Form 14D-9

A filing did when the target company files a recommendation statement regarding the position on the tender offer within ten days following its commencement

What Is Schedule 14D-9?

Schedule 14D-9 is a filing with the Securities and Exchange Commission (SEC) when the target company, i.e., an interested seller company, the issuer of securities (shares), files a recommendation statement, a solicitation, regarding the target company's position on the tender offer within ten days following its commencement.

A tender offer is a publicly available offer to buy some or all of the shares in a corporation from the existing shareholders.

The company subject to the takeover must file its response to the tender offer on Schedule 14D-9.

This form is required in any case when shareholders have to sell a significant portion of their shareholdings in exchange for cash or other securities.

Common information included in this might be the board of directors' recommendation, the fairness of the value offered, and corporate governance.

The Schedule 14D-9 filings are available to the public via the SEC's EDGAR database or the company's website.

Key Takeaways

- Schedule 14D-9 is a filing with the SEC required when a target company responds to a tender offer by an acquiring company during acquisitions.

- The 14D-9 filing recommends shareholders tender their shares to the acquiring company and disclose material information for informed decision-making.

- The Form 14D-9 includes a background of the transaction, terms and conditions of the offer, the board of directors' recommendation, fairness opinion, potential conflicts of interest, future plans, and information for shareholders.

- The form and information regarding companies are accessible to the public through the SEC's EDGAR database or the company's website.

Understanding Schedule 14D-9

In the event of acquisitions encompassing tender offers, the acquiring company has commenced the tender offer, and the target company files with the SEC and distributes it to the shareholder a 14D-9.

14D-9 recommends the shareholders tender their shares to the acquiring company.

In both types of transactions (mergers and acquisitions), the law compels the acquiring company to disclose all of the material information allowing shareholders to decide whether to support the transaction in discussion, either by voting or tendering the shares.

A tender offer is a bid to purchase some or all shareholders' shares in a company. Tender offers are made publicly available to invite shareholders to sell their shares for a specified price (usually at a premium to the market price) and within a particular window.

The SEC stipulates that a tender offer must be a purchase of a significant portion of a company's voting shares.

The target company's response is then conveyed to the acquiring company via Schedule 14D-9, which also functions as a notice by management to its shareholders.

It contains pertinent information about the tender offer, such as the response by the target company, the fairness of the valuation, the proposed corporate structure, and any other relevant information.

It is utilized in all mergers and acquisitions, including a leveraged buyout (LBO) and a management buyout (MBO).

Any transaction requiring shareholders to sell their shares in exchange for cash or other securities will require an SEC Schedule 14D-9.

Sections in Schedule 14D-9

The following are the sections:

- Item 1 - Subject Company Information

- Item 2 - Identity And Background Of The Filing Person

- Item 3 - Past Contacts, Transactions, Negotiations, And Agreement

- Item 4 - The Solicitation Or Recommendation

- Item 5 - Persons/Assets Retained, Employed, Compensated, Or Used

- Item 6 - Interest In Securities Of The Subject Company

- Item 7 - Purpose Of The Transaction And Plans Or Proposals

- Item 8 - Additional Information

- Item 9 - Material To Be Filed As Exhibits

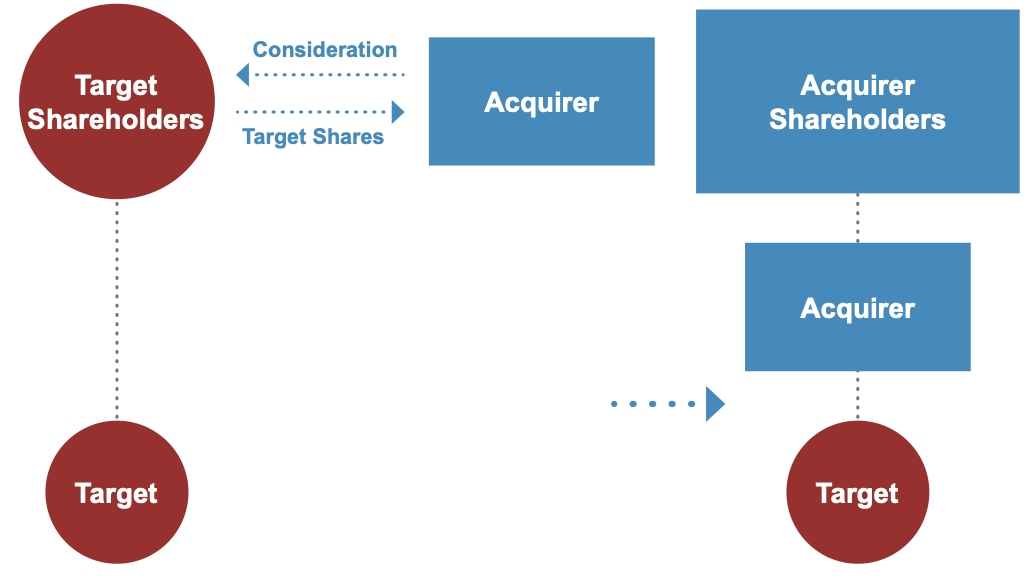

The acquisition process is a two-step process:

- The acquirer makes the "first step" tender offer directly and publicly to shareholders.

- The "second step" merger is required to acquire the remaining untendered shares.

- After the consummation of the back-end merger, the target is a wholly owned subsidiary of the acquirer.

Real-World Example of Schedule 14D-9

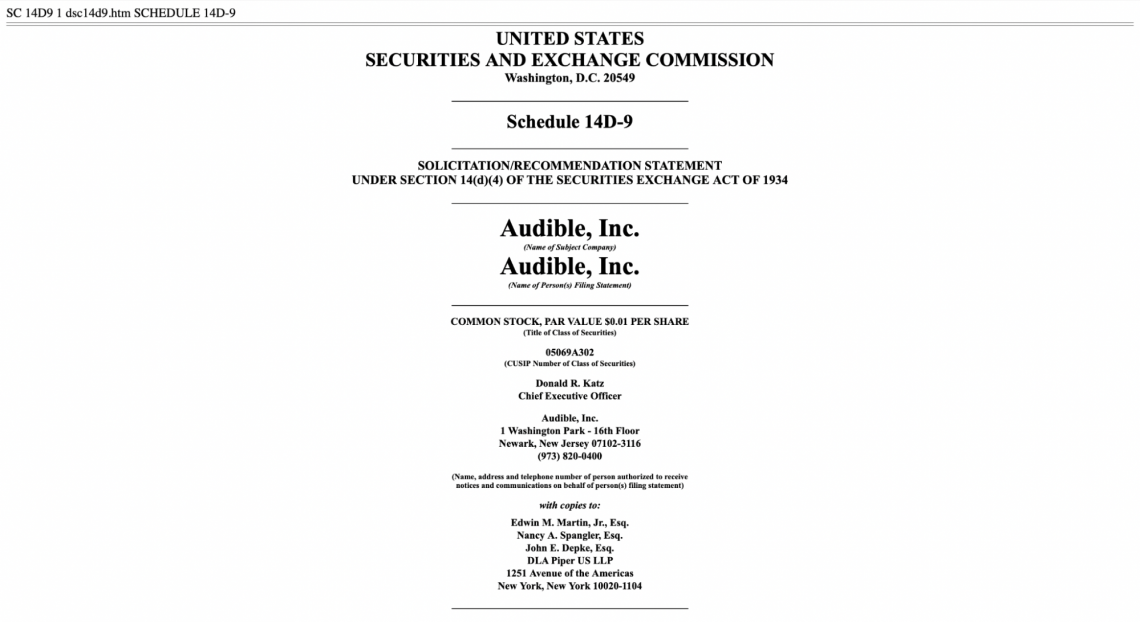

Audible, Inc., based in Newark, offers 80,000 audiobooks and spoken-word products from magazines, radio shows, and newspapers.

Amazon.com acquired Audible 2008, the largest online seller of audiobooks, for a sum of $300 million in cash, or $11.50 a share, a 23 percent premium to the stock's closing price on the date of the tender offer.

Audible, Inc. filed Schedule 14D-9 with the SEC on January 30, 2008.

Summary

Schedule 14D-9 is a filing with the SEC made by a target company in response to a tender offer by an acquiring company.

This Schedule 14D-9 is required in any case when shareholders have to sell a significant portion of their shareholdings in exchange for cash or other securities.

Mergers and acquisitions, such as a management buyout or leveraged buyout, are instances in which a Schedule 14D-9 would be utilized.

Common information in Schedule 14D-9 includes

- Background Of The Transaction

- Terms And Conditions Of The Offer

- Board Of Directors' Recommendation

- Reasons For Recommendations

- Fairness Of Opinion

- Potential Conflicts Of Interests

- Future Plans

- Information For Shareholders

- Legal And Regulatory Shareholders

- Corporate Governance

It's crucial to remember that each deal's unique circumstances and the companies involved can affect the specifics disclosed in Schedule 14D-9.

This document is essential to the communication between the board of the target firm and its shareholders throughout an acquisition process, and it is used by shareholders to make educated judgments regarding the tender offer.

Form 14D-9 FAQs

All Schedule 14D-9 filings are available to the public via the SEC's EDGAR database or on the company's own website.

The acquiring company files Form S-4, which includes the exchange offer/prospectus.

A tender offer or exchange offer must remain open for at least 20 business days.

Yes, target shareholders have the right to withdraw their shares at any time prior to the date of expiration of the offer.

No, a tender offer cannot close until the SEC declares the acquirer’s registration statement “effective”.

If the target company performs a back-end merger, it can “squeeze out” those shareholders who did not tender their shares in the offer by converting their shares into the right to receive the per-share consideration paid in the offer.

or Want to Sign up with your social account?