Economic Growth

The improvement in the overall value of goods and services produced by a country's economy over time

What Is Economic Growth?

Economic Growth is essentially the improvement in the overall value of goods and services produced by a country's economy over a period of time.

It's usually measured on a yearly basis and takes into account the effects of inflation. This measurement is typically represented as a percentage increase in the country's real Gross Domestic Product (GDP).

A rise in the GDP or GNP will positively impact the national income of the country.

Factors contributing to positive economic growth may include improvements in

- Capital Goods

- Labor Force

- Technology

- Human Resources

Positive economic growth will first contribute to boosting the productivity of individual citizens, resulting in higher incomes for people. This, in turn, leads to greater spending by consumers, ultimately improving people's quality of life.

Economic growth is essential for improving the living standards and conditions of citizens. This can be achieved through optimizing and improving the quantity and quality of the goods and services produced.

Historically speaking, economic growth has been instrumental in contributing to positively impacting education, food, healthcare, and minimizing poverty.

Essentially, the growth signifies progress in the society by enhancing the quality and quantity of essential goods and services.

Key Takeaways

- Economic growth is the increase or improvement in the inflation-adjusted market value of goods and services produced by an economy over time, measured as the percentage increase in real GDP.

- The rate of economic growth is the geometric annual rate of GDP growth over a specified period, representing the trends in the average level of GDP. It can be either intensive (more efficient use of inputs) or extensive (increased inputs).

- Economic growth is often applied to economies experiencing rising incomes and greater buying power, while economic development is more focused on economies close to subsistence levels.

- Several factors influence economic growth, including human resources, natural resources, capital formation, technological development, and social and political factors.

Understanding Economic Growth

The concept of economic advancement/growth is essentially the growth and optimization of the production of goods and services in the economy, which exhibits national income.

Economic progress is a pivotal instrument in shaping the lives of many individuals and families through shaping living standards, minimizing poverty, and catering to societal development.

Progress can be measured through real GDP, which adjusts the total value of goods produced and services rendered to eliminate inflationary effects.

The rate of economic growth is a way to measure how fast an economy is growing. It's calculated by looking at the annual percentage change in GDP from the first year to the last year within a specific period.

This rate helps us understand whether an economy is steadily improving or not.

The concept of economic progress/growth utilizes national income accounting since it is measured as the annual percentage of the GDP. The economic growth-rates of nations are compared using the GDP-to-Population ratio (per-capita income).

A rise in average marginal productivity is frequently, but not always, correlated with overall output improvements. When incomes rise as a result, customers are encouraged to spend more money, raising their level of living and material quality of life.

Economic growth can be of two types

- Intensive Growth: The term used by economists to describe economic progress/growth that results from more productive inputs, such as labor, physical capital, energy, or materials.

- Extensive Growth: Defined as GDP growth that is solely attributable to increases in the number of inputs available for utilization (such as new territory or an increase in population).

Phases Of Economic Growth

The business cycle, sometimes referred to as the trade or economic cycle, shows economic growth through many stages. You can spot economic patterns and changes more quickly by using the business cycle.

Making wiser and more informed judgments about your company's finances is another benefit of knowing the business cycle.

The economic growth is divided into 4 phases

- Expansion

- Peak

- Contraction

- Trough, and

- Recovery (after a recession)

Let's discuss these stages in detail below.

Expansion

The expansion phase in the economic progress is caused by improving government policies, increased consumer confidence, and business investment opportunities.

The expansion phase can also be called as Recovery phase since improvement and optimization in the mentioned criteria will put the economy on the pedestal of improvement.

This phase is characterized by a positive GDP, employment, and consumer spending. This phase is usually after the recession or economic slowdown.

Peak

A peak or boom phase is caused by increased consumer expenditure, investment spending, and positive economic feelings.

It's the highest point of economic progress of an economy, operating at near or full capacity, a turning point in the economy. The phase is characterized by vigorous economic growth, the highest employment rates, and investment activities.

Contraction

Contraction, or a slowdown phase, is characterized by decelerating growth. Indicators like GDP growth, employment, and consumer spending, are all positive. But, the comparative percentage of these metrics has started declining.

Factors such as increasing interest rates, inflation, or external contributors can result in the contraction of the economy.

Trough

Also known as Recession, is characterized by negative economic growth, declining employment rates, diminishing consumer spending, and cut-downs in investment activities.

A phase of recession is the lowest point in the life cycle of an economy.

A collection of different significant factors like diminishing consumer spending, a decline in employment opportunities, and unfavorable business space, all contribute towards a recession.

Recovery

Following a dip, the economy begins to show indications of recovery. The recovery is fueled by improved business conditions, fiscal policies, and government interventions.

Factors contributing towards recovery include policies, a rise in investor and consumer confidence, and an uptick in economic activity.

How To Measure The Economic Growth?

A variety of indicators that shed light on the general health and growth of an economy are used to measure economic growth. Among the important indications are:

- Gross Domestic Product (GDP): The GDP of a nation represents the total value of all the goods and services produced within the nation in a specific period.

- It can be measured through three indicators: Production, Expenditure, and Income.

- Gross National Product (GNP): The GNP is quite similar to the GDP, but it also takes income earned by the nation's residents abroad and subtracts it from income earned by foreigners in the country into consideration as well.

- GNP equals the GDP and Net Income earned from abroad.

- Gross Fixed Capital Formation: The metric that represents the amount of capital investments. Total investments made by a nation in machinery, plants, buildings, and infrastructure.

- This metric represents an economy's capacity for future production capacity.

- Employment And Unemployment Rate: The state of the labor market is revealed by these rates. High employment and low unemployment rates are typically signs of expanding economies.

- The percentage of the labor force that is actively looking for work but is not able to find it is known as the unemployment rate. The percentage of people in the working age group that are employed is known as the employment rate.

- Consumer Spending: Total expenditure made by household consumers on goods and services.

- Business And Consumer Confidence Index: These indexes measure the confidence levels of businessmen and consumers. Surveys are conducted to assess the market expectations and performance levels.

- Trade Balance: This metric is the difference between an economy's imports and exports. A positive difference positively impacts economic growth. And a negative difference contributes negatively.

- A positive trade balance, that is, imports exceeding exports, is favorable to a nation.

- Productivity Measures: This measure particularly assesses how effectively and efficiently the inputs are employed. Inputs here are referred to labor and capital to produce outputs.

When taken as a whole, these metrics offer a thorough understanding of economic growth by taking into account a number of factors like trade, employment, income, and production. Policymakers, economists, and businesses can better grasp the state and trajectory of an economy by analyzing a variety of indicators.

Calculating Economic Growth

However, to calculate and measure the economic growth in real GDP, it's important to assess the progress in mathematical terms.

There are three possible ways we can calculate the growth.

- Quarterly Growth At An Annual Rate: The calculation looks at the change in GDP from quarter to quarter. This rate is then compounded into an annual rate.

- Year-over-Year Growth Rate: This calculation is a single quarter's GDP with two successive years in percentage terms.

- Annual Average Growth Rate: By averaging the changes over the course of the four quarters, this computes an overall estimate of the growth in the economy for the year.

How To Generate Economic Growth?

A great example of how economic growth can occur is the Industrial Revolution. During this period, there were significant improvements in how things were produced.

This was made possible by advances in human skills (human capital), technology, the availability of machines and equipment (capital goods), and the size of the workforce.

For instance, the introduction of automated assembly lines in factories led to more specialized and skilled jobs for workers, which boosted technology. This, along with increased production, also meant more capital goods were available, and it contributed to the end of periodic famines, resulting in economic growth.

Human Resources

It is an essential determinant as the quality and quantity of human resources available in an economy can directly affect the growth of that specific economy.

The term quality of human resources indicates skills, training, education, and creative abilities. A highly skilled and trained human resource would give an output of high quality.

With quantity, it is seen that a shortage of skilled labor affects the growth of an economy. This means that it is essential to have adequate amounts of human resources to achieve economic growth, prosperity, and resilience.

Natural Resources

It is an important factor that depends on the climate and environmental conditions. Natural resources refer to the resources that are either produced on the land or beneath the land by nature.

The land resources include water resources, plants, and landscapes, and beneath the land, resources include oil, metals, non-metals, natural gas, and minerals.

Apart from plenty of availability, the efficient utilization of natural resources is essential for economic growth, which is achieved with the help of skills and abilities of human resources, technologies used, and the availability of funds.

Capital Formation

Producing and acquiring man-made products like buildings, power, machinery, a medium of communication, and transportation is termed capital formation.

Capital formation leads to an increase in capital/labor ratio by increasing the availability of capital per worker, which in turn increases labor productivity and ultimately increases the output and growth of the economy.

Technological Development

This involves the application of scientific methods and production techniques and can be defined as technical instruments used by a certain amount of labor in an economy.

Technological improvement facilitates increased productivity with the limited availability of resources. The economies that move hand in hand with technological development grow rapidly compared to other economies.

Also, it is necessary to choose the right technology as this selection plays an essential role in affecting the growth of an economy. The correct choice of technology leads to an increase in the efficiency of production.

Social And Political Factors

Traditions, customs, values, and beliefs come under the banner of social factors that contribute to the growth of an economy.

Along with social factors, political factors like the participation of the government in the formulation and implementation of various policies have a major impact on economic growth.

The factors affecting economic growth can be seen as demand-side factors and supply-side factors:

| s.no | Demand AD = C+I+G+X-M | Supply-side (Long-Run Aggregate Supply) |

|---|---|---|

| 1. | Higher real wages ↑C | Increased investment |

| 2. | Tax cut ↑C | Higher labor productivity |

| 3. | Devaluation ↑X ↓M | Discover raw materials |

| 4. | Government spending ↑G | Increase in the labor force |

| 5. | The lower interest rate ↑I ↑C | Improved technology |

The demand side says that any increase in consumption, investment, government spending, or exports will lead to higher aggregate demand and economic growth.

In the long run, no increase in long-run aggregate supply makes a rise in an AD an inflationary move.

Theories of economic growth

A rise in the production of products and services during a given period of time relative to a prior one is known as economic growth.

It is a gauge of a nation's economic health and is typically expressed in terms of GDP. On the other hand, the extent to which the growth's fruits are distributed is crucial to its survival as well as the advancement and well-being of society.

There are some theories revolving around the concept of economic growth. Let us discuss some of them below.

Adam Smith

The basic approach of his idea deals with competitive behavior and equilibrium dynamics, the need for diminishing returns, and its role in physical and human capital accumulation.

His idea also deals with the interaction between the growth rate of population and per capita income, how technological progress affects labor specialization, and the discovery of production methods and goods.

Smith's model of economic growth can be given by:

Y = F (K,L,N)

Where

- K = Capital

- L = Labor

- N = Land

- Y = Output, and

- F = The production function.

He gave an analysis of markets working on a self-correction mechanism. He focused on the impulses of the acquisitive drive where the nation's wealth annual flow could be observed growing steadily.

The theory explained the rise in labor productivity with the help of the division of labor and capital accumulation.

Malthusian Theory

It was proposed by Thomas Malthus. The theory suggested large population growth was caused by technological progress. Also, in the long run, no impact of technological progress was seen on per capita income.

Though technologically advanced economies had higher population densities, their per capita level of income did not differ from the technologically backward economies.

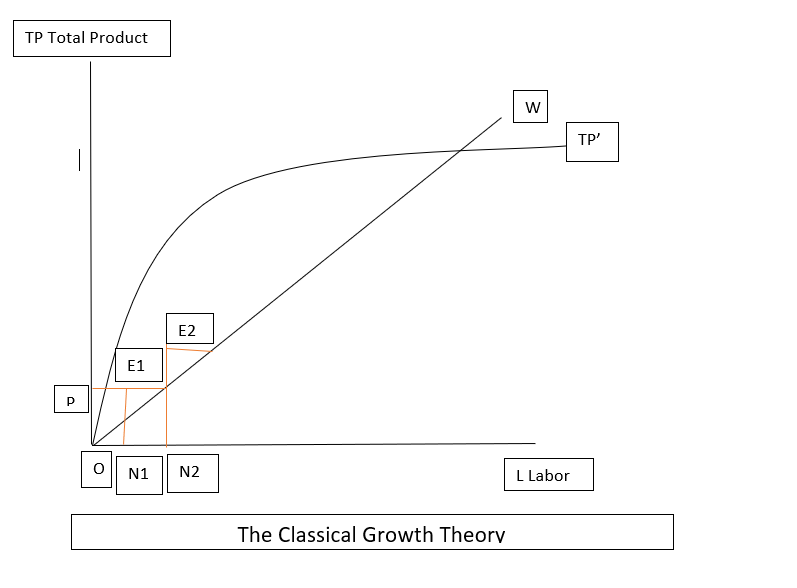

Classical Growth Theory

In this theory of growth, it is proposed that the theory of economic growth and production is based on the law of variable proportion.

The basic theme deals with the development from a progressive state into a stationary state of an economy. A progressive state implies a high level of accumulation.

Accumulation permits an increase in output in an economy by the addition of productive resources, mainly those that help in raising labor productivity. This accumulation depends on the level of profits of the economy.

The theory suggests that in the short run, wages( actual or market) are above the subsistence level leading to an increase in population. As the population increases, wages approach subsistence levels in the long run.

The big push model, originated by Paul Rosenstein-Rodan, emphasized that the decision taken by the firm to industrialize or not is dependent on its expectation about what the other firms will do.

The model focused on underdeveloped countries. It is said that large amounts of investments are required to bring underdeveloped countries on the path of economic development.

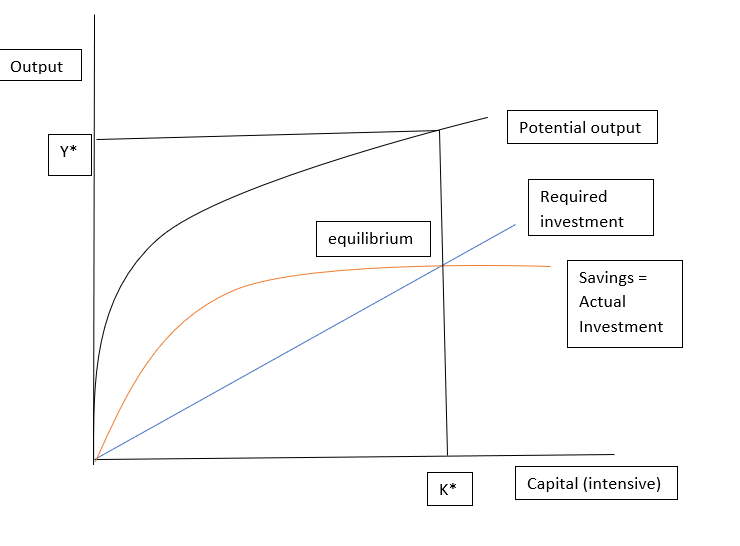

Solow-Swan Model

The model was developed by Robert Solow and Trevor Swan. The model assumes diminishing returns to labor and capital. Capital in an economy is accumulated through investments.

A steady-state condition means that due to the diminishing returns to capital and lack of technological progress, an increase in capital per labor leads to economic output.

The output is reached where economic output and capital per labor stay constant as annual investment equals annual depreciation in the capital.

Growth in the model can be seen with technological progress or an increase in the share of an economy's gross domestic product (GDP). The model suggests that the economies that invest a large share of GDP for a long time are rich.

This model is an exogenous growth model as it does not provide an explanation of why the different share of GDP is invested by the economies and why the technology is improving over time.

Though the model accounts for an exogenous rate of investment, it implicitly, under certain conditions, predicts convergence in the rate of investment. This concept had conceptual flaws and was rarely achieved in practice.

Endogenous Growth Theory

This theory was advanced by Robert Lucas, Jr. and Paul Romer in the 1980s. A new concept of human capital was incorporated by them, which gave an increasing rate of return.

Apart from human capital, innovation and knowledge were introduced as significant contributors to economic growth.

Concepts like positive externalities and spillover effects were seen as leading toward economic growth.

The theory mainly holds for the long run and emphasizes that the long-run growth rate is dependent on policy measures.

The principles on which this theory relies are:

-

The government plays a vital role in raising the growth rate of a country to facilitate intense competition by stimulating production and innovation processes.

-

Increasing returns to scale are observed from human and other capital investments.

-

Technological progress is a result of the private sector’s investment in research and development.

-

As a source of encouragement for businesses to engage in research and development, the protection of property rights and patents was important.

-

Growth requires investment in human capital.

-

For the creation and stimulation of new jobs, innovations, and investments, government policy should motivate entrepreneurship.

Romer said that technological change is not an exogenous by-product, as suggested by Solow.

He tried to prove that government policies are helpful in fostering endogenous innovation and economic growth.

Unified Growth Theory

It was proposed by Oded Galor and focused completely on the regime of modern growth, due to which it was unable to explain inequality across nations from the roots.

It suggested that the standard of living was near subsistence level across all spaces and time as population growth offset technological progress.

The theory of unified growth claims that the pace of technological progress can be increased with the help of enhancing education as education enables easy adaptation to changing technological environments.

Fertility decline was triggered by the allocation of educational resources, which further led to a steady increase in per capita income, making way for sustained economic growth.

A transition from stagnation to growth was a result of cultural and institutional characteristics assuming ceteris paribus. This theory together captured the fundamental phases of the development process in a single frame.

The fundamentals covered were:

-

Malthusian epoch and escape from the Malthusian trap

-

Human capital’s emergence for growth

-

Fertility decline

-

Concept of the Sustained Economic Growth Process

-

Divulge roots of divergence in income per capita.

Researched and authored by Parul Gupta | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?