Private Equity Job Description

Career Insights and Pathways to private equity

What is Private Equity?

Private equity (PE) firms invest in companies to improve their profitability through strategic and financial means with the objective of eventually selling them for profit.

The companies they invest in are generally private companies (whose shares don’t trade in a public stock exchange), and if they invest in public companies, they take them private, hence their name.

The most significant benefit these firms have compared to other investment firms is that since they own a controlling interest in a private company, they can easily and quickly make any structural changes.

Sometimes, they even sell off parts of a business and liquidate it entirely if they feel that it will lead to a better return than holding on to it.

PE firms typically specialize in one or two specific sectors: finance, retailing, manufacturing, energy, healthcare, technology, or real estate. This article will help you understand what a PE job entails, what the career path in this field looks like, and what PE recruiters look for in prospective candidates.

Key Takeaways

- Private equity (PE) firms invest in private companies with the goal of improving their profitability and eventually selling them for profit.

- PE professionals specialize in specific sectors like finance, retailing, manufacturing, energy, healthcare, technology, or real estate.

- PE jobs require skills in financial modeling, analytical abilities, monitoring investments, and relationship management.

- There are two common routes to enter PE: through an investment banking analyst program or a master's degree in business/finance.

- The career path in PE typically starts as an associate, with opportunities to progress to VP or principal roles based on performance and skills.

Understanding Private Equity

PE is a broad category of investments in which an individual or company acquires significant ownership stakes in smaller, less-liquid, and generally private companies.

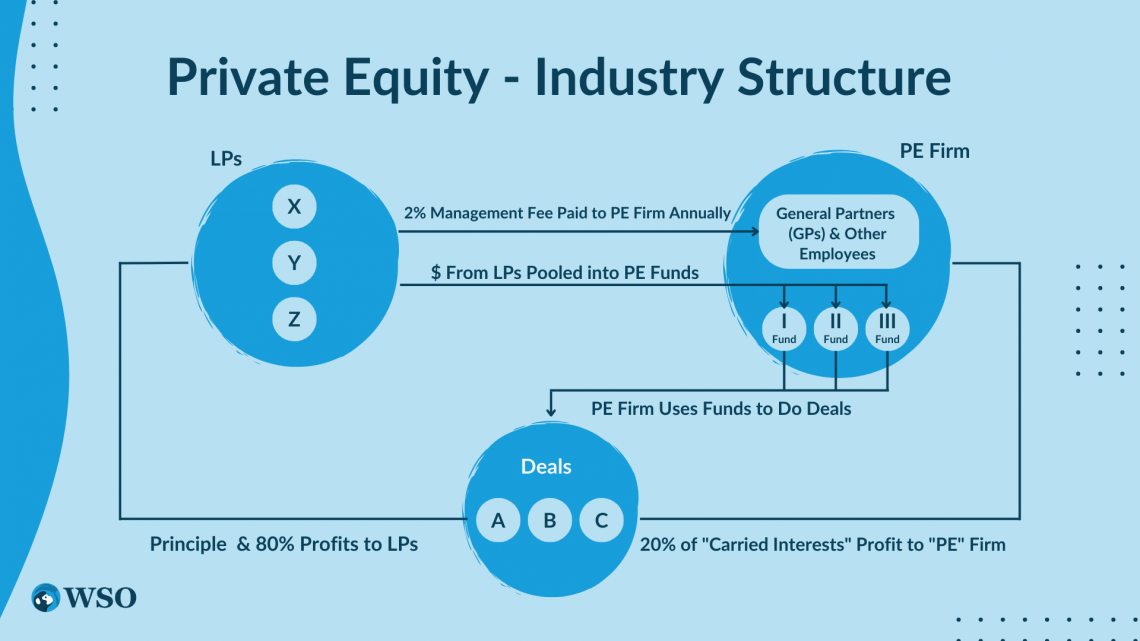

PE firms are usually organized as limited partnerships. The partnership structure consists of limited and general partners, with general partners (GPs) having most of the executive power and hence are the brains behind generating returns.

In contrast, the limited partners (LPs) are typically high-net-worth individuals who have the financial capacity to invest large amounts of capital in the partnership’s funds.

The goal of a PE firm is to improve the profitability of the acquired company and then sell it for profit. They may do this by increasing management efficiency, improving capital structure, selling non-core business lines, refinancing debt, or implementing other operational strategies.

In some cases, PE firms are known to have broken down a company and sold off the parts to strategic buyers who often buy at a higher premium, thereby generating a high return on investment on the transaction.

Due to these factors, they have a terrible reputation among acquiree companies. A PE investment generally means pay cuts, layoffs, and dissolution, which is good for the company, although not good from an employee’s standpoint.

The benefits arise as it does not have to report to the public or many shareholders, which speeds up the execution process and has fewer regulations to deal with from bodies such as the Securities and Exchange Commission (SEC).

PE professionals specialize in one or two specific sectors, such as finance, retailing, manufacturing, energy, healthcare, technology, or real estate.

This need for specialization is vital because the general partner would raise funds from the limited partners on the premise that they have experience in that specific sector and hence would generate additional returns for the investors.

These firms usually invest in mature companies with stable cash flows. As PE investments are funded primarily through debt (generally 70-80%), it is imperative to ensure that the cash generated by the target company is sufficient to cover all debt payments (both interest and principal) as they fall due.

This strategy contrasts with venture capital firms that invest in private but early-stage companies, which generally do not generate any cash flow.

Private Equity Job Description

Private equity jobs are very complex, and the descriptions are pretty broad. It is considered by many to be the next step after a stint as an investment banking analyst.

If you are looking to get into PE, it is essential to learn about the history of PE, how the industry has evolved, what a PE firm does, know what skills they look for while recruiting, the size and sector that your target PE firm specializes in, and also preferably have some experience working on deals.

The goals of a PE firm largely depend on the type of strategy. For example, one might focus on buying undervalued companies with high growth potential, while another would try to save a company from bankruptcy through restructuring.

PE professionals generally specialize in one or two specific sectors, such as manufacturing, healthcare, energy, or technology. However, a few critical skills that candidates for PE roles are required to have include:

This is one of the must-have skills for a career in PE. Not only is it enough to know financial modeling, but it is also essential to do so fast and efficiently. PE associates must analyze a wide range of companies, and financial modeling helps achieve that. The most sought-after type of modeling is LBO, as almost all PE firms rely on LBOs to invest.

2. Analytical skills

Unlike investment banking, PE associates are generally required to analyze documents such as confidential information memorandums (CIMs) to understand and evaluate potential opportunities. CIMs are documents sourced from investment banks containing data on investment opportunities. Also, analytical skills are needed to evaluate various financial ratios that are highly essential for financial assessments.

3. Monitoring investment and reporting performance

PE associates are usually required to monitor the firm’s current assets and prepare reports on their performance.

4. Relationship management

While juniors are not required to handle the client relationship aspect of fundraising, they are expected to have good interpersonal skills as PE firms have a thin structure, requiring teamwork and collaboration.

How to Get a Private Equity Job

Generally, there are two established routes into PE.

1. The first route is through an analyst program at a reputed investment bank. Many investment banking (IB) analysts have their eyes set on a career in PE. PE firms seek candidates who have the skills gained in the two-year analyst program at the big banks.

This route requires planning well in advance as the analyst intake is usually only open to new graduates, generally from the top target schools. It is also the easiest route to PE as there is no shortage of recruiters from these firms looking to bag a top-performing analyst.

2. The second route is through a master’s degree in business or finance. Graduates from top universities who have pursued internships in PE firms during their tenure as a student or have prior experience in finance have the best chance of receiving a job offer from a PE firm right after graduation.

Even though the recruits who come out of business schools might not have the best financial modeling skills, their business acumen is highly sought after.

PE firms generate profits by restructuring existing businesses, which requires many management and business skills, and candidates from top business schools tend to exhibit these in-demand skills.

A PE associate can be expected to be involved with day-to-day tasks like reviewing financial statements or meeting with management teams to discuss strategy or valuation. They may also be involved in developing the IPO (initial public offerings) process for the companies in the portfolio.

The experience gained from working in PE firms is valuable and generally more fulfilling. Add to that the fact that work-life balance at most firms tends to be better than investment banking, and you will see why it is the most sought-after career path for IB analysts.

An important thing to note here is that since PE firms tend to be smaller than investment banks, openings are fewer, and landing a job at one is very competitive. To land a role in PE, it is of utmost importance to put a lot of effort into networking with professionals already in the field and the recruiters who hire for such roles.

Therefore, our PE interview course comes with a networking course to help you network efficiently and ace that PE interview. If you want to jumpstart your preparation for an interview at a PE firm, please check out our free 40 Private Equity Interview Questions with Sample Answers guide.

Private Equity Career Path

The associate is the junior-most role in PE firms. Most recruits are hired into this role, from where they provide support to the principals and VPs. Depending on what path you were hired from, the career path looks slightly different.

Most PE firms tend to push out the recruits who joined after a two-year analyst program at an investment bank, and they are expected to complete an MBA and return. MBA is a prerequisite for either the senior associate role or VP role, depending on the firm.

It is also true that mid-sized funds may not be very particular about the MBA requirement for a promotion. It is a crucial point to keep in mind while looking for a move into a PE role.

The easiest way to gauge what type of firm it is would be to check out the LinkedIn profile of the senior staff working there. If all of them have an MBA, it can be reasonably assumed that it is a prerequisite, and you would be expected to get one at a certain point in your career to avoid stagnating your career growth.

PE firms tend to run thinner than investment banks due to their smaller sizes, and hence there is not much of a vertical hierarchy. However, most professionals can be divided into junior (associate) and senior (VP and principals). We look briefly at both of them below.

Private Equity Jobs – Associates

The associate is the most junior role in PE firms. Most recruits in the industry start at this level.

An associate will get plenty of training and on-the-job experience to make them competitive for jobs at higher levels of the firm. It is considered a testing ground where partners and seniors lookout for up-and-coming talent.

The most important skill they look out for at this level is understanding investment opportunities and how money is generated.

As an associate at a PE firm, the average tenure is just under three years. After this period, many associates move to senior roles or go into other industries entirely. The latter is especially true for those who do not find investing very interesting or do not have the talent and skills required.

An associate at a PE firm will work on various projects to improve the invested company’s profitability. These projects might involve anything from data analytics to M&A transactions to handling legal matters related to mergers and acquisitions. T

he wide range of experience gained as a result allows a wide range of career exit options.

Private Equity Jobs – Vice Presidents and Principals

A Vice President or Principal of a PE firm is often the company’s face. They are in charge of marketing, maintaining relationships with clients, fundraising, and arranging meetings for other employees.

Other responsibilities may include evaluating investment opportunities, negotiating acquisitions or sales, managing debt, and tackling bankruptcy proceedings.

Getting promoted to this level requires a specific skill set that includes having a feel for differentiating a good investment opportunity from a bad one, maintaining good client relationships, thinking strategically, and wearing many caps, amongst others.

Unfortunately, since PE funds have limited partner slots, it is tough to make it to that level. Hence, many high-performing associates and VPs move out to start their shop, the fastest way to partner.

Executives at the partner and VP level are often barred from exiting through compensation devices such as golden handcuffs, carry, etc. These are to ensure that there is no flight of partners and senior personnel before the liquidation of the investment to pay back the limited partners.

In fact, many PE partnerships have clauses that enable the LPs to dissolve the partnership if a certain number of GPs decide to leave.

Learn more about recruiting for executive partner private equity here.

Free Resources

WSO is a leading provider of financial modeling courses for finance professionals. To help you advance your career, check out the additional resources below:

or Want to Sign up with your social account?