Sales Revenue

Shows how a business is doing, its growth, profitability, and shareholder value

What is Sales Revenue?

Sales Revenue is one of any business's most important Key Performance Index (KPI). It shows how a business is doing, its growth, profitability, and shareholder value. In other words, sales revenue is critical for measuring a company's success.

Sales Revenue is the income a company generates from the sale of goods or services over a certain period. It can be in cash or in credit. Revenue generated by goods and services is sometimes referred to as operating revenue, as it stems from the primary operations of the business.

Sales Revenue is reported on the income statement and may be either gross revenue (before deductions) or net revenue (after deductions).

Gross revenue represents total revenue before deductions, such as allowances for sales returns and discounts, while net revenue reflects revenue after these deductions. Net income, on the other hand, is the company's profit after deducting all expenses from revenue.

Sales revenue is calculated as follows:

- For goods: Unit sold X Sale price

- For service: Hour served X Rate per hour

Key Takeaways

- Sales Revenue is the income a company generates from selling goods or providing services over a specific period. It is crucial for assessing a company's success.

- Sales revenue can be calculated by multiplying the number of units sold by the selling price for goods or the hours served by the service rate per hour.

- Sales revenue is a key metric for evaluating profitability, determining where to invest resources, qualifying for loans or contracts, and assessing company valuation.

- While sales revenue focuses on income generated specifically from core business activities, revenue encompasses all income sources, including non-operational ones like interest income.

Sales revenue vs. Revenue vs. Profit

In accounting, sales revenue and revenue can and are used interchangeably, but both have a minor difference.

Revenue includes all income generated by a company from its core business activities. This includes income generated outside of its core business, which is labeled as non-operational income.

For example, if a retail store earns interest from its cash reserves at the bank, it is included in revenue but under non-operating income, as it is not its core business income.

Sales Revenue includes only the income generated by a company from its core business. For example, a retail store's income will be sales revenue generated by selling goods or products.

Note

While sales contribute to a business's revenue stream, revenue can originate from various sources beyond sales, including interest income and investment income.

On the other hand, profit is the amount left for the company's shareholders after all the adjustments, such as operational costs, administration costs, taxes, interests, other income, and expenses.

Why Is Sales Revenue Important?

Sales revenue is a significant metric for evaluating a company's performance, highlighting the importance of accurate reporting. It can help the company and relevant parties:

- Measure profitability: Sales revenue helps the business to know the profitability of the company's core business. Revenue from non-core sources may distort the representation of a company's actual financial position, impacting the accuracy of profit and loss assessments

- Decide where to invest: A company can see which product or service is bringing in more revenue and which product is losing money by looking into sales revenue. It helps the company to invest in its more profitable products

- Determine eligibility for loan or contract opportunities: Some loans and government contracts require a specific revenue base and sales revenue calculation to qualify for a loan or a contract

- Determine valuation: Some industries (mainly in IT and software) give more weight to sales revenue than profit in their valuation. For example, Uber famously has been a loss-making company since its inception but still has a valuation of 62 Billion USD based on its 31.88 Billion USD revenue

Sales Revenue Example

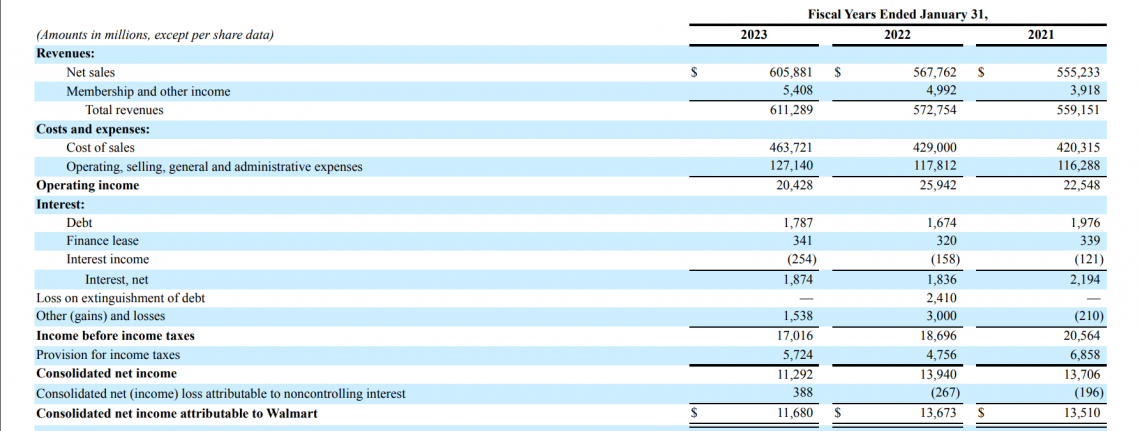

Below is the Walmart income statement from its 10k filing for the January 31, 2023 fiscal year.

As you can see, sales revenue is at the top, showing how much the company has earned during the fiscal year. It also shows the previous year's income to compare the current and previous results.

This report shows that Walmart's revenue has grown yearly for the last three fiscal years. In 2021, it reported a revenue of 559.151 billion USD; in 2022, it said 572.754 billion USD; and in 2023, it reported 611.289 billion USD.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?