Assets Under Management (AUM)

Refers to the total market value of assets managed by an investment advisor or financial institution

What are Assets Under Management (AUM)?

The acronym AUM stands for "Assets Under Management," which refers to the total market value of assets managed by an investment advisor or financial institution, either from one client or many.

'Under management' refers to something that belongs to a client that is being managed on their behalf by another party i.e. by a wealth/fund manager.

In the finance industry, this refers to assets under management or the assets that an investment advisor, wealth manager, or mutual fund manager is employing on behalf of their clients.

The exact definition of AUM varies by the institution; some include bank deposits, mutual funds, and cash in their computation, while others only consider the discretionary funds that investors have given an advisor to trade on their behalf.

AUM keeps fluctuating as the value of the assets managed changes with market performance. Funds with larger AUM tend to be more easily traded.

A fund's management fees (including expenses) are often calculated as a percentage of AUM.

Key Takeaways

- Assets Under Management (AUM) represent the total market value of assets managed by an investment advisor or financial institution, whether for one client or multiple clients.

- AUM indicates assets that belong to clients and are managed on their behalf by a third party, such as a wealth or fund manager.

- Methods for calculating AUM vary among companies, and it can fluctuate daily based on investor money flows, reinvested dividends, capital appreciation, and overall asset performance.

Understanding Assets Under Management (AUM)

This refers to how much money a hedge fund or financial institution manages for its clients, i.e., the sum of the market value for all of the investments managed by a wealth management firm, a venture capital firm, a fund, or a family of funds, a brokerage company, or an individual registered as a portfolio manager or an investment advisor.

AUM can be segregated in many ways and refers to the total assets managed for all clients or specific clients.

AUM also includes the capital that the fund/wealth manager can use to make transactions for one or all clients.

For example, if an investor has $25,000 invested in a mutual fund, those funds become part of the total AUM, i.e. the pool of funds. The fund manager can buy/sell shares using all invested funds following the fund's investment objective without obtaining special permissions.

Within the wealth management industry, some fund managers may have requirements based on AUM, such as a hedge fund. In other words, an investor may require a minimum amount of personal AUM to qualify for a certain type of investment.

Wealth managers want to ensure that their clients can withstand adverse markets without taking too large of a financial blow.

Individual AUM of investors can also determine the type of services the investor will receive from a financial advisor or brokerage company. In some cases, personal AUM may also coincide with an individual's net worth.

Calculating the Assets Under Management (AUM)

Methods for calculating AUM vary among companies. AUM can fluctuate daily as it depends on the flow of investor money in and out of a particular fund.

Other factors like reinvested dividends, capital appreciation, and asset performance will also increase the AUM of a fund. The total firm AUM also increases when new customers and their assets are acquired.

Factors causing decreases in AUM include drops in market value from investment performance losses, fund closures, and a reduction in investor footfall. AUM can be limited to all the investor capital invested across the firm's products, or it can include wealth owned by the investment company executives.

In the US, the Securities and Exchange Commission (SEC) has assets under management that vary among companies. AUM depends on requirements for funds and investment firms in which they must register with the SEC.

The SEC regulates the financial markets and is responsible for ensuring that it functions in a fair and orderly manner. Depending on several factors, the SEC requirement for registration, including the firm's size and location of the firm can range from $25 million to $110 million in AUM.

Why do companies monitor Assets Under Management?

Fund management will monitor this as it relates to investor product flows and investment strategy in determining the company's strength. Investment companies use this as a marketing tool to attract new investors.

AUM can help investors determine the size of a company's operations relative to its competitors. It may also be an essential consideration for the calculation of fees.

Also, many managers and financial advisors charge their clients a percentage of their total assets under management. This percentage declines as the Assets Under Management increases; in this way, these financial professionals can attract high-wealth investors.

Why Assets Under Management Are Calculated?

The total value of AUM is a key performance indicator of success and a measure of the size of a financial institution, as a larger AUM generally translates into more significant revenue in the form of management fees.

That is why financial institutions look at the value of AUM and compare it to competitors and their history to assess business trends.

Moreover, the value of AUM may determine whether an institution must comply with specific regulations. Investment advisors that oversee more than $25 million in AUM must register with the Securities and Exchange Commission (SEC).

The way investors or institutions calculate this can differ slightly. Some banks may include mutual funds, deposits and cash and their calculations.

Other institutions only consider the funds the institution can use to trade on behalf of the clients under discretionary management.

How Do assets under management change over time?

The number of assets under management changes due to the:

-

The dividends paid by the companies in the institution's portfolio, if reinvested and not distributed.

-

Inflows/outflows of funds. For example, an investor in a mutual fund can change the total size of the fund's AUM simply by increasing or reducing the size of their investment by selling the ones they already own or buying additional shares in the fund.

-

Value of the securities invested in. For example, when the market value of its securities increases/decreases, a mutual fund will experience an increase/decrease in AUM.

The asset's value under management changes continuously due to the factors above.

The factors above mentioned also help determine how fast AUM changes.

For example, other conditions held equal are:

-

A fund that invests in low-volatility, stable securities will experience lesser fluctuations in AUM than a fund that invests in volatile securities.

-

A fund with a stable and committed investor base will demonstrate lesser volatility in its AUM than a fund with frequent inflows and outflows.

However, the volatility in AUM can also depend on whether the securities owned are liquid or how often they are marked to market.

-

For example, extremely illiquid securities may not trade as often as liquid assets, and the impact of it on the AUM may not be as frequent.

-

Private securities may not be marked to market very often, which results in the value of AUM not changing as frequently as it does with a traded security.

The volatility of assets under management (AUM) and investor money

A fund with frequent and significant inflows and outflows will experience more volatility in AUM. This will hinder effective investing strategies, especially when targeted investments are illiquid.

To avoid the potential risk of damage from frequent inflows and outflows, institutions such as hedge funds or mutual funds can rely on some partial solutions:

-

Closing the fund permanently or temporarily to investors so that additional money can't flow in.

-

Lock-up periods generally range between a few months and a few years, during which withdrawing funds is impossible.

The measures mentioned above are helpful because:

-

They help the institution avoid forced selling or buying securities in illiquid markets, which in this case will be problematic.

-

They help avoid excessive growth in AUM that could lead to allocation problems. It is often difficult to invest and manage large amounts of money effectively, primarily if the fund aims for outperformance vs benchmarks.

If the volatility is under control, the manager can pursue its investment strategy without having to increase/decrease its positions due to inflows and outflows.

Assets Under Management as a Measure of Success

Whether dealing with asset managers, banks, insurance companies, or other financial institutions, the size of a company's AUM measures its success as it is generally correlated with other KPIs.

-

A larger AUM means higher revenue if ROA is constant or doesn't change significantly.

-

AUM size is also a measure of prestige for the management and its institution, as they are usually ranked based on this metric.

-

Compensation and bonus packages of the management often depend on the size of its Assets Under Management.

Assets Under Management and Fund Performance

For asset managers who invest with target outperformance vs benchmarks and an active style, excessive growth in AUM can be a negative factor.

-

Extensively large amounts of money can be challenging to allocate without impacting the price of the securities bought and sold promptly.

-

Asset managers usually need to increase diversification due to more significant amounts of money flowing in, which can produce an opposite result than the goal of achieving a significant outperformance vs benchmarks.

The biggest asset managers in the world

The following is a list of the top 10 asset managers in the world (as of 2022), ranked by total assets under management:

| Rank | Firm/company | Country | AUM (billion USD) |

|---|---|---|---|

| 1 | BlackRock | United States | 9,570 |

| 2 | Charles Schwab | United States | 8,140 |

| 3 | Vanguard Group | United States | 8,100 |

| 4 | UBS | United States | 4,380 |

| 5 | Fidelity Investments | United States | 4,283 |

| 6 | State Street Global Advisors | United States | 4,020 |

| 7 | Morgan Stanley | United States | 3,230 |

| 8 | JPMorgan Chase | United States | 2,960 |

| 9 | Allianz | United States | 2,760 |

| 10 | Capital Group | United States | 2,700 |

FUN FACT

The AUM of these asset management firms are so huge that if compared with the GDP of countries in the world, BlackRock would be the third-largest country, followed by Charles Schwab and Vanguard Group as the fourth and fifth largest, respectively.

Examples

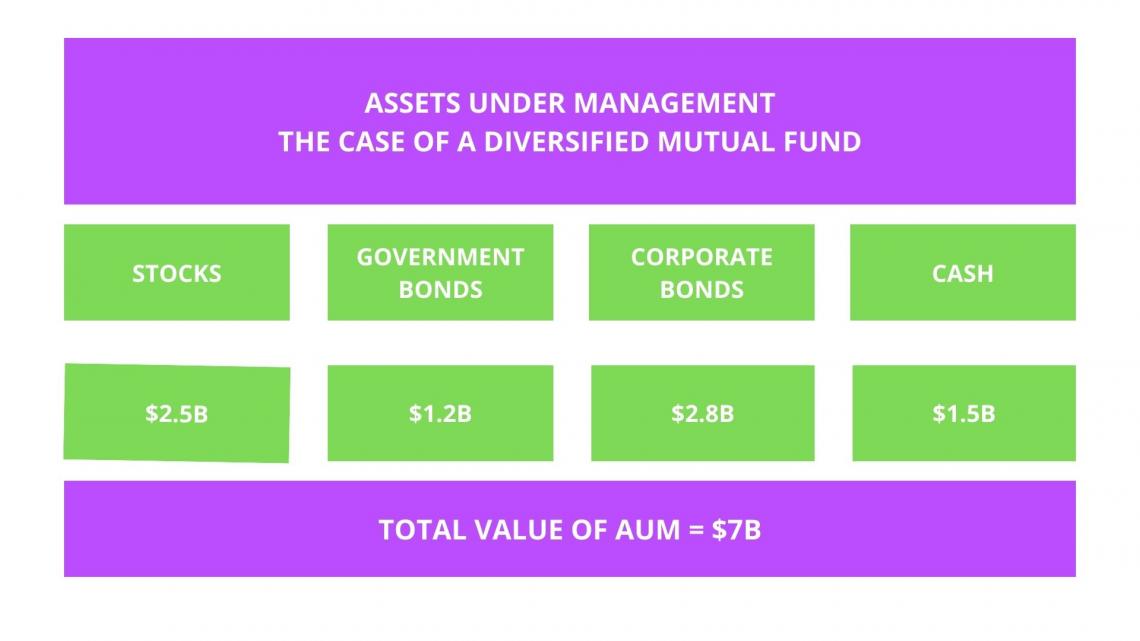

Let’s take the example of a mutual fund with a diversified portfolio of stocks and bonds and a significant cash position. Let’s suppose that the mutual fund’s portfolio consists of $2.5B in stocks, $1.2B in government bonds, $2.8B in corporate bonds, and $1.5B in cash.

The total value of the fund’s AUM will be $7B.

Assets Under Management (AUM) FAQs

Fund Managers may charge a percentage of the total Assets Under Management that they manage for a client, usually around 1 percent.

Before selecting a wealth management firm, thoroughly research the required minimum of investable assets, services offered, fees, disciplinary history, and experience.

Net Asset Value (NAV) is the total value of assets less all the liabilities of a fund, such as an ETF or a mutual fund, often shown on a per-share basis.

NAV shows what price shares in a fund can be bought and sold. Asset Under Management refers to the value of assets managed by an individual or firm.

Unlike NAV, AUM refers to the total value of managed assets rather than expressed on a per-share basis.

The calculation used is not always consistent between companies to determine total AUM. Some may only count discretionary funds, meaning those that investors give for investment purposes, while other institutions also count bank deposits and more.

Researched and authored by Rohan Kumar Singh | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?