Accretion Dilution Model

In the context of Mergers and Acquisitions

The accretion dilution model is used as part of accretion/dilution analysis, which is often used to evaluate Mergers and Acquisition (M&A) deals prior to both parties agreeing on the terms. This analysis is an attempt to estimate the effect of the M&A transaction on the earnings per share (EPS) of the company. An increase in EPS is called accretion, while a decrease in EPS is known as dilution. It is most commonly used with public companies rather than private companies.

This analysis is just one test among many other that contribute to the decision-making process regarding an M&A deal. A few of these factors include:

- The complexity of the actual deal, such as whether the negotiation process will be quick and easy or a lengthy and complicated ordeal

- The overall impact on the organization and how its structure will be affected by the deal (this could be a global effect for larger businesses)

- The benefits and risks of acquiring or merging with the company, such as the potential for growth, compatibility issues, and costs of the process, all of which are highly variable

What are accretion, dilution, and accrual?

In general, accretion and dilution are financial concepts representing an increase and decrease in value, respectively, and can apply to either a transaction or a bond. They refer to the fact that value is created or destroyed purely on paper.

In an M&A transaction, accretion is the increase in Earnings Per Share (EPS) post transaction, while dilution is the decrease in EPS post transaction. If the EPS increases, then the transaction is generally seen in good light and vice versa.

For a bond, accretion is the increase in the bond price between the time of trade and maturity. For example, all bonds mature at par value ($100), so if a bond was purchased for $95, the accretion on the bond at maturity would be $5.

Here is a five-minute video that summarizes what accretion and dilution is:

Accretion refers to an increase in financial value and is positive. On the other hand, accrual is defined as the accumulation or increase of something over time, typically in terms of revenue or expenses. This accumulation can be positive or negative.

What is EPS?

Earnings per share (EPS) is a financial metric that is used to compare different companies by looking at the earnings of a business for the period (a quarter or a year) on a per-share basis. A higher EPS indicates that the business is more profitable compared to its peers. It is calculated by dividing net income by the number of shares outstanding. The weighted average is used if the number of shares changes between the periods.

Accretion dilution model: How to calculate it?

Accretion-dilution analysis is a process that uses financial statements as input, specifically focusing on the EPS figure in the income statement (IS).

Steps involved in accretion dilution analysis

The first few steps of the analysis process are gathering the information required in later calculations that directly relate to accretion/dilution. These steps are:

1) Estimating synergies

Synergy is the concept that the value and performance of two or more companies post-merger will be greater than the sum of the performance of the companies operating individually. It can be challenging to quantify the effect of this combination, though it is used to offset the costs of an acquisition premium and transaction expenses.

Examples of synergies include cross-selling products and services, reducing overhead or manufacturing costs and time, and increasing efficiency in multiple areas like distribution.

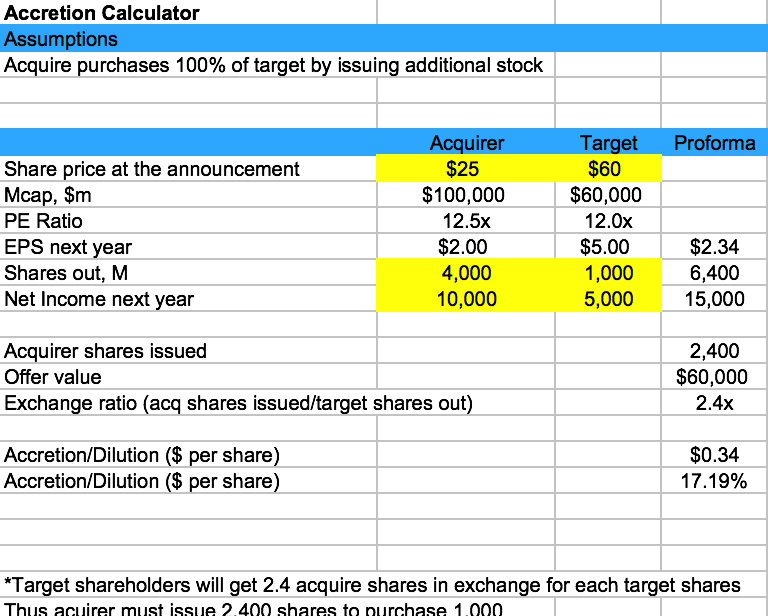

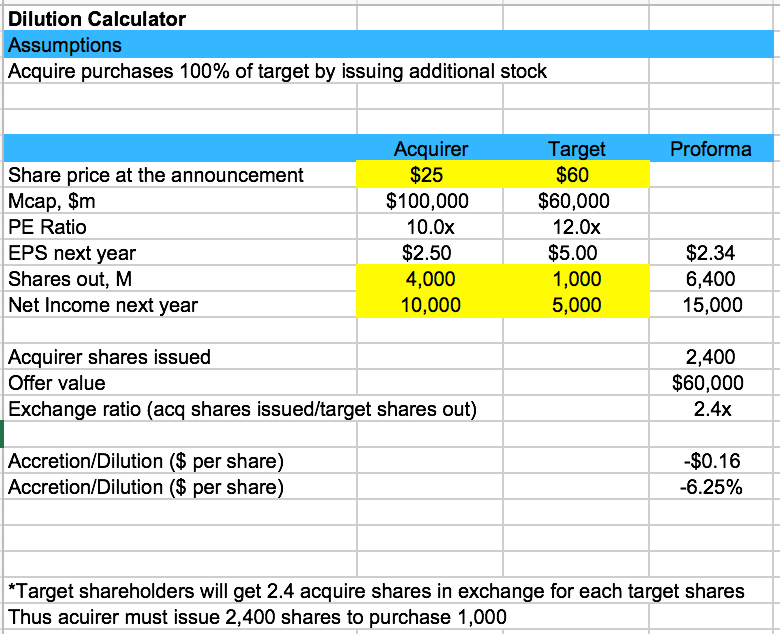

2) Determining shares outstanding after the acquisition

The acquirer can pay for the acquisition through either cash, issue of new shares, or a combination of the two. The purchase consideration by the issue of shares is generally accomplished through share exchanges or by issuing shares for cash. Regardless of the method employed, these new shares will need to be added to the share count.

Of course, if the buyer decides to finance the acquisition with cash rather than shares, there will be no effect on the post-acquisition share count. Typically, companies with a higher price to earnings (PE) ratio will not need to issue as many new shares since their shares are more valuable than that of a company with a low PE ratio.

3) Estimating transaction expenses

Transaction expenses will decrease the pro forma net income, which is calculated for the period after the acquisition. Therefore, these should be estimated and taken into account when performing analysis. Examples of transaction expenses are due diligence, financial and legal advisory, share issuance, loan fees, as well as expenses for arranging debt financing.

4) Calculating interest expenses

If the purchaser takes on additional debt to complete the transaction, then there will be an interest expense calculated on the amount borrowed. In addition to this, any cash taken from the buyer’s reserves also has implications as their interest income will decrease as a result of having less cash.

5) Calculating the acquisition price

The acquisition price is the price per share that the shareholders of the business being acquired will be offered if the transaction is completed.

6) Estimating a pro forma net income for the combined entities

A pro forma net income is essentially an estimation of their net income after the acquisition. All of the previous variables that have been calculated are factored in when calculating the pro forma net income. One would typically make this projection for the next one to two years, depending on the size of the deal.

7) Calculating pro forma EPS

After projecting the net income that will result from the acquisition, one can calculate the pro forma EPS by dividing the net income by the number of shares outstanding post-acquisition, both of which we have found.

8) Reviewing your findings

Check your numbers with regards to their accuracy and plausibility before presenting them. Accuracy refers to checking for mistakes, while plausibility could include whether your data is realistic and if you have integrated some form of professional skepticism on your estimations and projections (like the net income, transaction expenses, and prospective synergies). Of course, you don’t want to be too skeptical as this would negatively affect the outcome of the model and, in turn, the deal, but incorporating rationalism in your analysis is ideal.

9) Determining if the transaction is accretive or dilutive

This is the final step of creating the model. We start by taking the difference between pro forma EPS and the current EPS of the organization making the purchase. The resulting number would usually be either negative or positive. A negative result would signify a dilutive transaction (pro forma EPS is less than the standalone EPS), while a positive result would be accretive. To obtain this result as a percentage increase/decrease rather than in dollar terms, simply divide the result by the current EPS.

When pro forma EPS has neither increased nor decreased, when compared to the forecasted EPS (i.e. pro forma EPS - current EPS = 0), then the accretion/dilution analysis is said to break even. If this is the case, then other elements of the analysis would be considered to determine whether the M&A deal should proceed, including but not limited to financial modeling.

Businesses tend to avoid dilutive transactions simply because shareholders may view the transaction negatively and possibly stop investing in the company. However, if a deal has a reasonable likelihood of turning accretive after a year or two, a proposed business combination may be more agreeable for the acquirer.

Accretion dilution model: Sample interview questions

Getting through the interview process for a position in a mergers and acquisitions division (a field of investment banking (IB)) is often one of the most difficult processes. Besides the long application time, interviewers may ask you questions you weren’t expecting or didn’t prepare for, or some other complicated brain teasers. Since accretion dilution models are used for M&As, interviews for positions in this field will often ask technical questions on multiple topics.

While the answer can sometimes be obvious, most times, they are not. To handle this, we’ve compiled a list of sample interview questions from the WSO community and the members’ responses on our thread on accretion dilution model questions.

However, there are other smaller threads based on specific questions that you can find on our forum. While this may not cover every single question you will be asked, they will help you understand the logic necessary to land one of these positions. For a more comprehensive list of interview questions, please reference our Free Investment Banking Guide or this forum for some brain teasers.

Examples of such interview questions include the following:

Answer: More information - if it’s an all-stock deal it will obviously be accretive but if it’s not then I need more information.

If it's an all-cash deal, P/E ratio doesn't really matter. Suppose the cash consideration is 100% debt-financed, EPS can be calculated as:

Net income (Acquirer) + Net Income (target) + tax effected synergies - tax effected D&A step up - tax effected cost of debt / acquirer shares

From the above equation, it is clear that if the net income of target + tax effected synergies > tax effected D&A step up + tax effected cost of debt, the deal is accretive.

The above doesn't take into account transaction expenses, but arguably it's a one-time thing hence it can be left out of the accretion / dilution calculations.

From this question, we can see that in an all-stock transaction, the deal will be accretive in an all-stock transaction if the acquirer has a higher P/E ratio than the seller, while a lower P/E ratio would be dilutive.

Assuming a tax rate of 35%:

1 / after tax cost of debt = 1/ (0.65 * 10%) = 15x. Compare that to the target company’s PE of 10x. The deal is accretive.

Here is a twenty-minute video that provides additional examples from investment banking (IB) interview questions after outlining the method of accretion dilution analysis:

M&A modeling course

To learn more about this concept and become a master at M&A modeling, please check out our M&A Modeling Course, which teaches you techniques and concepts like accretion dilution modeling with videos like the one below.

More about financial modeling

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?