Course Overview

10 Modules to Master Investment Banking Interviews

To make sure you are one of the 1% of IB applicants that gets the job, this course gives you everything you need to nail your interviews, crush your competition and land the prestigious IB job you've always wanted. By the end of this, you will know how to build connections and ace interviews!

Who is this Course for?

Motivated undergrads and MBA students looking to break into investment banking

Professionals looking to prepare for the recruiting process to transition to a career in investment banking

Key Outcomes

Master ALL of the Investment Banking Concepts

This course provides you with ALL the resources you need to show your interviewer that you understand the industry, can solve problems, handle stress, and are good in front of clients.

Unlocking the Door to Investment Banking Success

After completing the Investment Banking Interview Course, you'll have a strong edge over other candidates in landing a position in investment banking.

Boost Your Confidence and Earnings Potential

Once you finish this course, you'll feel more confident in your investment banking interviews, which will increase your odds of landing a prestigious role on Wall Street.

This course has helped our students and young professionals land and thrive at positions across all top Investment Banks, including:

WHAT’S INCLUDED

A step-by-step course to help you ace your Investment Banking Interviews

Module 1: Course Introduction & Overview

In this module, we teach you everything about the recruitment process at investment banks. It also introduces you to our proprietary Flashcards feature, which gives you access to 30,000+ interview questions filtered by firm, group, and much more.

Module 2: Accounting – Concepts

In this module, we go into key accounting concepts. If you plan on working in investment banking or any other finance related field you'll need to have a bullet proof knowledge of accounting.

Module 3: Valuation – Concepts

In this module, we dive into valuation which is fundamental to nearly every type of corporate finance related project or strategic transaction you may work on as a finance professional. The module also features interview questions designed to reinforce understanding and prepare learners for real-world application

Module 4: DCF – Concepts

In this module, we move on to the third main valuation technique, discounted cash flow, which provides a comprehensive analysis of future cash flows to determine intrinsic value. The module also includes interview questions designed to solidify comprehension and practical application of DCF principles.

Module 5: LBO – Concepts

In this module, we explore our fourth and final common valuation technique: leveraged buyout (LBO). The module provides comprehensive coverage of LBO concepts and includes interview questions tailored to reinforce understanding and application of LBO principles in real-world scenarios.

Module 6: Mergers & Acquisitions – Concepts

In this module, we explore the technical session of our interview training for mergers and acquisitions (M&A). Additionally, tailored interview questions are included to reinforce understanding and readiness for real-world application.

Module 7: Other Common Technical Questions - Stocks

In this module, we explore other common technical questions around stocks... We step into this section covering a wide array of interview questions while highlighting the questions that are most likely to be asked within an investment banking interview.

Module 8: Other Common Technical Questions - Bonds, Loans And Interest Rates

After we covered some of the common interview questions around stocks, we now look into some common technical questions around bonds, loans, and interest rates that you are most likely to see in an investment banking interview.

Module 9: Behavioral Interview - Concepts

In this module, we dive into the intricacies of behavioral interview concepts, a fundamental component of the interview process designed to assess your alignment with organizational culture and values.

Module 10: Behavioral Interview – Your Questions

In this module, our focus is on equipping you with effective questioning techniques during interviews. This skill empowers you to obtain valuable insights about the role, the organization, its culture, and more.

Module 11: Investment Banking or S&T

In this bonus module, we explore a critical decision many individuals face early in their career journey: choosing between Investment Banking and Sales and Trading. Get clear guidance to understand each option better and make the choice that suits you best.

Course Bonuses

Exclusive Bonuses (Worth $1,000+) for Free

Bonus #1: Full WSO Company Database

12 Month Access to 24,681+ interview insights, 51,233+ exclusive salary and bonus datapoints + 20,127 company reviews...

Bonus #2: WSO Video Library

50+ hours of IB-specific videos: webinars, sample deals, 10+ PPT & Excel Templates, 5+ Networking Templates and more...

Don’t Take Our Word For It

Hear From Our Students

Wall Street Oasis has trained over 63,000 students at elite corporate and educational institutions for over a decade.

I'm an Econ major student, so I've never been taught how to properly do a model, and WSO's modeling course not only prepped me for modeling but also taught me a lot of tips and tricks that have saved me so much time while building up models. Also, it helped me to ace all my technical interviews.

For those who thinking about getting this course, do it now! You won't regret!

I am not sure how it compares to other LBO courses in terms of value for money (if there are even other LBO online courses out there), but I do want to emphasize that it is an extremely dense course compared to most other online/MOOC courses so the price (probably) scales accordingly compared to standard online course prices from other services.

I've been hailed by my boss and colleagues at work, trident insurance co.ltd finance department,I used the knowledge also in PowerPoint and word ,these hotkeys apply almost in ppt,word and excel. I've been so efficient yet I'm still in campus.

A local leather turning firm also gave me a role in finance and accounting and it's been a lovely experience, I've actually recoup the money I paid wall street oasis for the course and in fact I got a massive discount, Patrick didn't sell it to me$497 dollars if I remember. The PowerPoint course could improved though,it only gives tricks but does not teach one how to actually create a full presentation or pitchbook. I'm sorry that I have to write my review away from home, I saw the email from Patrick and had planned to do this at home unfortunately my schedule with university,exams have Started and work reasons left me with no time,so seeing the second email I had to pull over and give at least something back by the roadside. If one is keen on a career in finance WSO is the place, it's worth it and the discussion section will broaden your commercial awareness. Thank you WSO.

Finally you'll get to the modeling, and you'll cover that in reasonable depth to understand what you're doing.

The course is well laid out with exams at the end of every module. The files you keep from this are a great future reference if you ever forget how exactly to do something. One last thing that I found excellent: the instructor is not just an Excel instructor, but also clearly works in finance. This shows up in additional tips throughout the course on best practices and how best to present your models.

The theory explanation is straight to the point and clear. I could understand all the concepts to build a complex financial modeling.

Currently I'm working at a M&A company in Brazil, and what I've learnt in this course is very useful for my daily tasks.

I do recommend this course.

The teacher explain complex topics in a simple way.

The teacher explain complex topics in a simple way.

There are questions at the end of each section that could be improved upon, but it's a modeling course not exam prep so it is understanable.

Overall, I would recommend this course to someone interested in learning LBOs.

The best thing about the course was the amount…

The best thing about the course was the amount of veteran insight the instructors provide. That invaluable advice helped me gain confidence in the process, which lead to me landing at a BB!!

Thanks Curtis & WSO!

It also give access to a massive 20,000+ interview question database by firm / group, etc. which is a huge advantage.

I've done Excel courses before like this but with no practice, so only little of what I learned actually stuck. Practice makes perfect so I'm gonna head back to that :D

A solid use of time and great value for money - especially if purchased within the bundles.

However, despite this being of second nature to me, I decided to check out the WSO financial statement modeling course as part of the Elite Modeling package while planning my move to investment advisory. Needless to say, like the other WSO courses, this was a well-planned out course from which even a seasoned professional like me could take away a lot. Knowing various standards that are used in the finance and investment community helps to blend in with the pros.

Would definitely recommend getting not just this but the whole elite modeling package if that's still on offer. Thanks WSO team! :)

Received this as part of a bundle (fantastic value, I might add), and this was the perfect walk through for someone that knows theoretically what an LBO is, but wants a nuts and bolts perspective. Very accessible and quickly brings you up to speed. A very high yield course.

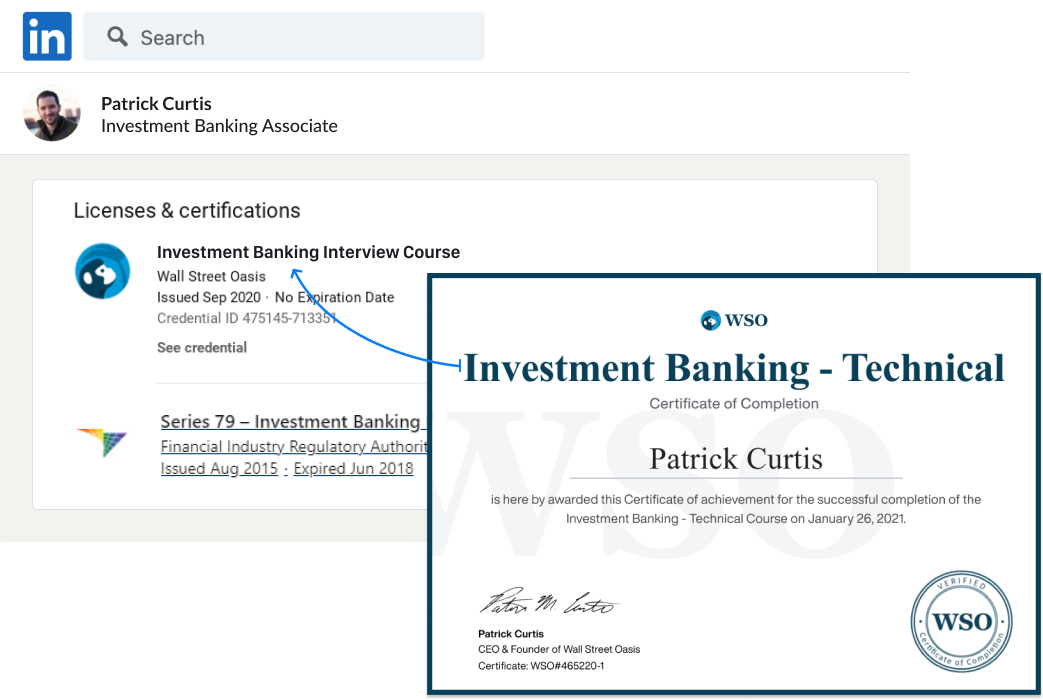

Certificates

Get The IB Interview Course Certification

After completing the course, all students will be granted the WSO Investment Banking Interview Course Certification. Use this certificate as a signal to employers that you have the technical and behavioral skills to immediately add value to your team.

Demonstrate that you have put in the work outside of university courses to make yourself more efficient and master the most critical program for success in finance careers. Easily share to LinkedIn and other social media sites to highlight your skills and strengthen your profile as a candidate.

Course Benefits

How much is the Investment Banking Interview Course Worth?

What You Get |

Value |

|---|---|

Module 1: Technical Question Mastery Guide 203+ questions, 10+ hours of video, 17 brainteasers, coverage of each of the 11 Technical Categories and more... |

$449 |

Module 2: Behavioral Question Mastery Guide 100+ behavior & fit questions, 10+ hours of video, 148 questions to ask your interviewer and more... |

$449 |

Module 3: Networking Mastery Guide 50+ questions to ask on your interviews, 14 templates for LinkedIn, Email & Cold-Calling, 3 WSO Resume Templates and more... |

$399 |

Bonus 1: Full WSO Company Database Access 12 Months Access - 24,681+ interview insights, 51,233+ exclusive salary and bonus datapoints + 20,127 company reviews... |

$297 |

Bonus 2: WSO Video Library 50+ hours of IB specific videos: webinars, sample deals, 10+ PPT & Excel Templates and more... |

$399 |

Total Value |

$1,993 |

Consider this your first investment in a long career...

After all, you've likely already spent tens of thousands of dollars on college (and perhaps tens of thousands more on an MBA)...

When you start your coveted investment banking job, you'll be making well over $100,000...

...over $300,000 if you have an MBA...

And that's just the beginning of a long and very lucrative career that could easily net you millions...

Even at thousands of dollars and your ROI would still be huge…

At a fraction of that price, the ROI is even better... When you do the math, it's a no brainer.

And that doesn't include the time you'd have to spend figuring all of this out and the hours of sleep these courses will save you.

Even if you used the free info online, you'd still have to find it, organize it, vet it and test it to get it to work. That would take months… and at that point, you may have missed your window.

The WSO Investment Banking Interview Course gives you everything you need to be super-efficient and get ready for your Investment Banking interview… quickly and easily.

But we're not going to charge you thousands...

We won't even ask for half of that...

Get Unlimited Lifetime Access To The IB Interview Course For

This offer (+bonuses) is limited-time only

12 Month Money-Back Guarantee

Your investment is protected by our 12-Month Risk-Free Guarantee -- easily the most generous in the market.

If, for any reason (or no reason), you don't think the WSO Investment Banking Interview Course is right for you, just do the following within 365 days of your enrollment:

- Email [email protected] letting us know

- That's it!

We'll refund every penny. No questions asked. We bear the risk and will eat the transaction fees because we're that confident you'll love it.

Course Reviews

Here’s what professionals like you think of the course.

FAQ

Answers to popular questions

About

Top professionals with many years of Investment Banking experience

No, you don't need an MBA to land an Investment Banking job. In fact, if you don't have Investment Banking experience prior to an MBA, it becomes even more difficult to break in since there are fewer seats for post-MBAs.

In investment banking, having sharp analytical skills is crucial. The problem is that most candidates now prepare well for these technical tests and ace them and ignore the fact that interviewers go an extra mile to test you on a lot more than just technical skills. Some test you on your knowledge of the industry, while others throw in brain teasers and mental math.

ENQUIRIES

Any other questions?

We’re here to help.

We're confident you'll love the program and happy to answer any questions you have! E-mail [email protected] at any time and we'll get back to you within a few hours.