What is MD&A?

A section in the company's annual financial report, or 10K, that caters to an overview of the company's financial performance over the period, current financial position, future projections, and outlooks as per the management.

What Is Management Discussion & Analysis (MD&A)?

MD&A is a section in the company's annual financial report, or 10K, that caters to an overview of the company's financial performance over the period, current financial position, future projections, and outlooks as per the management.

Companies are required to file quarterly or annual performance reports. These reports encompass various details, including the Management Discussion & Analysis, which is considered crucial as it provides insight into the company’s financial and operational performance.

MD&A is a section that is presented by the management (commonly known as C-level executives).

C-suite refers to managers within the organization who are the higher-ups. These are mainly the chief executive officer (CEO), chief financial officer (CFO), chief operating officer (COO), and chief information officer (CIO).

MD&A is all about comments from the management, as discussed above. These comments typically cover areas such as fiscal statements, systems, and controls, compliance with laws and regulations, challenges the company is facing, and the actions taken to combat those challenges.

Management also discusses future targets & objectives and its attitude towards the newer or coming projects.

The Securities and Exchange Commission (SEC) and the Financial Accounting Standards Board (FASB) mandate that public companies include numerous sections in the periodic report that they present to their shareholders, MD&A being just one of them.

The SEC monitors public companies to ensure compliance with U.S. securities laws. This helps investors by assuring them that the information they receive about the companies they invest in is acceptable.

A public company that issues stock or bonds at large is required to register with the SEC. The SEC authorizes 14 items to be included in the 10-K report, with the MD&A section as Item No. 7.

The SEC delegated the responsibility for posting accounting norms for public companies in the United States to the FASB, a private, non-profit, and regulatory organization that states the requirements for the MD&A section of periodic filings.

Key Takeaways

- Management Discussion & Analysis (MD&A) is a section of a company's annual report or quarterly filing where management provides insights into the company's financial performance, operations, and future outlook.

- The primary purpose of MD&A is to provide investors and stakeholders with a deeper understanding of the company's financial condition and results of operations.

- It allows management to communicate key drivers of performance, significant risks and uncertainties, and strategic initiatives undertaken during the reporting period.

- Management provides an overview of the company's business segments, products or services, geographic regions, and market conditions.

Importance Of Management Discussion & Analysis

The MD&A is an important declaration that should be included in regular reports. It briefs the company's way of work, financial statements, and performance and states the management’s view about the company's performance.

It is helpful and can be used as a tool even for beginners who need to understand a company's performance. It is not written in a complicated way. Rather, it is written in a way that the users can understand and digest.

Talking about the analysts and investors, it serves as a start since it briefs about the overall financial and operational performance of the company. The details provided in it are figures and facts relating to the preceding and current year and also any other future perceptions.

MD&A helps users understand how the company functions under macro and micro economic factors. It also helps users understand the mindset of the management and why certain steps are taken in certain ways.

Apart from this, it also helps users in calculating various financial ratios, which helps in a better understanding of the financial statements.

The Management Discussion and Analysis section discusses in detail the steps the company has taken to achieve its vision. It shows the prudent aim of the management and the hardships it went through to achieve its long-term objectives and targets.

It mainly shows the company's financial success throughout the reporting period. It discusses the company's present financial position in detail. This section also shows how the company has made progress in its operations and HR department.

MD&A summarizes the position in the past, the position in the current environment & future protrusions as well.

An investor can get an overview of the strengths and weaknesses of numerous companies by simply comparing their Management Discussion and Analysis reports.

This makes the work effortless since the information collected assists him in choosing the best of the lot for investment purposes.

These periodic reports show an investor not only a long-term view of the current business but also its potential and future. They provide one with a long-term investment portfolio rather than just profits.

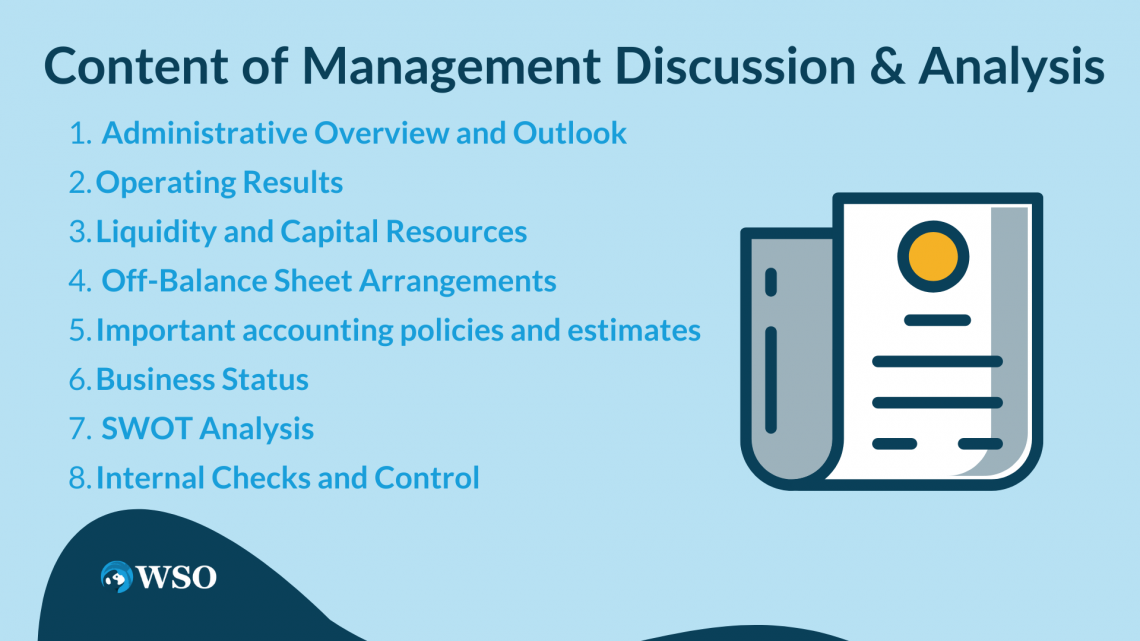

Content of Management Discussion & Analysis

There is no law or rule as such for the content of MD&A. Different companies use different content, but some of the information needs to be put in it. Here are some of the facts that needed to be stated for an MD&A to look informative.

Administrative Overview and Outlook

While the administrative overview is not a mandate, most companies choose to include it. In the overview, management discusses the company’s fiscal targets, strengths and weaknesses, pitfalls and challenges, and opportunities for growth.

Operating Results

Management generally presents the financial results for the year-end, recapitulating and interpreting the figures from the report, but they may also present quarterly reports.

They may also talk about any sort of precariousness that might affect future success, predicted results, and economic drivers.

They also include supplemental fiscal information that would be insightful to the reader. Apart from this, the companies are expected to declare any trends or pitfalls that may impact revenue (both positive and negative impact).

NOTE

While discussing the results of operations, the management must concentrate on unusual events or deals and any major economic changes that affect income from operations.

If the company experienced a major rise in sales compared to previous periods, the management must discuss the degree to which the increase is attributable to different factors, such as a price increase or the launch of a new product or service.

Liquidity And Capital Resources

The management should discuss any sort of significant events that might have changed the liquidity and capital resources.

They should also give insights on any current or implicit future capital expenditure commitments and the financing options available to meet the CAPEX commitments.

The management must recognize any known trends, events, commitments, demands, or uncertainties that are likely to result in significant changes in liquidity or capital resources.

Illustration: The management should discuss the current capital structure and any plans to offer fresh bonds or stocks.

Off-Balance Sheet Arrangements

Off-balance sheet arrangements are deals or agreements that are not mandatory to be reported on the balance sheet though this can affect revenues, expenses, and cash flows.

NOTE

Management can share how these arrangements serve the business and how they will affect credit risk.

Important Accounting Policies And Estimates

The SEC urges companies to give granular information regarding their accounting policies in the MD&A section of the periodic report.

It helps investors and other stakeholders understand the impacts of the accounting policies and decisions made. It also discusses possible changes that might have happened if the company had made other assumptions.

Business Status

It should give details about the industry & cut-throat structure, and crucial growth in current times concerning the company’s business.

It should also discuss the impact and changes in the regulatory environment due to new laws that are expected to be introduced in the future.

SWOT Analysis

It should discuss its strengths, weaknesses, opportunities, and imminent threats. It should also discuss the pitfalls that can affect the company in the future and the plans the management has in mind to avoid them.

NOTE

The report should also give details about any major change in the company’s economic environment that would affect its income from operations. It should also state the responsive action that the management plans to come out of the situation.

Internal Checks And Control

It should provide an overview of the internal checks and controls that the company has put in place to prevent threats. It should also tell how successfully the company has been dealing with internal errors, thefts, frauds, and other such threats.

The link to the MD&A report of a public company named MACO is inserted to understand it better.

Tips for drafting an effective MD&A

Management Discussion & Analysis of different companies may look distinct. This is because there is no prescribed format for the same, and SEC allows the changed reports provided that they should contain the important elements.

You can consider the following things while drafting and make sure it is adequate & productive.

1. Layered Disclosure

MD&A should be drafted in a way that the extra critical subject matters are placed at the top following less critical subject matters. This is also called the layering of matters from most important to least important.

The SEC staff has recommended layered disclosure to increase the clarity of MD&A. The SEC staff followed this recommendation in MD&A's illustrative release in 2003.

Some companies follow layered disclosure, where MD&A starts with an executive summary; the inclusion of an executive summary facilitates such layered disclosure.

2. Readability Techniques

To improve the legibility of MD&A, one should use heads & sub-heads, bold, italic font, bullet points, and an easy understanding.

One can use hyperlinking instead of repeating things while writing other parts or disclosures (in the case of Form 10-Q MD&A or the case of Form 10-K disclosures). This makes it crisp and clear and makes it sound non-repetitive.

3. Item 303- Mandates to Produce Material Trends

Item 303 lays down the SEC disclosure requirements applicable to MD&A. According to this, very basic disclosure is to be given. A detailed analysis of significant trends and other significant events that may affect the revenue & profit from operations, capital resources, etc.

NOTE

There is a dispute about putting progressive statements in MD&A. Some entities prefer it, while some don’t.

Some may say it is better to include progressive statements or any such disclosure since failure to disclose known things can have a bad impact, like Rule 10b-5 allegations from private parties and SEC civil actions.

4. Disclosure of Trends and their influence on Future Periodic Reports

One should be aware of the fact that the disclosures need to be updated periodically. You cannot delete the already given disclosure just for the fact that things changed.

You have to update about things and the changes in the disclosure periodically. Companies need to continue updating the changes every year rather than just omitting the disclosure itself.

5. Location of Trends Disclosure

The safe harbor for progressive/forward-looking statements, as provided by the Private Securities Litigation Reform Act (PSLRA), applies to MD&A disclosure and not the footnotes in the financials.

NOTE

It should be kept in mind the fact that PSLRA applies to MD&A only if one wants to share the trend insight in the financial statements also.

6. Cross-Referencing MD&A & Risk Factors Disclosure

While drafting Management Discussion & Analysis disclosures, one should keep a check that everything related to the particular disclosure is mentioned or updated.

For example, while drafting Form 10-K or Form Disclosure counsel should consider whether any disclosure 10-Q, should keep a check on risk factors and update the same.

7. Quantification of Factors Impacting Performance

MD&A requires disclosure of the factors that affect the revenue and profit from operations.

While disclosing this, one should understand whether the impact is magnanimous and whether quantifying the effect will give a crystal clear picture of the company’s performance.

NOTE

It should be checked and quantify the impact that the performance drivers had on the performance of the company during the period for which it is being drafted.

8. Non-GAAP Financial Measures

The non-GAAP financial measures in periodic reports are different from those of earnings release disclosures.

The disclosure of the reports is less substantial than that of the release. Companies believe that investors and analysts focus more on releases than on reports, so it is not necessary, and it may sound monotonous.

While drafting an MD&A, one should consider and evaluate the SEC rules and Staff guidance regarding non-GAAP financial disclosures and ensure that it complies with legal and regulatory requirements.

9. Review the Earnings Release Disclosure Package for Consistency

While drafting MD&A, one should analyze and evaluate the earnings release, earnings call transcript, and earnings deck investor presentation to check whether they follow the periodic report.

This is because the SEC Staff will check all four, including earnings releases, earnings call transcripts, earnings deck investor presentations, and periodic reports.

NOTE

If they find any conflicting disclosures which are also significant then it will be part of the Sec comment.

10. Post-Period Events

Companies should disclose events occurring after the period for which the report is drafted even if those events do not have a significant impact on the current period. This should be done even though those events are already mentioned in the financial footnote.

11. Review Peer Company Disclosure

One can review Management Discussion & Analysis of similar companies. This helps to keep a check on the clarity of and see that nothing important is missed out. One should check the SEC comment letters received by similar companies.

This helps to keep the focus on the areas checked in detail by the SEC since those areas might be of significant importance to the company itself.

12. Critical Accounting Policies and Estimates

Companies should also discuss the accounting principles and policies they follow. It is not necessary to disclose all the policies, three to four will suffice.

Apart from discussing the policies, they should also discuss the impact those policies have on the company and how significant the impact is. This has to be included despite being already included in the financials of the company.

Researched and authored by Shambhavi Himatsingka | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?