Liquidity

It is a company's ability to raise cash once they need it.

What Is Liquidity?

Liquidity is a company's ability to raise cash once they need it. In finance, it refers to the ability of a security or asset to be converted into cash at the current market value. It reflects how rapidly a company can purchase or sell securities/assets to get cash.

The ability of a business to turn assets into cash without affecting its market price is a crucial process.

It helps get the company through tough financial times, get credit, and pay off debts quickly, so it is essential for businesses to have liquid and non-liquid assets.

Liquid Assets

A liquid asset can quickly turn into cash without losing its market value. There are other things that change the liquidity rate of an asset, including:

- How long has the market been operating

- How easily can ownership of assets be transferred

- The amount of time an asset takes to be sold (liquidated)

The most liquid type of asset is cash on hand, followed by funds that may be withdrawable from bank accounts. If your business needs cash, you can access one of your bank account funds without converting them.

Stocks are an example of liquid assets. The stock market was established with numerous buyers and sellers. A stock can be liquidated in a few days, and it is less liquid than cash as it could take longer than cash to get the needed funds.

Other liquid assets include bonds, mutual funds, and money market funds.

These assets are easily liquidated and low-risk investments that ensure you get your money back once you need it without losing its market value.

Illiquid Assets

Non-liquid assets are not easily liquidated as they need to be sold, and ownership needs to be transferred to access the cash value. The non-liquid assets can be land, real estate, vehicles, and equipment.

Selling land is difficult as it takes time to find a buyer who agrees to pay market value and then transfer ownership to the buyer. Typically, illiquid assets are acquired through capital expenditures and decline throughout their several-year lifespan.

Some assets are not helpful, as you get penalized once you withdraw your money early. You agree to a term duration when you open a certificate of deposit (CD); if you withdraw funds early, you will get a penalty.

Key Takeaways

- Liquidity is the ability of securities and assets to be converted into cash without affecting their market value.

- It's vital for businesses to have liquid and non-liquid assets since it helps get them through tough financial times and pay off debts quickly.

- Liquid assets can quickly turn into cash without losing market value. In contrast, non-liquid assets are not easily liquidated as they need to be sold and transferred into ownership to access their cash value.

- There are four main types:

- Market

- Accounting

- Risk

- Liquid Capital

- Short-term liquidity and debt capacity show the financial health of a business and its ability to satisfy its financial obligations.

- Short-term liquidity refers to a company's ability to turn its assets into cash, and it is calculated by different ratios, including:

- Working capital ratio

- Test-acid ratio (quick ratio)

- Debt capacity refers to a company's ability to raise cash through new debts and its capacity to pay old debts. It calculates by using different formulas, including:

- Debt service coverage ratio

- Debt-to-asset ratio

What Are Liquidity Measures?

The ease of converting assets and securities into cash without affecting their market value is divided into four types.

The four main types include the following.

Market

This refers to the ability of individuals or companies to quickly buy or sell an asset without causing a significant shift in the price of that specific asset.

Speculators and market makers are the most critical contributors that make a market or asset liquid. Speculators are people or organizations that try to make money by expecting whether a market price will go up or down.

Market makers try to make money by charging for quick execution by making a bid/ask spread or by charging direct execution commissions. They provide the capital required to facilitate liquidity by doing so.

Accounting

A company can pay off its short-term liabilities, or those due in less than a year. It is typically presented as a ratio or a percentage that compares the amount the company owes to the amount it owns.

Liquid Capital

The company's liquid capital is the portion of a company's total assets that can easily be converted into cash. It includes cash on hand, deposits in financial institutions, and investments in money markets.

Since these assets generate income slowly, companies look for opportunities to invest in them that enable them to get a higher return on investment (ROI) to maximize their profits.

Risk

It is referred to as the possibility of suffering financial losses as a direct consequence of the inability to fulfill payment obligations when they become due.

This risk arises when an individual is interested in trading an asset but cannot do so because nobody wants to trade for that asset in the market.

This risk is especially important for an investor who is about to buy or is already holding an asset, as it affects their ability to trade.

What Is Short-term Liquidity

Short-term liquidity refers to a company's capacity to turn its assets into cash to satisfy its short-term obligations.

This can be calculated through different ratios, including the following.

Working Capital

Working capital is the amount of cash and other assets a business has after all its current debts have been paid.

It is the way that helps you figure out a company's short-term liquidity or how well it can pay its payments as they come due.

It is an important metric as it gives a clear picture of the available amount of money on hand to maintain sufficient work to cover all your obligations and have a chance to grow the business.

Working capital is the difference between current assets and current liabilities.

Working capital = Current assets - Current liabilities

Businesses can assess their working capital ratio, which indicates how much current liabilities can be paid off with the current assets. The working capital ratio is the current assets divided by the current liabilities.

Working capital ratio = Current assets / Current liabilities

Although the best working capital ratio might vary from industry to industry, most corporations seek a ratio between $1.50 and $1.75 of working capital for every $1 of current liabilities.

Example

Company Z has the following:

- Cash = $90,000

- Inventory = $250,000

- Accounts receivable = $70,000

While its expenses include the following:

- Wages Payable = $40,000

- Utilities Payable = $15,000

- Taxes Payable = $20,000

- Debt due within a year = 80,000

Compute the working capital of the company and determine the financial health of the company. First, calculate the current assets:

Current Assets = Cash + Inventory + Accounts Receivables

Current Assets = $90,000 + $250,000 + $70,000

Current Assets = $410,000

Second, calculate the current liabilities:

Current Liabilities = Wages Payable + Utilities Payable + Taxes Payable + Debt

Current Liabilities = $40,000 + $15,000 + $20,000 + 80,000

Current Liabilities = $155,000

Using the above two, we can now calculate working capital:

Working Capital = Current Assets - Current Liabilities

Working capital = $410,000 - $155,000

Working Capital = $255,000

Hence, Company Z is left with $255,000, which means it has enough money to expand its operations for the coming year.

Working Capital ratio = Current Assets / Current Liabilities

Working Capital Ratio = $410,000 / $155,000

Working Capital Ratio = 2.65

The company has a ratio of $2.65 of working capital for every $1 of current liabilities. It is an excellent ratio but needs to be compared with the industry average to get a clearer picture of the company’s working capital management.

Acid-Test Ratio (Quick Ratio)

The acid-test ratio compares a company's quick assets to its current liabilities. It is one of six computations used to estimate short-term liquidity, or a company's capacity to pay its debts when they become due.

Unlike the current ratio, which includes inventory, the quick ratio provides a more cautious evaluation of a firm's liquidity position because it excludes inventory.

The quick ratio can be found by dividing liquid assets by current liabilities. A normal liquid ratio is 1:1, where a company with a quick ratio of less than one cannot fully repay its current liabilities.

Quick ratio = Liquid Assets / Current Liabilities

Where,

Liquid Assets = Current Assets - Inventories - Prepaid Expenses

OR

Liquid Assets = Cash + Cash Equivalents + Marketable Securities + Accounts Receivable

Example

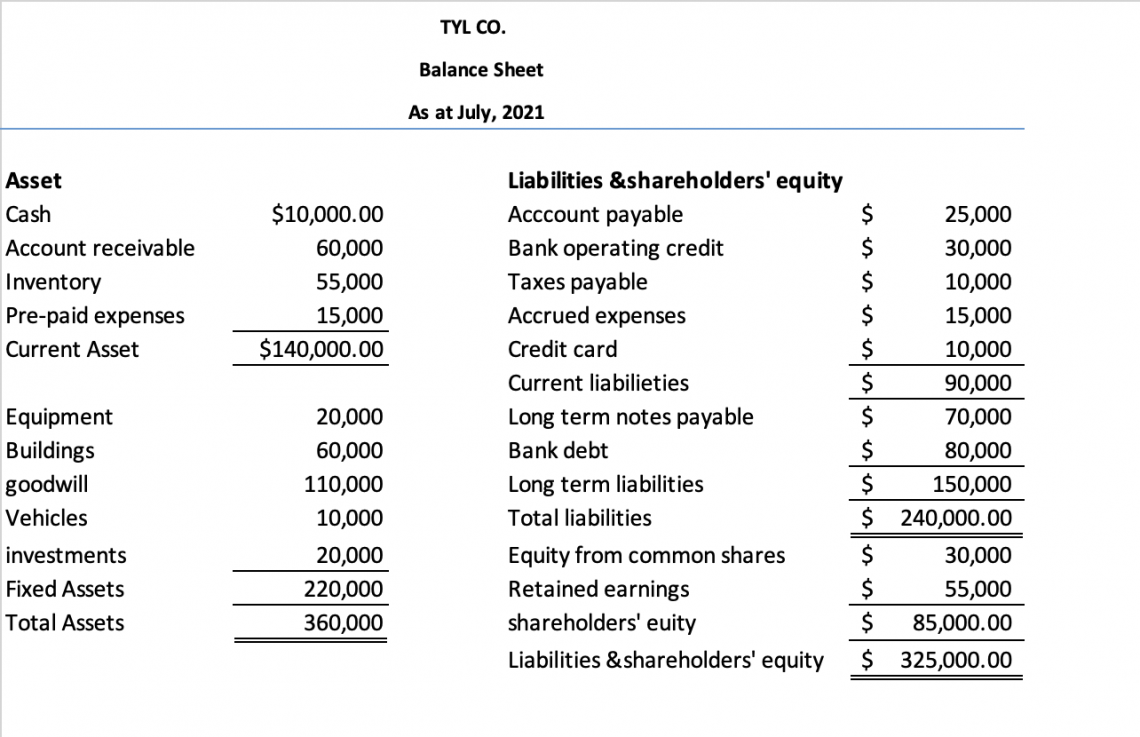

Compute the acid-test ratio for the TYL company.

Based on TYL’s balance sheet,

Acid Test = Liquid Assets / Current Liabilities

Acid test= $140,000 / $90,000

Acid test = 1.56

Hence, TYL can fully pay its current liabilities as its test acid ratio is more than one. If the company has a test ratio of less than one, it will not be fully able to pay its liabilities.

What Is Debt Capacity

The debt capacity is the ability of a company to incur and repay its debts. Debt capacity can be calculated through different ratios, including the following:

Debt Service Coverage Ratio (DSCR)

The debt service coverage ratio determines whether a corporation can meet its debt obligations on time. This ratio measures the amount of money a company makes for every dollar it owes in principal and interest.

In other words, it determines a company’s ability to generate cash to cover its debt. The company can easily acquire loans once it gets an excellent debt service coverage ratio, and it can struggle to obtain loans if its ratio decreases.

DSCR is calculated by dividing a company’s net operating income (NOI) by all outstanding debt payments of interest and principal (debt service).

DSCR = Net Operating Income / Debt Service

Net operating income is the difference between a company’s revenue and its current expenses. Debt service is the current debt obligations, including principal repayment, interest, and lease payments.

NOI = Gross Operating Revenue - Operating Expenses

Debt Service= Principal Repayment + Interest Payments + Lease Payments

Example

Suppose Company Z is willing to get a loan. The CEO wants to calculate the DSCR to determine the ability of the company to borrow and pay off their loan as they come due.

The CEO states that net operating income will be $3,000,000 annually, and the lender notes that debt service will be $500,000 annually. What is the DSCR for Company Z?

DSCR = Net operating income / Debt service

DSCR = $3,000,000 / $500,000

DSCR = 6

The company can cover six times its debt obligations compared to its operating income.

Debt-To-Asset Ratio

The debt-to-total assets ratio compares the number of a company's assets that its shareholders own to the number of a company's assets that its creditors own.

It is primarily employed to evaluate a company's capacity to generate cash from a new debt of other businesses in the same industry. The higher the debt-to-asset ratio, the harder it is for the company to raise some money through new loans due to its high leverage rate.

Companies with a high debt-to-asset ratio are more likely to miss debt payments if their revenues decrease, and it is more difficult for them to borrow new loans.

The debt-to-total assets ratio of a firm is determined by dividing the total debt of the company by the total assets of the company.

Debt-to-total assets ratio = Total debt / Total assets

Where,

Total debt = Short-term debt + Long-term debt

Example

Suppose Company Z provides its balance sheet with the following information:

- Total assets = $250,000

- Long-term debt = $5,000

- Short-term debt = $4,000

- Operating lease liabilities = $9,000

What is the total-to-asset ratio of the company? First, calculate the total debt:

Total debt = Short-term debt + Long-term debt

Total debt = $5,000 + $4,000 + $9,000

Total debt = $18,000

Debt-to-total assets ratio = Total debt / Total assets

Debt-to-total asset ratio = $18,000 / $250,000

Debt-to-total asset ratio = 0.072 ~ 7.2%

Company Z funds 7.2% of its assets with debt compared to other companies in the same sector. Suppose its competitors are Company X and Company Y, with 20% and 6% debt-to-total asset ratios, respectively.

Based on the debt-to-total asset ratios for the three companies, Company Y has a lower leverage rate, so its chances of getting new loans are greater than Companies Z and X.

Company X’s debt-to-total asset ratio is much higher than its competitors, so it would struggle to raise cash through new loans.

or Want to Sign up with your social account?