Portfolio Manager

A financial professional who is responsible for managing investment portfolios and making investment decisions to achieve clients' objectives.

What is a Portfolio Manager?

A portfolio manager (PM) is a person who manages a financial portfolio of an individual, business, or organization. They typically do this by planning and executing investment strategies, managing investments, and monitoring portfolio performance.

PMs must have a robust knowledge of financial markets and accounting. In addition, they typically have a deep understanding of various types of securities and how to value them.

A PM must also have a good understanding of risk management. They manage multiple portfolios for clients with varying risk tolerance levels and must tailor to their needs and desires.

This makes the role all the more challenging because someone in this position needs to be able to generate earnings and not take on too much risk, depending on the client.

The role is not an entry-level job and usually requires a fair amount of professional experience before one is able to land this role.

Usually, PMs start their careers as research analysts and move up the ranks as they prove themselves, although there is no singular path to achieve this position.

A PM usually has a Bachelor’s degree in economics, finance, or a related field and is quite adept at math and analytics. While it is not required, a person in this position may pursue a Master’s degree or other relevant certifications.

This job can be a lot of work but can also be very rewarding. It has moderately long hours and has the potential to be paid very well.

For a candidate who enjoys doing a great deal of research both on the macro and micro level and enjoys analyzing various types of investments to create profitable portfolios with varying degrees of risk, this job may be the right choice.

Key Takeaways

- Portfolio managers oversee investment portfolios, requiring expertise in financial markets and risk management

- To become a portfolio manager, you need experience and a degree in finance or a related field. Additional certifications like CFA can be beneficial

- PMs make asset allocation decisions, analyze securities, and balance risk and return using financial models and ratios

- Strong skills in finance, economics, and accounting are crucial for portfolio management

- A PM's day involves reviewing portfolios, researching, meeting with clients, and making investment decisions. The job offers high earnings and career growth potential

What does a Portfolio Manager do?

Portfolio managers are responsible for creating and managing investment portfolios for various clients.

They work in most financial institutions with a buy-side section such as:

Typically, this role is not an entry-level position and requires significant professional experience and a strong command of financial markets.

While a PM should have a great deal of knowledge surrounding financial markets and in creating financial models, much of the work regarding the actual creation of models may be left to analysts. PMs typically need to sift through a great deal of research and information.

It is often an analyst’s job to make this information digestible and in a format that makes the information relevant to the PM.

Typically PMs work about 50 - 60 hours per week and sometimes more, which can be a long work week but is only slightly above average if not average for finance jobs. However, they also get paid a substantial salary, with the average PM being paid close to $100k, and those that are CFA charterholders getting paid an average of $177k.

How to Become a Portfolio Manager?

To become a portfolio manager, you must have a Bachelor’s degree in:

- Finance

- Economics

- Any other related field.

This is also not an entry-level position and requires a substantial amount of professional experience.

Typically, PMs start in research analyst positions and work their way up the ladder over the course of multiple years. You should have a minimum of five years of experience in the financial industry. If you are interested in managing an institutional clientele, this requirement is a little higher.

For example, to become an institutional PM with JP Morgan Chase & Co., you would need at least 10 years of experience, among other requirements.

In addition to experience, many PMs possess a Masters in Business Administration (MBA). While this is not strictly necessary, many in this field possess this qualification, and employers may be looking for candidates that have an MBA.

PMs may also pursue other certifications such as the Chartered Financial Analyst (CFA) accreditation. This certification is considered among the top qualifications for a PM, as the exam is mainly focused on portfolio management and is notoriously difficult.

The majority of CFA charterholders work in PM roles. In addition, many pursue a Chartered Alternative Investment Analyst (CAIA) designation, as it can signify an understanding of many different kinds of investments and can show competence in alternative investment strategies.

Finally, it is common to pursue a Certified Financial Planner (CFP) designation, as it demonstrates knowledge about organizing portfolios and assisting clients with their portfolios, especially for individual clients.

To start building your PM skillset, it’s essential to understand what the job entails to apply yourself in the most effective way possible. There is no one-size-fits-all approach when it comes to becoming a PM; there are many different approaches that could land a candidate in this position.

There are some basics you need to learn before embarking on this career path. First, a PM should possess strong knowledge of both macro trends and accounting and the trading of various types of securities.

Often PM roles can lead to larger management roles such as:

- Managing Director (MD)

- Head of portfolio management

- Chief Investment Officer (CIO).

Understanding a Portfolio Manager's Role

Portfolio managers make the decisions regarding the organization of various client portfolios, deciding on the allocation of capital among different asset classes, and choosing which securities to buy and sell and when.

They receive help from some analysts and other positions, usually working in a team that provides relevant research surrounding individual securities and the market as a whole so that they can make quick and well-informed decisions throughout the day.

Every portfolio is managed differently depending on the investment strategy, such as:

- Growth Investing

- Value Investing

- Level of risk the portfolio maintains

- The turnover rate of the portfolio

- Whether a portfolio is meant to track an index or beat the market.

These factors can impact the relevant information the PM needs and how they make their decisions.

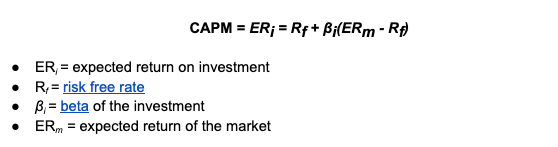

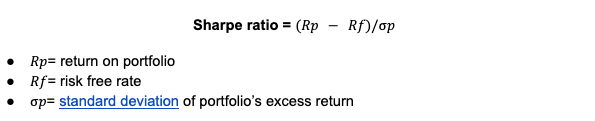

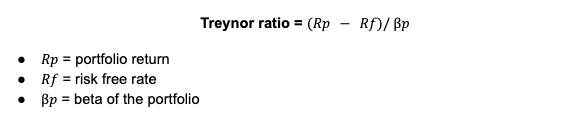

A PM uses a number of different equations and ratios to make decisions regarding the portfolio and what assets to purchase and sell. Still, they may look to:

- Capital asset pricing model (CAPM)

- Sharpe ratio

- Treynor ratio

- Information ratio

to balance levels of risk and return.

This formula is meant to produce an expected return on an asset based on the expected market return and the risk-free rate and considers the time value of money and other risks assumed. While this is a useful formula, it should be used in conjunction with other valuation formulas.

This formula aims to calculate risk-adjusted return so that a PM has some idea of how much risk is being created to generate revenue. The goal is to create a portfolio with high returns without overburdening it with risk.

The Treynor ratio measures the risk-adjusted return on a portfolio just as the Sharpe ratio does. Instead of using the portfolio’s standard deviation, uses the beta of the portfolio.

The information ratio is yet another method of calculating risk-adjusted returns, but instead of comparing portfolio returns to a risk-free rate, it compares the returns to a benchmark such as an index return or perhaps an arbitrary goal.

Also, instead of using the beta or standard deviation of a portfolio, it uses tracking error, the standard deviation of the difference between the benchmark and portfolio.

PM use many more equations and a much greater deal of analysis to measure volatility and risk and to calculate future returns. However, these are very common equations used to help balance risk and returns on a portfolio.

Essential Skills for Portfolio Management

A portfolio manager must be able to do macro analysis and value different types of securities.

It requires knowledge of the daily changes in the economy and how they can affect one’s portfolio. In addition, this requires a great deal of knowledge surrounding different types of securities and a comprehensive knowledge of accounting so that they are able to value various companies and forecast the future profitability of operations.

A PM must also be able to navigate risk levels. This position includes managing investment portfolios for clients with different risk tolerances. As such, they need to be able to quantify certain levels of risk and put together portfolios that are carefully allocated to create risk tailored to the client while still maintaining high profitability.

To be a successful PM, it is crucial for an individual to have strong skills in finance and economics. They must also be able to work with many different types of investors in various market conditions.

Other responsibilities that can fall on a PM are ensuring compliance with regulations and tax obligations and administering the sale of assets.

Individual PMs serve to satisfy the earning goals of their clientele. They typically do this by:

- Planning and executing investment strategies

- Managing investments

- Monitoring portfolio performance.

Day in the Life of a Portfolio Manager

Not every day in the life of a portfolio manager is exactly the same. They often have different responsibilities that are prioritized on different days. However, much of the work remains relatively similar day to day, and below is a detailed description of what a day in the life of a PM may look like.

7:30 AM - The workday usually starts around 9:00 AM, although some may start their day early to read the news, catch up on major events and market trends, and grab a much-needed coffee cup before heading into the office.

9:00 AM - Once in the office, it is time to review portfolios and performance and catch up on more news. Usually, they check their holdings and read the news and other research throughout the day, although some time is reserved explicitly for this critical responsibility.

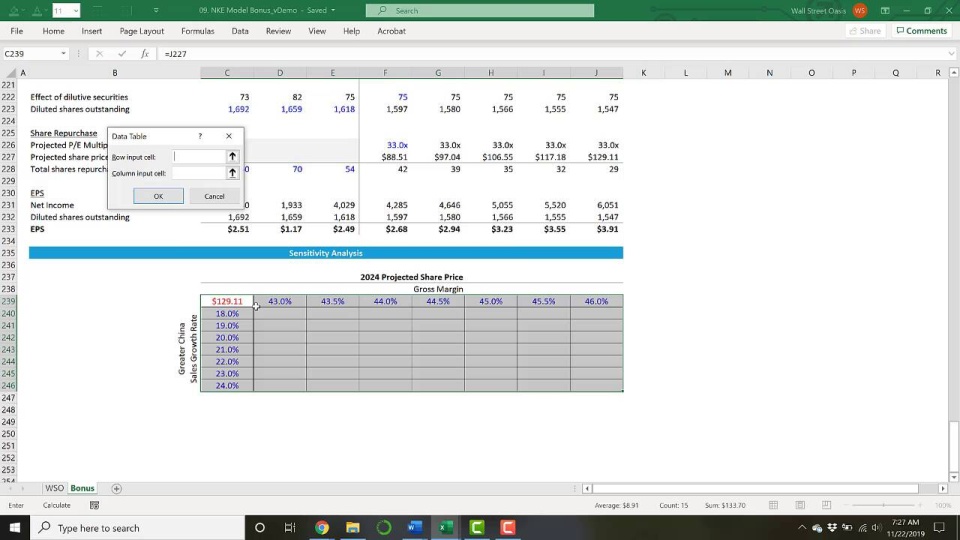

For example, they may run sensitivity analysis and update financial models to see what current forecasts look like, or they may ask an analyst to handle this responsibility and study the results.

Check out the video below from our Financial Statement Modeling Course to learn more about sensitivity analysis.

10:30 AM - They spend a significant portion of their day checking and responding to emails. This, again, is something that will happen throughout the day, but it is a responsibility that makes up a substantial part of the day, so it is worth noting here.

11:30 AM - Usually, they will have a meeting with their team to discuss news about the market and their holdings and go over research regarding forecasts and different securities. This also maybe when they hand out responsibilities to the team to work on.

12:30 PM - Even PMs have to eat. So around midday, it’s time for a half-hour lunch before getting back to work.

1:00 PM - They usually have many meetings throughout the day with clients to discuss financial planning and the current performance of the client’s investment portfolio.

They will also go through research and market happenings and keep the client informed overall to be satisfied with the way their money is being managed. This usually takes up a large portion of the day.

4:00 PM - They often think long-term and rarely change every portfolio every day. However, if they come to the conclusion that they should buy or sell an investment, they will set aside time to do so.

5:00 PM - They might take the time to work on a long-term project or work on whatever they feel deserves the most attention that day. This also may be time to meet with more clients, check the news, research the market and industry trends, read an analysis of current holdings, and answer more emails.

7:00 PM - This is about when the workday wraps up. Usually, most of the work is finished, and they can head home, although they may want to keep their phone with them if they need to be reached by their team or a manager.

Of course, daily operations depend on the day, and in many cases, a PM needs to wake up earlier and stay in the office later to complete all their responsibilities. On other days they may be able to leave earlier. They also may take a few hours during the weekend to read the news and stay up to date.

Regardless, this should give a brief look at how they allocate their time and responsibilities and what their priorities are on any given day.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?