Questions about liquidation pref

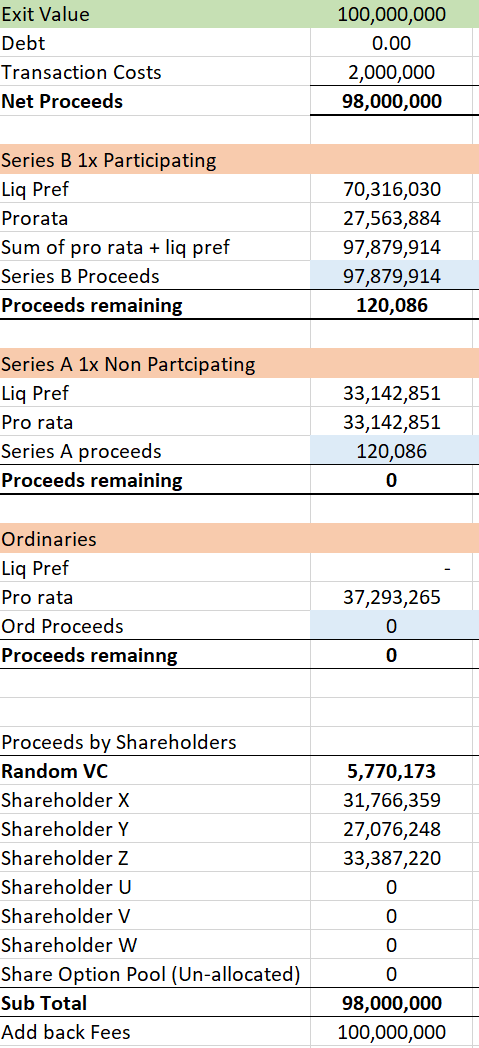

In my spare time I've been practising things like cap tables, CLN conversions and Liq pref, i have been able to understand where multiple investors have 1x Non-participating they essentially choose their liq pref until their pro rata share is higher. The remainder flows down to the next investor. Im still struggling slightly with 1x Participating say series B being the most senior get their proceeds first and they invested in the A as well as having a portion of ordinaries.

- The Liq pref total is 70m

- Pro-rata share of a 98m Exit event is 27m,

In this example does the proceeds for this 1x participating proceed equal the Liq pref + their pro rata of their Series B shareholding or is just the liq pref and then the money flows through.

I attached a screen shot of my assumptions:

I find it easier to think about it from a shares basis. For a participating preferred, they get the 1x and keep their shares which will be worth whatever the common PPS is.

That makes sense so essentially what actually happens is my Series B investors gets their guaranteed cash so 70m in this case and if they are the only participating pref share class then everyone converts to common and you get your %FD of shares

Yea your payoff is principal + % equity. Investors love it. You get your slice of the cake and can go for seconds. You've made a return on day 1. Companies naturally hate it.

I think it's wrong above or maybe I can't read it. Series B gets to double tap in the same proceeds pool as common. The as-if converted piece is not "preferred" only the principal. Treat the principal payment(s) like debt after which all rest is equity

That makes sense im realising now it looks abit more like this, Series B get their guaranteed, everyone converts to common so its just my pro rata ownership of the company times the remaining proceeds for common

Voluptas repellat quas blanditiis quidem voluptatem et. Voluptas impedit ut et voluptas nulla fuga. Sapiente ut in asperiores recusandae. Ea delectus tempore labore molestiae cumque.

In provident velit nihil earum molestias eum. Laborum est fugit ratione sint deleniti sit in. Alias sint est consequatur.

Quia qui dolores eveniet sed. Id error alias dignissimos accusamus. Minus fugiat dolores voluptatum quos praesentium consequatur cum similique. Nam velit modi nisi rem quibusdam asperiores. Qui vel exercitationem asperiores in. Dolorum occaecati et in vero.

Placeat possimus sed ut iusto pariatur. Impedit nisi repudiandae eveniet. Quasi ratione quo dolor. Magnam sed perferendis et nulla mollitia ut alias.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...