Hedge Funds Interview Questions and Answers

(40 Samples)

(40 Samples)

40 common hedge fund interview questions. Examples include technical, transactional, behavioral, and logical tests with sample answers

Hedge Funds are one of the main movers of global markets and one of the key influencers of global liquidity. With the lucrative bonus packages offered by hedge funds, it is not uncommon to hear of hedge fund analysts in their mid-to-late-twenties making well into the half-million-dollar range per year or more.

Given this, it comes as no surprise that hedge funds are extremely selective with their hiring process, as they rigorously filter out thousands of potential applications annually to settle for only the best.

Consequently, answering the technical, behavioral, and logical questions with confidence and consistency is key to converting an interview into an offer.

Hedge funds employ many different people, from equity researchers to asset managers to prop traders. Any background in finance can be utilized to get into a hedge fund, although experience with the markets is preferred. The most common route into a hedge fund is to complete 2-3 years in an investment bank (either in IBD, trading, asset management, or equity research) and then be recruited via a headhunter into a hedge fund.

The following free WSO Hedge Funds interview guide is a comprehensive tool designed to cover every aspect of the interview process, guiding you from the beginning to the end, therefore drastically improving your odds of landing your dream job.

Our guide features a total of 40 of the most common technical, behavioral, and logical questions, along with proven sample answers, that are asked by hedge funds professionals to candidates during the hiring process.

We strongly believe it’s a great place to start your preparation before investing in our more comprehensive Hedge Fund Interview Course.

This resource includes 13 firm-specific questions from leading hedge funds (Bridgewater Associates, Citadel, etc.) and proven sample answers.

This interview guide consists of 10 sections, each focused on different phases of the interview process.

Perfecting Your Entry

There are no excuses for not perfecting what is in your control. Irrespective of the fund, the position, or the region, you can be sure this question will be asked as it’s a standard in the finance industry.

Anticipating this question beforehand, crafting a compelling narrative around it, and selling yourself on it will make you stand out from the pool of potential candidates.

Tell me about yourself, and walk me through your background/resume.

Your answer should be a three-to-five-minute story about yourself, elaborating on the highlights of your resume and explaining any gaps or contradictions.

Here is your opportunity to choose your focus and introduce strengths and experiences that you may expand upon later in the interview.

Make sure to call attention not just to the parts of your resume you’re most proud of but especially to those most relevant to the position you are seeking. For example, you will probably want to talk about your involvement in the investment club at school.

Your answer to this question can be a story about your life, including what you have accomplished and how that led you to this job.

Move through your story in a logical, chronological fashion but not by reading your resume. By now, you should know it nearly word-for-word and be ready to speak in-depth about anything it includes.

Highlight points that show your aptitude to learn quickly and your genuine interest in this job, as well as a few that show you are well rounded and not just a bookworm or workaholic.

This question tests whether you can speak clearly and concisely for about five minutes, an important skill for your career. You have had all the time you needed to prepare for this, so make sure you make your pitch smoothly.

Be positive, enthusiastic, and confident (as well as knowledgeable!) about your resume.

And, of course, make sure everything lines up with your resume!

WSO has published its series of resume templates over the years that have become the standard within the finance industry. An official WSO resume template tailored for professionals applying to hedge funds can be found here!

15 Common Hedge Fund Technical Questions

Technical questions are a critical component of almost every hedge fund recruiting process. Accordingly, your interviewers will expect detailed and accurate responses to commonly asked technical questions, and your answers must demonstrate in-depth knowledge and expertise of the topic at hand.

The following section features 15 common hedge fund interview questions and provides a sample answer for every question.

At the end of these 15 questions, we also have provided you with a WSO bonus current markets question, as well as eight exclusive fund-specific technical questions to kickstart your mock interview training.

Note: The 15 technical questions covered below are exclusive to the hedge fund industry. To check out an additional 30 technical questions with sample answers, check out WSO’s free 101 Investment Banking Interview Questions and Answers page.

1. Describe the impact of purchasing a new tractor on the three financial statements.

Sample Answer:

The impact of buying a new tractor or any other fixed asset on the three financial statements is as follows:

- Initially, there is no impact (income statement); cash goes down, while PP&E goes up (balance sheet), and the purchase of PP&E is a cash outflow (cash flow statement).

- Over the asset’s life: depreciation reduces net income (income statement).

- PP&E goes down due to depreciation, while retained earnings go down (balance sheet), and depreciation is added back (because it is a non-cash expense that reduces net income) in the cash from operations section (cash flow statement).

2. What happens to Free Cash Flow (FCF) if Net Working Capital (NWC) increases?

Sample Answer:

Intuitively, you can think of working capital as the net dollars tied up to run the business.

- As more cash is tied up (in accounts receivable, inventory, etc.), free cash flow will be reduced.

- Remember, if the value of an asset goes up, it is a use of cash, whereas if the value of liability goes up; it is a source of cash.

- You subtract the change in net working capital (NWC) when you calculate FCF, so if NWC increases, your FCF decreases, and vice versa.

FCF = EBIT (1 – Tax rate) + D&A – Change in NWC - CAPEX

3. What’s the difference between intrinsic and book value, and how can they deviate?

Sample Answer:

Book value is what assets are carried out on a company’s balance sheet. Book value and Price to Book are common valuation measures for value-conscious investors.

Intrinsic value is the belief of what a business is truly worth.

The intrinsic value would consider intangible assets not properly valued or carried on the balance sheet – like the value of the intellectual property or of a brand like Coke.

Additionally, when a holding company acquires a portfolio company, it is carried at cost on the balance sheet. As a result, its value won’t be “written up” to its intrinsic value over time as the company grows.

However, companies must write down intangible assets that lose value as per accounting standards.

4. When would funds from operations (FFO) or Adjusted FFO (AFFO) be used, and why?

Sample Answer:

FFO is commonly used in valuing real estate and REITs, but it can be used in other industries like Oil & Gas and Utilities.

FFO = Earnings + Depreciation + (–) Gains (losses) on disposals.

The FFO calculation can vary.

It is likely the most relevant earnings figure for a REIT. This is because REITs are required to depreciate their assets just like anything else. However, because real estate tends to maintain its value or appreciate, it’s acceptable to add back the non-cash depreciation, which reduces normal Net Income figures.

This makes FFO a more “real” earnings metric for REITs.

FFO may be used in O&G and Utilities because it’s a little cleaner than using EBITDA or Adjusted EBITDA, which is often not comparable across firms due to the many adjustments that might take place.

Adjusted FFO (AFFO) is FFO less Capex. AFFO is probably more appropriate for real estate than FFO because maintenance capital expenditures are required to ensure the assets work smoothly and have no issues structurally.

5. What are Deferred Tax Assets (DTA) and Deferred Tax Liabilities (DTL)? How are they created in an M&A transaction?

Sample Answer:

A DTL occurs when the company has paid fewer cash taxes than it owes, which it will have to make up for by paying additional taxes to the government in the future.

A DTA occurs when a company pays more taxes to the government than they show as an expense on their income statement in a reporting period.

DTAs and DTLs are often created in an M&A transaction through the write-up or write-down of assets.

If an asset is written up, the company records profit, and a DTL is created because the new asset will have a higher depreciation expense in the short term, which means the company will pay lower taxes. These taxes must be paid back at some point, which is why liability is created.

The opposite is true when an asset is written down in value.

6. Why would you look at a company’s net debt instead of its total debt (also referred to as “gross debt”)?

Sample Answer:

Net debt is more relevant from a valuation perspective because a potential acquirer won’t pay to acquire cash in a buyout situation.

- The Rationale for using Net debt goes along the same lines as Enterprise Value (which uses net debt).

- A large difference between gross and net debt signals that a company has a lot of cash on its balance sheet. This might be a clue into its operational strategy and might signal that it has substantial cash balances trapped overseas.

- Overseas cash balances can’t be used for domestic purposes. For a US-based company, this would be US stock repurchases, US stock dividends, US investments, or US M&A. To use overseas funds, the company would first need to pay taxes on bringing the cash home.

- Apple and Oracle are examples of companies with big differences between Net and Gross debt due to their large overseas cash balances from international sales.

- This occurs because both companies incur most costs in the US for international sales, transfer their IP assets to low-tax domiciles and run as much of their revenues through those foreign subsidiaries as possible.

7. Let’s suppose implied volatility for security is extremely high. Why could this be, and how would you profit from this?

Sample Answer:

Implied volatility represents the expected volatility in a security. For example, it could be high during company-specific events like earnings or due to volatility in the broader sector or market during a correction.

- You can chart a security’s implied volatility to see where it stands versus historical levels.

- If you think implied volatility is overstated for a company’s options; you should sell the option for a relatively high premium with the expectation that it will fall, and you can: (1) Cover at a lower IV and lower price, or (2) Hold your option trade through expiration and let them expire.

- You can sell premium by shorting calls or shorting puts, depending on if you have a view on the direction in the security. You could also write covered calls or short a straddle.

- A short straddle is writing puts and calls at the same strike and betting that the underlying security won’t move as much as the market expects by expiration. In other words, realized volatility will be less than what’s priced in.

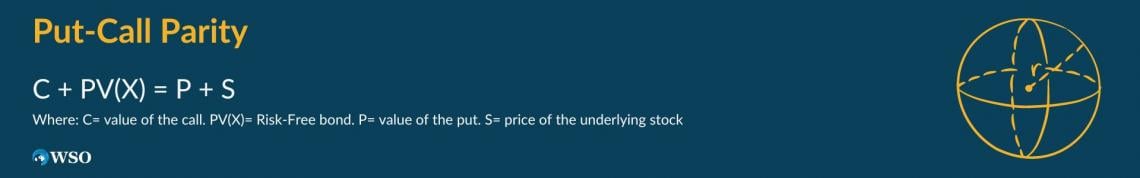

8. What is put-call parity?

Sample Answer:

Put-call parity describes the relationship between the price of European puts, calls, and holding a forward contract on an asset. The options and forward all have the same strike price and expiration date. Put-call parity is usually applied in the context of valuing one of a put, call, underlying stock, and risk-free bond, given the values of the other three factors.

- The equation is: C + PV(X) = P + S; where C is the value of the call, PV(X) is a Risk-Free bond, P is the value of the put, and S is the price of the underlying stock. PCP states that owning a call and a risk-free bond equals owning a put and stock.

- There’s an arbitrage opportunity whenever one side of the equation doesn’t equal the other. In practice, any arb opportunities will be short-lived. You would buy one side of the equation and short the other in the arbitrage, and the equation can be rearranged as needed.

9. What are the metrics you’d look at to assess a company’s creditworthiness?

Sample Answer:

A company’s creditworthiness depends on a variety of factors. A few of them are:

- First is its profitability and ability to generate cash reliably.

- Second is its degree of leverage – too much debt, and the company may not be able to cover its interest payments or refinance principal coming due in the future. Successfully refinancing debt is credit positive.

- The third is the general quality of the company, its competitive position in the market, and its management. Are the business fundamentals stable or improving? Is management too aggressive or too shareholder-friendly with excessive dividends and buybacks, putting its ability to service debt at risk?

- Finally, the general macro environment and industry dynamics are important. For example, a company in a very competitive industry being disrupted by new entrants or outside factors (i.e., a crash in oil price) will see its creditworthiness deteriorate. Weak macro conditions and a tight credit market could also impact the ability of a company to refinance debt in the future. Similarly, are the company’s liabilities based on floating or variable rates that rising rates will impact.

10. What is PIK interest?

Sample Answer:

PIK is often used in private and mezzanine debt issuance by companies. For the lender, it offers an equity-like upside to traditional lending, and it provides the borrowers with the ability to pay back loans without cash.

- PIK is often used in mezzanine lending, which is very event-focused, where the borrowing company expects to receive a meaningful return on the capital borrowed.

- PIK stands for Paid in Kind, referring to coupons paid in kind.

- When a company issues PIK interest, rather than making cash payments to bond/loan holders, the face value of its investment will increase/compound.

- A company may look to issue debt with PIK interest if it wants to limit cash interest payments in the near term and is willing to make slightly higher future payments.

- A company may also issue debt with both a PIK and a cash component. For example, if a company’s cost of debt is 10%, it may negotiate a bank loan that pays interest at 5% cash and 5% PIK.

11. What is OID?

Sample Answer:

OID is an Original Issue Discount. It is the discount from the par value that a bond or loan is issued.

OID = Par – Issue Price.

- The most obvious example is a Zero Coupon Bond, which pays no coupon and is issued below Par.

- OID is effectively a form of interest.

- In bank loans or mezzanine lending, the lender may negotiate the terms to get OID. It’s effectively extra interest or an upfront fee for borrowers taking out a loan.

12. What are typical default rates for bonds? What are typical recovery rates for bonds? What impacts the recovery?

Sample Answer:

The historical average default rate for high-yield bonds is just under 5%. However, the default rate for HY bonds has historically doubled to around 10% in times of distress around recessions.

- The 1-year default rate for a bond that is already distressed is a bit higher at 15-20%.

- The recovery rate for a distressed bond depends on where a bond falls in the capital structure compared to other creditors. The higher the seniority, the better the chances of recovering debt. The recovery rate has historically been around 40% for senior unsecured debentures. The type of recovery also impacts the recovery rate – Bankruptcy or distressed exchange. Distressed exchanges have had better recovery rates lately. Recovery rates are published annually by the credit rating agencies.

- Recently, especially in energy defaults, distressed exchanges have tended to have better recovery rates.

13. What’s the order of creditor preference in bankruptcy?

Sample Answer:

Senior bank loans are at the top of the capital structure with priority in the event of a bankruptcy, backed by company assets pledged as collateral. Bank loans can be syndicated loans sold to institutional investors through collateralized loan obligations (CLOs) or CLO funds.

Mezzanine Debt and Public or Private Placement bonds can be secured or unsecured. Most indentures (bonds) are senior, unsecured, and have a fixed interest rate, though floaters also exist. Publicly traded bonds tend to be more liquid than loans, though syndicated loans can be traded as well.

Subordinated bonds have fewer rights than senior secured or unsecured debentures. As a result, subordinated bonds offer a little more yield than senior bonds.

At the bottom is preferred stock and then finally common stock.

14. What investment could have a negative beta?

Sample Answer:

A beta less than zero would indicate security has an inverse relation to market moves. A defensive investment perceived as a safe haven could have no Beta or even a negative Beta.

Gold or gold stocks could be one example.

Long US Treasuries, like the 20+ year US Treasury bond or ETF like TLT, could be another example of low beta strategies over a short period.

Thought about another way, shorting the market using an ETF could also get you a negative beta.

15. If the spot exchange rate of dollars to pounds is $1.60/£1 and the one-year forward rate is $1.50/£1, would we say the dollar is forecast to be stronger or weaker relative to the pound?

Sample Answer:

The dollar is expected to strengthen when the spot exchange rate is higher than the forward exchange rate.

Since £1 costs more $ now than it will in the future, the dollar is expected to strengthen relative to the pound over the next year.

WSO Bonus Questions - Market Trends

Having knowledge and expertise in the public financial markets is inevitably a prerequisite for a successful career at a hedge fund. Given this, you should know that your interviewers will undoubtedly ask you questions related to markets, ranging from their history to the current trends.

Naturally, you must be prepared to answer these confidently with well-supported opinions, and the following bonus section aims to do just that! Covered below are two bonus questions on financial markets with four sample answers. The sample answers are not to be repeated word-for-word at interviews; rather, they serve to give you sample guidelines on the variety of ways you can answer these questions rightfully to gain a competitive edge over the applicant pool.

1. Discuss any moves you’ve seen in rates, spreads, and the treasury curve lately. (The answer below is written at the start of 2022)

Sample Answer 1:

Treasury yields have remained low given the concerns about the US and Global economic growth. With sovereign yields going negative in Japan and some countries in Europe, the yield on US Treasuries has remained low despite the Federal Reserve’s plan to continue hiking rates throughout the year. The Fed has been signaling an additional hike in June, and the forward rates are adjusting to incorporate these recent signals.

Sample Answer 2:

Energy markets largely drove the sell-off and recovery in high yield spreads. As a result, energy markets made up a large part of the high yield indices and remained the biggest credit risk out there. However, many non-energy high yield credits sold off amidst the turmoil in the market as bidders fled the market and HY fund flows turned negative.

Sample Answer 3:

There is very little yield to pick up in corporate bonds at the moment. However, bank debt has underperformed year to date. Therefore, it offers an opportunity to pick up some yield over other sectors. However, bank and financials’ profitability and growth remain challenged due to regulatory changes, low rates, and slow economic growth.

Sample Answer 4:

During the Covid-19 pandemic, the Fed lowered interest rates to accommodate the lack of demand due to the uncertainty caused by the pandemic. This led to massive inflation, the effects of which are now being realized. Looking at the treasury curve and comments by Mr. Powell (who mentioned that inflation is not transitionary), it is evident that the rates will increase by mid-2022. This ensures that inflation is curbed and the economy moves towards normalization post covid.

2. If you had $1 million to start any business right now, what would you do?

You could answer this in a variety of ways. Play to the focus of the fund. Your answer could be valued, return on capital, growth, opportunistic, or even special situation oriented.

For a growth approach, talk about a business that you’ll be able to grow sales, users, and possibly market share quickly, and don’t worry about profits. The ultimate goal could be raising additional outside capital from angels or venture firms or exiting the company by being acquired.

For an opportunistic/special situation fund, you could talk about creating a holding company to acquire lower-priced, undervalued earning assets that would deliver a reasonable return on capital. This could be low-priced real estate, mobile homes, or other distressed assets out of favor.

For a value, profitability, return on capital approach, You could focus on a high margin and low competition business that could generate consistent compounding returns.

Sample Answer:

With just $1 million in startup capital, my focus would be on a scalable business, high margins, and positive cash flow in its first few years. The business would also have few competitors and compete in a growing market with relatively low saturation. The ideal business would also have annuity-like, recurring income streams to stabilize earnings and provide working capital.

8 Firm-Specific Hard Technical Questions

Having the ability to correctly answer all 15 technical questions covered above is undoubtedly a great way to distinguish yourself as a strong candidate from the pool of thousands of hedge fund applicants. However, we can take you a step further by giving you critical insights into specific questions asked by different hedge funds to assist you in tailoring your preparation for the fund you’re applying for.

The following section features eight exclusive questions that candidates were asked by actual interviewers at some of the world’s biggest hedge funds.

Did you know?

The following questions have been taken from WSO’s company database, which is sourced from the detailed experiences of more than 30,000 candidates with hedge funds interviews. The Hedge Fund Interview Course includes over 800 questions across 165 hedge funds (no other resource comes close).

Point72 Technical Questions

A plausible reason for this would be that the distributor purchased a large amount of inventory before there was a price increase in the market and consequently sold it when the price had risen.

A sample general approach to modeling and research could involve the following 6-step process:

- Formation of assumption/hypothesis

- Collection of relevant data

- Analysis of markets

- Creation of forecast

- Simulation/test-run

- Release and monitoring of model

It would be useful to access information on the specific breakdowns of operating and non-operating revenue for both companies.

Operating revenue:

- Total number of packs of cups sold in comparison to dinner plates sold (this is needed to figure out if Company A sells 300x more dinner plates than Company B as its price/unit is 300x cheaper)

- Total number of Starbucks and Applebee stores

- Daily consumption of the two products

- Ordering system information like discounts for large pack orders

Non-operating revenue:

- Gains or losses from investments by either company

- Properties or assets for sale

- Divestiture: selling off subsidiary business interest

Citadel Technical Interview - Technical Questions

We assume that the entire Net Operating Balance (NOL) goes to $0 in an M&A transaction, and therefore we write down the existing Deferred Tax Asset by this NOL write-down.

An exchange ratio is an alternate way of structuring a 100% stock M&A deal or any M&A deal with a portion of stock involved.

Purchase Price: Stated as a per-share amount for public companies and Form of Consideration:

Cash, Stock, Debt…

An Earnout is a form of “deferred payment” in an M&A deal – it’s most common with private companies and startups and is highly unusual with public sellers.

Bridgewater Associates Technical Questions

It could be beneficial to increase the volume of software sold and increase the price of pens, as the incremental cost of each additional software license sold is relatively low, and almost all of the additional revenue would flow directly to margins.

However, increasing the price of pens has more advantages from a financial standpoint as they have a higher incremental cost (cost of producing a pen scales with quantity sold).

The Stock Pitch

The stock pitch is always a staple of the HF interview, and you should prepare accordingly. It is best to go prepared with one long idea and one short idea, as demonstrating that you understand the nuances of shorting is a great way to differentiate yourself from other candidates.

If you are interviewing for a specific sector/industry, pick a business to pitch. Yes, your interviewer will likely know more about the industry and/or company, but you should be more than OK as long as you stick to stating this. Using a pitch structure such as the one below gives the best results:

- Industry: Why is the industry attractive? [Use a quantitative metric to show you did your homework here, such as, “ABC Industry can grow xyz% in the next 3-5 years. This is also a good place to highlight changing competitive dynamics.]

- Company: Why is the company attractive? [Something like, “The business has sales of $30 in a $3000 industry representing a 3% market share despite being recognized as the product leader and having an exceptional management team.” is the best way to address this]

- Catalyst: Why is the market wrong, and how will the market realize the business’s intrinsic value? It is the most important part of the pitch. For example, “ABC is currently valued at 10x [insert multiple], but is being unfairly discounted because of the incompetency of the prior management team. XYZ has improved since the current management team took over [insert metric]. As of right now, the market has not recognized the improvement in XYZ or the overall business, but I expect that [insert catalyst] will demonstrate ABC’s true value to the market within [insert time frame].”

- Valuation: What is the intrinsic value of the business? [Say something like, “If my assumptions [discuss them here] about the effect of [insert catalyst] prove true, then the market will realize ABC’s intrinsic value of [insert valuation].” You can then speak about contingency valuations, etc.]

Try to keep your pitches as short and high-level as possible. This helps to minimize the chances of putting your foot in your mouth and allows the interviewer the chance to ask more in-depth questions where they feel necessary.

Of course, you also need to be prepared to answer in-depth questions about anything pertaining to your pitch – the industry, competitors, the company, etc.

Note: The above extract was taken and paraphrased from WSO User @Simple As…’s post, “The Asymmetric Risk Profile: Preparing For The Hedge Fund Interview.”

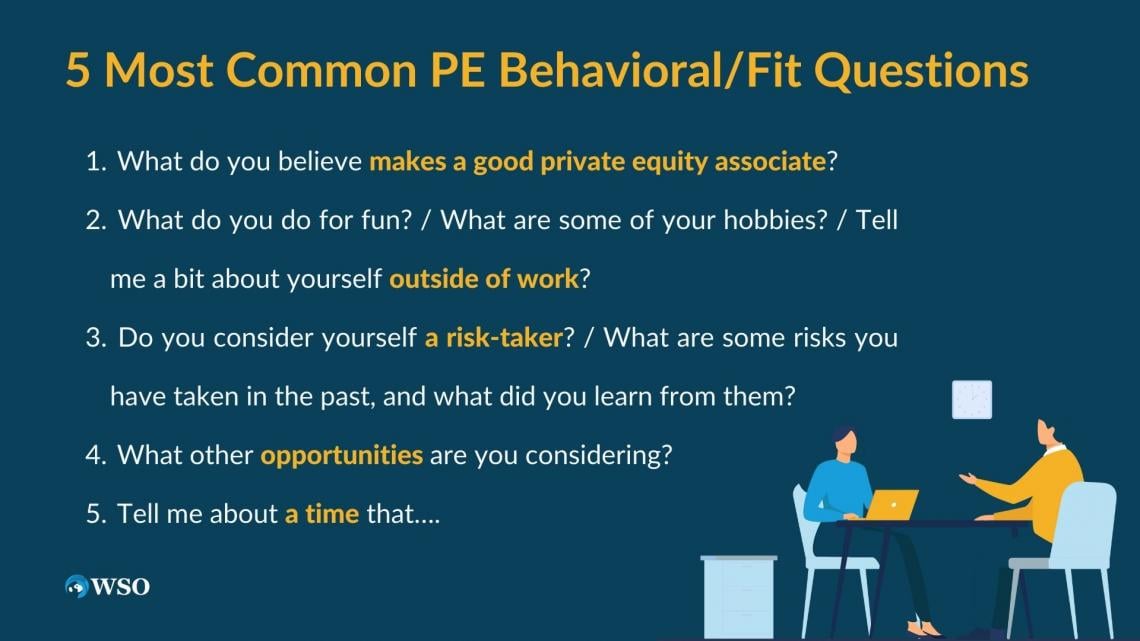

5 Most Common Hedge Funds Behavioral/Fit Questions

Fit or “behavioral” questions are used to assess whether you have the right attitude, work ethic, personality, and values to fit in with a Hedge Fund’s culture. Many Hedge Funds take it extremely seriously because most firms usually have only a handful of investment professionals who must collaborate over long hours and under tight deadlines.

For example, Bridgewater Associates is known for its intense corporate culture of radical truth and radical transparency, and its interviews, therefore, consist mainly of ethical and moral questions.

This section walks you through 5 of the most common types of fit questions and suggests approaches for answering them. The suggested approaches and sample answers are meant to be illustrative. But, always remember, you need to adapt your answers to be true to yourself and your own words.

1. What’s the single most impressive experience that is on your resume?

Have one experience in mind that you feel is most impressive to the position you are applying for, and talk about it in depth. Then, explain the important facets of the experience and how they relate to the job you are applying for.

Sample Answer:

The most impressive experience on my resume was my experience last year as an intern at a hedge fund after my sophomore year. As the only intern at the firm, I effectively managed multiple tasks from multiple bosses. Throughout the summer, I learned how to accomplish everything asked of me efficiently and accurately.

I took on tasks such as some basic modeling of a company’s projected revenues based on different drivers and qualitative analysis of a few different industries, putting together PowerPoint presentations for the senior members of the team. Even though I was just an unpaid intern, I was considered an integral part of the team and was expected to work long, intense hours, which gave me a feel of what I should be expecting as I enter the workforce.

2. What makes you think you can put up with the stress, pressure, and long hours of a career in finance?

Tell a story of a time in your life when you managed many different tasks and worked long hours.

The story can be from school, work, home, or a combination of all of them. For example, maybe during finals week, you wrote three papers while studying for two exams, finalizing the school newspaper, and still going to soccer practice.

Make sure to explain that you know your experience has not been as intense as what you will face as a finance professional. Still, you feel as well prepared as anyone, and you are 100% dedicated to succeeding, whatever it takes.

Sample Answer:

I feel I am as prepared as anyone else coming out of college to handle the long hours. When you add up all the time I spent doing all my different activities, school hours were almost as long. Every day I was up at 7:30 for classes that ran from 8:15 until 1:00. Then, after class, I would grab lunch and then go to soccer practice, which means I didn’t get back until 5:00.

Then I would grab dinner and work in either my room or the library until I was done, which usually wasn’t until pretty late at night or into the morning. So while I know it isn’t the same stress and time commitment as finance requires, I feel my experience has left me well prepared.

3. How did you choose your major?

This is another question intended to explore your decision-making process.

Use this answer to emphasize attributes and skills you learned from your major that will allow you to be successful on the job.

Emphasize that some relevant skills may not be demonstrated on your resume: problem-solving, teamwork, presentation, writing, teaching, or research.

Sample Answer:

I chose economics for a few reasons. First, during my sophomore year, I realized that finance was what interested me. Since my school didn’t offer a finance major, I chose economics to give me a broad perspective on the issues and ideas that shape the financial world. My second reason for choosing economics was that I like intellectual challenges and solving problems in teams.

My school’s economics program emphasizes group work, math, and intensive analysis, so I thought it would be a good fit for my interests and personality. In addition, I managed to supplement my econ degree by taking the two finance courses my school does offer, so I feel as prepared as I can be for the transition to a career in finance.

4. What is the biggest obstacle or challenge you have faced and overcome in your life?

Describe any challenges you are comfortable discussing which you overcame after facing the challenge head-on.

If you can come up with a situation that relates to school or a job you had, that is great. For example, a useful story might be one about a time when you were instructed to do something you did not fully understand, figured it out for yourself, and got it done right. This exemplifies your desire/willingness to learn, as well as your initiative and determination.

Sample Answer:

The biggest obstacle I have had to overcome was paying for college. I managed to do it in a combination of ways. Initially, I took out student loans, but then I began paying my tuition in cash and paying off some of my student debt early. I’ve waited tables several nights a week throughout all my college years, and I now work at a very popular restaurant, which pays me pretty well consistently. However, I have most enjoyed supporting myself in graphic design.

I was into art and photography in high school, and my graphic design skills were pretty strong. Unfortunately, when I began my business education, I didn’t have time for those classes, and I missed them. However, I have been able to earn extra money developing logos, letterhead, business cards, presentations for student startups, and some local businesses. All of this extra work has helped me to pay for a good portion of my college costs.

5. How would you compare your writing skills to your oral skills?

This is a bit of a trick question, and your answer must be personalized to your previous experiences.

For example, you cannot say that one skill is stronger than the other is. Instead, you must convince your interviewer that your written and oral skills are strong because they are vital in finance.

Any response that says one skill is stronger than the other is unacceptable.

5 Firm-Specific Behavioral/Fit Questions

Knowing the culture of each hedge fund before walking into an interview is key to clicking with the interviewer and walking out with an offer.

The following section features five exclusive questions asked by interviewers in the world’s biggest hedge funds during interviews. This aims to help you jumpstart your training for the respective private equity firms you are interviewing for.

The following questions have been taken from WSO’s company database, sourced from detailed hedge fund interviews experiences of more than 30,000 people.

Point72 Behavioral Questions

1. What roles are you applying for right now? What types of firms?

While you want to show that you are in demand by many hedge funds, you also need to make sure you come across as focused.

While most interviewers are aware that you are probably applying everywhere, you need to show that you have studied the culture and focus of this hedge fund and want to be at this particular fund for specific reasons.

By all means, you can mention other funds you are interviewing with that are similar in size and culture (i.e., mention Bridgewater Associates to Point72).

However, avoid telling a hedge fund that you are interviewing at an accounting firm, management consulting firm, etc. You want to appear highly focused on hedge funds.

The bottom line is that you should name firms similar to the one you are currently interviewing with.

Sample Answer:

I have been lucky to get interviews at some other great hedge funds. I have final round interviews at Hedge Fund X and Hedge Fund Y coming up. However, I hope I don’t even have to go to those interviews because I already have accepted an offer here; this is where I want to be and where I think I fit best.

2. What do you consider your greatest failure?

Here’s another trick question. The interviewer wants to hear about a failure but wants, even more, to see what you learned from that failure.

Do not discount your ability in a skill-set that is critical in finance. For example, you never want to say something like, “I failed my corporate finance course last semester,” since it is very hard to spin that positively.

Allow the story of the failure to be the shortest part of your response, and then turn the question around to focus on how you turned the failure into a positive experience.

If you are debating between two failures, pick the one that is farther from the past because it gives you more chance to change since the failure. For example, if you pick a failure that happened last week, you will have difficulty convincing anyone that you have succeeded in similar situations since then.

For both the greatest weakness and the greatest failure questions, some things to keep in mind are:

- Do not pick a failure that was costly to your employer’s finances or reputation.

- Do not pick an example that doesn’t allow you to show how you have improved or how you succeeded as a result.

Sample Answer:

I consider not getting an internship last year to be my biggest failure. I know that the hiring situation was difficult. Still, I feel like I let down my family and myself by not getting an internship after having the opportunity to study at a school like The University of X.

I went through the traditional channels and applied through my career center and websites. When that didn’t work, I realized that networking is essential. So this year, I reached out to almost everyone I know and now have interviews at many great hedge funds like this one.

D.E. Shaw Group Behavioural Question

3. What is your strength?

Going into the interview, you should have your three top strengths in mind and a story ready to go for each of them.

When you answer this question, make sure you identify your greatest strength and make it very clear. Don’t dance around the answer. The strength you describe must be a quality that will help you become a great junior employee.

You can list anything here; just make sure the strength you discuss backs up those characteristics for success that are listed in the introduction and provide vivid examples in support.

If you can, bring up a strength that doesn’t appear on your resume but could catch attention. For example, if you have performed in concert or theater all your life, learning to be poised in front of strangers and/or large groups, that may be a good strength to share.

Reiterate that you are a highly motivated, detail-oriented, great multi-tasker, team player, and fluent communicator with a high endurance level, and have appropriate examples to back each point up.

Sample Answer:

From my resume, I have strong quantitative skills and performed well in school, as you can probably tell. However, one of my greatest strengths is vital for finance but not necessarily something that can be documented.

It is my ability to learn quickly. For example, at my internship last summer, I was brought into the office by my boss, given an old version of an Excel model and a list of variables he wanted to tweak, and told to rebuild the model from scratch. At the time, I had no previous modeling experience, no training, and no idea what I was doing. I knew my boss didn’t have time to hold my hand through the process, so I had to teach myself.

I bought a book and used Internet resources to learn how to rebuild the model to my boss’s specifications in a very short amount of time. My boss was amazed at the quality of the model, and it is now being used for his analysis and in presentations to clients.

Bridgewater Associates Behavioral Interview Question

4. What feedback did you receive from your last job/internship?

Whatever you do, don’t give a generic answer like “I performed well, and everyone liked me.” Instead, your interviewer is looking for specific examples of what you are good at, what you have room for improvement on, and the steps you have taken to better yourself in your areas of weakness.

Discuss very specific examples of what you did well first, such as drive, attention to detail, teamwork skills, or the ability to work on your own and figure out what needs to get done.

Then, discuss a few areas that your superiors mentioned you could improve upon. Next, talk about real weaknesses (you should have these from your three strengths and three weaknesses preparation), and then talk about how you have taken steps to improve your skills. For example, maybe they said your Excel skills need to be improved, so you signed up for an Excel course your next semester at school.

Millennium Partners Behavioural Questions

5. What motivates you?

Almost all those in finance are in it, at least partly for the money but do not say that to the interviewer. But, of course, you are in it for the money; your interviewer wants to hear what else motivates you.

Rather than just saying what motivates you, have a story prepared that shows you are motivated by whatever you answer.

Sample Responses include:

- Outperforming expectations

- Hitting deadlines

- Respect from your peers

- Maximizing efficiency

- Learning

Sample Answer:

My biggest motivation is earning the respect of my peers and boss. In my job last summer, I was the sole intern responsible for building a model for a client. My boss, Mike, gave me the specifications and told me when he needed them. I wanted to make a positive impression, so I worked almost around the clock, including time at home, to get it built in only three days.

This allowed me to sit down and go through it with Mike before it was needed and still get it edited well before the deadline. Mike respected me for getting it done early, and earning that kind of respect is what keeps me going.

5 Logical Puzzles - HF Interview Brain Teasers

Logical puzzles, brainteasers, and riddles are an important part of the interview process as they allow the interviewer to determine your critical thinking abilities.

For this section of the interview, interviewers aren’t focused on whether you get the right answers or not. Rather, they are interested in your thought process while solving the riddles you are presented with.

Given this, it is key to walk your interviewer through your thinking as you progress through the riddle, who may even probe you with questions to assist you. Giving them a rundown of your thoughts and occasionally asking if you’re headed in the right direction demonstrates your capabilities to reflect and approach a problem with composure.

However, it is still extremely useful to anticipate these logical puzzles beforehand to avoid being put on the spot and caught off guard in the interview. The following section has five commonly asked logical puzzles that you can prepare beforehand to impress your interviewer.

5 Hedge Fund Brain Teaser Questions

Answer:

Be careful here. The initial instinct is to say half an hour. However, both boats are moving at 10 miles per hour, so they are converging at 20 miles per hour, meaning they will crash in 1⁄4 of an hour or 15 minutes.

Answer:

Each day has a 1 in 7 chance of being the first day of the month. However, if the month starts on a Saturday or a Sunday, the first business day of the month will be a Monday. Therefore, the chances of the first business day being a Monday is 3 in 7 since if the month starts on Saturday, Sunday, or Monday, the first business day is a Monday.

Answer:

Between 1 and 100, there are 50 sets of 101, for example, 100 and 1, 99 and 2, 98 and 3, and so on. 50 sets of 101 are 5,050, so the sum of 1 to 100 would be 5,050.

The average of all of those numbers is 50.5. So if you take the average and multiply it by the number of numbers, you get 100 times 50.5 or 5,050.

Answer:

With a question like this, the interviewer is looking at your thought process, not figuring out how many gas stations are in the US.

The easiest way to answer a question like this is to start small and work your way out. Think about your town. Say your town has 30,000 people and five gas stations serving that area. The United States has approximately 300 million people, so there are 10,000 “towns” in the United States and 50,000 gas stations.

You then want to make adjustments. For example, assume that a quarter of the population lives in larger cities with only one gas station per 30,000 people. So you have 7,500 towns with five gas stations and 2,500 “towns” with only 1. Do a little mental math, and you get a number of 40,000 gas stations in the US.

Answer:

You have 50 black balls, 50 white balls (total of 100), and two buckets. How would you split the balls between the two buckets to maximize the chance of selecting a black ball when one ball is chosen from one of the buckets at random?

The best way to maximize the chances of selecting a black ball would be to put one black ball in one of the buckets and all the rest of the 99 balls in the other bucket. Since you have a 100% chance of selecting a black ball if you choose the first bucket, and a 49.5% chance of selecting a black ball if you choose the other (49/99), the overall chances of selecting a black ball are (50% x 100%) + (50% x 49.5%) = 74.7%.

Full WSO Hedge Fund Prep Guide & Additional Resources

The majority of questions and sample answers covered in this free guide were obtained directly from WSO’s very own Hedge Fund Interview Course, which features:

- 814 questions across 165 hedge funds

- 10+ exclusive case videos with detailed pitches

- Long, short, equity, credit, event-driven, macro+ questions

Think about it - if this page can set you miles ahead of the competition, imagine what our complete course can do for you.

The WSO Hedge Fund Interview Prep Course will walk you step-by-step through the interview process and place you in the strongest position to land the job at a hedge fund.

List of Hedge Funds

The following are some of the biggest of the 750+ hedge funds firms WSO has data on in its company database:

- Bridgewater Associates| Bridgewater Associates Overview | Bridgewater Associates Site

- The Tudor Group| The Tudor Group Overview | The Tudor Group Site

- Brandes Investment Partners| Brandes Investment Partners Overview | Brandes Investment Partners Site

- Renaissance Capital| Renaissance Capital Overview | Renaissance Capital Site

- Millennium Partners Group| Millennium Partners Overview | Millennium Partners Site

- Alpine Woods| Alpine Woods Overview | Alpine Woods Site

- Carlson Capital| Carlson Capital Overview | Carlson Capital Site

- 360 Global Capital| 360 Global Capital Overview | 360 Global Capital Site

- GSO Capital Partners| GSO Capital Partners Overview |GSO Capital Partners Site

Additional interview resources

To learn more about interviews and the questions asked, please check out the additional interview resources below:

or Want to Sign up with your social account?