Can Good News be Good News?

There has been a lot of hyper-taper sensitivity of late, ever since Fed Chairman Ben Bernanke broached the subject of reducing the monthly $85 billion bond buying stimulus program during the spring. With a better than expected ADP jobs report on Wednesday and a weekly jobless claims figure on Thursday, everyone (myself) included was nervously bracing for hot November jobs number on Friday. Why fret about potentially good economic numbers? Firstly, as a money manager my primary job is to fret, and secondarily, stronger than forecasted job additions in November would likely feed the fear monster with inflation and taper alarm, thus resulting in a triple digit Dow decline and a 20 basis point spike in 10-year Treasury rates. Right?

Well, the triple digit Dow move indeed came to fruition…but in the wrong direction. Rather than cratering, the Dow exploded higher by +200 points above 16,000 once again. Any worry of a potential bond market thrashing fizzled out to a flattish whimper in the 10-year Treasury yield (to approximately 2.86%). You certainly should not extrapolate one data point or one day of trading as a guaranteed indicator of future price directions. But, in the coming weeks and months, if the economic recovery gains steam I will be paying attention to how the market reacts to an inevitable Fed tapering and likely rise in interest rates.

The Expectations Game

Interpreting the correlation between the tone of news and stock direction is a challenging endeavor for most (see Circular Conversations & Tweet), but stock prices going up on bad news has not a been a new phenomenon. Many will argue the economy has been limp and the news flow extremely weak since stock prices bottomed in early 2009 (i.e., Europe, Iran, Syria, deficits, debt downgrade, unemployment, government shutdown, sequestration, taxes, etc.), yet actual stock prices have chugged higher, nearly tripling in value. There is one word that reconciles the counterintuitive link between ugly news and handsome gains…EXPECTATIONS. When expectations in 2009 were rapidly shifting towards a Great Depression and/or Armageddon scenario, it didn’t take much to move stock prices higher. In fact, sluggish growth coupled with historically low interest rates were enough to catapult equity indices upwards – even after factoring in a dysfunctional, ineffectual political backdrop.

From a longer term economic cycle perspective, this recovery, as measured by job creation, has been the slowest since World War II (see Calculated Risk chart below). However, if you consider other major garden variety historical global banking crises, our crisis is not much different (see Oregon economic study).

While it’s true that stock prices can go up on bad news (and go down on good news), it is also possible for prices to go up on good news. Friday’s trading action after the jobs report is the proof of concept. As I’ve stated before, with the meteoric rise in stock prices, it’s my view the low hanging profitable fruit has been plucked, but there is still plenty of fruit on the trees (see Missing the Pre-Party). I am not the only person who shares this view.

Recently, legendary investor Warren Buffett had this to say about stocks (Source: Louis Navellier):

“I don’t have concerns about this market.” Buffet said stocks are “in a zone of reasonableness. Five years ago,” Buffett said, “I wrote an article for The New York Times that said they were very cheap. And every now and then, you can see that that they’re very overpriced or very underpriced.” Today, “they’re definitely not way overpriced. They’re definitely not underpriced.” “If you live long enough,” Buffett said, “you’ll see a lot higher prices. I don’t know what stocks will do next week or next month or next year, but five or 10 years from now, they are very likely to be higher.”

However, up cycles eventually run their course. As stocks continue to go up on good news, ultimately they begin to go down on good news. Expectations in time tend to get too lofty, and the market begins to anticipate a downturn. Stock prices are continually incorporating information that reflects the direction of future earnings and cash flow prospects. Looking into the rearview mirror at historical results may have some value, but gazing through the windshield and anticipating what’s around the corner is more important.

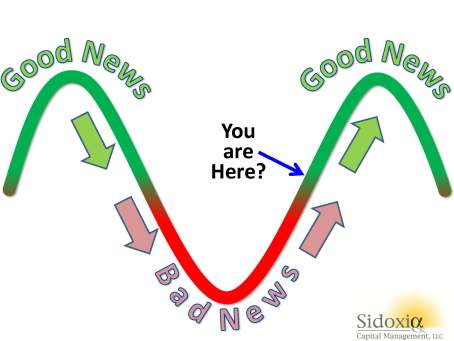

Rather than getting caught up with the daily mental somersault exercises of interpreting what the tone of news headlines means to the stock market (see Sentiment Pendulum), it’s better to take a longer-term cyclical sentiment gauge. As you can see from the chart below, waiting for the bad news to end can mean missing half of the upward cycle. And the same principle applies to good news.

Bad news can be good news for stock prices, and good news can be bad for stock prices. With the spate of recent positive results (i.e., accelerating purchasing manager data, robust auto sales, improving GDP, better job growth, and more new-home sales), perhaps good news will be good news for stock prices?

Fantastic write-up. DOW is going to zero.

Great write up. Love this. +1SB

Your article is a breath of fresh air. Here is [part of] the theoretical framework that can explain why you are looking at this correctly. It's simple really.

If the American labor force is expected to compete with cheap foreign labor, so then the dollar will have to compete with cheap foreign currencies. So, printing more dollars actually makes sense in a very particular way. How does this actually play out? Example: China's lending the US money and then artificially pegging the value of their economy to ours to boost exports? Fine. Since they won't reduce their fake money supply, we'll increase ours until relative parity is reached.

Futures markets tanked this morning, so not everyone is on the same page. This suggests a dip, but realize that futures markets aren't 1:1 correlated to stock indexes. Good news is finally being interpreted as good news because despite the glorified-gov'- stimulus-program-that-is-QE is closer to being wound down, the bottom line is that the economy is improving. Thus the indicators will go up. The reason that so many people have misinterpreted good news for bad news is that they have equated the FED's expanding balance sheet with inflation, and this is not the case when viewed in light of my first paragraph. In fact, when QE is wound down, the economy is very likely to experience a boom. There is always the potential for a black swan event, poor decision making, or some other structural issue that could weaken and cause a blow out....but as it stands things are looking up. The stock market is somewhat frothy now, hopefully people temper their greed with memories of what things looked like five years ago.

TLDR version: if the FED thinks that the economy will tank, they will just ramp up QE again. There is a limit to how far they can push it, but I don't believe we're even close. In the medium term, remember that the politicians now in power value stability over a boom/bust cycle, and that is all that matters. Contrast this with the last political administration that deliberately worked towards a pattern of 'creative destruction'. The only catch is that now that the gov't knows this trick works, they'll take full advantage of the QE mechanism in the future, thereby reducing its effectiveness and causing all of the very real problems everyone has had their panties in a buch about up until this point.

Pariatur minima est beatae ullam est. Dolores cupiditate facilis laboriosam sed necessitatibus iusto. Non non iste ut ipsam. Necessitatibus tempora velit inventore dolor repellendus magni.

Eveniet impedit voluptas molestias incidunt est dolores. Debitis aut architecto libero quia. Dolores labore voluptate quia molestias eum. Et fugit sit perferendis ea quasi corporis libero. Eaque magnam porro ea neque.

Eius qui doloribus voluptas aliquam. Unde molestias quasi nesciunt et maxime. Ipsa sapiente consequatur vel debitis et.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...