Current Assets

Assets that are expected to convert to cash within a year.

What Are Current Assets?

The current assets are assets that can be sold or consumed within the accounting cycle or within a year. These assets are essentially utilized for financing daily business operations.

They include tangible and intangible assets that prove to be beneficial by allowing the organization to function efficiently and help a business function proficiently.

All the assets the organization can utilize or can consume within a year or the accounting cycle are classified under current assets, under the assets of the balance sheet.

Some of the current assets are:

- Cash

- Cash Equivalents

- Accounts Receivables

- Stock or Inventory/Merchandise

- Marketable Securities

- Prepaid Expenses and

- Other liquid assets.

Current Accounts are another name for current assets.

The formula is written as follows:

Total Current Assets = Cash + Cash Equivalents + Inventory + Prepayments

The calculation of current assets is essential for the estimation of working capital or net working capital, which is the difference between the current accounts and current liabilities.

These assets are differentiated from the non-current assets, fixed or long-term assets, which are a part of the organization's capital expenditure.

Key Takeaways

- All assets that can be liquified are classified as current assets. Managers use this information for the company’s proper functioning and for stakeholders to help them make judgments.

- They can be found under the category of current liabilities in the statement of financial statement.

- Ratio analysis possesses the ability to understand if a business is profitable or not. It is also used to make decisions and understand where a company stands compared to its peers belonging to the same industry.

- They are short-term assets consumed within one financial year, whereas non-current assets are long-term assets that possess an economic life of more than a year.

- They include cash, cash equivalents, inventory, trade receivables, pre-payments, and other liquid assets.

Understanding Current Assets

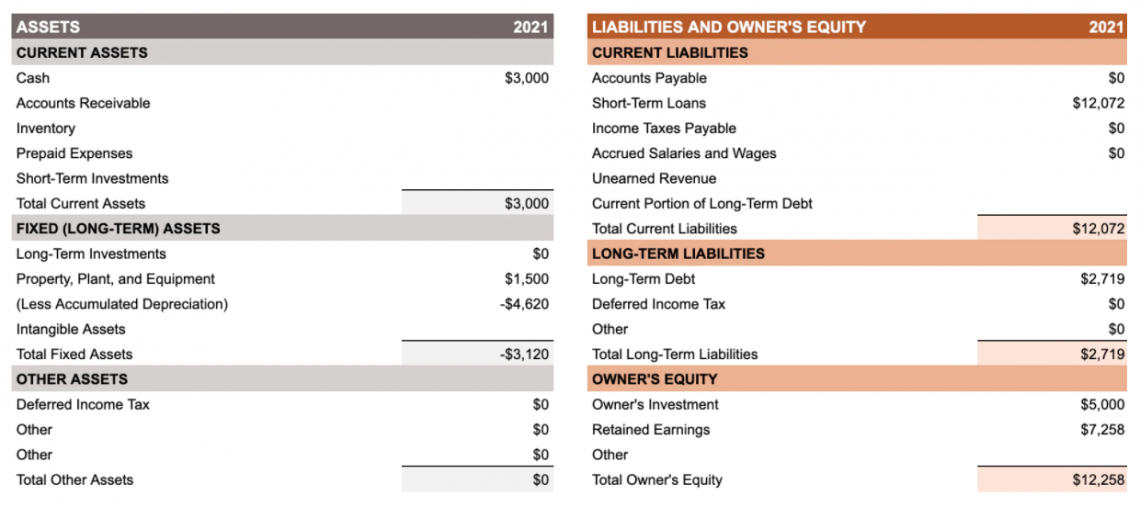

The current assets are recorded on the balance sheet under the assets head as the first item on the balance sheet. They are listed on the balance sheet based on their liquidity.

Liquidity is defined as the ease at which a current account can be converted into liquid cash by consuming or selling the assets.

These assets are reported on the balance sheet on their market value, whereas the long-term assets (or, non-current assets) are reported as book value less the depreciation.

Maintaining high-quality current accounts is essential for firms to conserve their ability to function efficiently in the short run. Satisfying the short-term obligations is the first step of avoiding bankruptcy.

Because if the company isn't able to understand and satisfy the short-obligations, imagine how that company would be able to satisfy its long-term obligations.

Examples of Current Assets

Current assets are a type of asset an organization owns which provides short-term liquidity. Often these assets are sold, consumed, or exhausted within one year or the operating cycle.

These assets are presented on the balance sheet. Some of the examples of current assets are discussed below.

Cash

Cash refers to the liquid, physical cash. Present in the form of notes and currency. Highly valued due to its nature of being used immediately. It is positioned at the top of the current asset section as items are arranged in order of their liquidity.

It is the most liquid asset used to purchase other assets easily. It is classified as a current asset on the balance sheet to denote it can be used or consumed within 12 months or less for business use.

Cash assets can be defined as assets consisting of cash and items that can be easily converted into liquid cash. These cash assets include, marketable securities, treasury bills, market funds, commercial papers, and other assets which can be easily converted into cash.

Commodities

Commodities are physical products that have intrinsic value, utilized in the realm of production/manufacturing and consumed as it is. These goods are the most volatile assets present.

These assets are considered essential for business operations and can also include raw materials and work-in-progress. The categories of commodities that exist are agriculture, minerals, metal, and energy.

They are considered “Real Assets,” thus reacting to the constantly changing economic world.

Commodities are publicly traded tangible assets used in commerce and trade. The most popular traded commodities are oil, gold, and base metals. Commodities are essential for growth and development. The commodity sector is vital in the economy of a developing country.

Pre-payments

Pre-payments are payments made in advance for the services or goods to be received later. For example, loan repayment before the due date, prepaid rent, electricity bills, salaries, and tax.

Trade Receivables

Trade receivables, also known as accounts receivables, are the amounts to be paid to a business by its users. It's the amount the users of our goods and services owe a certain amount of money to the business.

The trade receivables arise because of the firm's business on credit. The debtors are allowed to pay for the amount at any later date.

Inventory

Also known as Merchandise or Stocks, these are the goods that are to be sold or used in the production process.

Inventory serves as a major part of the business, including stocks, etc. Inventory includes:

- Raw materials

- Component parts

- Work in progress

- Finished goods

- Packing & packaging

Inventory serves the following functions in a business:

- Provide & maintain good service to its customers

- Smooth flow of goods through the productive process

- Provide protection and assurance against uncertainty in supply or demand

- To obtain an efficient utilization of resources such as people and equipment.

Cash Equivalents

Cash equivalents are defined as short-term investment securities that have a maturity of 90 days or less. These assets are highly liquid and easily convertible.

Cash equivalents are used in the liquidity ratio calculations to determine the ability of the company to pay off its short-term debt.

The main purpose of cash equivalents is for short-term investing. Businesses invest in cash equivalents to earn interest on their funds until the time they don’t need it in their business.

After that, it plays a role in the financial acquisition and is used in purchasing inventories, meeting operating expenses, and for several other purchases.

Other Liquid Assets

Other liquid assets include certificates of deposit, exchange-traded funds (ETFs), and mutual funds (they are slightly less liquid assets than stocks and ETFs).

Precious metals can also be considered valuable & liquid assets and thus can be used as currency. Money market funds are like mutual funds that only own highly liquid assets.

Where can you find current assets?

A balance sheet or statement of financial position is a document provided to the company’s stakeholders, such as investors, creditors, etc., that shows the company’s financial position. This includes critical information about the company, such as - assets, liabilities, equity, etc.

The formula for the balance sheet is as follows:

Shareholder’s Equity = Assets - Liabilities

Financial statements of a company, such as, a balance sheet, income statement, etc., can be used to assess the liquidity and efficiency of a business and the rate of return it is providing to its shareholders.

For example, the Current Assets are shown under the assets column on the balance sheet.

Main Users of Current Assets

Current assets form a very important part of the organization's finances. These assets constitute the assets that can be cashed, consumed, or exhausted withing or less than a year. The following are the main users of these assets:

As A Manager

The number of these assets maintained by a firm is critical for the company’s management in terms of day-to-day business operations. Because money has a time value, accumulating too much can be detrimental.

On the other hand, a shortage can hinder corporate operations like any inventory item. In addition, bills and loans are due at the end of each month, and the company’s management must be prepared to spend the cash to pay the debt.

Its monetary value shows the company’s entire cash and liquidity situation. It also aids management in planning the essential arrangements for the smooth functioning of commercial operations.

As A Stakeholder

These are used to calculate accounting ratios such as current ratio, liquid ratio, working capital ratio, and so on for financial statement analysis.

Various stakeholders monitor such ratios and make judgments based on them. For example, liquidity ratios assess a debtor’s ability to repay the debt. The dividend payout ratio assists investors in determining the company’s dividend payments.

Current Assets vs. Non-Current Assets

Current and non-current assets can be compared based on their liquidity and holding period.

The fixed assets are recorded on the net asset value is depreciation subtracted from the asset value. At the same time, the current asset is recorded at the cost or market value.

| Basis | Current Assets | Fixed Assets |

|---|---|---|

| Definition | Also known as short-term assets. | Also known as non-current or long-term assets. |

| Term Period | Generally consumed in less than a year | Possess an economic life of more than a year |

| Depreciation | They are not subjected to depreciation as they are released in a short period of time. | They are subject to depreciation as the company has owned them for a long time. |

| Function | Used for daily funding & business operations | Used to generate mainstream revenue for the company. |

| Examples | Inventory, cash, cash equivalents, cash receivables, short-term investments, and prepaid expenses. | Plant & equipment (P&E), physical assets, vehicles & machinery, furniture, buildings, etc. |

Financial Ratios That Use Current Assets

Ratio Analysis is really helpful for a business to ascertain important information about the company, such as its - operating efficiency, profitability, liquidity, etc. It also helps businesses compare themselves to their competitors and take remedial action to improve their overall efficiency.

Current Ratio

The current ratio is a liquidity ratio. It measures a company’s capacity to pay off all its current liabilities. Current liabilities are defined as those which have to be paid within one financial year.

Current Ratio = Current Assets / Current Liabilities

An excellent current ratio determines the liquidity position and financial health of a business. For example, a current ratio of 1.5-3 is usually considered a good ratio.

However, these also depend on the company’s nature or the industry the company is operating.

Efficient ratio analysis can help highlight the problems and other issues in the business. However, such ratios usually help only in identifying the problem, and the management of the company still has to decide the remedial action.

Acid-Test Ratio

Similar to the Current Ratio, another ratio known as the Acid Test Ratio (Quick Ratio) helps to determine the liquidity of assets in a business. The formula for the acid test ratio is listed below.

Acid Test Ratio = Current Assets - Inventory / Current Liabilities

This ratio can also be determined from the information provided on the balance sheet. A normal Acid test ratio for a business should be 1:1 or higher. Overall, The higher the acid test ratio is, the better the liquidity of a business.

Cash Ratio

Another ratio that helps stakeholders analyze the overall liquidity of a business is the cash ratio. It is the most commonly used method to determine a business’s liquidity.

For example, if a company is to pay off all its current liabilities, this metric shows its ability to do so without liquidating or selling other assets.

The formula for the cash ratio is:

Cash Ratio = (Cash + Marketable Securities) / Current Liabilities

There is no ideal figure for a normal or good cash ratio. However, a cash ratio of 0.5-1 is usually considered ideal. But, again, ratios greatly depend upon the nature of the business and must not be analyzed in isolation.

For example, for a company having £200,000 in the numerator, that is, cash and marketable securities, and £150,000 in short-term liabilities, the company’s cash ratio is 1.33, which is considered a good cash ratio.

Researched and authored by Abhinav Bhardwaj | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?