Net Working Capital

The difference between current assets and current liabilities

What is Net Working Capital?

Net working capital, also called working capital or non-cash working capital, is an accounting metric that measures the amount of capital locked up for the business's operations. It is calculated as the difference between current assets and liabilities on the balance sheet.

Net working capital (NWC) is a metric to assess a company's capacity to settle short-term debts. NWC is frequently used by accountants and business owners to swiftly evaluate the financial standing of a firm at any time. However, it can sometimes be challenging to understand the findings.

It's crucial to remember that current assets and liabilities have an expiration date. Current assets are accessible resources that can be converted into cash within a year, whereas current liabilities are obligations with an expiration date within the same year.

Net working capital is a tool used by small business owners better to understand the current financial situation of their enterprise. Large firms and companies frequently employ NWC in their finance departments.

Additionally, since accountants prepare financial statements that include the information required for the NWC, they may easily calculate and monitor NWC for customers.

The higher the working capital, the higher the investment required. Hence, it is an essential financial concept for valuing companies and accounting for budgeting.

Key Takeaways

- Net working capital measures capital tied up in business operations.

- It's calculated as current assets minus current liabilities.

- Positive net working capital shows operational efficiency.

- Factors affecting it include accounts receivable, accounts payable, and inventory.

- Changes in net working capital impact cash flows, influencing financial decisions.

How To Calculate Net Working Capital?

Net Working Capital (NWC) is a measure of liquidity. It can provide information on the short-term financial health of a company. Business executives usually aim for a positive net working capital, where current assets exceed current liabilities.

Current assets are any assets that a business can sell or consume within one year. Current assets include:

- Cash

- Accounts Receivable

- Inventories of Raw Materials

- Finished Goods

Current liabilities refer to the company’s debt and obligations, which must be paid within a year. Current liabilities include:

- Accounts Payable

- Notes Payable

- The portion of long-term debt due within a year

- Accrued Expenses

Positive working capital is also a signal of operational efficiency.

Net Working Capital = Current Assets - Current Liabilities

Another related measure that is used to understand the relationship between current assets and current liabilities is the working capital ratio which is calculated as follows:

Net Working Capital Ratio = Current Assets / Current Liabilities

A good working capital ratio is considered to be between 1.5 and 2. Conversely, a working capital ratio below one can be a cause for concern. The working capital ratio uses the current ratio, another liquidity metric, and represents the function between current assets and current liabilities.

The working capital can be calculated in Excel as part of financial modeling. However, there are different methods of calculating it depending on what is included in the formula as presented below:

Net Working Capital = Current Assets - Current Liabilities

Net Working Capital = Current Assets (less cash) - Current Liabilities (less debt)

Net Working Capital = Accounts Receivable + Inventory - Accounts Payable

Cash is excluded from current assets as it is not locked up in anything and can be utilized immediately.

What Factors Influence Net Working Capital?

NWC is an important liquidity metric for a company. It can be influenced by how the company conducts business with its suppliers, vendors, and customers. In addition, the company’s obligations, such as wages, taxes, and bonus accruals, among others, also impact the working capital.

Change in the following balance sheet items would lead to a change in working capital:

- Accounts receivable(AR) - Receivables refer to the money that a company is due to receive from its customers. Shortening or extending the periods for customer payments impacts the working capital. Therefore, considering accounts receivable days is key and helps identify areas for improvement.

- Accounts payable(AP) - Companies have obligations towards their employees, suppliers, and vendors. Negotiating longer payment periods could benefit the company, but they may not favor the other parties.

- Inventory - Identifying performing and underperforming products play a significant role. Underperforming products increase inventory levels and are harder to sell. This can lead to fewer accounts receivable and impact the working capital.

- Other current assets (OCA)

- Other current liabilities (OCL)

Typically, other current assets and liabilities represent a relatively small portion of a company’s assets and liabilities. Hence, they won’t impact working capital as much as accounts receivable or payable.

How To Set Up Working Capital Schedule?

Calculating working capital requires building a model in Excel and using data from a company’s income statement (IS) and balance sheet (BS).

The following steps will help you create the model.

- Take the so-called top-line sales and the cost of goods sold (COGS) from the income statement and input them into the model.

- Reference all balance sheet items, which are necessary for the calculation, below the sales and COGS. Current assets and liabilities should be separated and presented in different sections. If this calculation is used, they have to be adjusted for cash and debt.

- The sub-totals for assets and liabilities are then calculated.

- Subtracting current liabilities from current assets leads to the net working capital.

Presenting historical data regarding working capital and making future projections about it has to be clear and immaculate. In addition, you have to know and implement the Excel modeling best practices so that your working capital model stands out.

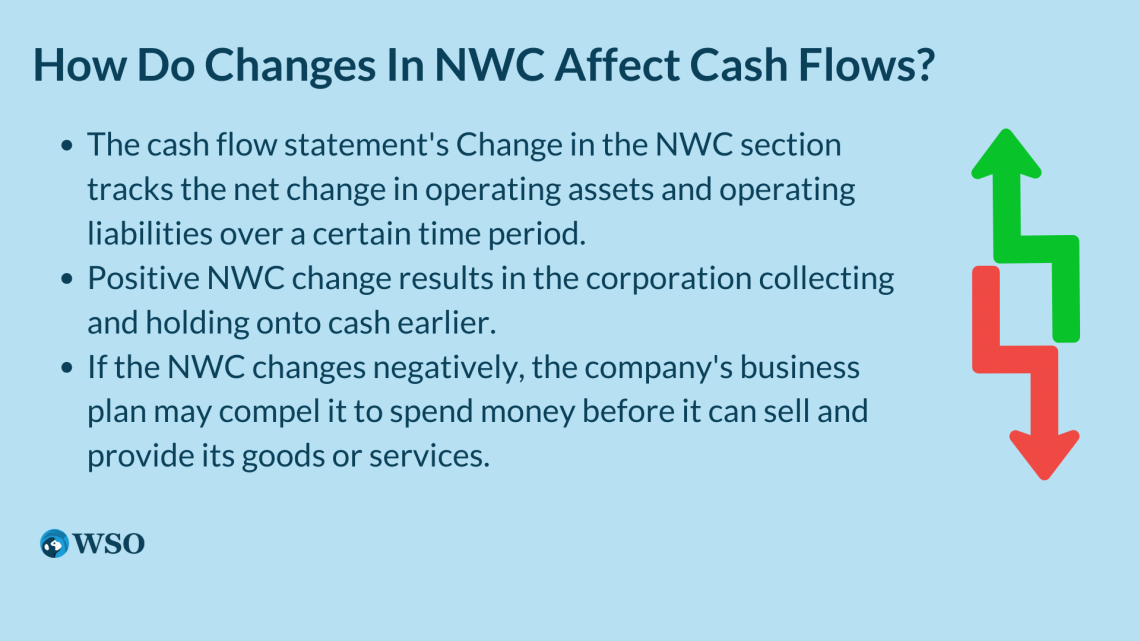

Changes in Net Working Capital: How Do They Affect Cash Flows?

Changes in working capital are presented in the company’s cash flow statement. These changes can signal the management about improvements that should be made, such as product streamlining or negotiating new terms with suppliers.

Therefore, the fluctuations in working capital are mainly due to changes in cash.

A decrease in cash, for example, after purchasing a new property or equipment, will decrease working capital; conversely, working capital will also rise when cash increases.

Changes in NWC impact both:

- Levered Free Cash Flow - The company's cash after meeting its obligations

- Unlevered Free Cash Flow - The cash that is available before debt and tax adjustments.

Positive working capital will result in decreased cash flow. Conversely, negative working capital increases cash flow. Understanding how changes in working capital can affect cash flows is important for a good financial model.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?