Retained Earnings

Retained earnings are the profits that a firm has left over after issuing dividends

What Are Retained Earnings?

Retained earnings are the profits that a firm has left over after issuing dividends. It may also be called earnings surplus or plow back. This account contains all the surplus funds that a company has retained throughout its existence. It is usually found under the shareholders’ equity section on the balance sheet.

For the most part, it is management’s responsibility to use this money in the best possible manner. That being said, the shareholders could form a majority stake in the company and overrule management.

Management, however, is obliged to use this money for the benefit of the shareholders. There are two primary ways in which this can be accomplished:

1. Repay shareholders through dividends or stock buybacks:

Many companies issue dividends at a specific rate to their shareholders at a fixed interval. Increasing dividends can be a good or bad sign for a company. It is usually paid out when the management believes that the shareholders can generate higher returns on the investment than the company can.

On the other hand, investors prefer securities that pay a constant rate of dividend periodically, which reduces the risk of investing in the shares.

2. Invest in fixed assets to improve growth prospects:

When the management is looking to invest in the near future, they usually don’t pay dividends. Instead, they invest this amount in expanding and growing the company, which slowly increases its overall value.

Some companies may spend this money on paying off loans, similarly reducing their interest expenses. Cyclical companies may choose to hold on to cash rather than use it for dividend issuance or expansion as they may need it during economic downturns.

Key Takeaways

- Retained earnings are the profits a company retains after paying dividends and represents the surplus funds accumulated throughout its existence.

- Management has the responsibility to use these funds for the benefit of shareholders, either by issuing dividends or investing in assets to improve growth prospects.

- The formula to calculate retained earnings is: Retained Earnings = Beginning Retained Earnings + Net Income - Cash Dividends - Stock Dividends.

- Retained earnings are essential for financial analysts as they provide insight into a company's financial performance and health. The retained earnings to market value ratio is used to assess how effectively a company allocates earnings for growth.

Retained earnings formula and calculation

Retained earnings are part of the equity portion of the balance sheet. It represents a company's profit after paying its expenses and dividends and includes all of the company's retained funds since its inception.

It can be calculated as follows:

Retained earnings = BOP RE + Net Income - Cash Dividends - Stock Dividends

where,

- BOP RE = Retained earnings at the beginning of the period

It can also be calculated without knowing its opening value by subtracting all the dividend payments made during the company's life from its total net income.

It can also be calculated as a percentage of income, also called the retention ratio. To calculate this, one must subtract the dividend payout ratio from one. The equation for this is:

Retention ratio = 1 - (Dividends Paid / Net Income)

Cash dividends are a cash outflow from the company, reducing its cash balance. Usually, companies issue dividends at a specific rate on a fixed schedule. A company is not obligated to pay dividends for common stock. Despite this, companies often stick to this schedule because missing dividend payments can indicate financial woes.

Real World Example

During the Covid-19 pandemic, many companies reduced their dividends or canceled them altogether.

Often companies that issue large dividends are low-growth companies because they don’t have many investment avenues for growth. On the other hand, high-growth companies usually pay relatively smaller dividends or no dividend at all.

Again, this is because they use the majority of their retained earnings to finance expansion rather than dividends.

Stock dividends are not a cash outflow for the company. Instead of paying cash, shares are issued to current shareholders for free against a portion of retained earnings, which gets added to the common stock pool.

This mode of dividend payout always creates little value addition for shareholders and often causes the stock price to decrease. The price decrease is due to the fact that there is a higher number of shares outstanding for the number of net assets.

What Retained Earnings Can Tell You

Retained earnings are significant for financial analysts. Therefore, the balance in the account may be a good indicator of the company’s financial performance and health.

One especially useful tool in analyzing a company’s value is the retained earnings to market value ratio. This ratio can provide insight into how effectively companies allocate their earnings to suitable investments that increase share value for growth companies.

Usually, this is calculated using data taken from multiple periods and involves dividing the earnings per share (EPS) by the retained earnings per share.

This ratio is calculated as follows:

Retained Earnings to Market Value Ratio = EPS / Retained earnings per share

Negative earnings may result from a large dividend payment or worse, continuous and irrecoverable losses.

Ways of describing negative retained earnings in the balance sheet are accumulated deficit, accumulated losses, or retained losses.

High retained profits can be both good and bad for a company. It can demonstrate significant profitability and increased earnings to the analysts. Despite this, not using its earnings balance may not be a good thing as this money loses value over time.

Most shareholders prefer that companies issue retained earnings as dividends or reinvest them to increase their growth.

It’s also important to consider how a company calculates its retained earnings. Businesses can calculate their retained earnings using either historical cost or current cost accounting methods. In the US, most companies use the latter, though there are some exceptions.

For example, Canadian-based firms typically use historical cost accounting to disclose all gains and losses from previous years in their annual reports, regardless of whether they have been included in current year shareholders’ equity accounts.

This can change how the account should be interpreted by investors and should be analyzed carefully.

Retained Earnings Example

Let’s understand this with the help of an example.

Retained earnings can be found on the balance sheet. It is the sum of net income a company has generated since inception minus its dividends.

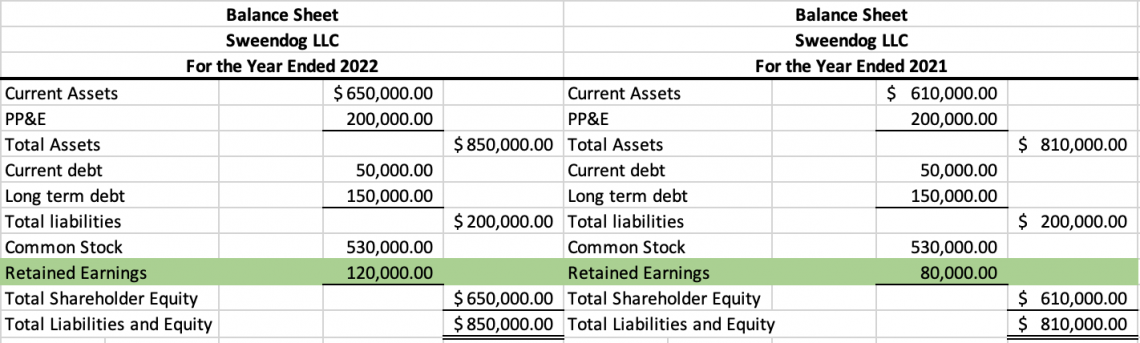

It is hard to know the increase in retained earnings for any given year unless one looks at the balance sheet for the previous period. The picture below shows that retained earnings increased by $40,000 ($120,000 - $80,000) from 2021 to 2021.

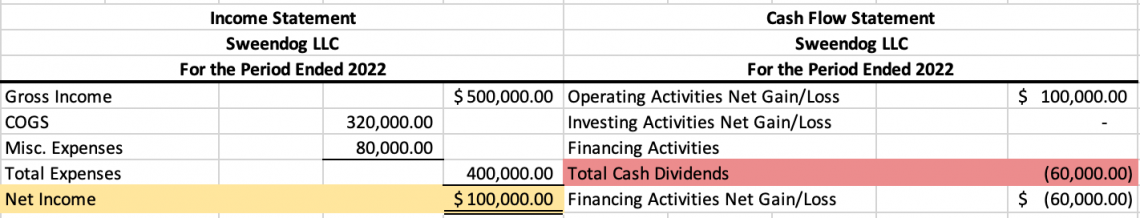

The change in retained earnings in any period can be calculated by subtracting the dividends paid out in a period from the net income from a period. This is because dividend payments are found in the financing activities section of the cash flow statement, and net income is found on the income statement.

In our example, Sweendog LLC earned $100,000 in net income as is shown in the income statement and paid out $60,000 to its shareholders in cash dividends, as is shown in the financing activities section of the cash flow statement.

This represents a retention ratio of 0.4. The increase in retained earnings can be found by subtracting the $40,000 in dividend payments from the $100,000 in net income the company earned, which equals $60,000.

To find the current retained earnings of the company, we can add the increase in retained earnings to its opening balance.

In this example, it amounts to $120,000 ($80,000 + $100,000 - $60,000).

Limitations of retained earnings

However, despite its benefits, one major limitation of the metric is that it does not account for money's time value.

Since idle money does not gain value over time without being invested, it may quickly deteriorate in value. Therefore, it is typically more beneficial for a company to use the money to invest in new assets and expand the company, issue dividends, or pay off loans.

Unless it operates in a cyclical industry where a cash buffer is necessary, holding on to earnings may destroy value for the shareholders.

Hence, capable management knows to properly balance these various options for the ultimate benefit of the company.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?