Current Income (Real Estate Investments)

These investments provide income with steady distributions to investors

What is Current Income (Real Estate Investments)?

Real estate investments can generate great yields for investors. In addition, this investment class provides attractive streams of cash flows that provide flexibility and predictability, unlike other investment options such as stocks, where active trading to receive regular cash flows is critical.

The criteria for investments that can be classified as current income meet the following two requirements:

- Consistent and anticipatable payouts in the immediate/short term

- Investments paying above-average distributions

This means that investments providing such income provide steady distributions to investors. Further, the distributions are predictable, as investors know how much they are likely to receive in any given year.

Usually, such investments prioritize consistent income over long-term capital appreciation, thus, focusing on capital preservation rather than reinvesting in the growth business.

Of course, the risk spectrum for such investments is diverse, with some investments prioritizing capital appreciation a bit more than others. Therefore, judging which type of investment is best is difficult, as it depends on the individual's goals.

A common way to earn a consistent income is via dividend-paying companies with a proven track record of paying out distributions. Most commonly, energy, telecom, and utility companies have paid consistent income despite recessions. For example

- Exxon Mobil Corp (NYSE:X OM) at a current yield of 4.09% (June 2022)

- AT&T (NYSE: T) at a current yield of 5.73% (June 2022)

- Verizon (NYSE: VZ) at a current yield of 5.22% (June 2022)

Companies in other sectors stand out in providing a growing and consistent income to investors since inception.

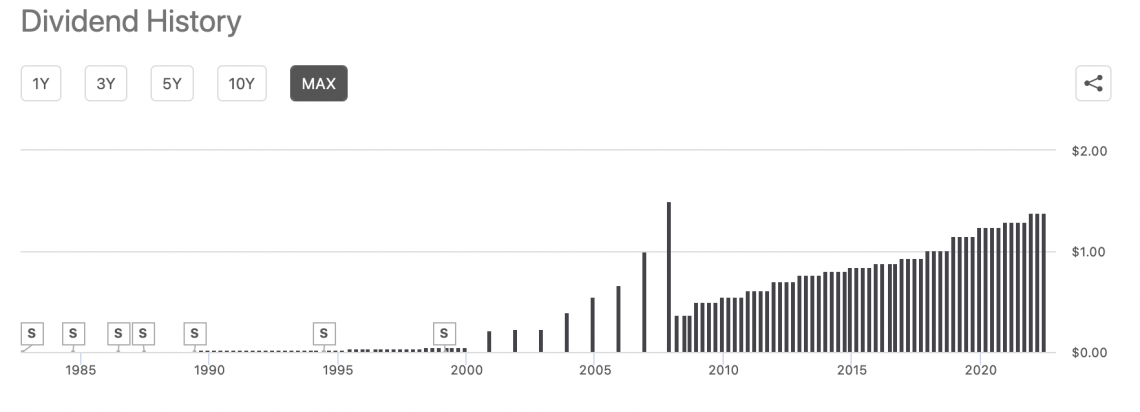

For instance, Mcdonald's Corp (NYSE: MCD) has a track record of paying distributions for 46 years. Plus, this company has grown its distributions over time, providing long-term value to shareholders. Here is a chart from Seeking Alpha that shows MCD's consistent history:

Strategies for Generating Current Income

The criteria for investments that can be classified as current income meet the following two requirements:

- Consistent and anticipatable payouts in the immediate/short term

- Investments paying above-average distributions

This means that investments providing such income provide steady distributions to investors. Further, the distributions are predictable, as investors know how much they are likely to receive in any given year.

Usually, such investments prioritize consistent income over long-term capital appreciation, thus, focusing on capital preservation rather than reinvesting in the growth business.

Of course, the risk spectrum for such investments is diverse, with some investments prioritizing capital appreciation a bit more than others. Therefore, judging which type of investment is best is difficult, as it depends on the individual's goals.

A common way to earn a consistent income is via dividend-paying companies with a proven track record of paying out distributions. Most commonly, energy, telecom, and utility companies have paid consistent income despite recessions. For example

- Exxon Mobil Corp (NYSE:X OM) at a current yield of 4.09% (June 2022)

- AT&T (NYSE: T) at a current yield of 5.73% (June 2022)

- Verizon (NYSE: VZ) at a current yield of 5.22% (June 2022)

Companies in other sectors stand out in providing a growing and consistent income to investors since inception.

For instance, Mcdonald's Corp (NYSE: MCD) has a track record of paying distributions for 46 years. Plus, this company has grown its distributions over time, providing long-term value to shareholders. Here is a chart from Seeking Alpha that shows MCD's consistent history:

Companies providing such income usually seek to increase the dividends paid to shareholders over time, thus growing the dividend over time. For example, Exxon Mobil Corp (NYSE: XOM) has grown dividends annually by 6% over the last 40 years.

Debt instruments such as bonds also provide income on a predictable basis, and there is much variety in the type of bonds investors can choose from. Moreover, credit ratings are used to determine the safety of a specific bond, thus, informing investors of the likely risk of default.

Therefore, debt instruments are also an attractive investment option to earn regular income via interest payments.

Current Income (Real Estate Investments) Objectives

You may choose to invest in assets that provide consistent income for different purposes. However, there are groups of people that find that such a strategy aligns well with their goals.

Portfolios focused on earning steady cash flows are usually held by individuals who wish to make a steady return. Usually, these are people at the lower end of the risk spectrum, such as those in their retirement who wish for their savings to produce a substantial yet low-risk return.

People looking for such investments prefer companies that pay quarterly rather than annually. This allows shareholders to receive payments more frequently, thus, allowing them to cover bills and expenses.

A well-diversified portfolio comprising dividend-paying stocks such as REITs and bonds will allow an individual to produce a portfolio that provides regular cash inflows. In addition, such a portfolio will have low unsystematic risk.

Many in the Financially Independent Retire Early (FIRE) community have saved at above-average rates and built such portfolios to allow for early retirement.

Current Income through Real Estate Investments

Nowadays, there is growing popularity of earning current income through investments in Real Estate Investment Trusts (REITs). These are companies that may own, operate, and develop real estate to produce income-producing real estate assets.

The first REIT was listed on the NYSE in 1965, and similar instruments have been introduced worldwide.

So you might be wondering how one can earn current income through Real Estate Investment Trusts (REITs).

REITs primarily focus on providing shareholders with great dividends on their investments. According to NAREIT data, equity REIT dividend stock yields averaged approximately 2.6% in 2021. This yield was more than twice the 1.2% yield investors earned from the S&P 500 index fund in the same year.

REITs can provide higher yields due to the requirement that 90% of their taxable income be paid out to shareholders as dividends. Therefore, unlike other firms, REITs are required to pay out significant distributions.

As you can imagine, this requirement leaves REITS with little room to invest back into the firm for growth, such as acquiring more property to lease out.

Still, REITs have become a great investment choice as they allow people to have a share in a diversified pool of real estate without many of the hassles of owning a property.

Further, as a REIT is listed as a publicly listed stock, it brings all the benefits associated with the ease of such an investment. Some of the major advantages of REITs include

- Liquidity

- Avoiding management of a real estate

- Predictable return

- Consistent payouts

- Diversification (lowers risk)

- Removes barriers of entry associated with real estate investments, such as

- Large capital needs (E.g., Down payment for residential property)

- Mortgage/loan approval

Of course, REITS charges a commission for providing such flexibility and value; this takes away some of the returns.

Should I invest in REITs or the S&P 500?

Which investment do you believe is better? Investing in an index fund comprising the companies in the S&P 500 or a fund composed of various REITS? Your guess may be wrong.

Here is data from the Motley Fool that compares these two investments:

| Time Period | S&P 500 (total annual return) | FTSE NAREIT all equity REITS (total annual return) |

|---|---|---|

| 1972-2019 | 12.1% | 13.3% |

| Last 25 years | 11.9% | 12.6% |

| Last 20 years | 7.7% | 13.3% |

| Last ten years | 14.2% | 13.2% |

| The last five years | 12.5% | 9% |

| 2019 | 31.5% | 28.7% |

Although for the past ten years, REITs have underperformed the S&P 500 by about one percentage point. Surprisingly, REITs have beaten the S&P 500's over the long term, for example, from 1972 to 2019.

Therefore, considering both capital appreciation and dividends, REITs seem to be the better investment. Hence you might wonder which type of REIT is the best.

REITs have different focuses, and some firms may focus entirely on one real estate subgroup, while others may own a diversified basket of assets. This is because real estate is diverse and offers many distinct areas. Some areas in real estate include

- Office

- Industrial

- Retail

- Residential

- Healthcare

- Lodging/Resorts

- Self-Storage

Therefore, the returns across the different areas are also varied. Consider the following data from the Motley Fool:

| REIT subgroup | Average annual total return (1994-2019) |

|---|---|

| Office | 12.9% |

| Industrial | 14.1% |

| Retail | 12% |

| Residential | 13.7% |

| Diversified | 9.8% |

| Health Care | 13.4% |

| Lodging/Resorts | 10.2% |

| Self-Storage | 16.7% |

| P 500 | 9.3% |

All types of REITs have outperformed the S&P 500 in all categories over this time period.

Self-Storage focused REITS stand out with a whopping 16.7% average annual total return from 1994 to 2019. This is significantly higher than the S&P 500's 9.3% return over the same period.

Further, a diversified REIT portfolio beats the S&P 500 by a fair margin.

Given this data, we find that in terms of average annual total return over the selected period, REITS did outperform when compared to the S&P 500 Composite Index.

Moreover, the data highlights that some subgroups for real estate do, on average, produce significantly better returns compared to others.

As you can see, the growing popularity of investing in REITs is well justified. The investment class has proved itself to be competing with the returns provided by the S&P 500, something that most active fund managers struggle to achieve.

Investors have also recognized the opportunity consistent income provides in covering short-term needs and creating long-term value as dividends grow over time.

Current Income Example

A few of the examples are:

Example 1: Omega Healthcare Investors Inc (NYSE: OHI)

Let's consider Omega Healthcare Investors Inc (NYSE: OHI). This company maintains a portfolio of long-term healthcare facilities and mortgages on healthcare facilities located throughout the United States and the United Kingdom.

As of this writing (June 2022), this stock provides a substantial dividend yield of 9.69%. According to Seeking Alpha, this firm has paid quarterly dividends consistently for the past 18 years.

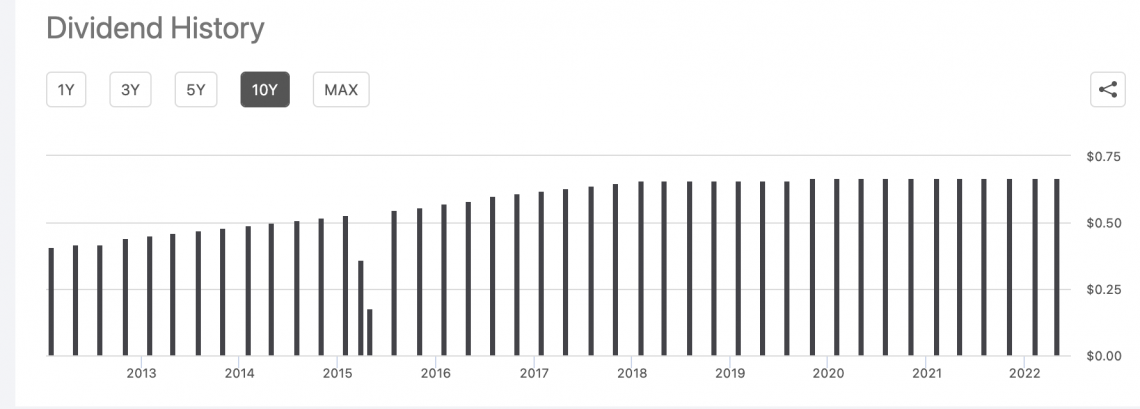

Here is OHI's dividend history over the past ten years:

Omega Healthcare has grown its dividend substantially over this period, achieving an annualized growth rate of 8.3% per year since 2003. Therefore, shareholders can see a snowball effect if they reinvest dividends back into the firm for more dividends and then repeat the cycle.

A Dividend reinvestment plan (DRIP) is a popular strategy for those creating a portfolio to meet retirement needs. This strategy involves setting up an automated dividend reinvestment program with your investments.

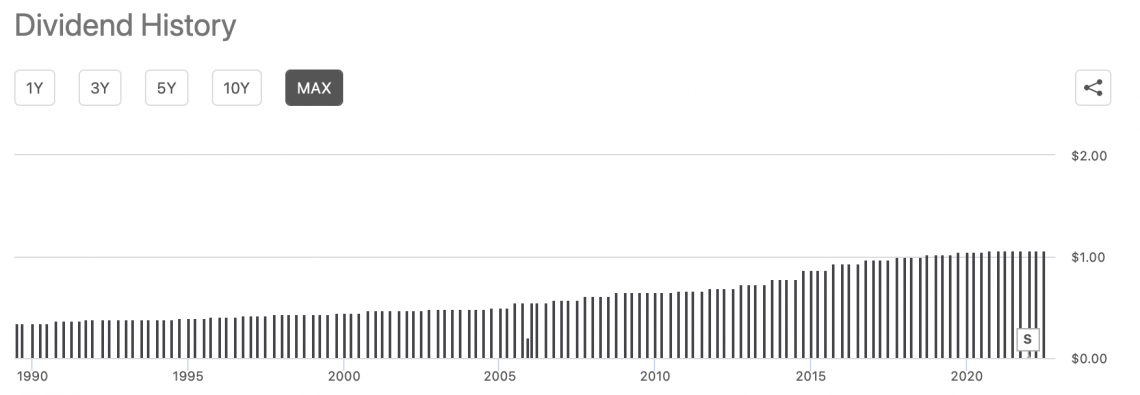

Example 2: Federal Realty Investment Trust (NYSE: FRT)

FRT invests in shopping centers in the U.S and has one of the best track records of distributions till data. Here is the dividend history chart from Seeking Alpha for FRT:

Current Income (Real Estate Investments) FAQs

It is possible to retire using dividend-paying stocks and debt instruments. A portfolio composed of companies with a proven track record of distributions and safe-haven bonds can allow the investor to receive a substantial return in the form of consistent payouts.

Such a strategy requires great saving habits early on in one's career.

No, the dividend distribution prospect is at the company management's discretion. Therefore, shareholders should not be surprised if they do not receive dividends.

However, many firms have paid out distributions even during the toughest times to maintain reputability. Therefore, investments in the right firms mean that the shareholder can produce a significant return even during a phase of economic shrinking.

Yes, you can. However, there are pros and cons to both options. An investor should clearly define his goals and purpose and understand which investment suits his/her style better.

Research and authored by Imran Husain l LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?