Hell or High Water Contract

It refers to carrying out a duty or action regardless of the circumstances and despite all obstacles.

What Is a Hell or High Water Contract?

This contract refers to a party's independent and unchangeable contractual obligation (hell or high water clause or provision). The phrase "come hell or high water" refers to carrying out a duty or action regardless of the circumstances and despite all obstacles.

Depending on the circumstances, these contracts may be used in project financing, purchase agreements, and high-yield indentures.

The potential buyer may be required to pay the costs of handling divestitures or legal action in case of antitrust regulatory difficulties under a purchase agreement containing hell-or-high-water clauses.

As a result, the buyer's capacity to settle these issues and for the transaction to move forward could directly affect the viability of the acquisition agreement. Several transactions contain these terms:

Hell or High Water clauses in various financial transactions demand unwavering commitment, ensuring obligations are met despite challenges.

For instance, in equipment leasing, lessees must continue rental payments even if flaws occur. Similarly, in project finance, parties must fulfill duties without legal justification, such as force majeure.

Take-or-pay contracts exemplify this commitment, where off-takers pay in full regardless of product utilization.

This applies to energy, gas, or oil transportation services. Leveraged leasing deals also include this clause, transferring defenses to lessors in exchange for lessees' rental payments.

Moreover, in bond indentures, issuers assume debt obligations from third parties, with a "hell or high water basket" allowing debt incurrence irrespective of certain constraints, based solely on basket size.

Key Takeaways

- A hell or high water contract demands an unwavering commitment to fulfill obligations, commonly used in various contexts like equipment leasing, project financing, and M&A deals.

- They require payments regardless of equipment flaws or obstacles, ensuring transactions proceed. They transfer default risk, motivating parties to honor agreements.

- Despite potential flaws, the buyer is liable for payments, motivating careful selection. However, misuse of these contracts, misrepresentation, or coercion can lead to disputes and legal challenges.

- These contracts are prevalent in venture capital, acquisitions, high-yield bonds, and indentures, imposing strict payment obligations and transferring legal risks to obligors. Careful negotiation is vital to avoid disputes.

Understanding Hell or High Water Contract

Contracts that demand payment must be honored regardless of whether the product or service is functioning as intended. These contracts are typically utilized when a service or product supplier is taking a significant risk on behalf of the client.

The quantity of capital committed may be referred to as this risk. Due to the product's remarkable degree of customizability, the risk might also relate to the possibility that there won't be another buyer in the market.

These essentially transfer all default risk from the seller, lessor, or lender to the party required to make the payment. The obligee's default risk may incentivize the obligor to engage in a transaction they otherwise may decline.

The expression "come hell or high water" denotes an unwavering resolve to follow through on a course of action regardless of the circumstances. This is where the word "come hell or high water" originates.

Hell or High Water clauses in M&A deals may require buyers to undertake necessary actions, such as litigation or divestitures, to secure regulatory approvals. This transfers antitrust risk and legal responsibilities to the acquiring party.

The expression is intended to convey that the speaker or oblige will keep their end of the bargain, regardless of the severity of any catastrophe or extreme adversity beyond their control, including supernatural or diluvial effects.

Such a contract may still be executed regardless of whether the property at its core is flawed or defective.

For instance, if a lessee agrees to rent or lease a piece of machinery under terms of "hell or high water," they are still liable for the payments even if the item breaks down. Financially, the seller or lessor may be solely responsible for the equipment itself.

It is common for the lessee to choose the equipment they wish to purchase as part of a lease agreement. Leasing is leasing a product after the lessor purchases the desirable item and leases it to the consumer.

It is necessary to use this terminology in finance agreements to ensure that the lessor receives payment from the lessee without any ambiguity.

Since the lessee chooses the equipment they wish to rent, the lessor is usually not responsible if there is a problem with what they give them. Equipment may be delivered directly to the lessee by the manufacturer or supplier without the lessor ever seeing it.

Equipment flaws could be the result of a manufacturing problem. The maker or supplier may be obligated to uphold any guarantees concerning the equipment's functionality.

The existence of such "hell or high water" clauses in contracts frequently serves as a powerful disincentive for potential buyers to decide against the deal.

How Hell or High Water Contracts Work

Contracts are irrevocable and cannot be canceled. Up to the end of the transaction, the buyer is responsible for continuing to pay the owner as agreed. Whatever problems the buyer may encounter while using the leased property or equipment, they are not the buyer's responsibility.

The lessor can then ensure the lessee keeps up with the payments necessary to fulfill their end of the bargain. In the following situations, such clauses are employed in financial transactions:

1. Leasing of equipment

In equipment leasing, Hell or High Water contracts demand lessees to continue payments regardless of equipment flaws.

They transfer equipment performance risk from lessors to lessees, ensuring payment continuity for lessors. Due diligence is crucial for both parties to understand and uphold contractual obligations.

2. Project financing agreements

According to the provision, a party is obligated to carry out a task by the terms of the deal without raising legal objections.

It is still necessary for the buyer to pay for services like gas or oil transport even if they do not accept delivery of the item.

In high-yield bond indentures, issuers may agree to maintain a certain amount of debt from third parties in a "general debt basket," irrespective of other restrictions in the indenture. This allows for the incurrence of approved debt under the clause's parameters.

It also applies to lease agreements where the lessee is responsible for all recurring rent payments on the leased asset. In both scenarios, the clause guarantees payment for services to the seller, service provider, or lessor.

3. M&A

In M&A transactions, Hell or High Water clauses require buyers to fulfill obligations regardless of obstacles.

These clauses often mandate buyers to handle regulatory approvals and antitrust risks. They transfer legal responsibilities to the acquiring party, incentivizing careful negotiation to mitigate disputes.

4. Indentures with a high yield

This section outlines the issuers' consent to maintain a specified amount of debt from third parties in a general debt basket by the agreement. Borrowers have options, such as the hell, high water, or generic debt basket.

Despite constraints in the contract that apply to other specific loan approvals, like the requirement that borrowers pass a financial ratio test before acquiring any debt, the basket enables them to sustain approved debt.

Only one factor restricts a borrower's ability to get debt under a general debt basket: size.

Putting into Practice Hell or High Water Contract

There are clauses in leases that allow the imposition of such contracts regardless of any problems with the leased property or equipment.

An excuse for not making installment payments is not equipment failure. When selling a piece of property, it's not uncommon for the selling party to exclusively deal with the financial aspects of the contract (i.e., the financing company). The leasing party occasionally deals with the property indirectly in the contract.

After signing this contract, the leasing party frequently purchases the property the lessee has requested and then transfers the title to the lessee. Therefore, after the handover, any flaws in the equipment will be the lessee's responsibility rather than the lessor's.

Defects in the production process are the responsibility of the producer and lessee.

There are flaws in these contracts, and people try to exploit them. For example, some lessees use the lessor to escape their contracts.

Implementing the contract's clauses can be challenging and may deter potential buyers. Accountability for equipment flaws often lies with the lessee.

The lessee frequently accuses the lessor of pressuring him into a hellish contract when the facts regarding the condition of the property or equipment are misrepresented.

Indentures, high yield bonds, takeovers, and venture finance transactions frequently use these contracts in the financial industry. For example, this clause in a takeover agreement requires purchasers to make consistent payments.

Additionally, purchasers are responsible for future legal actions resulting from possible antitrust laws about the property or equipment.

Remember that adding such clauses in contracts can be difficult and discouraging, which could cause potential purchasers to pass on the deal.

Implementing Hell or High Water Contracts

Despite flaws in the real estate or equipment leased out, some clauses allow contracts to be upheld come hell or high water.

It is unacceptable to refuse to pay an installment due to an equipment breakdown. Frequently, the lessor participates in the project's financial parts and has nothing to do with the actual equipment.

Occasionally, the lessor will not even touch the leased machinery. The lessor frequently fulfills a prospective lessee's desire to purchase equipment by purchasing it, and then once the parties have signed a hell-or-high-water contract, they hand over the item.

Therefore, any issues arising with the equipment following this transfer would be viewed as liabilities for which the lessee, not the lessor, would be responsible. The maker and lessee will have to work out problems like production flaws.

Parties involved in Hell or High Water contracts must carefully negotiate terms to ensure fairness and transparency. Due diligence is essential to assess the implications of these clauses and mitigate potential risks associated with their enforcement.

In several cases, lessees have filed court motions to escape such contracts or leases by claiming that the lessor or vendor deceitfully enticed them into what they now view as a questionable arrangement.

Some people accuse the lessor of forcing the lessee into such a contract. However, dealings involving venture capital, acquisitions, high-yield bonds, and indentures are most frequently seen when the hell or high water contracts.

These contracts impose obligations on the new lessees in takeover agreements, including facilitating uninterrupted payments. In addition, the company assumes the risk of future divestitures or legal actions due to the imposition of antitrust sanctions.

Such said clauses in contracts frequently serve as a powerful disincentive for potential buyers to decide against the deal.

Conclusion

The concept of a Hell or High Water contract epitomizes the unwavering commitment demanded in various financial agreements, ensuring that obligations are met irrespective of unforeseen circumstances or challenges.

These contracts, prevalent across industries like equipment leasing, project financing, and mergers and acquisitions, underscore the transferral of default risk from the seller to the obligor.

By obligating parties to fulfill their duties regardless of equipment flaws or legal obstacles, these clauses foster accountability and motivate careful negotiation to mitigate disputes.

However, while Hell or High Water contracts provide a sense of security and commitment in transactions, they also come with inherent complexities and potential for exploitation.

Through transparent communication, diligent negotiation, and a clear understanding of rights and responsibilities, stakeholders can harness the benefits of these contracts while mitigating potential pitfalls in their implementation.

Hell or High Water Contracts FAQs

A similar provision is employed in the financial sector, including in high-yield indentures, purchase agreements, and project finance agreements.

A language like this can ask the potential buyer to split the cost of handling any litigation or divestitures, for example, in a acquisition agreement. A purchase agreement may also be conditioned on the buyer's capacity to resolve these problems.

With a few exceptions, a clause of this nature is often enforceable in courts. It is essential to properly design these clauses since they might have significant repercussions.

To avoid legal issues, the parties must hire a reputable attorney in the case of :

- Fraud

- The buyer doesn't accept the product delivery

The coronavirus outbreak is negatively impacting business operations. To stop the virus from spreading, the government asked and directed certain unnecessary enterprises to close. Due to this, it was challenging for enterprises to fulfill their duties.

Applying the said phrase in such a case would rely on several variables. These elements may include the wording of the contested contract, the behavior of the parties concerning the agreement, and the applicable legal framework.

A carefully designed and aggressively negotiated clause could prove crucial for the supplier to avoid or significantly lower their financial risk during such a pandemic. For the aviation industry, such a contract proved to be a lifeline.

Typical language in aircraft lease agreements. Lease contracts stipulate that payments must be made by the leasing airline. Thus, a well-drafted and aggressively negotiated agreement is already considering the Coronavirus pandemic.

Therefore, even during the epidemic, it is the airline company's responsibility to make the lease payment.

Even the legal system would conclude that the lessee's financial difficulties and losses during the epidemic are insufficient justifications for withholding payment under the terms of the aircraft lease agreement.

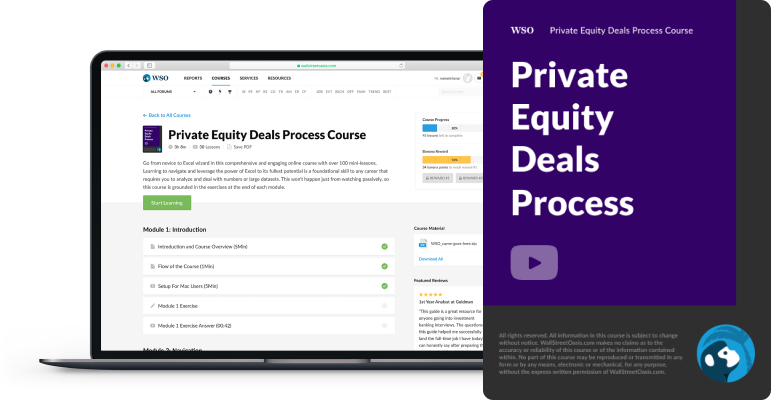

Everything You Need To Understand How PE Deals Work

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?