Annual Percentage Rate (APR)

A rate that represent the total cost of borrowing over a period of one year

What Is Annual Percentage Rate (APR)?

Annual Percentage Rate (APR) is the total cost of borrowing over the course of a year, and it includes the interest rate and all extra fees of acquiring the loan. It is the rate at which a person must pay on a loan and is computed for various loans, including mortgages, car loans, and credit cards.

APR is expressed through simple interest and does not account for compound interest. The cost of borrowing is expressed through the interest rate and any additional fees charged on the loan as the origination fees, the cost of funds over the loan term, documentation fees, and additional costs associated with the transaction.

The annual percentage rate provides a more precise overview of what you are paying when compared to interest. This is because interest-only refers to a loan's interest, while the APR provides a complete "total cost."

The annual rate must always be displayed before any agreement can be signed in all financial institutions. You can check the yearly rate of your credit card as an example.

Key Takeaways

- An annual interest rate is a figure that depicts the actual yearly cost of money throughout the life of a loan or the return on investment.

- APRs come in various forms, but fixed and variable APRs are the most prevalent.

- It of interest calculates how much of the principal you'll pay each year based on monthly payments.

- The interest rate you pay is calculated as a percentage of the principal amount borrowed.

- It does not always accurately represent the cost of borrowing. In reality, it may overestimate the actual loan value.

How Annual Percentage Rate Works

The APR represents the total cost of borrowing over a year, including both interest and any additional fees charged by the lender. It is expressed as a percentage of the loan amount or credit balance.

The APR is a valuable tool for borrowers to compare the cost of various loans. It does not determine the portion of the principal repaid each year; instead, it reflects the overall cost of borrowing over a one-year period, factoring in all relevant expenses related to the loan or credit.

For example, credit card companies always offer a grace period after making purchases. During those periods, if you pay off your ending balance each month, you will only have to pay the amount owed with no interest.

The opposite occurs when you carry a balance on your credit card, and the agreed-upon interest is added to the outstanding balance. This interest is expressed by the Annual Percentage Rate (APR), representing the annualized interest rate applied to the outstanding balance. The method used to calculate interest may be different among lenders. Some calculate it on a daily basis, and others calculate it on a monthly basis.

Annual Percentage Rate Calculations

To calculate APR, we will be using the below formula:

APR = (((Fees + Interest / principal) / n) x 365) x 100

Where:

- Interest = Total interest paid over the life of the loan

- Principal = Loan Amount

- n = Number of days in the loan term

Let us take a few examples to understand its calculation for credit card scenarios:

Let's say your credit card's annual rate is 15%. Your average daily balance around a 25-day billing cycle is around $1500. What is your monthly interest charge?

First, find your daily rate:

15% / 365 days = 0.041%

Then, multiply the daily rate by the billing cycle and average balance:

0.041% x 25-day billing cycle x $1500 = $15.38 monthly interest charge

This only applies if your account has one annual rate. Keep in mind that some accounts have multiple of them.

Let us find it using different compounding periods:

What is the annual rate if the monthly rate is 0.5%?

0.5% x 12 = 6%

What is the annual rate if the semi-annual rate is 0.5%?

0.5% x 2 = 1%

What is the monthly periodic rate if the annual rate is 12% with monthly compounding?

12% / 12 periods = 1%

Annual Percentage Rate Types

The credit card APRs are based on the type of transaction. For example, the credit card issuer can charge a single annual rate for purchases, another for cash advances, and another for transfers from another card.

The issuer can also charge a penalty rate for late payments or violate the cardholder agreement terms. They also have an introductory yearly rate of 0% with a range of usually six months to attract new customers to sign up.

Let us take a look at the summary of credit card APRs.

1. Purchase Yearly Rate: The rate is applied when purchases are made.

2. Cash Advance Annual Rate: The rate is applied to the cost of borrowing from your credit card.

3. Penalty Annual Rate: Usually, the highest rate of APRs is applied for violation of terms in the agreement.

4. Introductory/Promotion Yearly Rate: The lowest annual rate, usually around 0%, is to gain more customers.

When it comes to bank loans, there are two main types of APR. A fixed yearly rate or a variable annual rate.

- A fixed APR loan is an interest rate that rests at the same price and is guaranteed not to change during the life of the loan.

- A variable annual percentage rate loan is an interest rate that may change at any time.

Tips to have a low APR

What is the best way to get a low-interest-rate credit card? Unfortunately, there is no definitive answer. You can, however, qualify for cards with low APRs if you maintain a good credit score. Building credit isn't easy, but these principles from the CFPB can help:

1. Be responsible with your current card and pay your bills on time

A late payment can negatively affect your credit score. Make automatic payments or use your phone to set reminders.

2. Don't exceed your credit limit

Scoring models consider how close you are to max out. According to experts, you shouldn't use more than 30 percent of your available credit. For example, if your credit limit is $5,000, that would be $1,500.

3. Continue to build

Credit scores are a reflection of your credit history. Therefore, the longer you have paid your loans on time, the better your credit score.

4. Don't apply for more credit than you need

Do not apply for a lot of credit in a short period. Lenders may conclude that your financial situation has deteriorated, even if that's not the case.

5. Keep an eye on your credit

Each primary credit reporting agency must provide one free credit report to everyone every year. If you find an error, contact the agency and the company that provided the information to try to correct it.

APR vs. Annual Percentage Yield (APY) or Effective Annual Interest Rate (EAR)

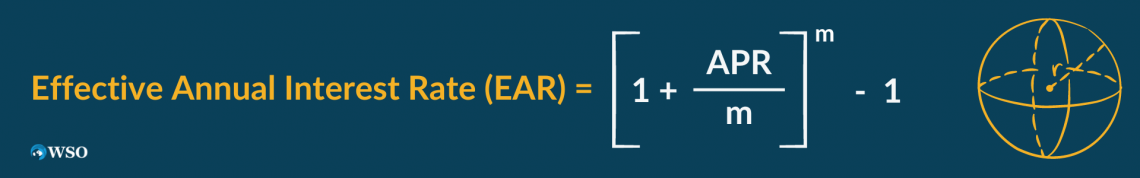

As previously mentioned, the annual percentage rate does not consider compound interest, but the annual percentage yield (or the Effective Annual Rate) does. Correspondingly, the APY value is always greater than its APR by using compound interest.

The higher the interest rates with smaller compounding periods, the more significant the gap between the rate of annual interest & the APY.

In basic terms, the yearly percentage rate gives you an idea of the costs you will sustain with a bank loan or credit card. Generally, you would want your annual percentage rate to be as low as possible.

In contrast, for APY, you identify how much interest you can gain from investments. So, you would want your APY to be as high as possible.

Calculation difference:

We've already seen the process for calculating the annual rate of interest. The formula to find your APY is shown below.

APY = (1 + Periodic Rate)^n −1

Where:

n = Number of compounding periods per year.

Let's compare both APR & APY as an example.

A bank gives you a credit card with a daily interest rate of 0.0578%. You would multiply your daily interest rate by its compounding period to get your annual interest rate. Since it's daily, that would mean that the APR = 0.000578 x 365 = 21.10% per year.

To calculate your APY, you would use the daily rate as your periodic rate and the number of compounding periods, which is 365 days. APY = (1.000578)^365 - 1 = 23.48%.

If you decide to only carry a balance on your credit card for a month, you will be charged the corresponding yearly rate of 21.10%. Yet, if you carry that balance for the year, your effective interest rate becomes 23.48% due to compounding daily.

Another way to view the APY/EAR formula is like this:

Note

The "m" variable represents the number of times interest is compounded in a year. It is the same as the "n" variable in the previous formula.

► The table below represents the pros and cons between the annual rate and the interest rate for mortgages and other costs associated with loans:

| Pros | Cons |

|---|---|

| Accounts for many fees and costs that are not included in the interest rate. | Having a lower rate does not always mean a better deal. |

| It makes sure the lender does not disclose any information required. | There are different fee structures for every lender. |

| Gives a valid comparison of different mortgage lenders. | Functions only if the borrower initially plans to stay in the property for the entire mortgage. |

| It gives you a good idea of what is more affordable in the long run. | It may not be helpful if the borrower decides to leave the property earlier, pay the rest of the mortgage through a balloon payment, or refinance mid-through. |

► The following table represents the pros and cons of a credit card with a 0% APR rate:

| Pros | Cons |

|---|---|

| Save money on interest. | Late payments can foil your plans (ex., Late payment on introductory bank rates can affect plans). |

| Lower your monthly payments. | New credit cards can temporarily impact your credit score. |

| Pay down your debt faster. | Using a 0% bank rate credit card to pay down debt will have balance transfer fees between 3% - 5%. |

| Many credit cards with a 0% annual rate usually offer rewards. | Intro annual rates do not last forever. |

Annual Percentage Rate (APR) FAQ

The multiple types of annual rates of financial products:

Mortgages

- When the repayment period surpasses more than one year, the annual rate of interest may slightly vary the amount to be repaid by the customer. Generally, the mortgage accounts as the guarantee of payment, so it does not include extra costs such as appraisals and taxes.

Personal loans

- The annual bank rate expresses the actual cost of repaying a loan or personal loan.

Saving products

- For a few products, such as accounts and insurance, the bank rate indicates the returns generated by the money we deposit.

In the case of mortgages, third-party costs, such as notary and analysis fees, are not included in the annual interest rate. Guarantees and insurance are also excluded.

Other aspects that should be taken into account include:

- Comparing the APRs of fixed and variable-rate loans is pointless. Variable-rate loans cannot be predicted how their interest rate will change over time.

- A comparison of the bank rate of loans only makes sense over the same timeframe.

When comparing offers, we can use the annual percentage rate to determine which option is best for us. However, we are unsure how the rate will change during the life of a variable-rate loan. Because of this, we view APRs as information rather than final decisions.

Accordingly, credit card annual rates depend on factors such as the competing market rates, as well as the prime rate set by the central bank, as well as the borrower's credit score.

or Want to Sign up with your social account?