Hedge Fund Manager

The person in charge of running a hedge fund

What Is A Hedge Fund Manager?

A hedge fund (HF) manager is a person who manages a large pool of funds, using a wide range of investment strategies and investing in many types of securities to generate returns for investors.

Hedge funds are large investment vehicles only available to very wealthy individuals and are considered a risky investment. They usually have large fees and promise large returns to their investors; however, they usually require that money be invested for at least one year.

Nevertheless, hedge funds have become very popular over time due to the large earnings they can generate and the diversified strategies they use.

HF managers are responsible for managing these funds, with a range of responsibilities, including:

- Overseeing a large team of talented employees

- Making crucial investment decisions

- Managing portfolios and defining the firm's investment strategy

- Meeting with investors to discuss their investment strategy

- Addressing any inquiries or concerns pertaining to their investments

Key Takeaways

- Hedge fund managers handle a large pool of funds and use diverse investment strategies to generate returns for investors.

- They require a competitive educational background, often with a finance-related degree and relevant certifications.

- Hedge funds use complex trading strategies and risk management techniques to achieve higher returns.

- Managers must regularly meet with investors, present strategies, and address concerns.

- Examples of successful hedge fund managers include Benjamin Graham, Jim Simons, and Ray Dalio.

Understanding Hedge Fund Manager

Being a manager of a hedge fund is a very prominent role that requires a large amount of knowledge and professional ability.

Usually, a person in this role has proven themselves to be extremely capable within finance, boasting numerous academic achievements and a great deal of prior professional experience.

This position is also very competitive as they generally are paid large salaries and bonuses. However, it varies highly depending on the size and performance of the hedge fund in any given year.

A large portion of profits is taken from how much the hedge fund can generate in earnings for its investors, so the most money is made at highly successful hedge funds, which is extremely dependent on the capabilities of its manager.

Please refer to our free Hedge Fund Pay Guide article to know more about hedge fund compensation.

What is a Hedge Fund?

A hedge fund is an investment vehicle that pools money from investors and invests using different complex trading strategies.

They were originally advertised as investment vehicles that “hedged” investments, meaning that they made investment decisions to minimize risk. However, in recent times, they have evolved to be considered risky alternative investments.

They use “alternative” strategies and leverage to generate higher rates of return than traditional investment options, investing in many different kinds of securities. Hedge funds have very little external regulation; however, they may follow the rules created internally by themselves.

In many cases, they put a certain amount of funds into bonds or other less risky securities to minimize their exposure to risky investments and fluctuations in the market. Over time they have become increasingly popular due to their promises of high annualized returns.

In 2021 hedge funds had a combined $3.8 trillion in assets under management, with the number of hedge funds growing by about 2.5% per year.

Investors in a hedge fund are usually high net worth individuals or institutional investors like universities and pension funds. In most cases, hedge funds require that the investor’s net worth meets a minimum threshold.

The 1933 Securities Act limits hedge funds to raising money only from accredited individuals: those with a net worth of at least $1 million or those making $200,000 annually and expected to make similar salaries in the future.

Hedge funds are allowed to include up to 35 non-accredited individuals, which is usually reserved for the manager’s family and friends.

They usually invest in many liquid assets; however, they are fairly illiquid for investors. In many cases, they require that investors keep their money locked in for at least one year. In addition, hedge funds typically follow a “two and twenty” model for fees, meaning that they charge 2% on all assets under management, as well as 20% on any profits.

Some hedge funds include a hurdle, where performance fees are only applied to portfolios that meet the fund’s benchmark returns. For an example of a two and twenty fee structure, check out the video below from our free venture capital video series.

Hedge funds are not without their own share of criticism. Many have been upset over the exorbitant fees that hedge funds charge, claiming that the price does not justify their performance.

Warren Buffet is among this crowd and put his money where his mouth is in 2007, betting $1 million that an index fund would outperform a basket of hedge funds over the next decade.

He understood that a hedge fund can make large gains in any one year but that the speculative assets they invest in are sure to create a high amount of volatility in earnings, meaning that high earnings come with high losses as well, creating a not-so-spectacular average over time.

Unfortunately, Protégé Partners LLC accepted this challenge and ended up losing the bet with the founder Ted Seides stepping down from the hedge fund two years before the bet was finished, admitting that “for all intents and purposes, the game is over. I lost.”

How to Become a Hedge Fund Manager?

The role of managing a hedge fund is a highly sought-after position and not easy land. A person looking to be such a manager has a lot of competition and usually has a lot of credentials and has proven themselves as a savvy investor.

Most managers earn bachelor’s degrees in finance, economics, or other related fields. In many cases, they graduate from top universities and go on to pursue a Masters of Business Administration (MBA) from top business schools such as Wharton or Harvard Business School.

There is no shortage of credentials that highlight a higher education in finance that a candidate can pursue. Although it is not required, these certifications can increase a candidate’s chances of landing the role. Included in these are:

- Chartered Financial Analyst (CFA)

- Chartered Alternative Investment Analyst (CAIA)

- Certificate in Hedge Fund Regulation (CHFR)

- Registered Investment Advisor (RIA)

- Certified Treasury Professional (CTP)

Beyond credentials, a manager is required to be well-experienced. In most cases, they work in other roles within finance before leaping to hedge funds. Seeking prior management experience can help demonstrate leadership qualities and prove oneself in a very intensive work environment before moving up.

Some entry-level roles include:

- Analyst in investment banking

- Risk managers

- Traders

- Research analysts in finance

In many cases, after completing some of the jobs above, a candidate will join a hedge fund and work up the ladder until they can apply for a manager role at another hedge fund or are offered the opportunity to manage that hedge fund.

To be eligible for this coveted position, a candidate should be prepared to put in a lot of hard work and time to possess the right education, professional experience, certifications, and a successful track record.

Please have a look at our free 40 Hedge Funds Interview Questions with Sample Answers Guide for more insights on cracking hedge fund interviews.

What Do Hedge Fund Managers Do?

Hedge fund managers have a lot of responsibilities, as they hold a powerful position that strongly affects the performance of a hedge fund. In many cases, they are the fund’s owner and therefore have a great deal of responsibility and autonomy in making decisions.

The manager is the individual responsible for running the funds, which means they need to decide where to invest. They are also responsible for managing risk and setting risk limits; this means they keep an eye on the fund’s exposure to different securities, currencies, and interest rates.

They are also responsible for several tasks that involve making decisions about allocating funds and arranging portfolios.

They may use software to create complex financial models and often employ many portfolio managers to create financial models that they can then analyze and make decisions based on. In many cases, they will manage a large number of employees, including portfolio managers that report back to them.

They should make sure to keep up with current events that could impact the economy and news and financial reports about various companies that the fund is concerned with.

They are also responsible for meeting with various investors, discussing their investment strategies, addressing any concerns that investors have, and pitching to raise funds from them.

Lastly, the hedge fund manager will have to comply with regulations governing their securities trade.

It can be extremely lucrative to be a hedge fund manager, as most in this role generally own the hedge fund. This means taking a large share of the profits after paying salaries and other expenses, although the pay can vary significantly.

The highest-paid hedge fund manager of 2020 was able to rake in $3.8 billion, with a fund that created returns of 26%; however, the median salary was about $124,000. One can usually expect to make between $300,000 to $3 million as a junior manager at a reputable hedge fund, with that number growing to $10 million as a senior manager.

Examples of Hedge Fund Managers

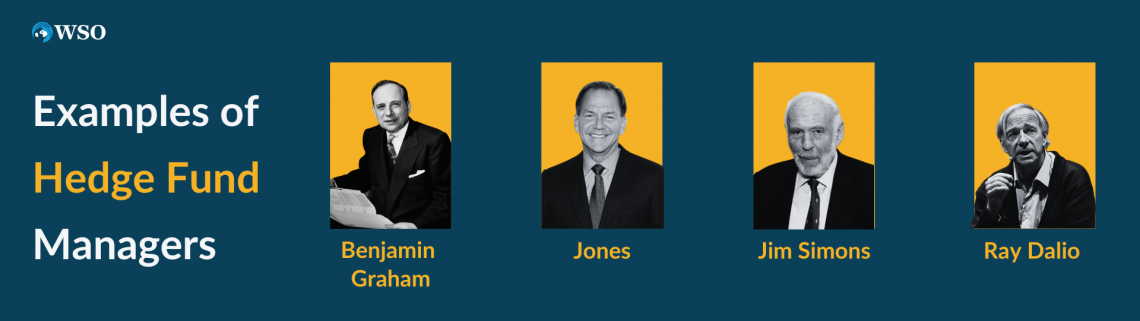

Some consider the Graham-Newman Partnership to be the first hedge fund, making Benjamin Graham and Jerry Newman the two first hedge fund managers.

1) Benjamin Graham

He is the author of The Intelligent Investor, an acclaimed book about investing, and is considered the “father of value investing.”

The term “hedge fund” was originally coined by Alfred W. Jones when he managed an investment firm that he advertised as a hedged fund, meaning that it was careful to avoid risks in the market by investing in hedges, or less risky investments, in combination with riskier investments.

2) Jones

Jones's strategy was to use leverage to buy shares and sell short other shares in a combination that would eliminate the effects of market-wide movements, a strategy known as long/short equity.

3) Jim Simons

He is the wealthiest hedge fund manager, with a net worth of $24.4 billion and a place at #28 on the Forbes 400 list. Jim Simons earned a bachelor’s degree in mathematics from MIT before pursuing a Ph.D. in mathematics from UC Berkeley.

For more than two decades, he was the hedge fund manager for Renaissance Technologies, managing multiple hedge funds that make trades mostly based on computer algorithms and mathematical models.

Renaissance is known for hiring many people with backgrounds outside of finance, such as mathematicians, physicists, and statisticians. It has three hedge funds; however, its highest-performing one is closed to outside investors and is only available to some employees, boasting an average net return of 39.1% annually from 1988 - 2018.

4) Ray Dalio

He is the second wealthiest hedge fund manager with a net worth of $20 billion and a place at #36 on the Forbes 400 list. In addition, he is considered one of the largest innovators in finance for having popularized many investing strategies.

He attended C.W. Post College with little academic achievement but quickly found a passion for stocks, particularly commodity futures.

After earning his bachelor’s degree, he pursued an MBA at Harvard Business School, two years after which he launched Bridgewater Associates. He managed it until stepping down in 2017.

It currently has $154 billion in assets under management and is one of the largest hedge funds globally, and at times was the biggest in the world.

Bridgewater Associates lost money only three times between 1991 and 2005, and never more than 4%; in the same time, the S&P 500 lost money three times as well, losing 22.1% in 2002.

Free Resources

To help you advance your career, check out the additional resources below:

or Want to Sign up with your social account?