Unicorn

A company is defined as a unicorn if it reaches a valuation of $1 billion without issuing public stock

What Is a Unicorn?

Unicorn is a term used to describe a privately held company that's valued at over $1 billion. Think of it as the gold standard of success in the startup realm, but instead of a horned horse, it's all about dollars and cents.

Reaching unicorn status isn't a walk in the park. These companies achieve their billion-dollar valuations through private investment funding alone. They dodge the traditional route of going public by not issuing stock to the public, which means no flashy initial public offerings (IPOs) for them.

For venture capitalists and other early-stage investors, spotting a unicorn is like finding a diamond in the rough. Getting in on the ground floor of one of these companies can lead to staggering returns on investment.

The rarity of unicorns is staggering. Estimates suggest that only about 1 in 1.7 million companies reach or exceed the $1 billion valuation, emphasizing just how uncommon they are.

But unicorns aren't the only ones in the billion-dollar club. There are even rarer creatures in the business realm, such as the decacorn, a private company valued at $10 billion. At the top of the rarity scale is the hectocorn, a term used to describe privately held companies worth a staggering $100 billion. Only three companies have reached this prestigious club: ByteDance, SpaceX, and SHEIN.

Key Takeaways

-

Unicorn companies are privately held firms valued at over $1 billion, achieved without going public, signifying rarity and investor allure.

-

Common traits among unicorns include technology integration, social media utilization, and smartphone-centric approaches, reflecting modern market demands.

-

Many unicorns pursue a "Get Big Fast" strategy, marked by large funding rounds, extensive marketing, and predatory pricing, prioritizing growth over immediate profitability.

-

Unicorns often remain private due to abundant private funding and challenges associated with going public, such as stock devaluation and regulatory burdens.

-

Factors driving unicorn growth include unicorn bubbles, where private valuations exceed public market expectations, and increased private investment funding, fueling innovation and market disruption.

Unicorn History

Aileen Lee was the first person to coin the term. In her article “Welcome to the Unicorn Club: Learning from Billion-Dollar Startups,” Lee analyzed software startups of the 2000s.

In the article, she estimates that only 0.07% of startups manage to reach a $1 billion valuation.

For an investor, this means that the chance of finding a startup before it reaches a $1 billion valuation is slim. From an entrepreneur’s perspective, the chance of starting a company and attaining a valuation of over $1 billion is extremely low.

To drive her point further, Aileen Lee likened finding a unicorn in the sea of startups to finding a real unicorn, a mythical creature.

In folklore, it is an extremely rare horse with a single horn on its head. This metaphor does a great job of conveying how hard it is to start or find a company before reaching $1 billion.

Along with the valuation requirement, Lee also only looked at tech startups. The term now covers companies in any sector, although occurrences of these companies are more common in tech.

Unicorn Common traits

While there are over a thousand privately-held companies valued at over $1 billion, many common trends/traits exist in this elusive group.

One might imagine that since there is a huge variance in unicorn companies and the goods and services they provide, that same variance must exist in their traits. This conclusion is far from the truth.

While it is true that some of these companies are unique, trends still exist.

For those searching for or wanting to start the next great company, an understanding of the common trends that exist among these organizations gives strong guidance. With trends seen in, but not limited to:

- Company strategy

- Name

- Location

- Sector

This group has clear commonalities that are hard, to sum up as coincidence. Something like a name can significantly impact an investor and a purchaser's perception of the company.

These trends, while insightful, should not be extrapolated to every company from every sector at every scale.

Another thing to consider about these trends is that they are just that: trends. These commonalities will change over the coming years as business, technology, and society continues to evolve. Just like a clothing trend, things move in and out of fashion.

Technology

Almost every one of the thousand-plus companies that have reached the $1 billion mark has integrated technology into their business model in some way.

Social media has been a great boon for revenue growth. Using social media for marketing as well as a channel for positive word-of-mouth referrals has proven to be a source of explosive growth.

One great example of social media use is SHEIN’s use of Instagram advertisements and sponsorships to reach its young target audience.

Another common use of technology is crowdsourcing of content. Examples of this are seen through Instagram and Twitter’s systems.

These companies create very little content; rather, they encourage users to create entertaining and engaging content for the platform. Airbnb and Alibaba are examples of crowdsourcing in different ways.

These websites do not list items. All they do is facilitate users to post their items for rent and sale, crowdsourcing listings.

The next strong trend is the use of smartphone technology. Many companies have capitalized on the simplicity, convenience, and global presence of mobile devices.

Uber and Duolingo both use the convenience of a smartphone to increase revenue. For Uber, it’s the form of booking a ride while you’re out on the go. For Duolingo, it’s learning a language in small digestible bites, allowing flexible integration into your life.

The last type of technology used by this group of companies is cloud computing. Many companies either take advantage of cloud computing or provide it to other companies. Pinterest, for example, uses Amazon Web Services to host its content.

Talkdesk, a company providing customer service solutions, and Rubrik, a provider of backup, recovery, and data archiving services, both use cloud computing to deliver value to clients.

As demonstrated through this non-exhaustive list of current technology trends seen in billion-dollar companies, tech plays a key role in value creation.

Moving on, we will look at what kind of strategies these companies enact to allow for extreme expansion.

Get a big fast strategy

Since the public release of the internet in the 1990s, the get big fast strategy (GBF) has been prevalent.

GBF has proven to be a key driver in the increasing number of private companies reaching $1 billion. The following are the basic behaviors defining the GBF strategy:

- Multiple large rounds of private investment funding

- Extensive marketing campaigns

- Utilization of predatory pricing

Rounds of investment allow a company to increase capacity, improve the product, and fund marketing.

Robust marketing campaigns can create huge growth within the target audience.

Lastly, predatory pricing entails a company decreasing prices such that competition is undercut, rivals are driven out, and barriers to entry are created.

Afterward, prices can be raised again to account for possible previous losses, but this time with less competition.

These three factors together create a potent recipe for growth.

While this strategy works well for growing a company, it doesn’t necessarily grow a profitable company. Predatory pricing and constant cash infusions can lead to an inability to break even, leave the growth phase, and start making a profit.

The GBF strategy is not just a focus for start-ups; it’s also ideal for venture capitalists. Explosive growth can lead to a quick and considerable return on investment.

This means that more funding goes to companies with the largest growth potential, planning to reach that potential as fast as possible through this debatably risky strategy.

Staying private

As stated in the GBF strategy, multiple private funding rounds are pursued.

Private funding can be a source of tremendous quantities of capital. If money can be secured in private markets, there is a decreased incentive to turn to the public capital markets.

Another risk posed by the public markets is the devaluing of company stock. There are many examples of a company undertaking an IPO with a lackluster response from investors.

As previously mentioned, this leads to a devaluing of the company compared to the valuations made privately.

While public markets allow early-stage investors to liquidate their shares, it can also upset investors should their shares decrease in value.

Peloton (PTON) is one example, dropping 11% after the first day of trading. Another instance of this exact phenomenon is SmileDirectClub (SDC). The company ended the first day of public trading with a valuation 27% lower than the IPO.

The last factor encouraging some private companies to delay or never reach the day of IPO is the rigorous requirements of a public company.

The process to even reach an IPO is costly, not to mention the fees involved in indefinitely outputting quarterly reports.

All the trends previously listed are directly related to the operations as well as the products and services of a company. Now we can move into more seemingly superficial trends.

Other trends

The first odd trend seen is the frequency of the letter S in their names. Other common letters include C, A, and T.

Cargill, Koch Industries, Publix Super Markets, and Pilot Company are some of the top private companies in America, all with some or all of these letters.

Commonly used words in titles like Cloud partly explain the frequent appearance of these letters. However, it seems to be more than coincidental.

A company’s name is a powerful way to convey its purpose and goals. While there isn’t significant research in this area, some believe these letters are used intentionally to communicate things like innovation and creativity.

Next, the majority of privately-held companies that manage to reach a $1 billion valuation are founded in the U.S. and China.

This is likely due to both countries standing at the cutting edge of technology and business.

When looking at concentrated areas of high-value companies, we come to the last debatably shallow trend.

The San Francisco Bay Area, compared to the rest of the U.S., has by far the largest concentration of unicorn company value.

This is likely due to entrepreneurs being drawn in by innumerable venture capital firms (V.C.s) and accelerators. This leads to further success for startups, drawing in more V.C.s and accelerators, with this cycle creating a feedback loop.

Valuation of Unicorns

The valuation system for a well-established company is considerably more concrete than a startup.

When there is a proven history of profitability and market demand, like in the case of a business that has run for many years, valuations become much simpler.

Without past performance, it’s difficult to guess whether the market at large will react well to the product or service, whether the company can handle expansion, or in a lot of cases, if it will ever be able to reach profitability.

A lot of companies striving for a $1 billion valuation find themselves in the latter position without a 100% proven track record. Using an example, it’s the difference between

-

Valuating McDonald’s, a well-established company with a revenue history and thousands of locations

-

Valuating Eyewear tech is a startup developing eye-tracking technology for applications like advertising. In this case, most of their revenue will come in the future.

There are two different kinds of valuation, the private (venture capitalists, angel investors, etc.) and the public (capital markets). Now, we will review the processes for each and what happens when there is a difference between private and public valuations.

The private stage of valuation occurs when a company searches out rounds of funding for a variety of reasons. It can be for expansion, marketing, product development, etc.

When executing these rounds of funding, a valuation must be done. This helps calculate how much equity an investor receives in exchange for a given amount.

Creating a valuation at the early stages of a company involves looking at the company today, but more so at prospects through total market size and financial forecasts.

The forecasting process can be extremely complicated and is exposed to many risks and biases.

For example, events like natural disasters can render a previous forecast useless. A biased forecaster, whether they be incentivized to over or underestimate earnings, can also create issues.

When an investor plans to put money into a company, these factors should be considered to decipher whether it is a worthwhile investment.

While there is a wide breadth of valuation methods, only a handful are widely used. To get an idea of the present value of a company, three different forms of valuation are performed:

-

Discounted cash flow analysis: Future cash flows are forecasted, and their worth is decreased based on the idea that a dollar today is worth more than a dollar tomorrow (time value of money).

-

Comparable company analysis: Multiples (financial ratios) of similar companies are reviewed to see if they are in line, cheaper, or more expensive.

-

Comparable transaction analysis: By looking at previous mergers and acquisitions (M&A) of similar companies, the value of a company be derived.

One or all analyses can be performed to reach a valuation. The accuracy of each of these methods varies from company to company.

Private valuations, however, have some risk of manipulation. A lot of the value of a company is based on previous rounds of funding, if there have been any.

As soon as one investor believes a company is worth $10 million, that valuation seems much more credible.

This can lead to inflated valuations in a market with thousands of VCs and angel investors throwing money at startups.

Why are Unicorns becoming more common

2021 created more of it than the previous five years combined, and then it doubled in 2022. This exorbitant growth raises questions. Why is it happening? How is it happening?

There are two factors believed to be the culprits.

1) The first is unicorn bubbles.

The public markets can be more scrupulous due to the extreme transparency required of public companies. A Stanford study on the valuations of private companies found that the average unicorn was overvalued by a whopping 48%.

This leads to some disastrous IPOs due to price corrections deemed necessary by the public markets.

WeWork, for example, was valuated at over $46 billion privately. The company, starting the IPO process, filed initial papers. After 33 days, the IPO was canceled, WeWork was at risk of bankruptcy, and the company valuation had dropped 70%.

This is a prime example of the dangers of going public. While this may seem like a standout situation, there are countless instances of private investors overvaluing companies.

Peloton and SmileDirectClub are great examples of unicorn bubbles.

This occurs when a private company has its value inflated by private investors. Once the IPO stage is reached, a huge public market correction occurs.

These bubbles could be part of the huge increase in billion-dollar companies around the world.

2) The second factor is the huge increase in private investment funding available.

As VCs and angel investors continue raking in huge profits, more and more are attracted to take part in the space.

McKinsey reports that fundraising is up 20 percent in 2022. Total assets under management also reached a new high of $9.8 trillion, up 32% from the previous year. This increase in funding is acting as a catalyst for real growth in private companies.

While this creates real value for companies, the increased demand for private equity merely inflates valuations. Both factors, however, are growing the number of unicorns.

Now that we have a strong grasp of it, how they’re evaluated, and what’s driving the increase in companies with this sought-after title, we can look at some examples.

examples of Unicorn

To fully understand the breadth of companies that have reached this level of achievement, it’s helpful to look at some examples.

Two of the upcoming examples are hectocorns. As was mentioned earlier, hectocorns are privately held companies with a value of over $100 billion.

One thing to notice about all three of these companies is that they fit the trends among large privately held companies talked about before.

They are all founded in the US and China, use technology to deliver value, albeit in different ways, and even have all the common letters S, A, C, and T.

While there are over a thousand companies valuated at over $1 billion, these three examples help demonstrate how many of these organizations are at the forefront of their respective fields of technology.

First, we’ll look at Bytedance, the Chinese corporation that created the powerhouse social media platform you are definitely familiar with.

Bytedance

Bytedance founded ten years ago in March of 2012, began as a company seeking to create a news app for the Chinese public.

This news app would utilize AI technology to perfectly cater to a newsfeed for every single user. The app, Toutiao (“headlines” in Chinese), was released and subsequently exploded, reaching 1 million users in 4 months.

Now one of the most popular apps in China, reaching over 300 million active monthly users, Toutiao was the starting point for Bytedance.

The next project for the company was a video streaming platform based around short-form content and, yet again, a powerful AI capable of catering feeds to each user.

Douyin was released in 2016. The app did not reach the global acclaim it has now until Bytedance acquired a very similar platform.

Musical.ly lets users stream short-form user-generated video content ranging from 15 seconds to 1 minute.

Aiming to get into the Western market, Bytedance purchased Musical.ly for $1 billion and combined it with Flipagram, a video editing platform acquired by Bytedance previously.

Douyin was rebranded to TikTok for the Western audience and moved the user base of Musical.ly over to TikTok.

Worldwide, TikTok and its variations now reach over 1 billion users monthly. That means that 1 in 8 people use TikTok!

With TikTok and Toutiao as their main offerings, Bytedance is currently valuated at over $400 billion, making it the most valuable private company in the world.

SpaceX

Founded in 2002 by Elon Musk, SpaceX aims to create affordable commercialized spaceflight, provide global internet, and colonize Mars.

To make space flight more affordable, SpaceX is engineering reusable space crafts.

The first rocket created by the company, the Falcon 1, cost an estimated $100 million. The first three launches failed, almost bankrupting SpaceX.

After straining Musk’s assets for funding, SpaceX ultimately landed a contract with NASA, saving the company.

The next crafts developed were the Falcon 9, an updated version of the previous rocket, and Dragon, a cargo hold created for transportation.

A slew of other NASA and International Space Station contracts were won, and successful landings were achieved, proving the viability of the reusable flight tech.

These events propelled progress further as well as dramatically increased the value of the company.

The next project announced by the company was Starlink, a network planned to be 30,000 satellites strong, all working together to provide high-speed internet globally.

In 2020, Starlink became the largest satellite network ever created and now boasts a fleet of almost 2,000 satellites currently in orbit.

The prospects of their reusable low-cost commercial spaceflights and Starlink combined have allowed SpaceX to acquire funding at a valuation of $100.3 billion.

This valuation makes SpaceX the second most valuable private company in the world.

OpenSea

Aiming to create an easy-to-use exchange for non-fungible tokens (NFTs), Devin Finzer and Nadav Hollander started OpenSea in 2017.

Allowing users to mint NFTs for free on the platform, OpenSea took a cut of every sale and began using the Ethereum blockchain.

Explained most simply, NFTs allow someone to prove ownership over a digital asset, be it a photo, video, or, more recently, things like digital real estate and apparel.

The company acts as one of many platforms facilitating the trade of NFTs in exchange for cryptocurrency, mostly Ethereum in the case of OpenSea.

Now the largest NFT marketplace in the world, OpenSea is valued at $13.3 billion. Reaching new highs in monthly trading volume consistently, OpenSea hit $5 billion in total NFT value traded on the platform in January alone.

The company is poised to take full advantage of the growth in NFTs that some profess to be the future of asset ownership.

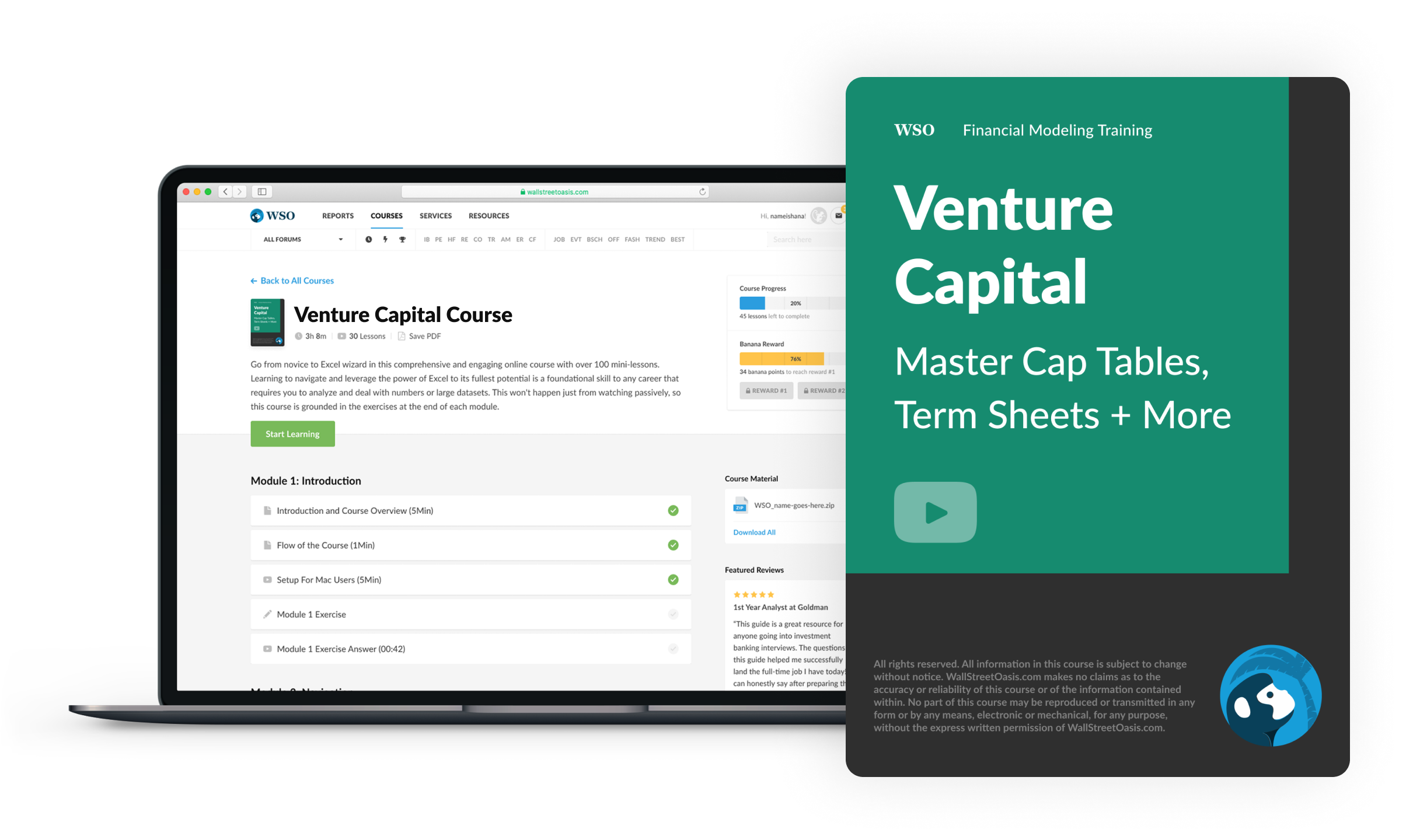

Everything You Need To Break into Venture Capital

Sign Up to The Insider's Guide by Elite Venture Capitalists with Proven Track Records.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?