Investment Banking

Facilitating Advisory-Based Financial Transactions for Diverse Clients

What is Investment Banking?

Investment banking (IB) refers to a financial services firm or a business division's advisory-based financial transactions on behalf of people, corporations, and governments.

A bank traditionally connected with corporate finance may aid in generating financial resources by underwriting or serving as the client's agent in the issuing of debt or equity instruments.

An investment bank may also help corporations with mergers and acquisitions (M&A) and provide ancillary services such as market making, derivatives trading, and equity securities trading.

Research or FICC services (fixed income instruments, currencies, and commodities) (macroeconomic, credit, or equity research).

In addition to their investment research divisions, most investment banks include prime brokerage and asset management sections. It is divided into three categories:

- Bulge Bracket (top tier)

- Middle Market (mid-level firms)

- Boutique Market (specialized businesses)

It is the division of a bank or financial institution that provides underwriting (capital raising) and mergers and acquisitions (M&A) advice services to governments, businesses, and institutions. Investment banks operate as:

- Go-betweens for investors - who have money to invest

- Companies - who require capital to grow and run their businesses

Key Takeaways

- Investment banking involves financial transactions, M&A, and advisory services for individuals, businesses, and governments.

- Investment banks aid in debt/equity issuance, M&A, market trading, and derivatives.

- Investment banking history includes milestones like the Dutch East India Company's public offerings. Regulatory changes, like Glass-Steagall Act's repeal, impacted the industry's scope.

- The 2007-08 crisis led to failures, bailouts, and regulatory transformations, reshaping investment banking.

- Investment banks link investors with opportunities, help raise capital through debt/equity, and advise on M&As.

A Brief History of Investment Banking

The Dutch East India Company was the first to sell bonds and equity to the general public. It was also the first publicly traded firm on an official stock market.

Such as initial public offerings and secondary market offerings, brokerage, and mergers and acquisitions, to a "full-service" range that includes:

- Securities Research

- Proprietary Trading

- Investment Management

The SEC filings of big independent investment banks such as Goldman Sachs and Morgan Stanley in the twenty-first-century show three product segments:

Trading and significant investments such as broker-dealer operations, including:

- Proprietary Trading - "dealer" transactions

- Brokerage Trading - "broker" transactions

The Glass–Steagall Act, which separated commercial and IB in the United States, was abolished in 1999. The repeal resulted in more "universal banks" providing a wider variety of services.

As a result, several prominent commercial banks have created IB units through acquisitions and recruiting. Major banks with significant investment banks are:

Following the 2007–08 financial crisis and the subsequent enactment of the Dodd-Frank Act in 2010, laws prohibited some investment banking practices, most notably the Volcker Rule's prohibitions on proprietary trading.

As a proportion of income, the conventional service of underwriting security problems has reduced.

As early as 1960, transaction commissions accounted for 70% of Merrill Lynch's income, while "conventional investment banking" services accounted for 5%. Merrill Lynch, on the other hand, was a "retail-focused" business with a big brokerage network.

Understanding the Impact of the 2007-2008 Financial Crisis

Several significant investment banks failed during the 2007–2008 financial crisis, including Lehman Brothers (one of the world's largest investment banks) and the rushed sale of Merrill Lynch and the much smaller Bear Stearns to much larger banks, saving them from bankruptcy.

Through the Troubled Asset Relief Program, the government bailed out the entire financial services industry, including several investment banks (TARP). To receive the TARP bailout, surviving US investment firms such as Goldman Sachs and Morgan Stanley transformed into typical bank holding companies.

Across the world, similar crises happened, with nations rescuing their banking industries. Banks first got a portion of a $700 billion TARP program designed to stabilize the economy and defrost the frozen credit markets.

Eventually, federal support to banks totaled about $13 trillion—most of which went unnoticed as lending did not increase and credit markets remained frozen. The crisis called into question the investment bank's business model in the absence of Glass–Steagall legislation.

When former Goldman Sachs co-chairman Robert Rubin joined the Clinton administration and deregulated, banks, the prior conservatism of ensuring established firms and pursuing long-term advantages gave way to weaker standards and short-term profit.

Previously, the requirements required a firm to operate for at least five years and be profitable for three consecutive years to go public. These requirements were removed during deregulation, but small investors did not understand the full extent of the shift.

Former Goldman Sachs executives such as Henry Paulson and Ed Liddy held high-level government roles and managed the contentious taxpayer-funded bank bailout.

The Congressional Oversight Panel's TARP Oversight Report stated that the bailout encouraged risky activity and "corrupted the fundamental precepts of a market economy."

Under the subpoena threat, Goldman Sachs reported that it got $12.9 billion in public assistance, $4.3 billion of which was distributed to 32 companies, including various:

- Foreign Banks

- Hedge Funds

- Pensions

The same year, it got $10 billion in government subsidies and gave out multimillion-dollar incentives, totaling $4.82 billion in compensation.

Likewise, Morgan Stanley received $10 billion in TARP cash and distributed $4.475 billion in bonuses.

Transactions in which capital is raised for the corporation include:

These transactions are:

-

Mergers and acquisitions (M&A) and demergers involving private corporations are examples of transactions in which money is raised for the corporation.

-

Public company mergers, demergers, and takeovers, including public-to-private transactions.

-

Management buy-outs, buy-ins, or similar transactions involving firms, divisions, or subsidiaries are generally backed by private equity.

-

Equity issuance by firms, including the initial public offering (IPO) of a company on a recognized stock exchange and the use of online investing and share-trading platforms;

-

The objective may be to obtain funds for development or to reorganize ownership.

-

Joint venture or project finance financing and structuring.

-

Raise infrastructure funds and provide advice on public-private partnerships and privatizations.

-

Raising funds for corporate refinancing and restructuring through issuing different kinds of stock, debt, hybrids of the two, and similar securities.

-

Raising finance for seed, start-up, development, or growth.

-

Raising cash for specialized corporate investment funds such as private equity, venture capital, debt, real estate, and infrastructure.

-

Secondary equity issuance, whether through a private placement or subsequent public offerings, particularly when tied to one of the events described above.

-

Creating and restructuring private corporate debt, sometimes known as debt funds.

Compensation for Investment Bankers

It is frequently chastised for its employees' excessive pay packages.

According to Bloomberg, Wall Street's five largest firms paid their leaders more than $3 billion between 2003 and 2008:

"As they presided over the packaging and selling of loans that helped bring the investment-banking system down."

From 2003 through 2007, Merrill Lynch CEO Stanley O'Neal received a salary package of $172 million. Before its acquisition by Bank of America in 2008, and $161 million for Bear Stearns' James Cayne before the bank's failure and sale to JPMorgan Chase in June 2008.

Such compensation agreements had enraged Democrats and Republicans in the United States Congress, who sought CEO pay caps in 2008 when the United States government was bailing out the sector with a $700 billion financial rescue plan.

Aaron Brown, a vice president at Morgan Stanley, writes in the Global Association of Risk Professionals magazine:

"By any definition of human decency, of course, investment bankers make ridiculous amounts of money."

Exam for Investment Banking

The Limited Representative – Investment Banking Exam, often known as Series 79, is an examination for such professionals administered by the Financial Industry Regulatory Authority (FINRA).

The test is intended to certify candidates for a restricted scope of activity as investment bankers without requiring the complete criteria of the General Securities Representative Exam.

The Financial Industry Regulatory Authority (FINRA) is a private American corporation that functions as a self-regulatory organization (SRO) for member brokerage companies and exchange markets.

FINRA is the successor of the National Association of Securities Dealers, Inc. (NASD) and the New York Stock Exchange's member regulatory, enforcement, and arbitration activities.

The US Securities and Exchange Commission is the US government entity that serves as the ultimate regulator of the US securities sector, including FINRA (SEC).

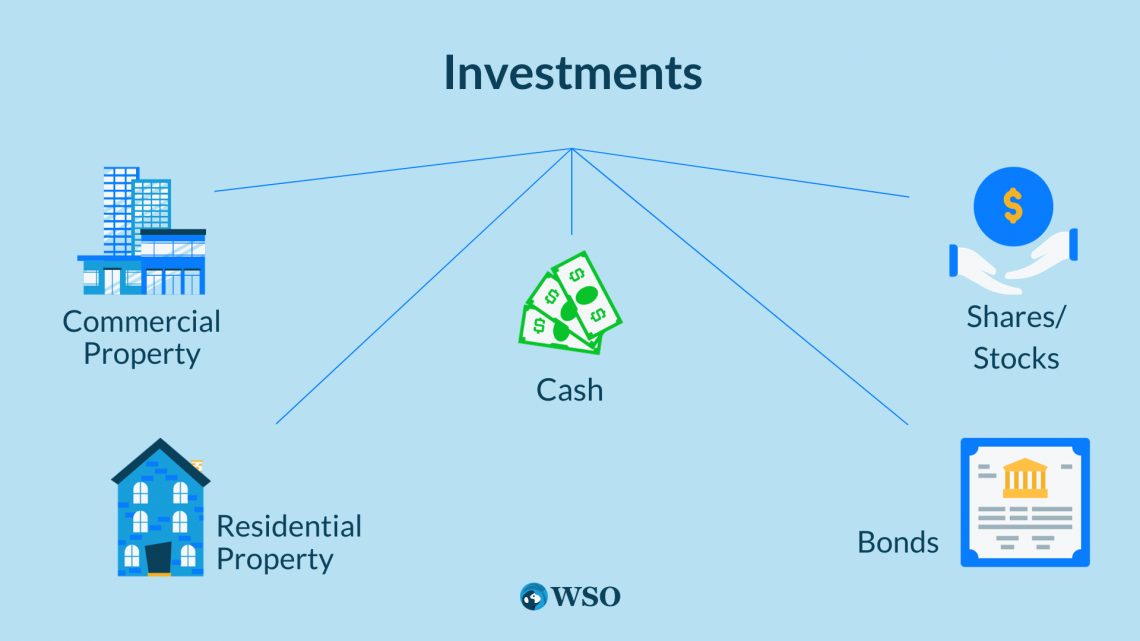

Exploring Traditional Investment Options in Investment Banking

Traditional investments in finance relate to placing money into well-known assets (such as bonds, cash, real estate, and equity shares) with the hope of:

- Capital Appreciation

- Dividends

- Interest Profits

Alternative investments are to be contrasted with traditional investments.

1. Bonds

Bond (finance) In this case, the investor purchases debt issued by firms or governments that provides a yearly return until the debt is repaid.

The investment's value swings when the level of general interest rates changes, causing the bond to become more or less valuable.

2. Cash

When investing, money is often invested in short-term, low-risk investment vehicles such as certificates of:

- Deposit

- Money Market Funds

- High-Yield Bank Accounts

3. Residential property

Residential real estate investment is the most prevalent type of real estate investment in terms of the number of participants since it comprises property acquired as the main residence. In many circumstances, the buyer does not have the total purchase price and must borrow additional funds from a:

- Bank

- Financing Firm

- Private Lender

4. Commercial property

Apartments, office buildings, retail spaces, hotels, warehouses, and other commercial structures are examples of commercial real estate. Investors can buy commercial real estate outright, with a loan, or collectively through a real estate fund.

5. Property investment trusts

Investing in real estate investment trusts (REITs) is similar to investing in a pool of real estate managed by a corporation.

6. Shares and stocks

This entails acquiring a share of a company's equity with the anticipation that the share price will rise. Buying stock in the firm is the same as owning a piece of it. The following can all be used to invest in equities:

- Individual stocks

- Mutual funds

- Index funds

- Exchange-traded funds (ETFs)

What Exactly is investment banking?

IB includes the following:

1) The Middlemen

Those who act as a middleman between those who have cash but want to acquire real estate and persons who have real estate but want to sell it for cash.

Investment bankers are similar to real estate brokers. However, instead of selling real estate, they provide investment alternatives. And they are well compensated for their efforts. Bankers link together parties with funds seeking investment possibilities and parties seeking investors.

A firm in need of funds might obtain it in three ways:

-

Borrow Debt

-

Equity should be sold (aka ownership)

-

Sell the entire business

This is the investment banking sell-side. They're exchanging cash for an investing opportunity. To the buyer, however, each represents an opportunity to invest and get a return on investment.

2) Borrow Debt

Assume you want to borrow $200K to buy a property for $500K. What are your plans? You visit a bank.

All retail banks would be delighted to lend you money because they would gain interest. Their interest revenue is equal to your interest expenditure. So they get a return on their investment by lending you money. But what if you're a major corporation in need of a $10 billion loan?

You can't stroll into Chase and expect the cashier to hand out $10 billion. There aren't many individuals or corporations in the world that can offer you $10 billion in cash. However, many investors will lend you a little portion of that.

One investor may lend you $10 million, and another may lend you $15 million, and so on. None of them can lend you $10 billion individually, but they could lend you $10 billion together. However, finding and convincing each investor takes time, and you'll need the connection.

This is where investment bankers come into play. They do this for a living and maintain ties with all Wall Street's big players.

They will meet with investors prepared to lend money to determine their appetite. If these investors are interested in the prospect, they will subscribe to or commit to investing in your debt. It is also known as debt financing.

The corporation borrows money, lenders receive interest, and bankers are paid a fee.

3) Selling Equity

Assume you paid $500K for the house after borrowing $200K from the bank. After a few months, you decide you want to get into the models and bottles game.

There is only one issue. You don't have enough cash and can't take on any more debt. So, how can you acquire cash without taking on extra debt? You can, however, sell a portion of your equity ownership in the property to friends and relatives for cash.

That sounds fine, so you sell 10% of your house to a buddy for $40,000 in cash. Pro forma, or "after the deal," you receive the $40,000 cash in the bank and now own 90% of the house, with your buddy owning 10%.

Investment Banking for Businesses

Companies that do not wish to incur debt might sell stock ownership in return for cash, which they can utilize to support and develop their firm.

However, huge corporations are worth billions of dollars, and few investors have that kind of capital. Like debt financing, several investors are interested in purchasing a tiny portion of the equity ownership.

So investment bankers travel about meeting with various equity investors, who will subscribe to the investment opportunity if they like what they see. This is referred to as equity financing. You're exchanging cash for a portion of your company's stock or ownership.

The firm receives cash, the investors receive a stake in the company, and the bankers receive a fee. The real estate market is doing well a year after you bought the property, and the $500,000 house is now worth $700,000.

You decide to sell the house, so you hire a real estate agent to sell it for you and pay the agency a brokerage fee.

Companies operate in the same manner. A corporation's owners may wish to depart and sell the company for a profit. So they employ an investment banker to look for a buyer for the firm. The investment banker identifies other corporations or private equity firms interested in acquiring the company.

If the buyer and seller can agree on the conditions, they sign an agreement and finish the transaction. This is referred to in finance as mergers and acquisitions (M&A) or the purchasing and selling of firms. When the transaction is completed:

- The seller receives cash

- The buyer buys a firm, and

- The banker receives an M&A fee.

Everyone is content.

Such inquiries are frequently made by ordinary individuals unfamiliar with the financial system. Banking is something that everyone, especially in India, needs to deal with. Everyone in India has a bank account, whether they are

- High-profile business people

- Middle-class folks

- BPL employees

This is because consumers exclusively conduct activities such as making deposits and withdrawing cash for everyday necessities through banks.

Banks are licensed financial entities that accept customer deposits and issue loans. The deposit amount is re-used in banks to produce large sums of money. In addition, they provide:

- Currency exchange

- Asset management

- Safe deposit lockers

- Other financial services

In many aspects, investment banking differs from commercial banking. For example, investment banks assist firms in raising cash and providing financial consulting services.

In other words, investment banks function as middlemen between users and investors, assisting new companies to become public.

Their principal function is to connect those who need money (corporations, SMEs) with those who have money to invest (HNIs, angel investors). They also distribute capital and set prices in these financial transactions.

In this case, financing can be accomplished through underwriting (a process where investment banks raise capital for corporations, governments, etc., in the form of stocks or bonds).

Thus, when you hear about a company going public for the first time and offering its shares to shareholders through an SME-IPO, investment banks are in charge of the whole IPO process.

An investment bank has too many responsibilities when managing an IPO, such as creating and managing a prospectus that includes all the companies and stock details. Handling such complex issues and deciding on a stock price will attract investor attention to raise capital in the company's desired amount.

Setting an initial IPO stock price may be difficult for any investment bank since they must strike a delicate balance to discover an appropriate price that not only offers cash to their customers but also draws the attention of different investors.

- If the stock price is too high, it will not entice investors

- A low price will not give a suitable quantity of funds.

Investment banks provide comparable services to IPOs in the case of bond issues. However, once again, the critical factor is price, which is controlled by the interest rate.

Mergers and Acquisitions (M&A) in Investment Banking

Investment banks also cover mergers and acquisitions in which one company is poised to purchase another. When a business is up for sale, an investment bank determines what one firm is ready to pay for the others based on the company valuation.

Investment banks primarily advise their customers preparing to make an acquisition on the company's valuation and the most advantageous manner of arranging the offer.

Investment banks whose customers are high-quality firms suitable for purchase estimate the company's realistic asking price or worth. The recommendation is on the sale's favorable or unfavorable structures. In acquisitions, cash, stocks, or a combination of both cash and shares are utilized.

Investment bankers are financial consultants who help their customers raise funds by selling stocks or loans.

a) Financial Advisory

Investment banks also offer financial advice to high-level clientele. They typically deal with hedge funds and private equity, and they have access to millions of dollars. Their services included general fund capital raising, IPOs of portfolio firms held by the funds, and more.

b) Management of Risk

Investment banks manage risk by hedging interest rates, foreign currency exchange, and commodities positions via F&O swaps. Swapping is a method through which two parties trade debt obligations to reduce the risk profile.

Because various organizations have different types of debt in the financial market, swapping works. Parties with varying financial demands frequently trade their duty to develop their financial plan.

c) Wealth Management

Institutional investors amass tremendous wealth, which needs money management. Therefore, investment banks compete for assets under management with one another, as well as with commercial banks and specialized money management organizations.

d) Investing Alternatives

Alternative investments made by investment bankers include private equity, real estate, arbitrage, overseas funds, and others. Investment banks are essential in financing and capital allocation for businesses and governments. In addition, they:

- Act as financial consultants to their customers

- Assisting them in allocating resources

- Managing instruments

- Pricing capital

or Want to Sign up with your social account?