Schedule 13D

Form that must be filed with the SEC whenever an individual, company, or fund acquires a greater than 5% stake in another company

What Is Schedule 13D?

A 13D is a form that must be filed with the SEC whenever an individual, company, or fund acquires a greater than 5% stake in another company. This is measured by shares outstanding on the market. Some examples of when a 13D form would be required are:

Schedule 13D filings are commonly referred to as "beneficial ownership reports."

The term "beneficial owner" is defined under SEC rules. It includes anyone who shares voting or investment power directly or indirectly (the ability to sell the security).

When an individual or group acquires beneficial ownership of more than 5% of a voting class of a company's equity shares registered under the Securities Exchange Act, they are mandated to file a Schedule 13D with the SEC.

It discloses ownership positions of 5% or more in a company's stock within ten days after reaching the threshold. This schedule, filed with the SEC, is provided to the company that issued the securities, and each exchange where the security acquired is traded.

Any 'material' changes in the information contained in the schedule require an amendment. It is often filed in connection with a tender offer.

Key Takeaways

- Schedule 13D is a mandatory filing with the SEC whenever an individual or entity acquires over 5% ownership in a publicly traded company, serving as a "beneficial ownership report."

- It aims to provide transparency to stakeholders by disclosing significant ownership changes, intentions behind the acquisition (e.g., takeover or investment), and relevant background information about the new owner.

- Beneficial owners must submit Schedule 13D within ten days of crossing the 5% threshold, detailing various aspects like the source of funds, the purpose of the transaction, and any related agreements or relationships.

- The form comprises seven sections covering details such as security and issuer information, the owner's background, the transaction's purpose, interests in the securities, and any contracts or arrangements related to the acquisition.

- Failure to disclose material information as required may lead to civil or criminal actions. The information disclosed aids regulatory oversight transparency and may be used for investigative purposes in securities law enforcement.

Understanding Schedule 13D

Investors may buy a significant number of shares in a publicly-held company for various reasons.

For example, investors attempting a hostile takeover, institutional investors who believe the stock is undervalued, or a dissident shareholder contemplating a proxy contest to replace management.

When an individual or group of individuals acquires a significant ownership stake in a company (more than 5% of a voting class of its publicly traded securities), the S.E.C. requires that they disclose the purchase on a Schedule 13D form.

In some cases, they may be able to use a more straightforward form called Schedule 13G.

Once the disclosure has been filed, the publicly listed company and the stock exchange(s) in the U.S. on which the company trades is/are notified of the new beneficial owner.

It intends to provide transparency to stakeholders regarding these new shareholders and why they have acquired a significant stake in the company.

It signifies to the public that a change of control, such as a proxy fight or a hostile takeover, might occur. This ensures current shareholders in the company can make informed investing and voting decisions.

The beneficial owner(s) must file Schedule 13D within ten days after acquiring more than 5% of a voting class of the company's publicly traded securities. The obligation to file it lies with the new beneficial owner(s) because the target company might not know the individual or group behind the transaction.

Requirements for Schedule 13D

It requires that the beneficial owner provide relevant information about several items, including the following seven sections:

| Serial Number | Section | Description |

|---|---|---|

| 1 | Security and Issuer | This contains basic information regarding the class, type of security, and owner's contact information. |

| 2 | Identity and Background | This contains even more background about the owner, including past criminal activity (if any). |

| 3 | Source and Amount of Funds or Other Considerations | This lets investors know the source of the cash flows. The most important use is determining if a buyout is overleveraged, i.e., when most of the purchase is leveraged or borrowed capital. |

| 4 | Purpose of Transaction | This is the most important section. This section answers investors' questions. It answers whether the purchase was for acquisition, hostile takeover, proxy battle, because they believe it is undervalued, etc. |

| 5 | Interest in Securities of the Issuer | This states the purpose of the transaction, which should be explained better in section 4 (Purpose of Transaction). |

| 6 | Contracts, Arrangements, Understandings, or Relationships concerning Securities of the Issuer | This contains any unique relationships between the owner and the company. It is important to be sure that the buyer is genuine and legitimate and not a result of some other agreement or just a friend purchasing stock. |

| 7 | Material to be Filed as Exhibits | This section includes any exhibits that may be filed along with the form, which can provide additional documentation or information related to the disclosures in Schedule 13D. |

Schedule 13D And Disclosure Of Material Changes

Under Sections 13(d) and 23 of the Securities Exchange Act of 1934, certain security holders of certain issuers are required to disclose information specified in this schedule to the Securities Exchange Commission.

Disclosure of information specified in the schedule is mandatory, except for I.R.S. identification numbers, the disclosure of which is voluntary. The information disclosed will help disclose the holdings of certain beneficial owners of particular equity securities.

Any information provided will be made a matter of public record and will be available for inspection by interested parties.

Because of the public nature of this information, the Commission can utilize it for various purposes, including referral to other governmental authorities or securities self-regulatory organizations for investigatory purposes.

Alternatively, it can be used for investigatory purposes concerning litigation involving the Federal securities laws or other criminal, civil, or regulatory statutes or provisions.

If furnished, it will assist the Commission in identifying security holders, contributing to regulatory oversight and transparency.

Failure to disclose material information as required by securities laws and rules, except for I.R.S. identification numbers, may result in civil or criminal action against the persons involved.

Example of Schedule 13D

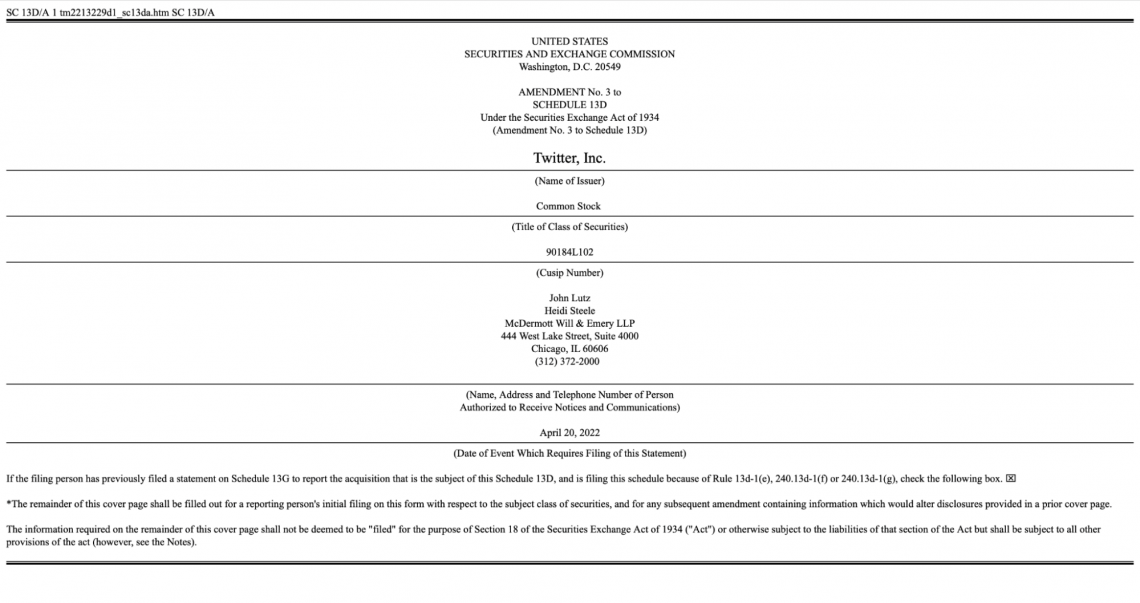

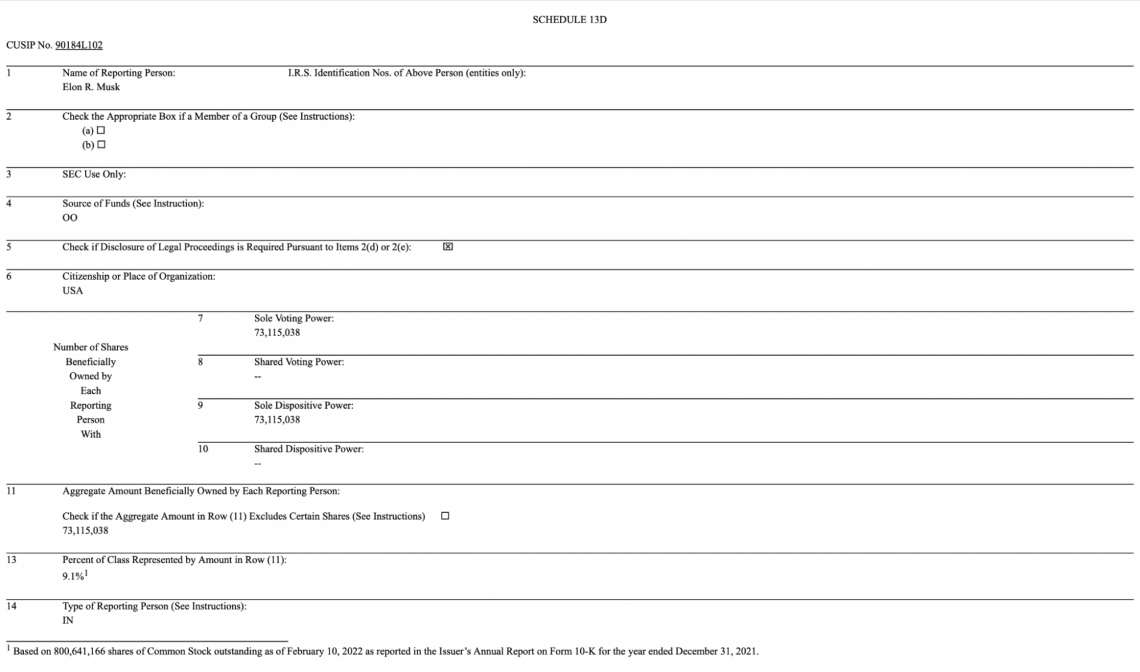

The Tesla and SpaceX founder and C.E.O., Elon Reeve Musk, purchased significant equity shares in Twitter. The Schedule 13D filing with the S.E.C. was filed on April 20, 2022.

Below is a small portion of the 13D filing information for Twitter:

- Elon R. Musk is named as the reporting person (section 1)

- The number of shares purchased was 73,115,038 (section 7)

- The purchase represented a 9.1% ownership in Twitter, based on the outstanding shares at the time (section 13)

Title page for the 13D Filing:

Details from the 13D Filing

At a glance:

-

When individuals acquire 5% or more of a company's shares, they must report it to the S.E.C.

-

The question Schedule 13D asks is the purpose of the transaction, such as a merger or a takeover

-

If the beneficial owner's holdings change by 1% or more, they must amend their Schedule 13D

Schedule 13D FAQs

The Securities and Exchange Commission (SEC) requires public corporations, certain company insiders, and broker-dealers to file periodical financial statements and other disclosures.

The Schedules 13D and 13G filings for publicly traded companies are available on the SEC’s EDGAR database.

The SEC's EDGAR database presents Schedule 13D as "SC 13D–General statement of acquisition of beneficial ownership."

An SEC Schedule 13G filing is specifically for entities that acquire between 5% and 20% without the intention of a takeover or any other action that will materially impact the company's shares.

The Schedule 13G filing is typically for entities making significant purchases with no intention of influencing or taking over the company, but it does not entirely rule out the possibility of a takeover.

If the investor is not passive or the ownership stake is above 20%, the buyer must file a Schedule 13D. It must be filed within 10 days of reaching the ownership threshold, not necessarily the purchase.

Occasionally, asset management companies like insurance companies or mutual funds exceed the 5% margin merely because of the size of their AUM (Assets Under Management).

A partnership, corporation, limited liability company, or tax-exempt charity having assets worth more than $5 million. A general partner of the company selling the shares; any general partner of a general partner of that company; or any director or executive officer.

Electronic submission of registration statements and other paperwork is required for all businesses, domestic and international.

Investors can then view these registrations and other corporate papers via EDGAR. However, not every security issue is required to be registered with the SEC.

or Want to Sign up with your social account?