Private Equity Funds

Investment vehicles pool capital to invest in private companies, aiming for growth and profitability, often with active management involvement.

The largest publicly-listed companies are Apple, Microsoft, Alphabet (Google), Amazon, Berkshire Hathaway, and Toyota Motors. The largest private businesses are Koch Industries, Mars, and McKinsey & Co.

Do you know what is common between private and public firms? The answer is that both types of businesses incurred private equity funding at a particular time. So let's first discuss what private equity is.

Private equity (PE) is an alternative investment asset class. The main feature of this asset class is that it generates high revenue through investments in private companies that have a high potential for growth, profitability, or innovation.

The following sections will discuss the:

- PE fund

- Its exit strategies

- Who can invest in those funds

- The primary considerations and concerns

- The top firms in that industry.

Key Takeaways

- Private equity is an alternative investment asset class that generates high revenue through investing in private companies with growth potential.

- PE funds make money through exit strategies like IPOs, strategic sales, or selling to other PE firms.

- PE benefits companies, employees, and investors while positively impacting communities through increased capital distribution.

- PE strategies include venture capital, growth equity, buyouts, mezzanine funds, distressed funds, and funds of funds.

- Investors in PE seek higher returns compared to public stock markets and contribute to the industry's success.

What is a Private Equity fund?

A PE fund is a fund investing in companies with the potential to generate a high rate of return.

The investment horizon is fixed. In the end, the PE fund makes money through exit strategies such as IPO, selling the firm to a strategic buyer, or another PE firm.

The industry plays an essential role in the economy of every country. The following section discusses the reasons for that.

Role of the PE

To discuss the importance of the industry and its advantages, let's consider four groups of stakeholders:

- Companies

- Employees

- Investors

- Communities.

All companies need capital to expand their businesses, whether at the startup or maturing stages. However, in most beginning stages, companies are private and have no reputation for attracting public investors. They also don't have access to the securities markets.

The mature companies are not big enough to go public. Moreover, they want to avoid the extra costs of compliance and accounting from going public. The private equity funds can offer accessible capital for both types of companies, thus solving the problem of those businesses.

The expansion of those companies means more demand for labor. That aids the Unemployment problem in the economy. Moreover, more employed people mean a more productive economy for the country.

Investors can also consider PE as a means to get high returns. This is because the public stock markets primarily consist of mature companies that have no potential to generate startup-like returns.

However, PE funds offer tremendous upside potential to generate profits and help manage investments effectively. Isn't that the goal of the financial industry? To fund the most competitive businesses and generate the highest potential return for its investors?

You may say, "Ok. So it benefits companies, employees, and investors. But how does it affect the communities?" The answer is simple. The investors of these funds are not only high-net-worth individuals but also pension funds and university endowments.

The higher the return PE generates, the more money will go to invested pension and endowment funds. It means that pension funds can distribute more capital to retirees, and universities can provide more scholarships for students. That's the direct impact of the industry on the community.

Legal Structure & Investment Payout

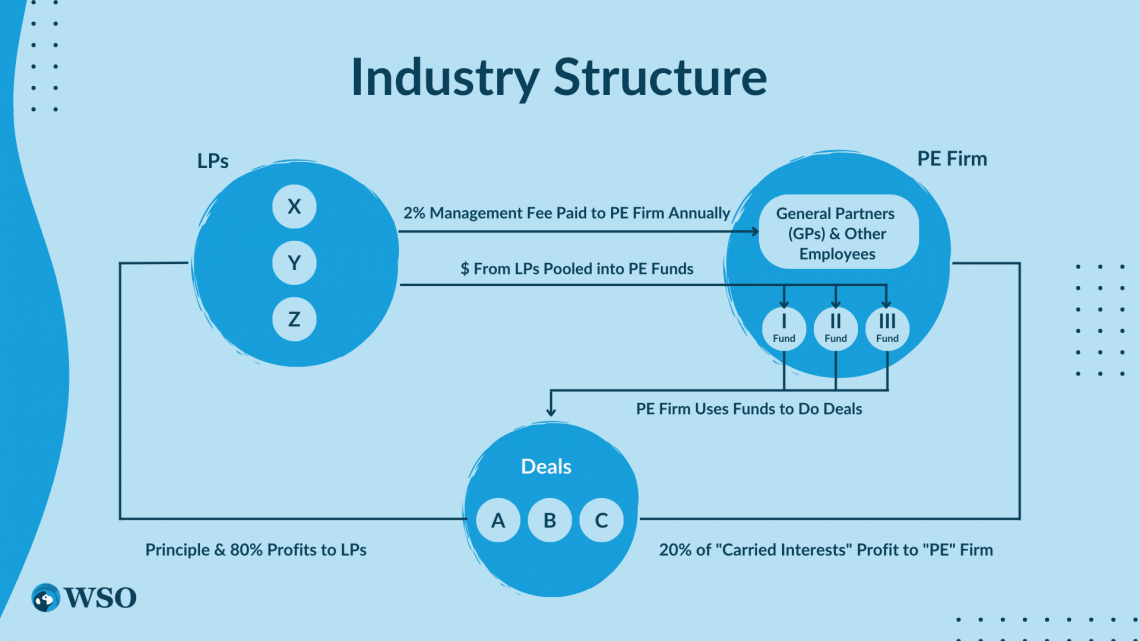

The legal structure is quite simple. The most common form of the fund is a limited partnership. The investment firm is a general partner, and the investors are limited partners.

The limited partners are usually:

- Sovereign wealth funds

- Mutual funds

- Pension funds

- Endowment funds

- Insurance companies, etc.

All the partners claim an ownership stake in the fund. Still, only the general partner who controls the private equity firm manages the partnership.

The general partner (GP) gets 2% of the committed capital as a management fee independent of the generated returns. However, if the fund generates positive returns, the GP receives 20% of those profits as a performance fee. LPs have to pay those fees to a GP.

For example, a hypothetical private equity firm has a 2030 Fund, L.P. The commitments are $17.6 billion. The PE firm gets $352 million in management fees ($17.2 billion x 2%).

If the fund generates $5 billion in profits, the firm gets $1 billion in performance fees ($5 billion x 20%). Overall, the total fees for $17.6 billion are $1 billion and $352 million.

However, keep in mind that the fees and other terms might vary according to the limited partnership agreement. This document specifies the fund's general partner(s) and the limited partner(s) and determines the following details:

-

The organization and formation

-

The fund-raising period (typically two years)

-

The period of deal-sourcing and investing (typically three years)

-

The exiting from existing investments through IPOs, secondary markets, or trade sales (in < 7 years)

How does PE create value?

How exactly does a PE firm create value? The mechanism is quite simple.

Initially, the firm considers a target company. Then, it investigates:

- The company's management

- Financial history

- Market and industry

- Competitors.

In other words, it starts with due diligence.

Then, depending on the investment strategy, if the company addresses investment criteria, the fund acquires either some portion or 100% of the ownership.

After purchasing, the fund tends to scale the target company's business, change the management team, boost sales, or do anything that could potentially increase the company's value.

Then, after 3-10 years, the fund can hopefully generate large returns by exiting the portfolio company. There are two types of exits:

- Total

- Partial.

The fund sells its stake in the portfolio company to another fund, strategic buyer, or share repurchase in the total exit. In partial exit, the fund partially sells its positions.

There are three ways to do a partial exit:

- Private placement

- Corporate restructuring

- Corporate venturing.

In private placement, the fund sells some of the target company's shares to another private investor. Incorporating restructuring, the fund sells some of its shares to external investors. By incorporating venturing, the management increases its stake in the business.

Another exit strategy is an IPO, a hybrid form of total and partial exits. In the IPO, the fund sells 25-50% of the company's shares to the public. Then, the fund gradually sells the rest of the stocks. So, these strategies show how the fund creates value and generates returns.

Taxes

The limited partnership structure gives a tax advantage to PE firms. The carried interest or performance fees are treated as capital gains, taxed at much lower rates than the ordinary income.

The maximum rate for capital gains is 20%, while the ordinary income rate is 37%. That gives a tax advantage to the firm. Also, the firms might use fee waivers. In other words, they might also treat the management fees as capital gains.

That way, they can significantly reduce their taxes.

The PE market performance and trends

According to McKinsey, as of 2020, the PE market is growing and outperforming all other alternative asset classes. In addition, the industry outperformed the public markets on average by over 14%.

Initially, the industry experienced an outbreak due to Covid-19. But, after a few adjustments, it became even more robust.

The covid-19 also boosted the demand for healthcare and technology industries. As a result, venture capital funds made massive investments in those industries.

Also, the cheap debt and high leverage increased both the market and the PE multiples to a higher record since the global financial crisis. The raise of secondary funds (of fund of funds) also improved the accessibility of the investments.

Another trend in the industry was Special Purpose Acquisition Company (SPAC) deals. SPAC deals primarily occurred in the tech, clean energy, and healthcare sectors. The PE firms can act as both deal sponsors and sellers in those deals.

Private Equity Strategies

The funds vary based on:

- Industry

- Geography

- Funding stage

- Exit strategy, or combination.

For example, the fund might focus on mature companies operating in the U.S. technology industry.

Let's now talk about the most common classification of PE funds.

Venture Capital (VC)

Venture Capital firms invest in early-stage companies with high growth potential. VCs target:

- Tech

- Biotech

- eCommerce

- Other innovative industries.

They typically provide capital in exchange for equity, convertible shares, or convertible debt of the portfolio company.

The risk and return are very high. More than 50% of startups fail during the first 3-5 years. However, successful startups such as Google or Facebook can compensate for those losses and earn huge returns. The investment horizon for these startups is 5-10 years.

How do VCs manage the risk? They take board seats and become actively involved in the company's operations. They provide industry expertise and guidance in addition to financial resources.

Venture capital can be divided into:

- Seed

- Early/startup

- Late-stage investing.

If you are interested in venture capital, you can purchase our Venture Capital course.

Growth Equity (GE)

Growth equity (GE) firms are also known as "expansion capital" or "development capital" firms. They typically invest in companies to fund specific expansion strategies. The main goal is not to "create" but "scale" the business.

The funds may also give industry expertise and marketing advice to portfolio companies. The investment horizon for growth equity firms is 3-7 years.

The typical target company has already proven its market and product and needs external funding only to expand its business. The target companies usually operate in:

- Tech

- Financial services

- Healthcare

- Retail

- Media industries.

Unlike VC, growth equity investing has low risk due to established products and markets. Therefore, there are only management and execution risks in this type of investment strategy.

To manage those risks, the GE fund thoroughly investigates the management team. In addition, the GE fund invests via convertible securities with a high liquidation priority.

Our Intro to Growth Equity course will equip you with fundamental knowledge about that industry.

Buyout or Leveraged Buyout (LBO)

LBO funds invest in a mature company with stable cash flows. Typically they acquire more than 50% of the company ownership. Usually, LBO fund uses a massive amount of debt (up to 90% of the transaction value) to finance the acquisition. The investment horizon is 2-5 years.

The strategy's primary purpose is to acquire a mature company with leverage and then improve that company's operations by restructuring, cutting expenses, and other methods. In the end, the fund plans to sell the company five times the initial value.

The use of leverage is the only possible way to make such returns since mature companies have no further room to generate extraordinary returns. However, the higher the debt, the more the default risk is.

The fund fully controls the operations, invests in mature industries, and avoids speculative sectors such as biotechnology to manage risk. In addition, there are two other types of buyouts:

- Management Buyout (MBO)

- Management Buy-in (MBI).

Check out our LBO Modeling course to equip you with the relevant skills for the LBO fund job.

Mezzanine Funds

Mezzanine funds give mezzanine debt to companies. The loan lies between senior debt and common equity on the company's Balance Sheet and has several characteristics.

The coupon rate of the loan is about 10-15%. The borrowers pay the principal at the end. Thus, the loan is called a bullet. The borrower might either pay interest only or pay nothing during the life of the loan. Also, the debt has:

The main goal is to see which company can survive and pay the debt.

Unlike LBO funds, mezzanine funds have no control over the company's operations. Therefore, even exercising options doesn't give that much power to mezzanine funds. Since there is a lower risk than LBO, the expected return is also lower.

However, keep in mind that the risk of this type of debt is higher than the traditional bank loan. That's why the cost is higher than the conventional market's one.

Distressed Funds

Distressed funds (also called "vulture funds") invest in companies that need liquidation or restructuring. Typically, the target companies are mature.

The fund works with the portfolio company's management to come up with a reorganization and turnaround strategy. For example, the fund might use distressed debt trading, buying and holding debt, and other techniques to influence the firm's reorganization.

After that, the fund improves the company's financial situation and sells it to the public. The IRR of those types of deals is 8-15%. This industry is relatively small compared with other strategies. Distressed investing is also called the "credit" strategy.

The strategy highly overlaps with a hedge fund's distressed investments strategy. The main difference is that a PE fund's investment horizon is from 2 years while a hedge fund is up to 3 months.

Fund of Funds

The fund of funds works in the following way. It doesn't invest directly in portfolio companies. Vice-versa invests in other funds with:

- VC

- GE

- LBO

- Mezzanine

- Different investing strategies.

The fund does due diligence on other investment firms and checks their track record and portfolio companies.

Others

There are also other types of strategies that the funds use. They are:

1. Real Estate Funds

These types of funds invest in residential and commercial real estate. The RE funds may buy and rent the existing property, improve that property, or develop the new one.

The most common strategies of RE funds include:

- Investing in mature assets ("core")

- Renovating ("value-add")

- Developing properties ("opportunistic).

2. Infrastructure Funds

Another uncommon strategy is investing in infrastructure. These funds invest in roads, pipelines, bridges, and wind farms. The specific goal of this strategy is either purchasing stable assets ("brownfield") or developing new ones ("greenfield").

The main features of infrastructure investments are:

- High stability of cash flows

- Low volatility.

In addition, unlike returns in LBO, the high return is earned during the holding period, not after it.

Who can invest?

The individual investor must be an accredited investor to invest in such funds.

In other words, the investors must satisfy one of the following conditions:

-

Individual income > $200,000/year OR Household income > $300,000 in each of the past two years.

-

Net worth > $1,000,000 (excluding primary residence)

-

An insider in the company the person is investing in (being a general partner, CEO, executive, managing partner, director, etc.)

-

Accredited family office

-

Licensed investment professionals holding Series 7, 65, 82

-

"Knowledgeable employee" of the fund

For the legal entities, depending on the entity, the requirements are the following:

-

Owning investments > $5,000,000

-

Assets > $5,000,000

-

All equity owners are accredited.

-

Investment advisers / SEC-registered broker-dealers

-

Financial entities (bank, insurance company, registered investment company, etc.)

The minimum investment depends on the fund requirements. So it's not standardized and is a measure depending on many other variables. So the investor has to check the fund's website or ask their investment adviser or broker about the investment requirements.

However, typically the funds require a minimum of $1,000,000 of investments.

What should I know?

You have to consider these factors of investing in this type of fund.

1. Illiquidity

Since the implemented investment strategies are long-term, the fund might need the capital for the long-term, thus posing some limitations on the withdrawal amount and period. That's why the investment might be illiquid.

This is not a problem if you can wait for an extended period (say five years). But, if your goal is to save the liquidity for short and medium-term purchases, then it's incompatible. So, always check the compatibility of this investment with your goals and consult your financial advisor.

2. Fees and expenses

The fees and expenses are specified in the offering documents. These documents also specify

1) the terms of the limited partnership

2) the material information about investments

3) how the fund is governed.

Beware that some funds might levy fees without the adequate consent of investors and transparent disclosure.

For example, the PE firm might manage several funds. However, the costs and expenses of each fund must remain within that fund and not intermingled with other funds.

3. Conflicts of interest

Private equity firms often have a conflict of interest with limited partners. The fund typically pays the investment firm the advisory fee for managing the portfolio company and other related services.

But, there is always a risk that the managing firm might exploit the opportunity for self-interest at the expense of other stakeholders. As a result, the funds the firm manages and its investors might suffer from it. Therefore, the investment firm must disclose all possible conflicts of interest to a potential investor.

For more information, please check the SEC's guidelines.

Top Private Equity Firms

This industry has several players:

-

Pure PE firms

-

PE divisions of investment banks

Many asset management companies, such as BlackRock (BLK), launched their private equity divisions.

Also, investment banks (such as Goldman Sachs and Morgan Stanley) are entering this field through their private equity arms (such as Goldman Sachs Principal Investment Area and Morgan Stanley Capital Partners).

Below is the list of top private equity firms.

Blackstone Inc. (ticker: BX)

Blackstone is probably the most influential investment firm globally, headquartered in New York City. It's a public company and launched its IPO in 2007. Since 2009, the price of the company's stock raised from $5 to $101 as of May 7th, 2022.

The firm is founded by Stephen A. Schwarzman and Peter G. Peterson. Before its IPO, the firm's structure was organized as a publicly traded partnership. Then, in 2019, Blackstone changed its structure to a C corporation and expanded its business line.

As of May 7th, 2022, it manages $268 billion in private equity, $298 billion in real estate, $266 billion in credit & insurance, and $83 billion in hedge funds. The overall assets under Blackstone's management are $915 billion. In 5-years, the firm raised $95.9 billion in funds.

Blackstone's most notable current investments are:

The most famous past deals that built the brand for Blackstone are deals with Hilton Hotels, Pinnacle Foods, and Freescale Semiconductor.

Carlyle Group Inc. (CG)

Carlyle Group is a publicly-traded firm founded in 1987 by William E. Conway Jr., Daniel A. D'Aniello, and David M. Rubenstein. Washington D.C.-based firm has over $293 billion in assets under management (AUM). It went public via Nasdaq in 2012.

The company has 26 offices on five continents and 1,900 employees. The global private equity unit of the firm manages $169 billion worth of assets.

The division invests in aerospace, consumer, media, retail, financial services, healthcare, industrial infrastructure, and technology industries. Their most notable current investments are:

KKR & Co. Inc. (KKR)

KKR is an investment firm founded in 1976 by Henry R. Kravis, George R. Roberts, and Jerome Kohlberg Jr. The New York-based firm has $459 billion AUM. The firm became well known due to its focus on a leveraged-buyout strategy.

The most famous deal in the history of the leveraged buyout was the acquisition of the RJR Nabisco tobacco company in 1989. As time passed, KKR evolved into a sizeable mega-fund offering different services across many industries.

The most important current deals are:

TPG Capital

TPG Capital is an investment firm founded by David Bonderman, James Coulter, and William S. Price III in 1992. The firm started as a family office, raising about $50 billion in investor commitments. The firm is headquartered in Fort Worth, Texas.

In 1993, the firm purchased Continental Airlines. TPG also acquired Petco (2000) and used leveraged buyouts to buy Burger King (2002). As the firm evolved, so did its strategy of the firm. As a result, TPG has focused on investing in companies on the West Coast.

The investment in the biotech industry lifted the company. Currently, TPG manages $114 billion worth of assets. The most recent significant deals are:

Warburg Pincus

E.M. Warburg & Co. was founded in 1939 by Eric Warburg and headquartered in New York City. Then, in 1966, it merged with another firm and became Warburg Pincus. The main advantage of Warburg Pincus over other firms is its employees.

The firm's president, Timothy Geithner, was in the position of Treasury secretary during the 2008 financial crisis. The employees like Timothy Geithner gave access to various deals for Warburg Pincus.

As of today, Warburg Pincus manages more than $80 billion in assets.

The firm's primary focus is investing in technology, financial services, healthcare, real estate, consumer, and industrial companies. Currently, the firm has 245 portfolio companies operating in the Americas, Europe, and Asia-Pacific regions.

The largest portfolio companies currently under management are:

Neuberger Berman

Neuberger Berman is an investment firm founded in 1939 by Roy Neuberger and Robert Berman. It's headquartered in New York City and 100% owned by its employees.

Overall, the firm manages $447 billion in assets and follows a multi-asset strategy. The investments are diversified across equities, fixed income, hedge funds, real estate, private equity, private credit, specialty alternatives, and private real estate.

The firm launched its private equity division in 1981 and currently manages $73 billion with that division. In 2003, the firm was acquired by Lehman Brothers and, in 2008, had a risk of bankruptcy. However, there was a new opportunity in an employee-owned structure.

In tandem with the deferred cash compensation tied to the company's performance, that structure gave the edge and reputation to the firm. That increased the investors' trust in Neuberger Berman.

The most famous recent deals of the firm are:

CVC Capital Partners

CVC Capital Partners is a U.K.-based investment firm founded in 1981 as an investment operations division of Citigroup Inc. The European part of this division became an independent firm, CVC Capital Partners.

Today, the firm manages €123 billion and has €157 billion in committed capital. The main strategies of the firm is a private equity and private credit. The former division of the firm has €94 billion AUM.

The main strategies are Europe/Americas, Asia, Strategic Opportunities, and Growth Partners.

CVC Capital Partners actively invest in sports leagues. For example, from 2005 to 2017, the firm was the largest shareholder of Formula One Group. That kind of portfolio diversity gives the edge over public market diversification. As a result, the correlation between private assets is low.

The most recent largest deals of CVC Capital Partners are:

- Premiership Rugby

- Breitling

- Petco

- Naturgy.

EQT Partners

EQT Partners is an investment firm founded in 1994 and based in Sweden. The firm focuses on Private Capital and Real Assets business segments. Private Capital is divided into Private Equity, Ventures, Future, Life Sciences, Growth, and Public Value.

The firm manages $100 billion or €90 billion as of March 2022. The firm invests in companies across Europe, North America, and the Asia-Pacific regions. However, the main focus is still on European companies.

The technology and industrial sectors take up to 44% of the overall EQT portfolio.

The most famous U.S. portfolio company of EQT Partners would be Flying Tiger Copenhagen. The most significant deals of EQT Partners are:

Keep in mind that these investment firms are just a few examples of the largest companies in the industry. There are plenty of other firms that focus on specific strategies like venture capital or even growth equity.

Please check our Private Equity Interview course if you want to break into the private equity field but don't know how to.

In our Private Equity Interview Bootcamp, you can get all interview guides, networking guides, and LBO modeling tests at a discount, plus 24 months of unlimited support from elite finance professionals.

If you want to learn about financial modeling, check out our Financial Statement Modeling course. For more information about valuation fundamentals, take our Valuation Modeling course.

or Want to Sign up with your social account?