Equity Research Interview Questions and Answers

(40 Samples)

(40 Samples)

40 common equity research interview questions. Examples include technical, transactional, behavioral, and logical tests with sample answers

Equity Research (ER) attracts seasoned professionals and new hires with a variety of talents and diversified skill sets across the world for a fulfilling career. New hires starting right out of school will start as research associates and move up the chain to becoming research analysts after gaining experience in the industry.

Given the limited number of positions for a tremendous amount of applicants, it is no surprise that the interview process is designed to be incredibly competitive.

Consequently, answering the technical and behavioral questions confidently and consistently is key to converting an interview into an offer. Therefore, the best way to prepare for these interviews is to follow the markers, learn to answer the common questions asked (covered below!), and practice tirelessly.

The following free WSO ER interview guide is a comprehensive tool designed to cover every single aspect of the ER interview process, walking you through step by step from the beginning to the end of the interview. This interview guide will drastically improve your chances of securing an offer with your dream job.

Our guide covers a total of 40 of the most common behavioral, technical, and logical questions, along with proven sample answers, that are asked by hedge funds professionals to candidates during the hiring process.

We strongly believe it’s a great place to start your preparation before investing in our more comprehensive Hedge Fund Interview Course.

This resource features 13 firm-specific questions from leading hedge funds (Citadel, Bridgewater Associates, etc.) and proven sample answers to them.

Common First Equity Research Interview Questions

Successful professionals within the equity research industry can present themselves as the ideal candidate for the position by highlighting their genuine interest in finance and strong work ethic. A candidate’s presentation of themself occurs at the beginning of the interview, often through these two questions. Regardless of the firm, the position, or the location, we can guarantee that these industry standard questions will be asked.

Anticipating both of these questions before walking into the interview, being well-practiced in crafting a compelling narrative around them, and selling yourself will make you stand out from amongst the pool of potential candidates.

Walk me through your background/resume

We recommend you dial in a cohesive 90-second resume walkthrough that highlights as well as explains all the on the positive and motivating factors behind every transition on your resume (school to job, job to better job, most recent position to grad school).

A good example highlighting this is as follows,

I initially went to school to learn how to design cars, but after my first internship in the field, I realized that I loved interacting with clients directly and decided to pursue full-time roles in B2B sales. In these sales roles, I learned and developed solid selling skills as well as gained direct exposure to A, B, and C. Since I wanted to continue refining that skill set and branch out to focus on X, Y, and Z, I am looking for a new role/promotion which provides that opportunity…

Be deliberate with your delivery. Every decision you made should have a purpose (preferably that you initiated). Don't be negative with your answers. It's important to never say you left because you were bored or "wanted to try something new."

Moving on from there, have a few backup stories prepared. These stories should effectively portray you as a good ER candidate involve highlighting your abilities as a go-getter with a genuine interest in financial markets. Have these stories prepped and use them to answer whatever the interviewer is asking you. Tell these stories with confidence, clarity, and relevance, and you’ll be putting yourself in good territory. Again, it is key to ensure your resume lines up and supports your stories.

WSO has published its very own Equity Research sample resume template and provides guidelines on crafting a successful ER resume. Check it out at WSO’s official Equity Research Resume Guidelines page.

Why equity research?

Given the wide variety of professional backgrounds that candidates come from, WSO has created a dedicated page to answer this question. WSO’s “Why Equity Research?” page covers a variety of sample answers tailored for students and professionals looking to break into equity research.

15 Common Equity Research Technical Questions

Technical questions are a cruical component of almost every equity research recruiting process. Therefore, your interviewers will expect accurate and detailed responses to commonly asked technical questions. It's important that and your answers must demonstrate in-depth knowledge and expertise of the topics at hand. The following section features 15 common ER interview questions, and sample answers have been provided for every question.

At the end of these 15 questions, we have also provided you with eight exclusive firm-specific technical questions to jumpstart your mock interview training.

The 15 technical questions covered below are exclusive to the equity research industry. However, equity research interviews often overlap with investment banking and hedge fund interviews as general finance/accounting questions can also be asked. To check out an additional 45 technical questions with sample answers, check out WSO’s free 101 Investment Banking Interview Questions and Answers and Hedge Fund Interview Questions pages.

1. What is EBITDA?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It is a general metric for evaluating a company’s cash profitability. In addition, it is sometimes used as a proxy for free cash flow because it will allow you to gauge how much cash is available from operations to pay financing costs like interest, capital expenditures, etc. This is one of the most important single items someone will look at in evaluating a Company.

EBITDA = Revenues - Expenses (excluding non-cash and non-operational items like interest, taxes, depreciation, and amortization)

Sample Answer:

EBITDA is an acronym for Earnings Before Interest, Taxes, Depreciation, and Amortization. It’s an excellent high-level indicator of a company’s financial performance.

Since it removes the effects of financing and accounting decisions such as interest and depreciation, it is a much better metric than revenue or net profit for comparing different companies. As a result, it serves as a rough estimate of free cash flow and is used in the EV/EBITDA multiple to establish a company’s high-level valuation quickly.

2. What is enterprise value?

Enterprise Value is the value of an entire firm. It accounts for the debt and equity in a business and is calculated using the equation below. This is the price that would be paid for a company in the event of an acquisition, where the acquirer takes on all the debt and equity of the acquiree.

Simplified Enterprise Value Formula:

Enterprise Value = Market Value of Equity + Debt + Preferred Stock + Minority Interest - Cash

Sample Answer:

Enterprise Value is the value of a firm as a whole from the perspective of its owners, including both debt and equity holders. In its simplest form, you calculate an Enterprise Value by taking the market value of equity (aka the company’s market cap), adding the debt and the value of the outstanding preferred stock. Then you add the value of any minority interests the company owns and then subtract the cash the company currently holds.

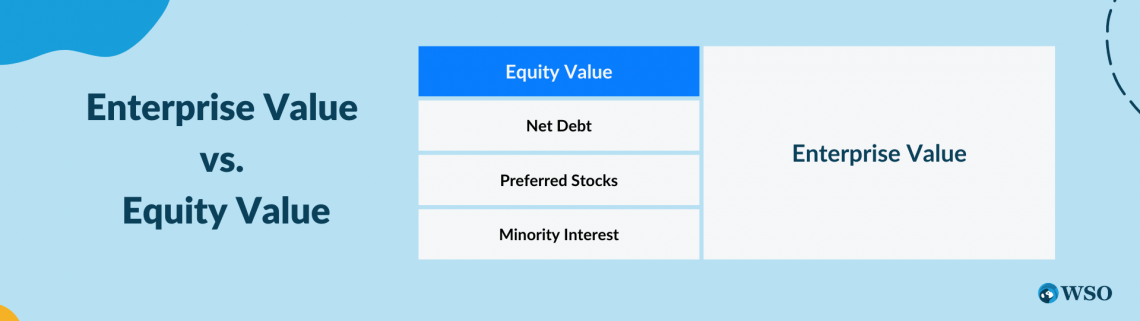

3. What is the difference between enterprise value and equity value?

Sample Answer:

Equity Value represents residual value for common shareholders after the company satisfies its outstanding obligations (net debt, preferred stock, which is senior to common equity). In contrast, enterprise value represents the value available to both equity and debt holders.

4. How do you value a private company?

- You can value a private company using the same techniques you use for a public company, with a couple of exceptions:

- You cannot use a straight market valuation since the company is not publicly traded.

- A DCF can be complicated by the absence of an equity beta, making calculating WACC difficult. In this case, you have to use the equity beta of a close comp in your WACC calculation.

- Financial information for private companies is more difficult to find because they are not required to make public online filings.

- An analyst may apply a discount on a comparable company’s valuation if the comps are publicly held because a public company will demand a 10-15% premium for the liquidity an investor enjoys when investing in a public company.

5. Why might there be multiple valuations of a single company?

Sample Answer:

Each valuation method will generate a different value because it is based on various assumptions, multiples, or comparable companies and/or transactions.

Typically, the precedent transaction methodology and discounted cash flow method result in a higher valuation than the result of a comparable companies' analysis or market valuation. In addition, the precedent transaction result may be higher because the approach usually includes a “control premium” while calculating the company’s market value. This premium exists to entice shareholders to sell and will account for the “synergies” that are expected from the merger.

The DCF approach typically produces higher valuations because analysts’ projections and assumptions are usually somewhat optimistic.

Sample Answer:

You can value a private company with many of the same techniques one may use for a public company valuation. However, there are a few differences. There will be difficulty in obtaining the right inputs as financial information will likely be harder to find, potentially less complete, and less reliable. Further, you can’t simply use a straight market valuation for a company that isn’t publicly traded. On top of this, a DCF can be problematic because a private company will not have an equity beta to use in the usual WACC calculation. Finally, if you are doing a comps analysis using publicly traded companies, a 10-15% discount may be required in the calculations as a 10-15% premium is typically paid for the public company’s relative liquidity.

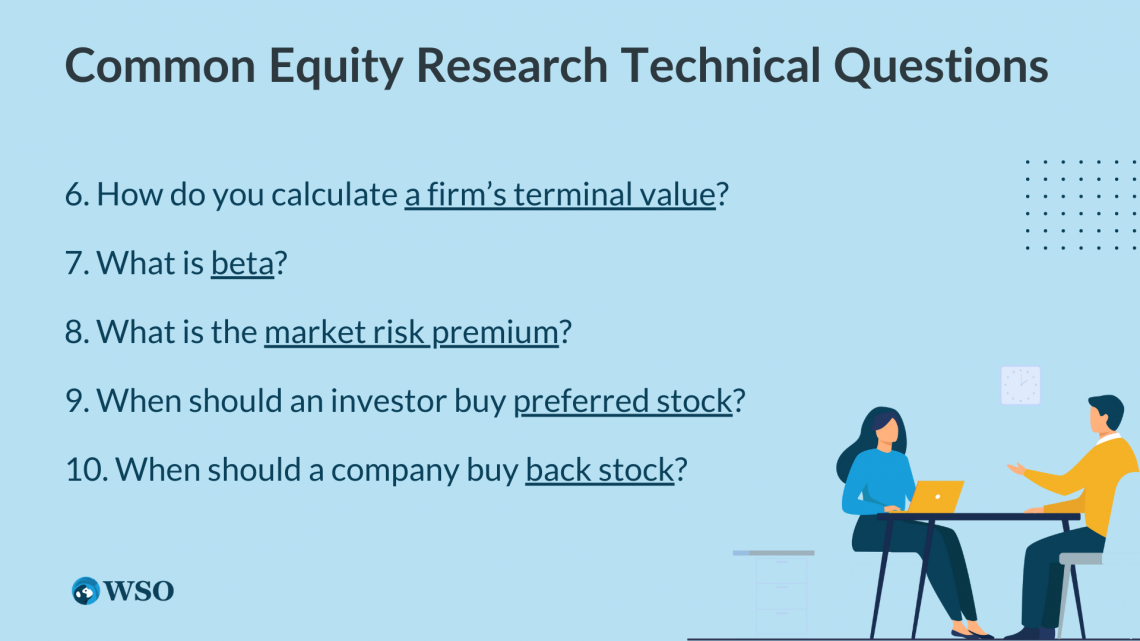

6. How do you calculate a firm’s terminal value?

Terminal Value = (FCFt(1+g)) / (WACC - g)

- To establish a terminal value, you can either use the formula above, which is the perpetual growth methodology, or the multiples method.

- In the multiples method, you assign a valuation multiple (such as EV/EBITDA) to the final year’s projection and use that as the “terminal value” of the firm.

- In either case, you must remember to discount this “cash flow” back to year zero as you have with all other cash flows in the DCF model.

Sample Answer:

There are two ways to calculate terminal values. The first is the multiples method. In order to use this method, you choose an operation metric (most commonly EBITDA) and apply a comparable company’s multiple to that number from the final year of projections.

The second method is the perpetual growth method, where you select a modest growth rate, typically just a little bit higher than the inflation rate and lower than the GDP growth rate, and assume that the company can grow at this rate infinitely. Then you multiply the FCF from the final year by 1 plus the growth rate and divide that number by the discount rate (WACC) minus the assumed growth rate.

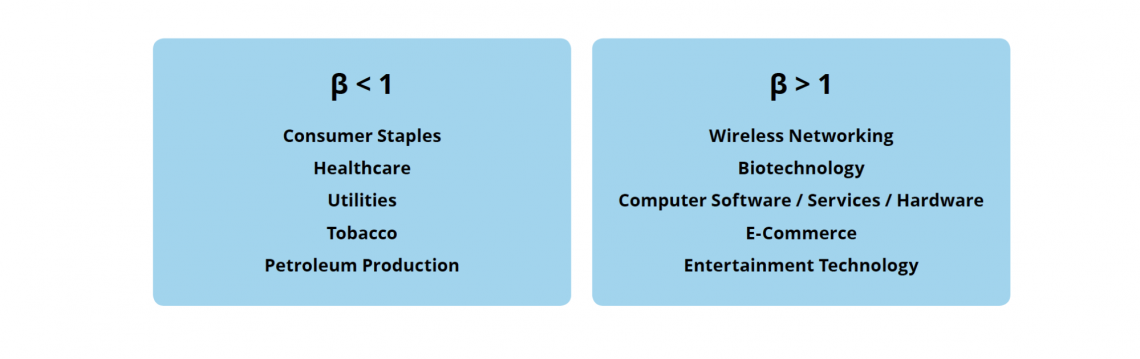

7. What is beta?

Sample Answer:

- It represents the relative volatility or risk of a given investment with respect to the market.

- Beta is a measure of the volatility of an investment compared with the market as a whole. The market has a beta of 1, while investments that are more volatile than the market have a beta greater than 1, and those that are less volatile have a beta less than 1.

- β < 1 means less volatile than the market (lower risk, lower reward).

- β > 1 means more volatile than the market (higher risk, higher reward).

- A beta of 1.2 means that an investment theoretically will be 20% more volatile than the market. For example, if the market goes up 10%, that investment should increase by 12%.

8. What is the market risk premium?

Sample Answer:

The market risk premium is the excess return that investors require for choosing to purchase stocks over “risk-free” securities. It is calculated as the average return on the market (usually the S&P 500, typically around 10-12%) minus the risk-free rate (current yield on a 10-year Treasury).

9. When should an investor buy preferred stock?

- Preferred stock could be looked at as a cross between debt and equity. It will generally provide investors with a fixed dividend rate (like a bond), but also allow for some capital appreciation (like a stock). Preferred stock may also have a conversion feature that allows shareholders to convert their preferred stock into common stock.

- It typically does not have voting rights like those of common stock.

- It is senior to common stock within the company’s capital structure.

Sample Answer:

An investor should buy preferred stock for the upside potential of equity while limiting risk and assuring stability of current income in the form of a dividend. In addition, preferred stock’s dividends are more secure than those from common stock. Owners of preferred stock also enjoy a superior right to the company’s assets, though inferior to those of debt holders, should the company go bankrupt.

10. When should a company buy back stock?

Sample Answer:

A company should buy back its own stock if it believes the stock is undervalued when it has extra cash. However, if it believes it can make money by investing in its own operations, or if it wants to increase its stock price by increasing its EPS by reducing shares outstanding or sending a positive signal to the market. Also, a stock buyback is the best way to return money to shareholders, as they are tax-efficient when compared to dividends.

11. What might a shareholder analysis tell you about an equity deal?

Sample Answer:

- For an existing public company, a shareholder analysis compares current institutional investors to ones that the company might target in a new equity offering.

- You could also use this analysis to find institutional investors with similar industry holdings that have not yet invested in your client and target them in the offering.

12. Suppose you hold a put option on Microsoft stock with an exercise price of $60. The expiration date is today, and Microsoft is trading at $50. How much is your put worth, and why?

Sample Answer:

This put is worth $10. It gives you the option to sell your shares at $60, and you can buy them in the open market at $50. You therefore would buy shares of Microsoft at $50 per share and immediately sell them for $60, making a profit of $10 per share.

13. Where did the S&P 500/Dow Jones Industrial Average/NASDAQ close yesterday?

Sample Answer:

- This question is used to gauge your general interest in the financial markets. You probably will not be expected to know the number to the penny, but knowing the levels of the three major exchanges/indices, as well as whether they were up or down and why will show your interviewer that you keep track of what is going on in the world of finance.

- You should know how the market moved (up or down) the previous day and why it moved. You can find this information by watching CNBC, reading the WSJ, or just by using Google.

- Yesterday the XXXX closed at XXXX, up/down XXX from the open. I also noticed that it was up XXX from the day before due to …

- It would also be a good demonstration of market interest to know the overall valuation levels of the three major indices. The P/E ratios for the overall Dow, S&P 500, and Nasdaq are publicly available on major financial news publications.

14. Where do you believe the stock market will be in future, say 3/6/12 months from now?

Sample Answer:

- This question can show your interest in the markets. There’s no right/wrong answer as everyone has different opinions on where the market is going.

- You need to have an opinion and well-thought-out reasoning for that opinion.

- If you think the market will drop in the next three months, hit bottom, and then begin to bounce back, have a reason to explain why you think it is going to drop, why it is going to bottom out, and why it is going to bottom out will begin to rise.

- It is more important to display logical reasoning than to be correct.

- Do some research before your interview. Read what writers for major newspapers are predicting and saying, and then implement some of their reasons in your own explanation.

- Also, be sure to stick to your reasoning. Your interviewer may challenge your position and question your reasoning. If you have to come up with a solid theory behind your response, be confident in your position and try to explain your rationale. If your logic and thought process makes sense, don’t change your opinion just to agree with your interviewer.

15. Is 15 a high P/E (Price to Earnings) ratio?

This is not just a yes or no question. A firm’s P/E ratio is essential compared to other companies in its industry. P/E can be thought of as how many dollars an investor is willing to pay for one dollar of earnings.

A high P/E represents high anticipated growth in earnings. In high-growth industries, such as technology, a P/E ratio of 15 may be considered relatively low. This is because the company is expected to grow its earnings at a high rate and therefore deserves a higher valuation relative to its present earnings.

However, a P/E of 15 may be considered high for a large pharmaceutical company since earnings growth may be expected to be slow but steady in future years.

Sample Answer:

It depends on the industry. For example, a P/E ratio of 15 in an industry like financial institutions may be considered a bit high, but if the company is a high-growth tech company, 15 may be considered relatively low.

WSO Bonus Technical Question:

"Pitch me a stock"

The stock pitch is arguably the most crucial and most common question you will be asked during the interview process. Ideally, you want to have 2-4 stocks in mind that you can pitch, i.e. large-cap, small-cap, stock to short. We advise spending 30 minutes to a couple of hours finding a stock you like and listing out the reasons why. Even if your interviewer doesn't ask you, it's always better to be prepared for these interviews. Here's a good explanation of how to answer this question.

They are trying to figure out whether you understand the underlying concept of what drives a business. Some questions to help figure this out are:

- What are the key drivers of the company (both revenue and cost)?

- Why is it a good investment?

- What are the potential opportunities available?

- What's their competitive advantage?

- What are the primary risks?

Here's a sample stock pitch, courtesy of [esbanker] , a private equity associate. The post has been edited and formatted.

Well, I've recently been following Copa Airlines, a Panamanian airline company, currently trading at $xx per share. Recently, the airline industry has been underperforming the markets for several reasons: compressed margins from the volatility in oil this year increased competition from low-cost carriers, and over-leverage by most airlines (think American or Air Canada).

While many airline companies are in desperate need of restructuring, Copa airlines have seen their revenues - now at $1.4 billion - growing at a robust 10% compounded over the last 5 years. Copa boasts an EBITDA of approx. $350 MM, Net Income of around $240MM, which translates to roughly 18%. Margins have remained stable over the last few years and are significantly greater than other airlines.

After running a basic DCF (5-year projections), Copa has an implied price per share of $xxx. In terms of comps, Copa is trading at an EV/EBITDAR of 7.7x, which is slightly less than the industry median of 10.3 x, and a PE ratio of 12.9 x relative to an industry median of 14.1 x. Given Copa's strategic positioning in Latin America, its strong operating and financial performance of late, and its relatively low share price, I would strongly recommend buying Copa Airlines.

Note:

Some of the numbers are out of date - this is from an early 2011 model.

8 Fund-Specific Hard Technical Questions

Walking into the interview with an in-depth understanding of the above-covered 15 technical questions will undoubtedly make you stand out in the applicant pool.

However, to achieve complete technical mastery, you must expect technical questions that are specific to different hedge funds.

The following section features eight exclusive interview questions that actual interviewers asked potential candidates at some of the world’s largest hedge funds during equity research interviews.

The following questions are from WSO’s company database, which is sourced from the detailed personal experiences of more than 30,000 people with hedge funds interviews. The Hedge Fund Interview Course includes access to over 800 questions across 165 hedge funds (no other resource comes close).

Point72 Technical Questions

Sample Answer:

- In order to value a company with no revenue, such as a start-up, you must project the company’s cash flows for future years and then construct a discounted cash flow model of those cash flows using an appropriate discount rate.

- Alternatively, you could also use other operating metrics to value the company. If you took a start-up website with 50,000 subscribers, but no revenue, you could look at a similar website’s value per subscriber and apply that multiple to the website you are valuing.

- Valuing a company with no revenue comes down to determining the market opportunity for a company and assigning a value per user, customer, or subscriber, and then discounting that back at an appropriate rate that accounts for the inherent execution and market risk.

Sample Answer:

A sample general approach to modeling and research could involve the following 6-step process:

- Formation of assumption/hypothesis

- Collection of relevant data

- Analysis of markets

- Creation of forecast

- Simulation/test-run

- Release and monitoring of model

- The profits generated on the Income Statement after any payment of dividends are added to shareholder’s equity on the Balance Sheet under retained earnings.

- Debt on the Balance Sheet is used to calculate interest expense on the Income Statement.

- Property, plant, and equipment, on the Balance Sheet, are used to calculate depreciation expenses on the Income Statement.

There are many other links, but the above are some of the primary connections frequently analyzed as part of accompanying schedules in financial modeling.

Sample Answer:

There are many links between the Balance Sheet and the Income Statement. The central link is that any net income from the Income Statement, after the payment of any dividends, is added to retained earnings. In addition, debt on the Balance Sheet is used to calculate the interest expense on the Income Statement, and property, plant, and equipment (PP&E) are used to calculate any depreciation expense.

Citadel Investment Group Technical Questions

Sample Answer:

The exchange ratio is the relative number of new shares given to existing shareholders of a company that has been acquired or merged with another.

It is used by companies looking to offer a full or part equity offer for an acquisition transaction.

It is best to go prepared with one long idea and one short idea. Being able to demonstrate that you understand the many nuances of shorting is a fantastic way to differentiate yourself from other possible candidates.

If you are interviewing for a specific sector/industry, then select a business from that industry to pitch. While your interviewer will likely know more about the industry and/or company, but as long as you stick to stating this, you should be in the clear.

Using a pitch structure such as the one below gives the best results:

- Industry: Why is the industry attractive? [Use a quantitative metric to show you did your homework here, such as, "ABC Industry has the ability to grow xyz% in the next 3-5 years. This is also a good place to highlight changing competitive dynamics, etc.]

- Company: Why is the company attractive? ["The business has sales of $30 in a $3,000 industry representing a 3% market share despite being recognized as the product leader and having an exceptional management team" is an example of one of the best way to address this]

- Catalyst: Why is the market wrong and how will the market realize the intrinsic value of the business? [This is the most critical part of the pitch. For example, "ABC is currently valued at 10x [insert multiple] but is being unfairly discounted because of the incompetency of the prior management team. Since the current management team has taken over [insert metric] XYZ has improved. As of right now, the market has not recognized the improvement in XYZ or the overall business, but I expect that [insert catalyst] will demonstrate ABC's true value to the market within [insert time frame]."

- Valuation: What is the intrinsic value of the business? ["If my assumptions [discuss them here] about the effect of [insert catalyst] prove true, then the market will realize ABC's intrinsic value of [insert valuation]." You can then speak about contingency valuations, etc.]

Try to keep your pitches as short as possible and as high-level as possible. This helps to minimize the chances of putting your foot in your mouth and allows the interviewer to ask more in-depth questions where they feel necessary. Of course, you also need to be prepared to answer in-depth questions about anything pertaining to your pitch. This includes topics ranging from the industry, competitors, or the company.

Note: The above extract was taken and paraphrased from WSO User @Simple As…’s post, “The Asymmetric Risk Profile: Preparing For The Hedge Fund Interview”

Sample Answer:

We assume that the entire Net Operating Balance (NOL) goes to $0 in an M&A transaction, and therefore we write down the existing Deferred Tax Asset by this NOL write-down.

Bridgewater Associates Technical Question

Sample Answer:

It could be beneficial to increase the volume of software sold and increase the price of pens, as the incremental cost of each additional software license sold is relatively low, and almost all of the additional revenue would flow directly to margins, not to mention its scalability. Increasing the price of pens has more advantages from a financial standpoint as they have a higher incremental cost (cost of producing a pen scales with quantity sold).

D.E. Shaw Group Technical Question

Sample Answer:

During the Covid-19 pandemic, the Fed lowered interest rates to accommodate the lack of demand due to the uncertainty caused by the pandemic. This led to massive inflation, the effects of which are now being realized. Looking at the treasury curve and comments by Mr. Powell (who mentioned that inflation is not transitionary), it is evident that the rates will increase by mid-2022. This is to ensure that inflation is curbed and the economy moves towards normalization post-Covid.

5 Most Common Equity Research behavioral/Fit Questions

Fit or “behavioral” questions are used to gauge whether or not you have the right work ethic, attitude, personality, and values to fit in with a Hedge Fund’s equity research department. Many Hedge Funds take this process extremely seriously because most firms typically have only a handful of investment professionals who must collaborate on projects over long hours and under tight deadlines.

For example, Bridgewater Associates is known for its intense corporate culture of radical truth and radical transparency. Therefore, its interviews consist mainly of ethical and moral questions.

The following section walks you through 5 of the most common types of fit questions and suggests approaches for answering them. The proposed strategies and sample answers are meant to be illustrative. Always remember, you need to adapt your responses to be true to yourself and your own words.

1. What do you consider to be your greatest accomplishment?

- There’s no correct answer to this. Your response to this can really go any direction.

- If you want your answer to be related to your education, talk about how you worked on an assigned project that you didn’t understand at first, struggled through understanding it, and eventually received an A for your hard work.

- If you want to relate it to your personal life, talk about something you are proud of in your family life. You can even connect it to athletic success, community service, or recovery from illness.

- You can use this question to reveal the balance in your life. This can be especially useful if your resume is short on classroom excellence. Be sure to explain that you are extremely proud of your less-than-perfect GPA because it allowed you to accomplish other activities at school (as long as you have a solid list of extracurricular activities).

- Whatever approach you choose to answer this question, be sure you spin it to demonstrate how one or more of the qualities valued in finance, such as positive attitude, willingness to learn, drive, and determination lead you to success.

Sample Answer:

I consider one of my most significant accomplishments to be the work-life balance I have achieved between keeping my grades up while serving as the captain of my hockey team. As a result of this, I gained greater leadership skills as I led our varsity team through the entire season as well as structured our fall and spring workouts. This leadership role required me to polish my time management skills which were invaluable. I also wouldn’t trade the friendships and connections I made during my time on the hockey team I made for anything else in the world.

2. Coming out of this interview, what are three things about you that I should take with me?

Choose three traits you have that demonstrate your natural abilities at equity research and reveal that you are memorable and unique compared to other potential candidates.

Sample Answer:

The three things that I would like you to take from this interview are,

- To start, I want you to know that I am extremely hard working and will bust my tail every day to ensure that the job gets done

- That I have excellent communication skills and a positive attitude; and

- Your firm is my top choice, and I would be ecstatic to come to work here every day. I’ve already spoken to X, Y, and Z people and I believe that I’ll make a great fit with the other team members.

3. Describe your ideal work environment?

- The most important things about your work environment, especially in finance where people spend many hours together, are the people you work with every day.

- Talk about the fact that you want to be in a work environment with others who are all as driven, dedicated, and hard-working as you are, where everyone can rely on one another to get tasks done efficiently.

- Talk about your ideal environment as one that allows you to excel due to great teamwork and communication, one that allows you to grow intellectually and professionally, where your performance evaluations are directly correlated to your rewards.

Sample Answer:

In my mind, at least in finance, the most crucial aspect of the working environment is the people you are working with on a daily basis. Suppose you do not enjoy the company of your colleagues or teammates. In that case, the environment will be especially challenging because you’ll often be working countless hours per week, over multiple years, with these same people.

My ideal workplace is one where everyone works hard, communicates well, and trusts each other to get the job done right and on time. As a result, the team is then rewarded and evaluated based on our performance.

4. What would your last boss tell me about you?/Tell a story about a time when your boss praised you for a job you performed exceptionally well.

- You should generally hope your last boss would say that you are:

- highly motivated

- hard-working

- strong analytical and quantitative skills

- a good team player

- Be sure to talk about a quality your boss observed that may not be clearly listed on your resume. For example, your ability to put clients at ease upon meeting them or that you’re a great leader who sees the best in every team member.

Sample Answer:

My boss from last summer’s internship would say I worked extremely hard with maximum dedication and minimal supervision. On one occasion, he actually tell me to go home when it was getting late and I was still at my desk. He even reminded me it was just a summer internship.

Since I really strived to get the most out of my time with the internship, I guess I just didn’t want to leave any task unfinished, even if it would have been OK with my boss. At the end of the summer, my boss telling me how dedicated I was to the position was one of the biggest compliments he had to have given me.

5. What makes you think you can put up with the stress, pressure, and long hours of a career in finance?

Talk about a time in your life when you worked long hours and managed many different tasks.

The story can be from work, school, home, or a combination of all of them. For example, maybe during finals week, you had to study for two exams, finalize the school newspaper, write three papers, and still go to soccer practice.

It’s vital to ensure that you explain that while your past experience has not been as intensive as working full time as a finance professional, you are still 100% dedicated to succeeding, you feel as well prepared as anyone, and you’re willing to do whatever it takes to get the job done.

Sample Answer:

I am as prepared as anyone else coming out of college to handle the long hours of working in finance. In fact, when you add up all the time I spent doing all my extracurricular activities, my school hours were almost as long as a full-time position. Every day I was up at 7:30 for classes that ran from 8:15 until 1:00. Then, after class, I would grab lunch and then go to soccer practice, which means I didn’t get back until 5:00.

Then I would grab dinner and work in either the library or my room until I was done. This would typically go pretty late at night or into the morning. So while I know it isn’t the same time commitment and stress as working in finance, I feel my experience has left me well prepared for this career.

5 Firm-Specific Behavioral/Fit Questions

Knowing the culture of each hedge fund before walking into an interview is one of the secrets to connecting with the interviewer and walking out with an offer.

The following section features 5 exclusive questions that interviewers have asked in the world’s biggest hedge funds (Point72, Bridgewater Associates, Millennium Partners, etc.) during interviews. These should give you a jumpstart to help with your training for the respective hedge funds interviewing you.

- What roles are you applying for right now? What types of firms?

- What do you consider your greatest failure?

- What is your strength?

- What feedback did you receive from your last job/internship?

- What motivates you?

WSO Free Resource:

To view WSO’s sample answers and walkthroughs for the above-mentioned exclusive fund-specific behavioral questions, check out WSO’s free Hedge Fund Interview Questions page.

5 Logical Puzzles - Interview Brain Teasers

Logical puzzles, brainteasers, and riddles are typically used in the interview process to gauge the candidate's critical thinking abilities.

In this part of the interview, your interviewers aren’t focused on whether you can answer the riddles correctly or not. Instead, they are really focused on trying to figure out your thought process and how you arrive at your answer when solving the riddles presented before you.

Given this, it is critical to walk your interviewer through your thinking as you progress through the riddle. They may even probe you with questions to assist you or test your logic. By occasionally asking if you’re headed in the right direction and giving them a rundown of your thoughts demonstrates your ability to reflect and approach a problem with composure.

However, it is still beneficial to foresee these brainteasers in order to avoid being put in an awkward position and caught off guard in the interview. The next section has 5 commonly asked logical puzzles that you can practice beforehand to impress your interviewer.

1. How many NYSE-Listed companies have 1 letter ticker symbols?

Answer:

It could be 26 as that’s how many letters are in the English alphabet, but in this case it is only 24 because I & M are already saved for Microsoft and Intel, in case they change their minds.

2. A stock is trading at 10 and 1/16. There are 1 million shares outstanding. What is the stock’s market cap?

Answer:

This question is just a test of your mental math abilities.

- If a fourth is 0.25

- An eighth is 0.125

- A sixteenth is 0.0625

As a result, the stock price is 10.0625 and the Market Cap is 10.0625 million.

3. What is the probability that the first business day of a month is a Monday?

Answer:

Each day has a 1 in 7 chance of being the first day of the month. However, if the month starts on a Saturday or a Sunday, the first business day of the month will be a Monday. Therefore, the chances of the first business day being a Monday is 3 in 7 since if the month starts on Saturday, Sunday, or Monday, the first business day is a Monday.

4. You have 10 black marbles, 10 white marbles, and 2 buckets. I am going to pick one of the two buckets at random and select one marble from it at random. How would you fill the two buckets with marbles to maximize the odds that I select a white marble?

Answer:

For this scenario, you want to put one white marble in one bucket and put the other 19 marbles in the other bucket. Due to this setup, the bucket with the lone white marble will be chosen nearly 50% of the time. When the alternative bucket is selected, the odds that a white marble is pulled are still nearly 50%. Setting up the situation this way makes the overall odds of a white marble selection almost 75%.

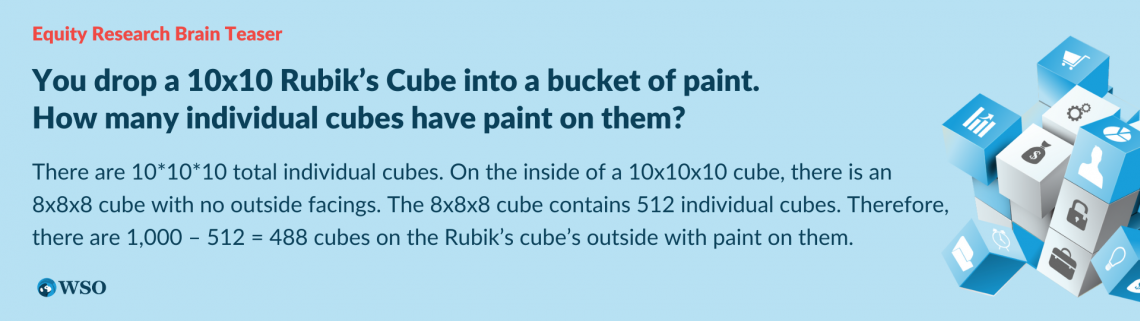

5. A 10x10 Rubik's Cube is dropped into a bucket of paint. How many of the individual cubes have paint on them?

Answer:

The trick is to realize that cubes on the edge of any one of the 6 faces have a side on two faces (3 faces for corner cubes). This prevents you from simply calculating the number of cubes on a single face and multiplying by the number of faces. One of the most intuitive ways to solve this problem is to calculate the total number of individual cubes in a 10x10x10 Rubik’s cube. Once you have that you want to subtract the number of all internal cubes with no facings on the outside. There are 10x10x10 total individual cubes on this Rubik's cube. On the inside of a 10x10x10 cube, is an 8x8x8 cube with no outside facings. The 8x8x8 cube contains 512 individual cubes. Therefore, there are 1,000 - 512 = 488 cubes on the outside of the Rubik’s cube with paint on them.

Full WSO Hedge Fund Prep Guide & Additional Resources

The majority of questions and sample answers covered in this free guide were obtained directly from WSO’s very own Hedge Fund Interview Course, which features:

- 814 questions across 165 hedge funds

- 10+ exclusive case videos with detailed pitches

- Long, short, equity, credit, event-driven, macro+ questions

Think about it - if this page alone can set you miles ahead of the competition, imagine what our complete course can do for you.

The WSO Hedge Fund Interview Prep Course will guide you through each step of the interview process and ensure you're in the strongest position to land the job at a hedge fund. Click the button below to check it out!

The following are additional resources as forum posts posted by WSO and WSO’s users alike over the last 15 years and are recommended by WSO for taking a look at.

List of Hedge Funds

The following are some of the biggest of the 750+ hedge funds firms WSO has data on in its company database:

Bridgewater Associates | Bridgewater Associates Overview | Bridgewater Associates Site

The Tudor Group | The Tudor Group Overview | The Tudor Group Site

Brandes Investment Partners | Brandes Investment Partners Overview | Brandes Investment Partners Site

Renaissance Capital | Renaissance Capital Overview | Renaissance Capital Site

Millennium Partners Group | Millennium Partners Overview | Millennium Partners Site

Alpine Woods | Alpine Woods Overview | Alpine Woods Site

Carlson Capital | Carlson Capital Overview | Carlson Capital Site

360 Global Capital | 360 Global Capital Overview | 360 Global Capital Site

GSO Capital Partners | GSO Capital Partners Overview | GSO Capital Partners Site

Additional interview resources

To learn more about interviews and the questions asked, please check out the additional interview resources below:

or Want to Sign up with your social account?