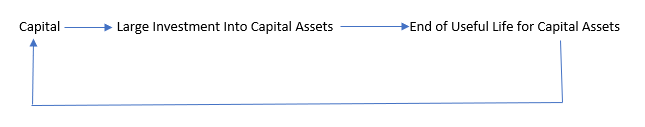

Long-Term Capital Investment Cycle

The lifecycle of a company's assets from acquisition to disposal and often includes long-lived resources such as machinery and infrastructure

What is the Long-Term Capital Investment Cycle?

The long-term capital investment cycle covers the lifecycle of a company's assets from acquisition to disposal and often includes long-lived resources such as machinery and infrastructure.

Within this extensive investment timeline, there exist smaller operational cycles that focus on individual components and mechanical parts. These cycles are integral parts of the broader sequence that demonstrates the movement of capital throughout the investment process.

Consider a manufacturing plant as an example: it encompasses cycles that include acquiring machinery, utilizing it for production, conducting necessary maintenance, and eventually replacing or upgrading those machines.

This perpetual investment cycle and utilization outlines how businesses handle and progress with their fundamental resources over the long haul. Each stage assumes a pivotal role in ensuring the overall efficiency and sustainability of the investment journey.

Key Takeaways

- It involves the entire lifecycle of a company's assets, from acquisition to disposal, emphasizing long-lived resources like machinery and infrastructure.

- Within the long-term cycle, there are smaller operational cycles focusing on individual components and mechanical parts. For example, in a manufacturing plant, these cycles involve acquiring machinery, production, maintenance, and eventual replacement or upgrade.

- Each stage of the cycle plays a pivotal role in ensuring the overall efficiency and sustainability of the investment journey for businesses.

Understanding the Long-Term Capital Investment Cycle

The following case study is useful in explaining the steps of a long-term capital investment cycle:

ABC Manufacturing, a notable name in the automobile manufacturing sector renowned for its quality and innovation, has decided to bolster its production capacities to meet the surging demand for electric vehicles. This strategic move involves a comprehensive, long-term capital investment plan:

Stage 1: Procurement and Implementation

The company invests in cutting-edge machinery and advanced robotics customized for electric vehicle production. This includes revamping assembly lines to ensure efficient manufacturing.

Stage 2: Utilization and Enhancement

ABC Manufacturing focuses on optimizing its production processes once the new machinery is integrated. Regular maintenance, employee training on new equipment, and consistent monitoring of performance metrics are key elements in their efforts to maximize efficiency.

Stage 3: Lifecycle Management

Maintaining a proactive approach, the company diligently tracks the lifespan of its machinery. They meticulously plan maintenance schedules and prepare for necessary upgrades or replacements.

Stage 4: Renewal and Advancement

After nearly a decade of operation, the initial machinery starts to show signs of technological aging. ABC Manufacturing orchestrates a phased replacement strategy, incorporating the latest technologies and more efficient equipment into their production lines.

Outcomes:

Through this strategic investment cycle:

- ABC Manufacturing significantly boosts its production capacity, adeptly meeting the escalating demand for electric vehicles.

- Their proactive asset management approach minimizes unexpected downtimes and bolsters the overall efficiency of the equipment.

- Machinery upgrades lead to improved energy efficiency and decreased operational expenses.

By staying ahead of technological advancements, the company sustains its competitive edge within the industry. This exemplifies how a well-executed, long-term capital investment strategy in infrastructure upgrades can augment operational capabilities, curtail costs, and preserve competitiveness in the sector.

Phases of the Long-Term Capital Investment Cycle

The phases of the long-term capital investment cycle involve a comprehensive sequence from the initial acquisition of core resources to their eventual removal, encompassing various operational cycles and components that endure over extended periods, shaping the financial trajectory of a company. Typically, the extended investment process involves various stages:

- Exploration and Analysis: The initial phase involves identifying potential investment avenues. Evaluating the asset’s potential profitability involves financial assessments, risk evaluations, market analyses, and feasibility studies

- Blueprinting and Development: Once a potential investment opportunity surfaces, meticulous planning and design follow suit. This phase involves crafting a detailed strategy encompassing investment structure, budgeting, resource allotment, and timeline.

- Financial Support: Securing funding marks a critical step in the investment process. This stage involves acquiring finance through diverse channels like loans, equity, or a blend of both. Negotiations with financial institutions, investors, and banks usually occur here.

- Execution: This phase witnesses the materialization of the investment blueprint. It involves constructing, developing, or procuring assets aligned with the conceptual plan.

- Supervision and Governance: Post-implementation, continuous oversight and management become imperative. This stage entails monitoring investment performance, comparing projected targets, noting deviations, and addressing issues as necessary.

- Evaluation and Adjustment: Regularly evaluating investment performance against initial objectives assists in gauging success. Based on these assessments, modifying the investment strategy to maximize returns or mitigate risks becomes essential.

- Exit or Reinvestment: Depending on the investment plan, this stage involves either enhancing the asset for future growth or divesting the asset, reaping profits, and exiting the investment.

Long-Term Vs. Short-Term Capital Cycle

Long-term and short-term capital investment cycles differ significantly in several ways.

| Factor | Long Term Cycle | Short Term Cycle |

|---|---|---|

| Time Horizon | Assets (infrastructure, machinery) with a long useful life, covering years or decades. | Operates within a short time frame and typically affects assets with short lives (inventories, short-term securities, etc.). |

| Purpose | Focus on key investments for future growth, expansion, and development. | Focus on quick returns and liquidity to meet immediate operational needs. |

| Investment Scope | Includes major investments in long-term assets, strategic expansion, and infrastructure. | Covers immediate cash flow management, inventory turnover, and short-term financial instruments. |

| Risk and Reward Profile | Generally involves higher risk and potentially higher reward due to longer investment horizons and sensitivity to market fluctuations. | Typically has a shorter investment horizon and greater predictability of short-term assets, which results in lower risk but also lower returns. |

| Decision-Making Process | Requires comprehensive analysis, strategic planning, and a broader decision-making process that takes into account future market conditions and potential uncertainties. | You often need to make quick decisions based on immediate cash needs, market trends, and short-term liquidity needs. |

| Flexibility | Allows adjustments over time, increasing planning flexibility. | Requires agility and rapid adjustment to market changes and immediate financial needs. |

| Capital Structure | May include a combination of equity and long-term debt to fund larger investments. | Often relies on short-term debt to meet day-to-day financial obligations. |

Risks within the Long-Term Capital Investment Cycle

Significant financial commitments can lead corporations to consider increased borrowing or redistributing substantial portions of their assets within the company.

This scenario often affects the liquidity and general financial position of small to medium-sized businesses, posing particular challenges for them:

- Consider a scenario where a company requires substantial capital, such as establishing a new facility. These endeavors carry risks, especially during economic downturns, as they involve significant cash outflows and take time to generate profits.

- Unfavorable market conditions notably heighten risks for businesses involved in prolonged capital investment cycles.

- Large corporations need to exercise prudence and avoid hastily expanding internationally. Rushed international ventures are a common misstep, especially among retail businesses. To avert overextension and financial strain, such expansions require careful, deliberate steps.

- Opportunity cost should not be ignored. Businesses must carefully weigh their options as part of a long-term investment strategy because every investment decision they make entails selecting one investment opportunity over another.

How To Avoid Over-Expansion

To avoid the financial burden that correlates with over-expansion, a balanced approach and careful consideration of various factors are required to avoid overextending business operations. Below are some methods to avoid over-expansion:

- Clear investment criteria: Define clear and realistic investment criteria. Establish specific objectives, financial objectives, and benchmarks that the investment opportunity must meet. This helps weed out overly ambitious or risky projects.

- Thorough Analysis and Due Diligence: Perform comprehensive analysis and due diligence before making any investment. Evaluate market conditions, potential risks, expected returns, and how the investment aligns with your overall business strategy. Make sure your investments align with your core competencies and skills.

- Risk Assessment and Mitigation: Assess and understand the risks associated with investments. Develop strategies to mitigate these risks. Diversifying your investments spreads your risk and prevents overexposure to a single investment.

- Conservative Financial Model: Use a conservative financial model when predicting revenue and growth. Avoid overly optimistic forecasts that can lead to overestimation of potential profits.

- Phased approach: Consider a phased approach to expansion rather than a large up-front effort. This allows us to test the waters, evaluate initial results, and make adjustments before full expansion takes place.

- Monitoring Performance Indicators: Set key performance indicators (KPIs) to monitor the performance of your investments continuously. Periodically assess whether your investments are meeting expected milestones and goals.

- Stay Flexible: Stay flexible with your investment strategy. Market and business conditions can change rapidly. Adaptability allows you to make adjustments in response to changing circumstances.

- Capital Allocation Strategy: Develop a disciplined capital allocation strategy. Allocate resources based on prioritization and a clear understanding of the potential benefits and risks associated with each investment opportunity.

- Stress Test: Perform stress tests on investment plans. Simulate scenarios to understand how your investments will perform under adverse conditions. This helps identify vulnerabilities and create contingency plans.

- Learn from experience: Analyze past investments and learn from successes and failures. Understand why expansions are successful and cases of overextension to improve future investment decisions.

Conclusion

There are several crucial stages in the long-term capital investment cycle. This process starts with the acquisition of assets such as machinery and infrastructure and ends with the eventual disposal of these assets.

Within this cycle, the operational phases focus on the movement of capital across various assets and machines, ensuring efficiency and sustainability.

Understanding this process entails understanding research, planning, implementation, and evaluation of capital allocation, whilst also considering risks such as overextension and market vulnerabilities.

Distinguishing between long-term and short-term investment cycles is categorized by differing risk levels, decision-making approaches, and time horizons.

Potential risks within the long-term capital investment cycle can include heightened debt, liquidity issues, and sensitivity to market changes, especially for smaller enterprises.

To avoid overleveraging, establishing well-defined investment criteria, analyzing assets meticulously, and adapting to changing market conditions is crucial. Acknowledging and balancing risks while learning from experiences are also essential in applying the long-term capital investment cycle in practice.

or Want to Sign up with your social account?