Working Capital vs Investing Capital

Working Capital is the difference between a firm’s current assets and current liabilities, while investing capital refers to the amount of money used by the firm to acquire fixed assets

What Is Working Capital?

The working capital, also referred to as the net-working capital of an organization, is defined as the difference between a firm’s current assets (assets that can be converted into cash in less than a year) and the firm’s current liabilities (debts to be paid within a year).

It indicates the firm’s short-term financial health and ability to pay off short-term debts. It can be harmful if the ratio is lower than 1 (current assets < current liabilities).

It can be inferred from a positive ratio that the firm has sufficient capital to fund its current operations and invest those funds in future projects for growth and development.

However, a very high working capital can be disadvantageous to a firm as it indicates that the funds of the firm are lying idle and are not being invested in growth and profitable projects; the firm has excess inventory and is not able to capitalize on low-expense debt.

Moreover, it helps to measure the firm’s operational effectiveness and efficiency. A positive number means that the firm has a higher potential to exploit growth opportunities that other firms might not be able to capitalize on.

The sufficient amount of working capital a firm should hold depends on the industry in which the firm is involved. For example, firms having longer production cycles require higher net working capital as the firm’s inventory turnover isn’t quick enough to generate cash when needed.

Key Takeaways

- Working capital is the difference between current assets and liabilities, indicating short-term financial health and debt-paying ability.

- Positive working capital suggests sufficient funds for operations and future investments, while excessive working capital may indicate inefficiency.

- Working capital measures operational effectiveness and the potential to exploit growth opportunities.

- Investing capital is used for long-term asset acquisition and can be raised through sources like bank loans, equity issuance, or venture capital.

- Investing capital has drawbacks, including reduced earnings growth, diluted equity value, and constraints on growth due to debt repayment.

Working Capital Calculation

It is determined by calculating the difference between a firm’s current assets and current liabilities. The existing assets and liabilities value can be extracted from the firm’s balance sheet and is available for most public firms.

Although it can easily be determined for public firms due to the easy access to the financial statements, it can get time-consuming and complex for private firms, as information is not readily available for potential investors.

The formula can be seen below:

Net Working Capital = Current Assets - Current Liabilities

The final value of the working capital is always expressed in dollar figures. Let us consider an example of a firm with $120,000 worth of current assets and $70,000 cost of current liabilities.

The firm's working capital will be $50,000, which implies that it has $50,000 at its disposal in a short-term period in case a situation arises where the firm will have to raise funds for particular business activity.

A positive number implies that current assets' value is more significant than current liabilities. The firm has enough assets to meet its short-term debt obligations and will still have residual cash if all other purchases are used to pay off the debt payments.

A negative number implies that the firm has more current liabilities than current assets, and those assets won't be sufficient enough to pay off all current penalties. As a result, such firms have poor short-term financial health and low liquidity.

Working Capital Disadvantages

Although short-term capital valuation is an essential metric to ascertain a firm’s short-term financial health and stability, the calculations can sometimes be flawed, which might give a misleading representation of the accounting data.

1. Firstly, the value of working capital is constantly fluctuating. If a company operates as a going concern, the current assets and liabilities continuously change during the accounting period.

As a result, over time, when financial information gets accumulated within the company data, the firm's short-term financial position might likely have changed compared to what was reported in the previous accounting period.

2. Secondly, working capital calculations do not consider certain underlying accounts; for instance, consider a company with accounts receivable as its only current asset.

Although the firm might have positive working capital, it will not indicate solid financial stability as all the firm’s financial strength depends upon the customer’s payment cycle and whether the firm will be able to receive that short-term cash for other expenditures and investments.

3. Thirdly, assets are often revalued by the firm, which sometimes results in a decrease in the asset's value. Accounts receivables will decrease in value if one of the debtors goes bankrupt. Inventories are at risk of being obsolescent or stolen.

Furthermore, it assumes that all the debt obligations are known to the organization. Sometimes, invoices can be prepared incorrectly, and working capital strongly follows the accounting practices of internal control and safeguarding assets.

What is Investing Capital

Investing capital, also known as capital investment or financial worth of an organization, refers to the amount of money used by the firm to acquire fixed assets such as plants and machinery, land and buildings, or other essential items for the production process.

Investing capital is to procure non-current assets from the market that will be used for more extended periods, fulfilling the company’s long-term strategy and objectives.

The capital can be generated from different financial sources such as bank loans, equity issued by the organization, and even venture capital deals. The firm also uses its cash to exploit long-term growth opportunities to purchase these assets.

Companies use specific investment accounting software, which helps the firm to manage the accounting processes related to the investment made by the firm.

These accounting tools can be used for various reasons other than tracking the investment, such as maintaining investment records, following the firm’s activity, and reporting the gains and losses generated by the asset for the firm.

In simple terms, financial capital refers to the money the firm uses to fund its capital expenditure, such as purchasing capital goods, investing in new projects, improving production processes, etc.

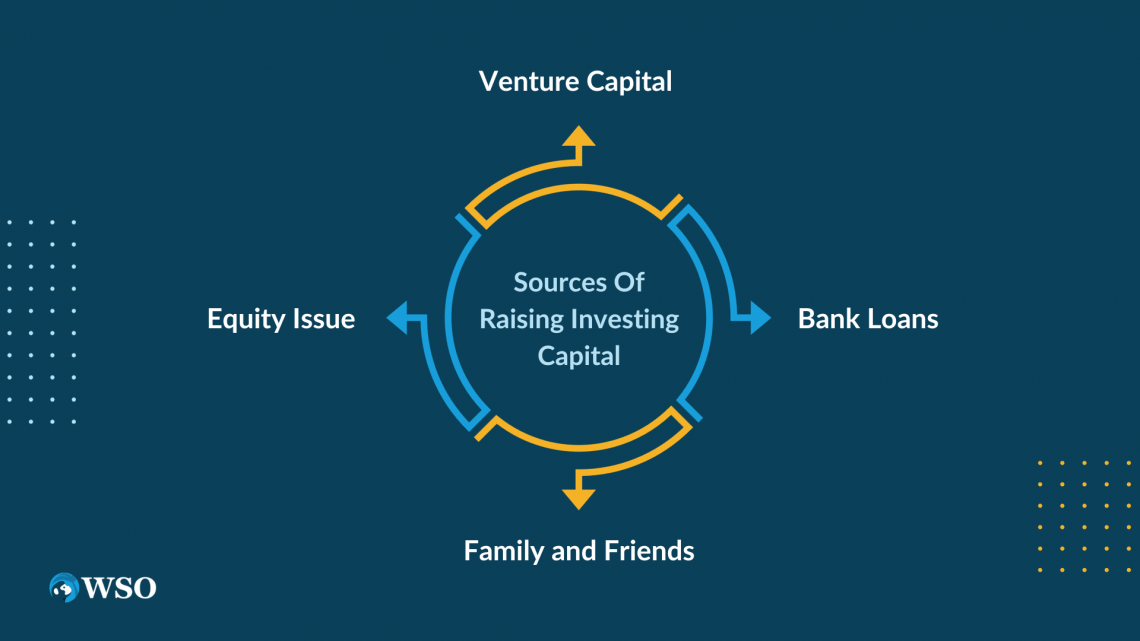

Sources of Raising Investing Capital

A firm can use different sources to fund its capital expenditure. Some of the most common germs that the organization uses are explained as follows:

1. Bank Loans: One of the most common funds firms use to fund their capital expenditure is the bank loan. Banks provide loans to business organizations and individuals at a given interest rate.

Most small to medium-sized firms rely on bank loans for funding their capital expenditure needs. The bank considers the client’s credit portfolio, previous repayment records, and credit ratings before giving the loan.

2. Equity Issue: The equity issue is one of the most common methods employed by big publicly listed firms to raise funds for fulfilling long-term growth and expansion opportunities.

Equity issues can be in the form of new shares in the market, bonus issues, etc. The firm uses the money raised from this source to procure new assets, and funds are invested in different projects.

3. Family and Friends: Although this source is one of the unsecured sources of funds, many small to medium-sized business owners rely on funds they procure from their families and friends.

These funds can be generated by borrowing from friends in the form of a loan attached to a specific interest rate or selling a firm stake to the investor.

4. Venture Capital: Venture capitalists are high net worth individuals that provide financial support to already established businesses, or businesses in their early formation phase, like start-ups, in exchange for equity or ownership interest.

The venture capitalist assumes the risk associated with the business and thus makes a high return on the investment if the company succeeds.

Investing Capital Disadvantages

The disadvantages associated with investing capital are listed as follows:

1. Reduction in Earnings Growth: Capital investments tend to reduce the firm’s earnings growth over a short period. Capital expenditures made by the firm provide benefits over a more extended period.

As a result, investors and shareholders of the organization will not be pleased due to lower returns over a short-term period.

2. Dilutes Value of Existing Equity: Issuing additional equity shares, one of the most common ways in the market to fund capital expenditures, tends to reduce the firm’s value of existing equity.

As a result, no investors prefer to see the value of their investment decline due to the firm’s funding. Thus, this method is typically frowned upon by the existing shareholders of the organization.

3. Restrains the Growth Opportunities: The company, to raise money to fund its capital expenditure, may take out a loan from the bank, and the total value of outstanding debt is expressed on the organization's balance sheet.

Since the value of the debt is available on the financial statements for the shareholders, the regular interest and principal repayments made by the organization may reduce the possibilities of growth for the organization.

Researched and authored by Mehul Taparia | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?