Current Liabilities

Short-term financial obligations, including debts, payables, and accrued expenses, that a company must settle within the short run of the company

What are Current Liabilities?

Current liabilities are short-term financial obligations, including debts, payables, and accrued expenses, that a company must settle within the short run of the company.

The term "liability" suggests that a person or company owes financial obligations to another person or business. In accounting, current liabilities are understood to be settled within one financial year or an operational cycle.

In simple terms, liability refers to an obligation or debt that a person or company owes to another party, which may involve the exchange of goods, services, or cash.

An example might be mowing the lawn after the homeowner paid you beforehand. Since they paid you prior, you are liable for completing the lawn service. They are also short-term liabilities as they must be settled quickly.

Key Takeaways

- Current liabilities are short-term financial obligations, including debts, payables, and accrued expenses, that a company must settle in the short run.

- They provide insights into a company's financial strength and liquidity, influencing investment decisions and creditor assessments.

- Current liabilities are recorded on the balance sheet under the liability column, representing obligations due within one financial year.

- Ratios such as the current, acid-test, and cash ratios help assess a company's liquidity and ability to cover short-term liabilities.

- Current liabilities are settled within one year, while non-current liabilities have longer settlement terms, typically over one year.

- Current liabilities include bank overdrafts, current portions of loan borrowings, trade and other payables, provisions, and dividends payable. These obligations impact a company's financial position and cash flow management.

Understanding Current Liabilities

Current liabilities give investors or banks insights into a company's financial strength.

Investors and creditors both benefit from a thorough examination of current liabilities. Banks, for instance, like to see firms collecting payments through their accounts receivable before issuing them a loan.

A company should allocate its resources efficiently in case of high current liabilities, which may mean job redundancies, optimizing operations, and shifting internal controls. More often, this is where consulting firms like the Big 4 (K.P.M.G, Deloitte, E.Y., and P.W. C) come in.

The consulting firms help a company identify a problem, diagnose the core area, and find, create, and implement a solution to achieve the desired result (in this case, reducing current liabilities).

The types of liabilities can vary widely. It mostly depends on what sector or industry a company works in; some examples include:

- Accounts payable

- Short-term loans

- Income Taxes

- Dividends

- Notes payable

Note

There are also non-current liabilities, such as long-term settlements. Any settlement(s) to be paid longer than a year is considered a long-term liability. Usually, these could last 2-3 or even 15 years. They are mostly settled by liquidating existing assets but can also be determined by replacing the liability with another liability.

Accounting For Current Liabilities

A balance sheet or statement of financial position is a document that displays a company's financial position, including its assets, liabilities, and shareholder's equity, prepared primarily for internal and external stakeholders.

The document shows the financial position of a company and displays what the company owes and owns. The principal formula for the balance sheet is:

Assets = Liabilities + Shareholder's Equity

With the efficient use of data provided in the balance sheet and income statement, various financial metrics can be assessed, including liquidity, efficiency, and leverage. However, rates of return are typically calculated based on investment performance rather than directly from these statements.

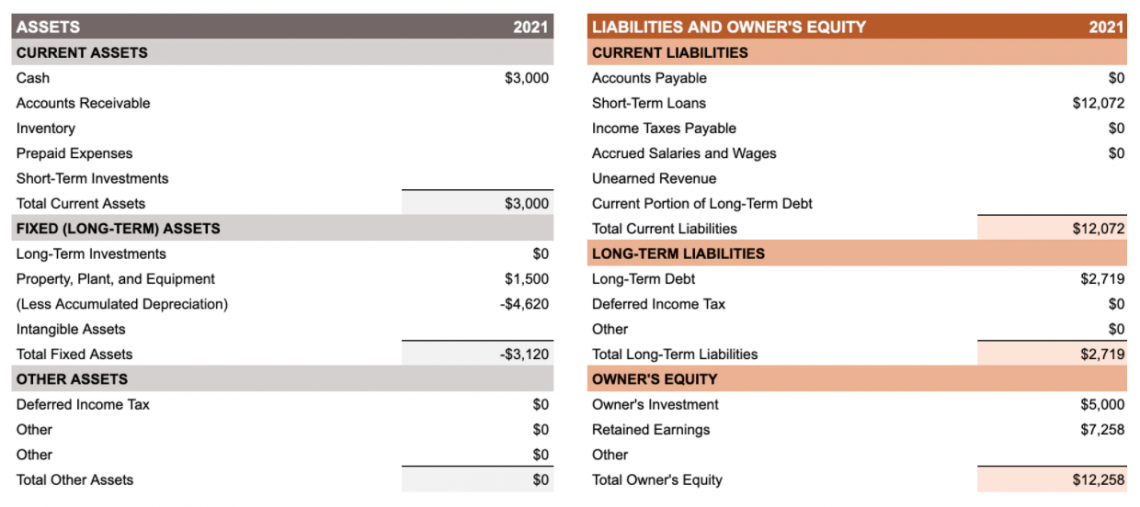

Current liabilities are stated under the liability column on the balance sheet as shown below:

In double-entry bookkeeping, the transactions are recorded by crediting the most applicable current liability account and debiting an expense or asset account.

For example, a person purchases a brand-new laptop worth $2,000 for his e-commerce business. Then, he transfers $2,000 from his cash account to his expense account. This is because he has less cash in hand, and his technological expense assets are now worth $2000 more.

The journal entry will be:

| Particulars | Debit | Credit |

|---|---|---|

|

Expense account |

2000 |

|

|

Cash account |

2000 |

Current Liabilities Ratios And Analysis

Ratio analysis is really helpful for a business in determining its performance statistics against the industry or sector in which it competes. Analyzing ratios also provides insights into a business:

- Solvency

- Liquidity

- Operational efficiency

- Profitability

Which helps the business gauge and work to become more competitive in the market. These ratios are derived (or calculated) from the items listed on the balance sheet and income statement.

Current Ratio

The Current Assets ratio shows a business's current assets to its current liabilities as shown in the formula below:

Current ratio = Current Assets/ Current Liabilities

The current ratio is a liquidity ratio that measures a company's capacity to pay off all its present liabilities due in one fiscal year. A good current ratio indicates a company's liquidity and ability to cover its short-term liabilities.

A current ratio of around 1.5 to 3 is considered an indicator of a profitable business. An efficient analysis can highlight problems or other issues in the business. However, ratios and analyses are limited in that they help identify the problem but not the solution.

Acid Test Ratio

Similar to the current ratio, another ratio known as the acid test Ratio (Quick Ratio) helps determine the liquidity of assets in a business. The formula for the acid-test ratio is shown below:

Acid Test Ratio = (Current Assets - inventory)/ Current Liabilities

This ratio can also be calculated from the resources provided on the balance sheet. A normal Acid test ratio for a business should be 1:1 or higher.

Note

A higher acid test ratio indicates greater liquidity for a business.

Cash Ratio

The cash ratio is the most commonly used method to determine a business's liquidity. It shows a company's ability to pay off all its current liabilities using only cash and marketable securities without liquidating or selling other assets.

The formula for the cash ratio is:

Cash Ratio = (Cash + Marketable Securities)/ Current Liabilities

There is no ideal figure for a 'normal' or 'good' cash ratio, but a ratio between 0.5 and 1 is considered good.

For example, a company with $200,000 in cash and marketable securities and $150,000 in short-term liabilities would have a cash ratio of 1.33, which is considered a strong ratio. The calculation is:

Cash Ratio = $200,000 / $150,000 = 1.33

Current Liabilities Vs. Non-Current Liabilities

Let's understand the difference between the two in the table below:

| Current Liabilities | Non-Current Liabilities |

|---|---|

|

Liabilities are to be settled within one financial year (<1 year). |

Liabilities that have a term of more than one year for settlement (>1 year). |

|

Appear on the balance sheet once and are settled within the period of recording. |

It might appear on balance sheets for consecutive years. |

|

Occur due to regular business activity & operations. |

Occur due to the long-term funding needs of the business. |

|

Have a short-credit period and thus do not have any interest obligation. |

They are due for several years and thus have an interest obligation attached to them. |

|

Arise due to day-to-day operations and thus do not have any security attached to them. |

Have longer terms of repayment, therefore keeping security as a guarantee.

|

|

Examples- include trade receivables, short-term loans, etc. |

Examples- include long-term bank loans, bonds, debentures, etc. |

Current Liabilities Example

Let's discuss some of the examples of Current Liabilities:

1. Bank Overdrafts

Overdrafting is a commitment that lets you utilize money in your current account by taking out more money than you have. Bank overdrafts are considered liabilities because they represent amounts owed to the bank, typically to be paid within 12 months, regardless of whether interest is charged.

Bank overdrafts are liabilities because an excess amount is taken beyond the available funds in your account, leaving your account in a negative balance. Moreover, there are two types of bank overdrafts: authorized bank overdrafts and unauthorized bank overdrafts.

Authorized bank overdrafts are advance arrangements made between the account holder and the bank. Both parties agree mutually on a limit that can be used for any future payment.

Advantages of having an authorized overdraft:

- Fulfilling an urgent cash requirement

- Interest is to be paid only on the amount to be utilized

- No requirements for collateral

- Availability of cash for a business or an individual

Unauthorized bank overdrafts are when no advance arrangements are made between the account holder and the bank when the account holder spends more than what is deposited.

Note

An unauthorized bank overdraft happens when you spend more money than what is available in your account without prior approval from the bank. This could potentially impact your credit score, affecting your ability to obtain credit in the future.

2. Current portions of loan borrowings

Current debt, also known as short-term debt, refers to obligations that must be paid off within one financial year. This includes formal borrowings from a company outside the payable account.

For example, a company pays machinery costs in installments.

Current debt and capital lease obligations are both classified as liabilities on a balance sheet. This differs from accounts payable, which include goods and services, whereas notes payable relate solely to borrowed cash or funds.

3. Trade and other payables

Accounts payable include the money businesses owe their suppliers for products/services purchased on credit. This includes monthly bills, rents, and other miscellaneous expenses.

Account payable is a burden on the company's shoulders. The repayment period for accounts payable can vary depending on the agreement between the buyer and the supplier, ranging from weeks to several months or more.

Disadvantages are:

- If payments are delayed, the supplier's financial position will be pressured. Therefore, suppliers tend to give the business a shorter credit payback period (shorter amount of time to pay) for payments

- Prolonged accounts payable reflected in financial statements can forecast the company's financial trouble

- Any delay in payments can impact the relationship between a supplier and business and, thus, potentially harm long-term business relationships

4. Provisions

These are funds set aside by a business to cover any future losses.A provision is an amount set aside by a business to cover anticipated future losses or expenses. Provisions are shown in the liabilities section of a company's balance statement.

Provisions include warranties, income tax liability, future litigation fees, depreciation costs, guarantees, pensions, losses, asset impairments, provisions for bad debt, etc. These are not savings as the expense is likely to occur.

Provisions are funds set aside by a business to cover anticipated future expenses or losses. These make the company's financial statements more accurate and precise.

Note

To be recognized as a provision, funds must be set aside for a specific future obligation that is probable and can be reliably estimated.

5. Dividends Payable (liability dividend)

Dividends payable represent the obligation of a company to pay dividends to its shareholders at a later date. It is recorded when a company faces liquidity problems and does not have the cash to pay its shareholders soon.

The receiver of a liability dividend can choose either to wait until a later date to collect dividend distribution or sell it to a third party at a discount rate. When a dividend is declared, it is recorded on a company's financial records and reported on its balance sheet.

Young startups reinvest their profits to fuel growth through scalability and expansion. In contrast, mature company dividends are enjoyed by shareholders as the company has reached optimal levels of growth and scalability.

The potential for periodic income streams from dividends makes the company attractive to certain investors seeking returns from their stock investments.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?