or if the company needs cash.

- It enables companies to invest in securities that may not align with their primary business strategy but still offer lucrative investment prospects.

- AFS securities can also provide companies with revenue through dividends or interest payments while potentially increasing in value over time.

- This strategy can prove advantageous for businesses aiming to increase their revenue from investments without losing the ability to sell securities when needed.

- Companies also acquire AFS to minimize the risks linked to their investment portfolio. Mitigating strategies include investing in two industries with negatively correlated returns or opting for lower beta securities to hedge against risk.

On the other hand, some of the disadvantages or challenges we should consider when dealing with AFS securities are the following:

- AFS securities are susceptible to market fluctuations. Since they are not held to maturity, their value can change based on market conditions, resulting in unrealized gains or losses reported as part of OCI. A company's financial performance may suffer; say, the company goes bankrupt, which could lead to fluctuations in its stock value.

- Accounting for AFS securities can be complex. For example, these securities are reported at fair market value, and companies may need to use intricate valuation techniques to determine their value. However, this can lead to consistency in reporting among different companies.

Example of Available-For-Sale-Securities

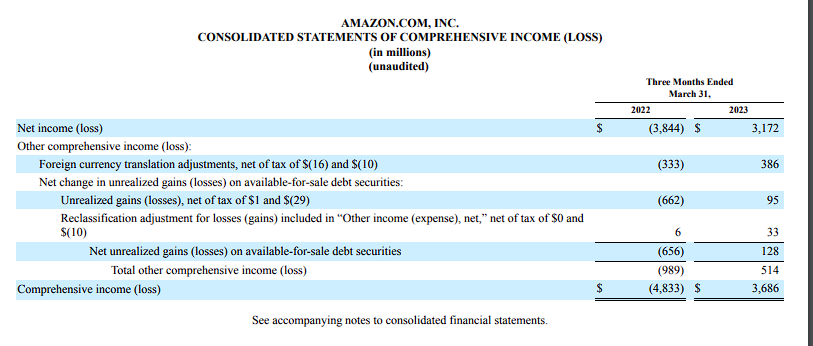

Let's take a closer look at Amazon's latest 10 Q report and explore the role of Available-for-Sale Securities (AFS) within it.

Source: Amazon.com

In the financial statement, AFS securities are placed in a distinct category called "Other Comprehensive Income." This category reflects the unrealized gains or losses on these securities, which indicate changes in their value that have not been realized through selling.

Note

The 10 Q report from Amazon presents figures for the March 31, 2023 quarter, enabling a comparison with the same period from the previous year.

According to the report, Amazon reported a net gain of $128 million in AFS securities for the March 31, 2023 quarter. In contrast, during the same quarter in the previous year, Amazon experienced a loss of $656 million in AFS securities.

AFS securities impact a company's financial performance, even if not explicitly stated in income statements. Therefore, comprehensive income includes these numbers in net income.

In Amazon's case, the comprehensive income is calculated by adding the net income figure to the other comprehensive income figure.

Accounting for both realized and unrealized gains or losses on AFS securities gives a more comprehensive picture of the company's financial performance.

By including comprehensive income, companies like Amazon can provide stakeholders with a more holistic understanding of their financial results, considering the immediate gains or losses and the potential impact of market fluctuations on AFS securities.

Silicon Valley Bank's Failure

The collapse of Silicon Valley Bank (SVB) has raised concerns about risk management practices, particularly regarding available-for-sale portfolios. AFS portfolios are not intended for immediate sale but may be sold in the future.

Hedging is essential for managing the risk associated with these portfolios, particularly interest rate fluctuations.

Interest rate risk poses a significant concern for banks holding these portfolios. Fluctuations in interest rates can cause losses to fixed-income securities. However, effective hedging strategies, such as interest rate swaps, help offset these fluctuations and protect banks from financial instability.

Neglecting proper hedging practices can have severe consequences, as demonstrated by SVB's collapse. For example, unwinding a significant portion of interest rate hedges left SVB vulnerable to market fluctuations, ultimately leading to its demise.

This highlights the importance of robust risk management and hedging strategies for banks holding available-for-sale securities.

SVB’s collapse will be a lesson to note in the future for banks regarding proper risk management.

Available-for-Sale Securities FAQs

AFS Securities are reported at fair market value on the balance sheet. Unrealized gains or losses are recorded in the Other Comprehensive Income (OCI) section of the financial statements.

Some examples are:

- Stocks

- Privately held company shares

- Bonds

- Mutual funds

- ETFs

- Preferred shares

- Convertible bonds

Both public and private companies can issue debt and equity securities classified as AFS.

Companies invest in AFS Securities to diversify portfolios, earn extra income, and have flexibility in their investment strategy, even if the securities do not align with their core business model.

or Want to Sign up with your social account?