Modeling Test Help

Hello Community,

Trying to make my way to a new position in Real Estate and I've been having difficulty doing test like this one. Anyone could help?

All the best

Cheers,

Paul

Hello Community,

Trying to make my way to a new position in Real Estate and I've been having difficulty doing test like this one. Anyone could help?

All the best

Cheers,

Paul

Career Resources

Which part(s) are you struggling with?

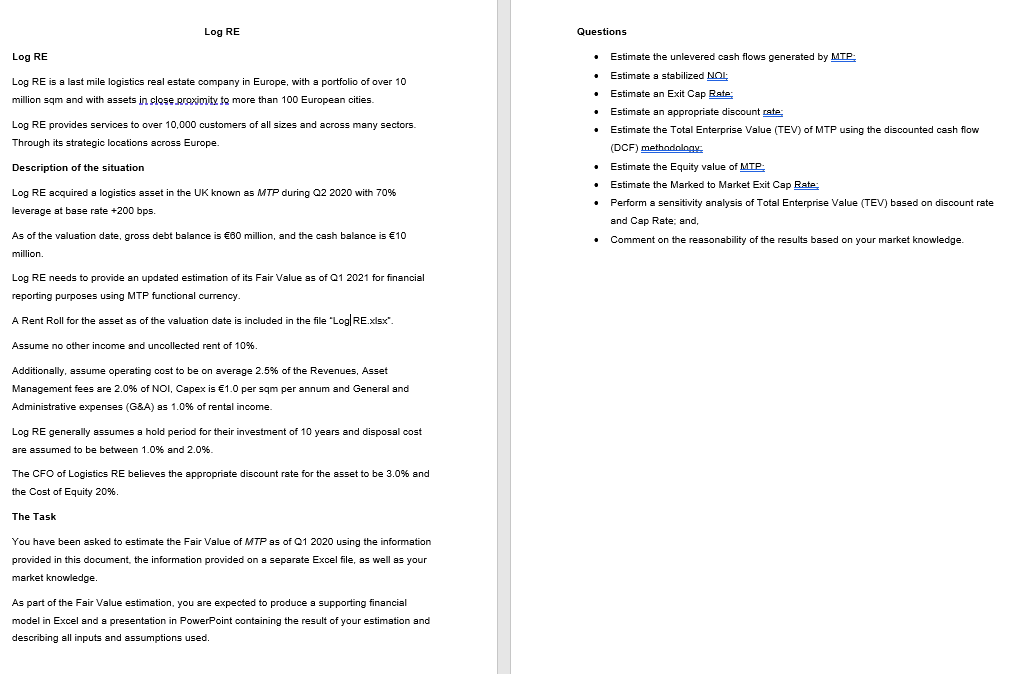

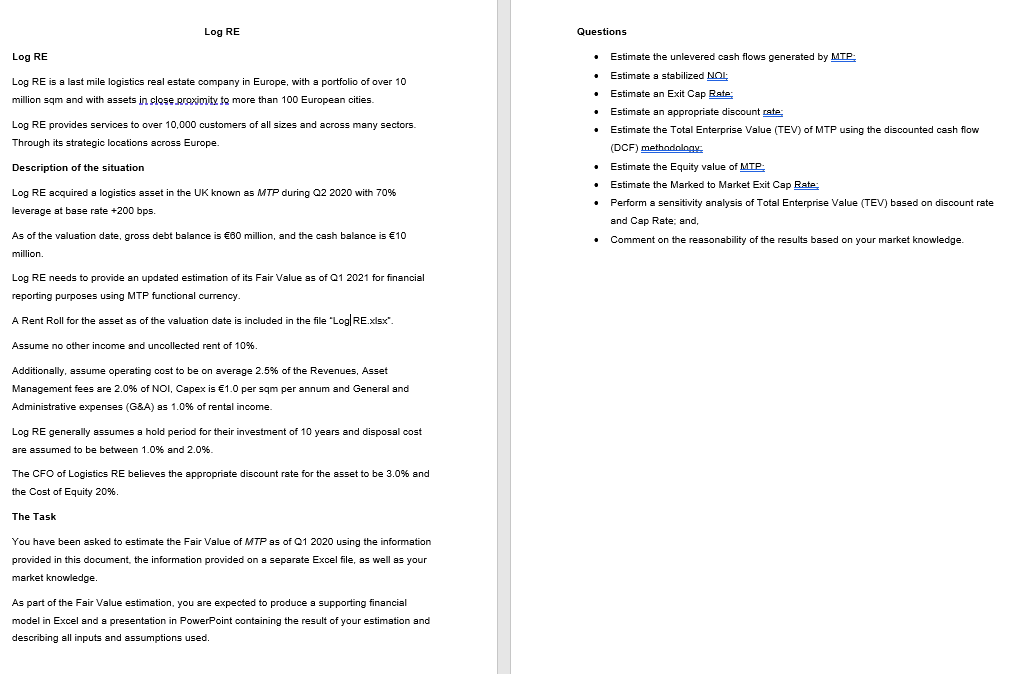

Thanks for your reply, To be honest, I only managed to go to NOI and unlevered cash flows thus I had various issues:

- Starting point: should I begin the model on Q2 2020 the purchase date or Q2 2021 the new valuation date?

- Rent Roll assumptions (see picture), I had trouble factoring in the renewal probability

- Estimating the entry value and the exit cap rate (based on the fact that I dont have any entry value, just have the NOI I computed)

- All the following questions on the entreprise value and equity value

Do you know any similar case with a completed version of the case I could study for example? I guess I have to learn how to properly do a similar test.

Thanks

Necessitatibus maxime quasi minima officiis autem vitae. Eaque veritatis adipisci nihil. Est nihil praesentium quia dignissimos sed ut nemo ut. Optio et voluptatem vitae. Beatae eligendi asperiores fugiat repudiandae.

Repudiandae aspernatur sed et magni dolorem. Qui veniam id necessitatibus officiis quo deserunt. Quis libero sed inventore nulla rerum ut sit.

Nulla ut ducimus impedit. Est qui et ex amet autem neque quis. Facilis aspernatur debitis aliquam rem illo totam autem aspernatur.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...