Hedge Fund

An investment vehicle wherein an investment pool is created

What Is a Hedge Fund?

Hedge funds (HFs) are an investment vehicle wherein an investment pool is created consisting of various institutional and accredited investors having large sums of money to deploy. These funds are mostly not open to retail investors as it involves a high degree of risk.

Examples of institutional and accredited investors are - Banks, Financial Institutions, Pension Funds, Endowment Funds, HNI, etc.

Hedge fund managers often use unconventional investment strategies to generate above-average returns for their clients, and these include techniques like - using leverage (borrowed money) to take positions in the market and trading in specialized assets/markets.

These funds are also allowed to hold multiple long and short positions in the derivatives market, and this is because they are less strictly regulated by the Securities and Exchanges Commission (SEC) as compared to other funds/investment vehicles.

Taking a long position in the market means betting that an asset/security will appreciate at a price. This is because investors buy at lower levels and square off their positions when the prices shoot up.

Short positions are exactly the opposite; in this strategy, the trader/investor believes that the asset will see a drop in its price. Therefore the trader sells the asset at higher prices only to square it off (buy the asset back) at a lower price.

The term 'hedge' means taking a bet or a trade in the opposite direction of one's focus. This is done to protect a portfolio of assets from severe depreciation and offset any losses.

For instance - If Fund A has a long position on Amazon's stock and they realize that the stock may fall, they have the option to take a short position on Amazon, which offsets losses made by the long position taken earlier. This is a simple example of hedging; however, hedging is highly complex and involves different strategies.

Key Takeaways

-

Hedge funds are a specialized form of investment where a group of wealthy and professional investors pool their money together. These funds are often not accessible to regular investors due to the high risks involved.

-

Hedge fund managers use unique strategies, like borrowing money to make big investments and trading in specialized assets, to aim for above-average returns.

-

Unlike other investment vehicles, hedge funds have fewer regulations from the SEC and can take both long and short positions in the derivatives market.

-

Hedge funds have distinct characteristics, including leverage, exclusivity to certain investors, limited liquidity, flexible investment strategies, and unconventional fee structures.

-

Most HFs usually focus on generating returns even in market downturns (bear markets) rather than beating market returns in a normal scenario, and this is because the main purpose of these funds is to act as a hedge rather than a wealth creator.

Understanding how Hedge Funds work

These funds can park investor money anywhere in the market and use almost any strategy, making a "typical" hedge fund challenging to characterize.

The majority of them, however, have a preference for liquid financial instruments (as opposed to illiquid private equity investments) and an inclination to use unorthodox trading strategies such as derivatives or short selling.

Their usual fundamental structure is an investment or partnership pool in which a fund manager invests in various asset classes, geographies, and stocks that correspond to the fund's objectives.

Fund managers pitch several plans to clients, and those who buy into the fund expect the management to follow it and generate maximum returns.

There are several types of funds present in the market; some of these include - a fund that is long or short on all of its stocks or a fund that specializes in a certain form of investment, such as common stock or patents.

Key Features

These funds have certain characteristics which separate them from other types of investment vehicles; let us list down some of these important features below:

1. Use of leverage:

The use of leverage or borrowed money is a common characteristic among all such funds, and leverage is used so that these funds can maximize the returns for their clients.

This borrowed money can be acquired through various means, and some funds prefer trading on margin, i.e., using their broker’s money to take bigger positions in the market, while some funds prefer to trade on a credit line provided by a financial institution, in the hope of getting returns which surpass the interest costs.

2. Open to limited investors:

The Securities and Exchange Commission (SEC) and most other market regulators worldwide only allow accredited/qualified investors to deploy their money in such high-risk funds, as it is believed that these investors have an adequate risk appetite for these funds.

Also, institutional investors and HNI’s (High net-worth individuals) usually have a large portfolio. Therefore, they often need to diversify their investments across various asset classes and geographies. These services are provided to them by specific funds.

3. Low liquidity:

These funds usually provide lower liquidity to investors than other traditional investment vehicles. Fund managers usually lock up the investments for two years or more.

This is because these funds use a high degree of leverage along with complex trading strategies that do not allow them to withdraw money or liquidate their positions easily.

4. Lesser regulatory oversight:

The SEC and other market regulators worldwide usually do not strictly regulate this industry.

In the United States, the SEC does not require these funds to register with the Commission. Their fund managers are also exempted from registering themselves with the Financial Industry Regulatory Authority or the Commodity Futures Trading Commission.

However, many funds register themselves with the concerned authorities as it gives their investors peace of mind and provides these funds the necessary protection under various laws/acts.

5. Flexibility in investments:

Since this industry is not very strictly regulated, it has the flexibility and option to invest in various asset classes and geographies to maximize returns. This is a feature that is missing in other investment vehicles.

For instance - If the team of analysts at Fund X concludes that there is a good investment opportunity in the real estate sector of China, then Fund X has the option to invest their client’s money in the opportunity, unlike other investment opportunities which limit themselves to a specific asset class or geography.

6. Unconventional fee structures:

Traditional investment schemes like mutual funds usually charge a fixed commission from the investors, known as the expense ratio. However, the fee structures of such funds are complicated and unconventional.

We will cover the fee structure of these funds in detail later in this article.

7. High degree of risk:

Because of the above-mentioned reasons such as - less regulatory oversight, use of high leverage, investments in unconventional assets, etc. Such funds are risky bets and are, therefore, only open to qualified investors.

Since the majority of retail investors have a comparatively smaller portfolio or capital size, they might panic seeing the extreme volatility and riskiness of this industry. Therefore, the SEC only allows big investors to deploy funds in such schemes.

Types of Hedge Funds

There are various types that are present in the market. Investors carefully examine their investment goals and select a fund that fulfills those goals.

Let us look at the types of such funds:

1. Domestic Funds:

Domestic funds are those funds that are set up in a particular country or geography and are open to investors who belong to that specific geography.

For instance - Fund X is set up in the United States and operates within the specified geography. Therefore, the fund offering of Fund X will only be available to eligible investors from the United States of America, and clients belonging to other countries will not be able to invest in Fund X.

2. Off-shore funds :

These are hedge funds that are established and operate outside one's own country, and these funds usually prefer low-tax geographies to maximize their post-tax returns.

However, there are certain risks associated with investing in such off-shore funds:

-

Movement in currency value can significantly affect the value of one's investments.

-

The off-shore country might come up with new laws and rules, or there might be geopolitical tensions that can impact the returns of such funds.

3. Fund of Funds (FOFs) :

These are funds that invest in the investment schemes of other funds. This is a strategy that helps these funds to diversify their investor's portfolios.

Some of these funds are owned by bigger financial institutions, and in those cases, they invest in the funds of their parent company.

For instance - Fund X invests a large part of its client's money in Fund Y's investment vehicles, and this allows Fund X's clients to firstly diversify their portfolios. Secondly, it acts as a hedge against Fund X not being able to generate enough returns.

Fee Structure of Hedge Funds

Before we understand the exact fee structure of these funds, it is important to be aware of certain terminologies, and these will help us when we finally move on to understanding the fee structures :

1. Net Asset Value (NAV):

The NAV is defined as the net value of a business or fund. It is calculated as the business's assets minus the total liabilities.

In the context of a mutual fund, hedge fund, or ETF, it simply represents the unit price of a fund on a particular date, and investors can use the NAV to find out the number of units that they would be allotted corresponding to their total investment. This further helps them while redeeming or withdrawing their money from funds.

2. Hurdle Rate:

It is defined as the minimum rate of return that a fund (usually HFs) has to achieve before it can start charging a performance fee.

This hurdle rate can be either fixed, variable, or even linked to benchmark rates such as LIBOR, equity index, bond index, etc. For instance - if the hurdle rate of a fund is 10%, then until the fund's returns exceed 10%, they cannot charge performance fees from their clients.

3. High-Water Mark:

This refers to the highest value (NAV) a fund has ever reached. Some funds use this mechanism to pay fees only when the current NAV exceeds the high-water mark.

This is done to ensure that investors pay performance fees only on the new profits made by the fund manager, and incentives are not given on profits that are used to offset losses.

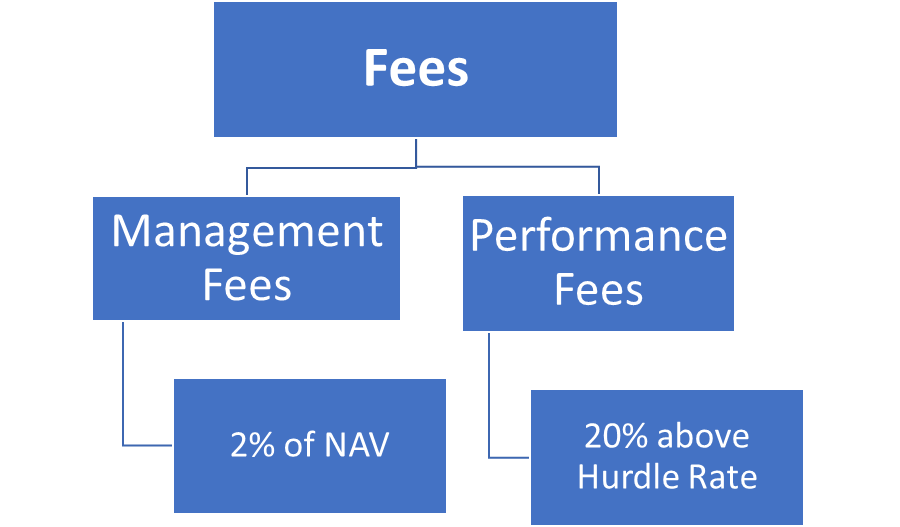

Such funds, which hedge their client’s portfolio, usually operate on a 2/20 fee structure. Let us see the various components of this fee structure:

1. Management Fees:

This can be defined as the fees paid by investors for having their money professionally managed by fund managers. Management fees are paid annually regardless of a fund’s performance.

The usual fee is around 2%, which means clients will have to pay management fees equal to 2% of the fund’s NAV every year.

For instance - A fund managing $1 billion in AUM (Assets under Management) will receive $20 million as management fees every year.

2. Performance Fees:

This is the fee paid by clients to incentivize fund managers to generate excess returns. The performance fee is only paid when the fund’s returns exceed the hurdle rate set. The performance fee is usually set at 20% for most hedge funds.

Who can invest in a Hedge Fund?

Investing in hedge funds carries a high amount of risk along with lots of volatility in the value of investments. Therefore, regulatory authorities worldwide have imposed certain restrictions on investors who can deploy their money in such funds.

The majority of market regulators do not allow retail investors to invest in such funds due to the high-risk factor. These funds are usually only open to accredited and qualified investors. In the context of the United States, the Securities and Exchanges Commission (SEC) defines qualified investors as the following:

1. Institutional Investors - Banks, Insurance companies, Pension funds, Endowment funds, Mutual funds, etc. are examples of institutional investors. They are categorized as investors who possess large sums of money to deploy in the markets on behalf of an institution or company.

2. Accredited Investors - Accredited investors are defined as individuals having a net worth of a minimum of $1 million, excluding the value of their primary residence. They are also sometimes categorized as investors having an income of above $200,000 or $300,000 if the individual is married.

Apart from these two criteria, certain funds have their eligibility criteria which govern the nature of their investors. Anybody who does not fall into those categories is not allowed to invest in such funds.

This is the reason only a small fraction of the entire population invests in such types of funds. However, these funds still remain very profitable as their fee structure often supports their financial feasibility.

or Want to Sign up with your social account?