Deferred Tax Liabilities

Listed on the balance sheet that shows taxes that are payable in the future

A Deferred Tax Liability (DTL) is listed on the balance sheet that shows taxes that are payable in the future.

Deferred tax is accounted for as per IAS® 12, Income Taxes. IAS® 12 defines a DTL as being the amount of income tax payable in the future periods in respect of a taxable temporary difference.

This means the tax will be due at some point in the future. The delay is due to the tax treatment of several items differing in time.

To understand the definition fully, we need to know the term ‘temporary difference.’

The ‘temporary difference’ means the difference between the carrying amount of assets or liabilities in the financial statement and its tax base.

Temporary differences may be classified as:

-

A taxable temporary difference will result in a future tax payment when the asset or liability is settled or recovered. (Creation of DTL)

-

The deductible temporary difference will result in future tax savings when the assets or liabilities are settled or recovered (Creation of DTA).

In simple words, the deferred tax liability is a tax to be paid on a future date.

For example, in the case of installment sales, when a product is paid for in installments, the company lists the full value of the sale on its balance sheet but only pays taxes for each annual installment. The company recognizes that they have it for future payments on that sale.

How does deferred tax liability work?

The DTL on the company’s balance sheet shows tax payable that the company needs to fulfill in the future.

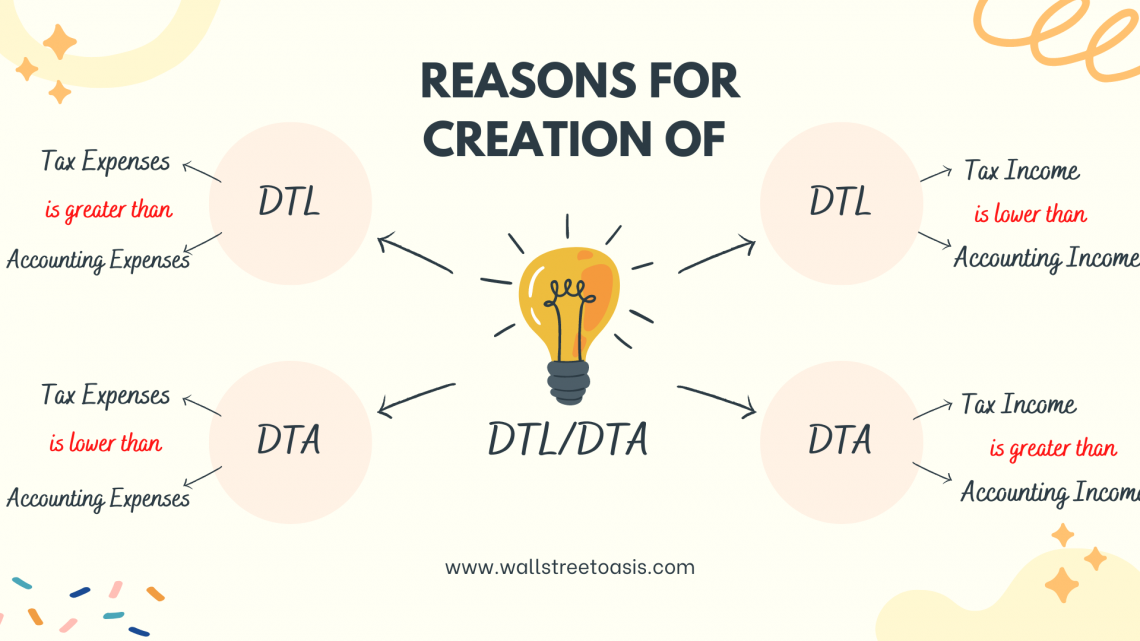

DTL and DTA are created with the objective of correct calculation of profit based on future tax and consequences and for correct valuation of net assets.

Deferred tax is just an application of the accrual concept.

It is calculated as the company’s anticipated tax rate times the difference between its taxable income and accounting earnings before taxes.

Deferred tax liability is created when revenues and expenses are recognized in the income statement before they are taxable. It originates when a company underpays the amount of taxes due, which it will eventually pay in the future.

Note that being underpaid does not mean that they have not fulfilled their tax duties. It’s just that the taxes are to be paid in the future.

In simple words, DTL is the opposite of DTA, which occurs when the taxable income is lower as compared to the income mentioned in the income statements of the company. It creates an obligation to pay taxes in the future.

For example, a firm may be aware that a subsidiary will pay a dividend but will not pay tax on the payout until the next year. This indicates that the corporation is aware that a tax liability may arise but that the present tax liability will be shifted to the following year.

How is deferred tax liability calculated?

It is calculated by finding the difference between the company’s taxable income and its accounting earnings before taxes, then multiplying that by its expected rate.

In simple words, the deferred tax liability can be calculated by recognizing methods that are treated separately by companies and tax authorities.

Remember, this is a future event; it’s recorded on the basis of confirmed events and recorded as a non-current liability in the balance sheet.

To calculate it, we use the following formula:

Deferred Tax Liability = Income Tax Payable - Income Tax Reported

In another way, we can calculate it by finding a taxable temporary difference, then multiplying that by the company's anticipated tax rate.

To calculate, we can use the following steps:

1st step

Carrying amount – Tax Base = Taxable temporary difference

2nd step

Taxable temporary difference x Rate of Tax = Deferred Tax Liability

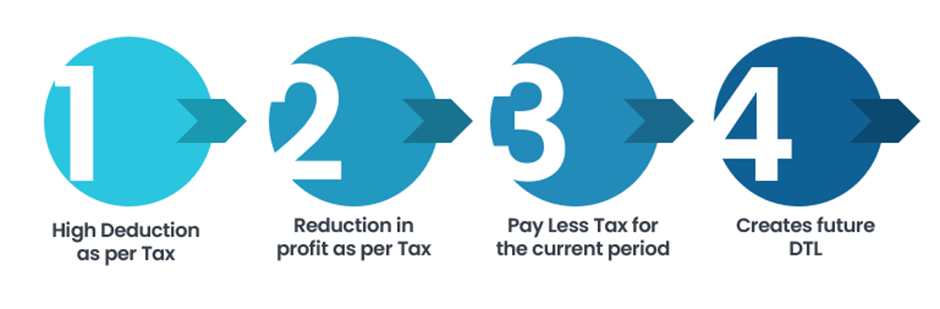

The tax due to the timing differences is termed "deferred tax," which literally refers to the tax postponed.

Simply put, it occurs when financial income exceeds taxable income, implying that the firm will pay less tax in the present period and more tax in the future.

Kindly note that it is only created for temporary timing differences, i.e., a difference between book profit and tax profit, which is capable of being reversed in subsequent periods.

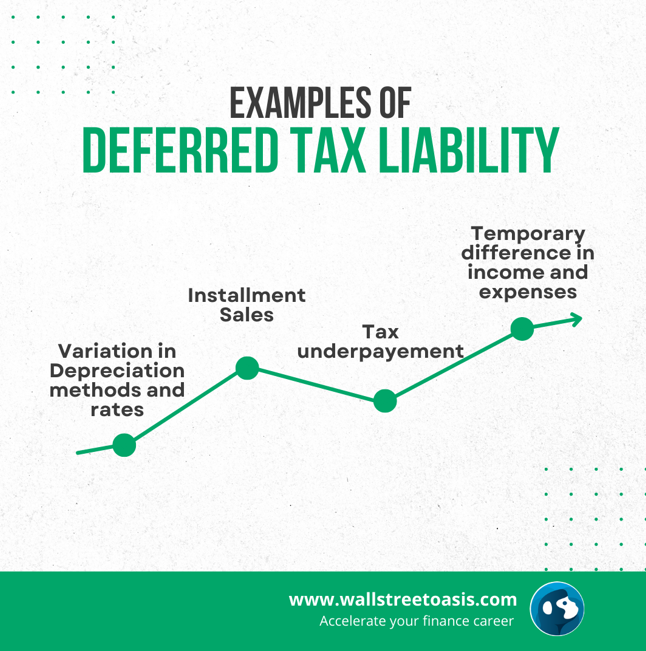

Examples of DTL

It happens because of the differences between tax laws and business accounting methods. For a better understanding of this, let’s take a few examples.

Example 1: Installment Sales

DTL occurs if a business has income from installment sales.

Revenue from installment sales occurs when a business sells products to a customer on credit and allows the customer to pay off the purchases over time.

Under accounting rules, a business is recognized for full income from installment sales.

Whereas, as per tax laws, the income from installments is to be recognized when payments are made.

Thus, the company recognizes that they have a DTL for future payments on that sale.

e.g., Let’s say there’s a business that offers Internet services to clients. Each month, clients pay a certain amount of money, as a subscription amount is $20 a month for a minimum of 12 months.

According to accounting methods, businesses report this income as $240 earned for the year, but as per tax laws, this will be recognized when the actual installment payment is made each month.

Therefore, they create it for the months that do not fall in the same year but know they must pay tax in the future.

Example 2: Variation in depreciation methods and rates

One of the most common situations that gives rise to deferred tax liability is due to how depreciation is calculated in tax laws compared to accounting rules.

A business typically uses straight-line depreciation on assets for its financial statements, whereas tax laws permit businesses to use accelerated methods of depreciation.

Since using straight-line depreciation results in a lower rate than the tax laws, this inflates profits in its books in comparison to the tax statement of the year.

The difference between those two figures would eventually narrow over the following years.

e.g., The company ABC assumes that a manufacturing machine costs $600,000, having a depreciation rate of 15%. However, regular financial accounting will consider 10% depreciation (life of 10 years).

It generated revenues worth $15 lakh in that year and incurred expenses of $8 lakh, excluding depreciation on assets. The below table outlines the comparison between the two reports:

| Particulars | For Books (in $) | For Tax purposes (in $) | Difference (in $) |

|---|---|---|---|

| Revenues | 1,500,000 | 1,500,000 | Nil |

| Expenses | (800,000) | (800,000) | Nil |

| Depreciation | (60,000) | (90,000) | 30,000 |

| Gross Profit | 640,000 | 610,000 | 30,000 |

| Tax @ 25% | (160,000) | (152,500) | 7,500 |

| Net Profit | 480,000 | 457,500 | 22,500 |

Therefore, the tax liability as per books is $160,000, and for tax purposes, it is $152,500. The temporary difference creates a DTL of $7,500 for the company, which it will account for in a subsequent year.

What is the journal entry for deferred tax liability?

It is a liability recognized because of the temporary difference between taxable profit and book profit.

Deferred Tax Liability is when to book profit is greater than taxable profit, which means the entity pays a lower tax today and will have to pay higher taxes in the future.

In simple words, it is created for temporary differences that will result in a taxable amount in future years.

The journal entry for DTL is:

| Particulars | Debit | Credit |

|---|---|---|

| Profit & Loss A/c | xxx | |

| To Deferred Tax Liability A/c | xxx |

For example, a company with a 25% tax rate depreciates an asset costing $1,000 placed in service in 2021 over ten years.

In the second year of the asset's service, the company records $100 of straight-line depreciation in its financial statements and $150 of depreciation (i.e., 15% depreciation) in its tax books.

The $50 difference represents a temporary difference, which the company expects to eliminate by year ten and pay higher taxes after that. The company records $12.50 ($50 × 25%) as a DTL on its financial statements.

So, a journal entry would be

| Particulars | Debit | Credit |

|---|---|---|

| Profit & Loss A/c | $12.50 | |

| To Deferred Tax Liability A/c | $12.50 |

Is deferred tax liability a good thing or bad?

The word ‘deferred’ means to delay or postpone something.

So, in other words, a deferred tax is a tax that has been delayed or postponed to the future.

In the case of deferred tax liability, the tax actually paid is less than the tax to be paid, so the difference between these two creates tax to be paid in the future.

DTL means the company owes taxes but has not yet paid.

This item is shown on the company’s balance sheet, and the money is reserved for this future expense.

This liability does decrease the company’s cash flow. However, this does not mean that it is bad.

This money is set aside for paying the taxes that the company owes, which is important as it would cause difficulties if the company spent the money on something else.

As there is a downside that the company must hang on to pay off this liability in the future, it could be neutral or good, depending on the situation. It creates a situation where we owe money but must pay it off at a future date.

Additionally, pushing profits into the future can show stakeholders that the profit margin is good, creating more confidence in the company.

Sometimes organizations also push their profits into the future to lower their tax amount this year. This money, which has been saved and not paid now, is being invested, and extra income is generated on that investment.

Why does DTL matter?

It is important to take care of it for the following reasons:

1. Impacts on a company’s taxes:

It impacts tax simply because if you have a balance due, you need to pay it in the future.

It is often shown as a non-current liability on the balance sheet; there could be a default if cash is not kept aside to pay the tax in the future.

The only variable here could be a change in the tax rate, which will decide whether your balance will fluctuate, so it may increase or decrease the expected taxes.

2. Affects the financial status of a firm

Whether in small businesses or large corporations, everyone considers how every expense and income affects finances and business operations.

Since it is a debt that will be paid in the future, it needs to be planned so that it can be assured that books are balanced and primed for growth, not bankruptcy.

It helps to know how much money a business is making in comparison to how much it owes in taxes. This liability is combined with the business assets to get the net worth.

All the information from the balance sheet helps to gain a better understanding of the broader picture in terms of how much money is coming in, how much money you owe, and where your finances stand.

With this information, finances can be optimized to make the business grow.

3. Effect Business growth

As net worth is considered public information, many investors use this information to assess whether they will invest in the organization.

If the company has too much debt, this could be considered a red flag and would affect the company's ability to acquire funds in the future.

Still, high debt showing up is risky, but deferred tax liability can be used to their advantage since the company's net worth is reflected as a lower number than what they've accounted for.

This could put them in a better position to pay dividends to shareholders and wages to staff by lowering their apparent net worth, allowing them to ask for less, resulting in more unrestricted income for the company.

A high DTL can also indicate that a corporation is in capital-building mode, i.e., spending more money on capital. This has a positive impact on investors' perceptions of the company because it will be seen as having great growth chances.

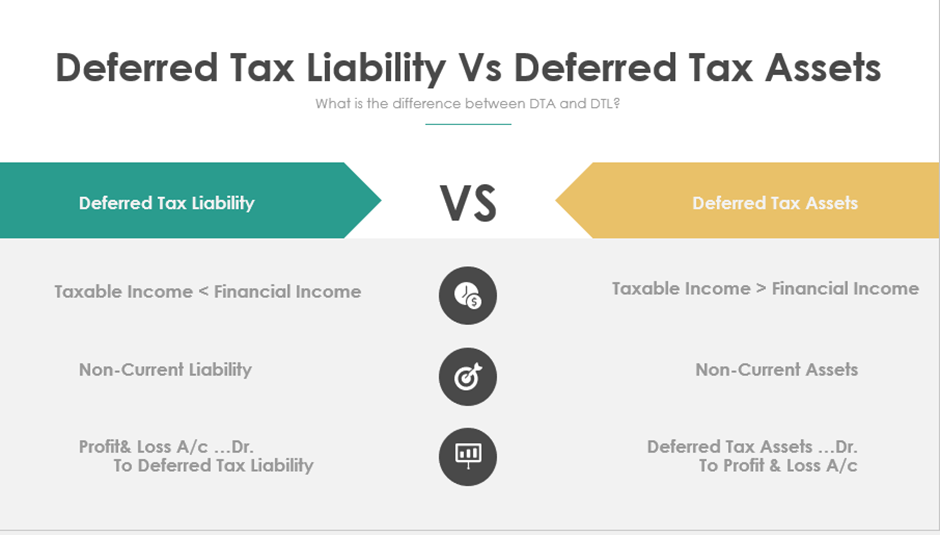

Difference between DTL and DTA

Both arise due to timing differences. DTL and DTA are opposites of each other. DTL is a tax to be paid in the future, and DTA is a tax paid in advance.

DTL is presented under non-current liabilities, and DTA is presented under non-current assets in the financial statements.

By DTA, it means that tax is paid in advance in the current period for the future, therefore creating DTA, which will in the future lead to less tax to be paid.

While in the case of DTL, it means that tax is to be paid in the future of the current period, therefore creating it will in the future lead to higher tax to be paid.

A common example of DTA could be

-

overpayment of taxes

-

expenses recognized by tax authorities even before they need to be recognized

-

revenue earned is taxed even before the time when it is recognized.

A common example of DTL could be

-

tax underpayment

-

the difference in depreciation methods and rates

-

installment sales.

Both DTA and DTL can be adjusted with each other, provided they are legally enforceable by law, and there is an intention to settle the asset and liability on a net basis.

Key Takeaways

-

A DTL reflects a tax that is owed and must be paid in future years.

-

DTLs can happen for numerous reasons; some common ones are Depreciation, installment sales, and credit transactions – but it mainly happens due to differences in accounting methods and tax laws.

-

DTL and DTA both represent an amount of money owned; DTL is owed to the government, while DTA is owed to the company

-

DTL and revenue can be smartly managed to help a company keep balanced account statements and books

-

This tax obligation arises when an event occurs that would create a tax liability that is delayed until a future period.

-

DTL should be included in the liabilities section of their balance sheet.

-

In simple words, DTL is caused due to temporary differences and is the amount of tax a company has underpaid, which they will pay in the future.

FAQs

It is listed on the balance sheet as “Non-current Liability.”

A DTL is created when there is a temporary gap between the amount owed in taxes and the amount that must be paid in the current accounting cycle.

Because temporary differences establish deferred tax liabilities, the reversal of a DTL is dependent on the reversal of the temporary difference that caused it.

Researched & Authored Swastik Chaturvedi | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?