Interest Expense

The price that someone pays in exchange for borrowing money

What Is Interest Expense?

Interest expense is the price that someone pays in exchange for borrowing money.

In a typical transaction, a lender would extend a certain amount of money to a borrower in addition to a negotiated term. This negotiated term is usually a fixed percentage of the amount the borrower and lender agreed to.

On an income statement, it is shown as operating expenses. Most often, individuals borrow money (in most cases) from a bank, investor, loan shark, and other various sources. Each source has pros and cons, and banks and investors are generally the safest bet.

Financial institutions may help a company or individual fund their investing, operating, or economic activities in return for a fixed percentage that the institution (e.g., bank) is to be paid back after a certain period.

Key Takeaways

- Interest expense is part of non-operating expenses since it is not part of a business’s day-to-day operations.

- Interest expense represents the cost incurred when borrowing money. It is the price paid for the privilege of using borrowed funds.

- Interest expense is tax-deductible, making borrowing an attractive option for companies looking to reduce their taxable income. This deduction can free up more cash flow for other purposes.

- Interest expense is recorded on the income statement as a non-operating cost incurred when a company borrows money. It is also reported as "interest payable" under current liabilities.

Interest Expense Example

The most straightforward example of this would be getting a mortgage on a house.

An individual would get a loan from a bank to buy the house of their dreams. In turn, the bank negotiates to lock in a fixed percentage or floating rate on top of the regular installment payments until the house gets paid off.

The buyer, happy with this affordable negotiation, agrees and enjoys the luxury of owning a home, which, perhaps, they could not have had if they had to purchase the house in full.

Mortgage payments can accumulate a significant amount of money. It comes down to available cash flow, usually on a month-to-month basis (the usual structure of salary payments).

Some large corporations opt to borrow money and pay interest rather than use their equity or cash flow to implement a project.

This approach allows corporations or individuals not to put all their eggs in one basket. Borrowing money will enable them to maintain liquid and accessible cash reserves.

Maintaining liquidity allows one to account for any unexpected event or situation that one might face.

Let’s not forget to mention one of the biggest benefits of borrowing money is that it is tax-deductible.

Such expense can be generated in various ways and is a broad concept with multiple aspects to look for. Here’s what you need to know.

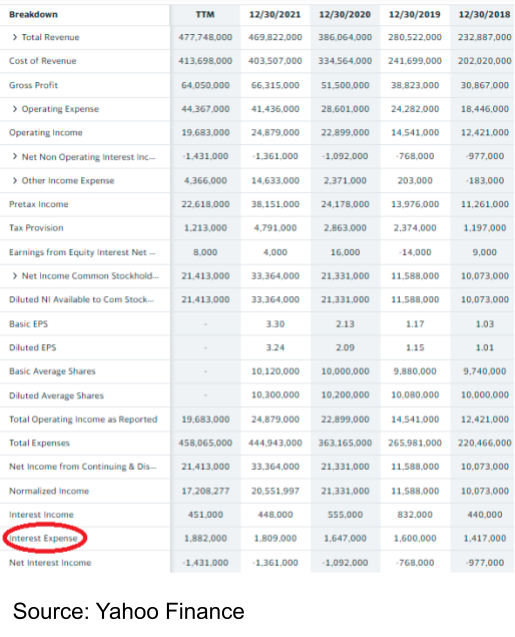

Interest Expense in Accounting

It is a non-operating cost displayed on the income statement that a company incurs when it borrows money from an investor, bank, or any similar financial institution.

This expense is recorded on the income statement and shows the incurred expense when the transaction occurs (and not necessarily when the amount was paid).

It is then recorded as ‘interest payable,’ which is part of current liabilities. Current liabilities are obligations that a company must pay off within one year.

One of the amazing advantages of interest is that it is a tax-deductible expense. This deduction makes it favorable for companies to borrow instead of using their equity.

Note

Extra debt may lead to financial problems if the debt cannot be paid (debt-to-equity ratio).

Interest may take the form of interest payable or prepaid expenses.

- Interest payables are current liabilities that the borrower owes to the lender and has to pay sometime in the future.

- Prepaid expenses are when the borrower pays the expense before the first scheduled repayment date.

How is interest expense calculated, and what’s its formula?

Interest Expense = Principal X Period X Interest Rate

Suppose a small company borrows $10,000 from a bank. The bank asks for 5% interest each year on the loan.

The company prepares its financial statements for the first quarter of the year and wants to determine how much interest paid on loans is.

= $10,000 * 0.25 * 0.05 = $125 (0.25 is also in the equation because there are 4 quarters in a year, and we are talking about the first quarter. So ¼ = 0.25).

Therefore, the company will incur $125 each quarter as interest for the bank. This payment will be recorded as an interest expense on their income statement.

Why is interest expense a non-operating expense?

Most corporations use loans to fund their daily business activities, but interest payments on such loans are not considered a core activity of the corporation. Thus, it is regarded as a non-operating expense.

So what is the difference between operating expenses and non-operating expenses?

1. Operating expense (OPEX)

A company incurs expenses when conducting its normal operations. These include, but are not limited to, inventory, equipment, payroll, and the cost of research and development.

Companies’ management needs to reduce operating expenses as much as possible but without affecting routine operations and the company’s competitiveness. In that way, companies can significantly increase their earnings.

*Usually displayed under the cost of goods sold (COGS) on the income statement.

2. Non-operating expenses

Expenses that are not directly related to a business’s everyday operations, such as:

- Loans

- Settling lawsuits

- Assets Disposal

- Inventory write-offs

- Restructuring expenses

- Depreciation

- Office Supplies

*Non-operating expenses are usually displayed at the bottom of the income statement and are deducted from operating income.

Now that the difference between the two concepts is clear, we can conclude that interest expense is part of a non-operating expense since it is far from a company’s regular operations.

Why is it essential to separate operating expenses and non-operating expenses?

Operating expenses are a controllable type of expense that a business should always aim to minimize to make higher profits. These expenses indicate how the company performs, a critical indicator that banks and investors gauge.

There are several metrics and analyses used to optimize expenses. Consultants are an excellent way to find solutions and provide more cost-effective and efficient methods to run a business.

On the other hand, non-operating expenses are non-controllable expenses for a company. Simply put, these are black swan events or circumstances that cannot be prepared for and just come up as life unfolds. Some of these non-controllable expenses include:

- Payments to settle lawsuits

- Disasters

- Investments losses

- Maintenance

- Utilities

It is only fair to separate these expenses from other expenses because the company has little to do with how much of it they are going to bare each year.

Interest Expense and tax returns

First of all, let’s introduce you to interest deductions. Interest deduction reduces taxes that are charged on income. How is that? Let us explore this concept with the following example.

Let’s say the income tax is 10% in your business’s country.

Upon doing your accounting work and running through book-keeping, you look at your income statement at the end of the fiscal year.

The income statement shows that your business recorded $100,000 as operating income with no interest paid, meaning you funded your businesses with equity and no loan or borrowed money whatsoever. Therefore, a net income of $100,000.

Now, assuming the aforementioned federal tax rate of 10%, you will have to pay 10% of your $100,000 towards taxes ($100,000 * 10% = $10,000).

Your net profit is now $90,000 after paying $10,000 (10%) of taxes from your $100,000 operating income.

Let’s take another case where your company recorded operating income of the same amount, $100,000, with the same tax rate of 10%. However, this time, you also record an expense of $5,000 on your business’s income statement.

Since this type of expense is non-operating, you would have to deduct it from your operating income. Doing so, your net income is now $95,000 ($100,000 - $5,000).

And, since you have to pay 10% income tax, this 10% will be taken from your net income of $95,000, equating to $9,500 ($95,000 * 10%) in income tax. This means less tax paid and more income retained.

Now that is a win, wouldn’t you agree?

Hence, it is not all black and white regarding expenses. However, such non-operating expenses allow businesses to cut down tax payments. This makes it all the more worthwhile since it leaves more cash flow and equity for day-to-day operations and expansion.

As a general rule of thumb, consult financial advisors and accountants, as they will know more about writing off expenses, obtaining tax benefits, and retaining more money. Misrecording transactions can be a bad practice and tarnish a company’s reputation.

Where does the Expense Appear on the Financial Statement?

Interest expense is added to the debit side with interest payable accrued on the credit side, increasing expenses and payable accounts.

However, when recording these expenses on financial statements, this is how it’s done:

1. Income Statement

It is recorded at the end of an income statement under operating activities. Sometimes, it can be combined into a single line called “Interest Income - Net” or “Interest Expense - Net.”

- “Interest Income - Net” is written when there is more interest income than expenses. The latter is reported when there are more expenses than income.

- Assume a business pays $50 of interest on a loan and earns $20 of income from savings. In this case, the business will record an “Interest Expense - Net” of 30$.

2. Balance Sheet

Interest that has been accrued but not yet paid is recorded under “Current Liabilities” as Interest Payable. In contrast, the interest paid in advance is recorded under “Current Assets” as a prepaid element.

Net profit or loss reported by the cash flow statement contains these expenses. However, the amount the business has paid will be displayed on a separate line of the cash flow statement.

- Interest amounts a business pays (short-term or long-term) are recorded under operating activities in the cash flow statement.

- The amount of money that has been borrowed and the amount repaid is shown under financing activities in the statement.

- Moreover, since borrowed money is not part of a business’s sales, they are reported under the cash flow statement, not the income statement.

What is the Interest Coverage Ratio (ICR)?

The interest coverage ratio (ICR) is the ratio of a business’s operating income, or EBIT (earnings before interest and taxes), relative to its loan expenses.

This measures a company’s capability to meet its interest on debt using its operating income.

- The higher the interest coverage ratio, the higher the company’s ability to meet its interest obligations.

- Creditors and lenders usually use the ICR (interest coverage ratio) to determine whether it is safe or not to lend entity money.

- The interest coverage ratio is also known as “times interest earned.”

1. Interest Coverage Ratio Formula

To calculate the interest coverage ratio, we use the following formula:

Interest Coverage Ratio = Earning Before Interest and Taxes (EBIT) / Interest Expense

Where:

- Earnings Before Interest and Taxes (EBIT): represents a company’s operating profit.

Another formula version uses Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) as the numerator instead of EBIT.

The formula will therefore be:

Interest Coverage Ratio = EBITDA / Interest Expense

2. Interest Coverage Ratio Example

Assume a company reported $100,000 debt with a 7% interest rate.

The company reported an annual EBIT of $70,000.

Applying the mentioned formula above:

70,000 / 7000 = 10

Therefore, the company’s interest coverage ratio is 10.

3. What is a Good Interest Coverage Ratio?

Financial analysts prefer companies with an interest coverage ratio of at least 3. An interest coverage ratio below 1 indicates that the company is struggling financially and cannot meet its debt obligations. This is because its operating income might not be adequate to cover such expenses.

4. What is a Good Interest Coverage Ratio?

Financial analysts prefer companies with an interest coverage ratio of at least 3. An interest coverage ratio below 1 indicates that the company is struggling financially and cannot meet its debt obligations. This is because its operating income might not be adequate to cover such expenses.

Interest Expense FAQs

Since debits increase expenses, it is part of the debit side. However, Interest Payable is part of the credit side since it is a liability, and credits increase liabilities.

Expenses are the cost of borrowing money when the company is the borrower, while interest income is when the company is the lender. In that latter case, it’s the income that a company receives when lending money to another party.

When the loan you have taken is for personal use, such as to purchase a car for personal use, the expense is no longer deductible, according to the International Revenue Service (IRS).

In accounting, a non-cash item is an expense displayed on the income statement that does not include cash payments. Since expenses on loans are recorded on the income statement before payment, it is regarded as non-cash item.

A negative net interest means that the company paid more on interest for borrowing money than they received for lending money. On the income statement, expense and income can be listed separately or combined as net interest, positive or negative.

Fixed costs are costs that companies incur and have nothing to do with their production level. Since borrowing money does not depend on the company's production level, this type of expense is a fixed cost.

or Want to Sign up with your social account?