Growth Equity

A type of private equity that focuses on investing in late-stage growth firms that need to scale their businesses

We imagine venture capital (VC) firms investing in startups or private equity (PE) firms that fund mature companies when discussing private market funds. Guess what? One type of fund is a mix of VC & PE funds. That is growth equity.

It is one of the hottest topics in private equity. Nowadays, most private equity and venture capital firms focus their effort on growth equity investing due to its favorable characteristics. In other words, it's like the innovative strategy of investing with high potential.

So, let's talk about growth equity: what it is, how it works, the difference among other types of funds, the trends, and the career-building in this field.

Growth equity (GE) is a type of private equity that focuses on investing in late-stage growth firms that need to scale their businesses. They invest in firms with proven market demand and scalability. That is the distinctive feature of GE's investing strategy.

Almost all businesses need external funding or operational guidance to scale their business. If those businesses don't accept external investments, they might stunt their growth potential.

External funding at the right moment can help the business grow at a very high rate increasing their market presence and maybe even disrupting the space.

Nevertheless, the founders of those businesses want to retain their voting power and share of ownership while scaling their businesses. And then comes the GE fund, which acquires a minority stake in the firm and helps scale the business without interrupting the control.

GE inherits the advantages and disadvantages of both VC and PE. The following section discusses how:

- GE works

- Strategies

- Target company profile

- Risk characteristics

- Return profile

Key Takeaways

- Growth Equity (GE) is a type of private equity investing in late-stage growth firms with proven market demand and scalability.

- GE aims for quick growth and revenue improvement without heavy leverage, providing downside protection.

- Target companies are in the commercialization or expansion stage, typically in innovative sectors like technology and healthcare.

- GE seeks a target IRR of 30-40% during a 3-7 year holding period with limited default and market risk.

- GE funds have a minority stake, focus on partnerships, value-add opportunities, and ensure alignment of interests with target firms.

Understanding Growth Equity: How It Works

The GE strategy is between venture capital (VC) and private equity (PE).

The main features of GE are:

-

Quick operational improvements and revenue growth of the target firm

-

Minimum or no leverage

-

Downside protection

The above characteristics made the growth equity strategy an attractive way of investing.

Target Company Profile

As the name suggests, growth equity (GE) funds invest in "growth" companies. Here the "growth company" means the firm at the commercialization or expansion stage. The company may or may not be profitable, but it has proven its business model.

The GE funds make decisions on these defined and quantifiable foundations:

-

Validation of product-market fit

-

Proven business model

-

Pathway towards profitability

-

Target market and customer profile identified

In addition, the target firms have an excellent track record of cash generation. Their revenues may hit the annual $3M - $50M. The target firms use GE as a tool for growth rather than survival.

For example, the firms have a clear customer acquisition strategy: expansion into a new market, acquisition, etc. They also target the planned allocation of the cash proceeds into re-investment, unfunded growth opportunities, etc.

Furthermore, target companies usually operate in the technology, financial, healthcare, and other innovative sectors. That way, the investors can generate a higher return than the overall economy.

Risk & Return Profile

The risk characteristics and return profile are two major points in any type of investing, and GE is not an exception.

The GE fund aims to generate 30-40% IRR during a 3-7 year holding period. The Return comes in revenue growth, profitability, and strategic value. In addition, the fund generates revenue through exit strategies such as:

- Selling the firm to a strategic buyer

- Financial buyer

- IPO

The exit multiple is 3-5x for GE funds. The fund has limited default risk, market risk, or product risk. The reason is that the portfolio company has already proven its product's market demand and cannot borrow more debt. The only possible risks are execution risk and management risk.

The execution risk is a risk of failure to achieve an expected outcome. In this case, the target company might fail to follow its expansion plan. Finally, the management risk is also attributable to a portfolio company.

For example, the company needs to add more departments for expansion. However, the management team might not always address the requirements. Thus there will be a management risk.

The more departments the company has, the more managers it must assign. The firm must ensure that all team members are skilled and well-fit for their posted jobs.

There is a high risk of the company choosing the wrong person for a given position.

Structure of Growth Equity Investments

A growth equity (GE) firm doesn't have a majority stake in the portfolio companies. Thus it has less control over the strategic and operational decisions of the target firms.

Subsequently, there are three critical components for the GE fund to ensure the profitability of the investment:

-

Focus on partnership

-

Value-add opportunities

-

Alignment of interest

Partnership

GE funds invest in a small ownership portion of the late-stage firms. Typically, late-stage firms have no majority shareholder because the founders have given up their shares in previous funding rounds.

So, the strategic and operational decisions of the target company remain under the control of the current management and significant shareholders.

In most cases, there might even be no controlling shareholders. Instead, the fund might be just one of the several minority shareholders.

That’s why the only thing they can rely on is trust. So the partnership between the investment fund and the portfolio company is based on confidence in the management team and that the management team will keep its strategic direction.

Suppose the target company doesn’t stick to or suddenly changes its strategic decisions. In that case, it might be no longer attractive to the investment fund. However, the fund cannot interact with the operations given that it’s one of the minority shareholders and might lose investments.

The fund uses liquidation preferences and convertible securities to mitigate those risks of investing in the target company.

Investor Value-Add

Money is just one type of resource that the portfolio company needs. The other things that the target company needs are expertise on how to scale and navigate the obstacles in its business.

The investment fund can stand out by offering expertise to the portfolio company. That makes the fund quite similar to the venture capital fund, which provides capital and expertise to the portfolio companies.

However, due to the competition in the industry, some investment funds differentiate themselves by delivering those monetary and expertise resources. The expertise of the fund provides valuable input for scaling the business operations of the target firm. The typical examples of expertise are the following:

-

Capital structure optimization (debt financing, restructuring)

-

Mergers & acquisitions (M&A)

-

Relationship management with institutional investors, bankers, lenders, etc.

-

Market expansion and customer cohort analysis

-

Business development and go-to-market strategy planning

Some firms might even go further. You may be interested; what kind of other services can the fund provide? For example, the fund can provide a networking opportunity for the target company, its management team, and the board of directors.

For example, let’s say that the firm needs to professionalize the CRM processes. The fund might not always offer the solution directly. Still, it may have a portfolio company that offers customized CRM platforms. That is very helpful for the growing company to scale faster.

Aligned Interests

As mentioned before, the trust between the fund and the management team is essential to invest. But, before that, the investment fund gathers information about the short- and long-term goals of management and shareholders.

Also, the fund looks at the following significant points:

-

Attainable and reasonable market share estimated by the target company (the clear target customers)

-

The efficient expansion growth pace (at maximum capacity) of the company (industry standards, average indicators given the company's size, geographic location, and industry)

-

Funding requirements for future growth (the acquisition, buying long-term assets, etc.)

-

Stakeholders' long-term exit strategy. For example, shareholders might want to sell the firm in 5 years. The management team might want to go public to increase their wealth since some managers are paid with equity as a bonus instead of a salary.

After discussing these points, the fund analyzes whether the target firm's goals align with the expansion. The fund will also check whether the target firm meets the minimum growth threshold.

Suppose the target company addresses all of the above criteria. In that case, the fund decides to invest in that company and accept the related risks. However, if the potential portfolio company doesn't fit into one of those criteria, the fund will decline to invest.

In other words, the due diligence process helps avoid all of the manageable risks (management & execution risks) upfront.

Growth Equity vs. Venture Capital vs. LBO Private Equity: Key Differences

VC and leveraged buyout private equity are two ends of the investment line. GE lies right in the middle of that line. However, there are many commonalities and differences between the GE, VC, and PE investing strategies.

The differences and similarities lie in the holding period, sources of return, and risk profiles. All of them can be measured by:

- Money multiples

- IRRs

- Holding periods

- Target industries

- The inherited risks (product, market, management, execution, and default)

The other way to differentiate those three types of investment funds is the recruitment process. So, first, let’s discuss the similarities and differences in the recruitment process.

In PE, the recruiting process is highly structured with clear deadlines (typically on cycle). Investment bankers are the expected candidates for that role. The compensation is relatively high due to the complexity of deals. Thus, PE requires proficient financial modeling and technical analysis from candidates.

In GE, the process is on-cycle only for mega-funds and top firms. Other funds recruit off-cycle. The compensation is a little bit lower than that of PE. The candidates have average proficiency in financial modeling and technical. They are usually investment bankers, consultants, and product managers.

In VC, recruitment is entirely unstructured and need-based (no deadlines). The compensation is the lowest among all three.

The candidates may come from various backgrounds:

- Investment banking

- Consulting

- Product development

- Entrepreneurship

- Engineering

The main requirements are:

- Entrepreneurship

- Industry expertise

- Networking

- Interpersonal skills

The modeling is still important but not as detailed as the other two funds.

The following two sections discuss the differences between GE and other investment strategies in terms of

- Multiple metrics

- Investment philosophies

- The target companies

Growth Equity vs. Venture Capital

First, let's talk about the commonalities between GE and VC. Unfortunately, people confuse GE with VC due to these similarities.

Both GE and VC investments focus on the companies operating in innovative industries (technology). Both types of investments have high potential returns and focus on minority ownership (via preferred stocks). Both types of funds use only equity to fund their investments.

However, VC funds invest in early-stage companies to conduct market research and develop the product. The funds expect to get a return from only 1 or 2 successful startups that can cover all other expenses. The industries of target firms are tech, fintech, biotech, etc.

The VC fund chooses target startups primarily based on the potential of the idea or product, not on the scalability. The typical holding period of VC investments is 5-10 years, the IRR is 35-50%, and the exit multiple is 5-10X. The regular revenue of target firms is up to $3M.

The GE funds invest in late-stage companies with established business models. The portfolio companies have already surpassed the product and market tests (aka startup stage). They have already achieved positive revenue, and they are on the way to profitability.

Unlike the VC fund, the GE fund looks to the scalability potential of target companies. As a result, the GE funds expect to get positive returns from their investments with no risk of losing the majority of their portfolio.

They invest in firms operating in TMT, financial, and healthcare industries. The holding period for GE investments is 3-7 years, the IRR is 30-40%, and the exit multiple is 3-7x. The typical revenue of the target firms is $3M-$50M.

Growth Equity vs. Private Equity (LBO)

The LBO PE and GE funds invest in relatively mature companies with established products and models. Sometimes people confuse that GE funds are the versions of LBO funds. That's incorrect, and here are the reasons for that.

The GE fund uses minimum or doesn't use debt to invest in target companies. Instead, the GE fund only acquires a minority stake (<50%) in the target firm with equity. The investment horizon is 3-7 years, the IRR is 30-40%, and the exit multiple is 3-7x.

The GE funds focus on target companies in TMT, financial, healthcare, and other disruptive industries. The targets have no defensible market or consistent track record of profits. The typical revenue of those targets is $3M-$50M.

The LBO funds invest in portfolio companies using high leverage. They acquire a majority or 100% of the target company. The investment horizon is 2-5 years, the IRR is 25-35%, and the exit multiple is 2-5x.

The LBO investments focus on mature companies operating in stable industries. The target companies have stable free cash flows that ensure the ability to pay down the debt. That is crucial for traditional PE funds. The typical revenue of those target firms is $20M+.

The Top Growth Equity Firms

There are several players in this industry: pure GE firms, late-stage venture capital firms, and GE divisions of private equity firms.

A few well-known venture capital firms already have a foot in the GE industry such as:

Many private equity funds, launched their growth equity divisions, such as

- Blackstone (BX Growth)

- Texas Pacific Group (TPG Growth)

Also, family offices, mutual funds (such as Fidelity), and hedge funds are entering this field. Below is the list of pure GE firms.

TA Associates

TA Associates is an investment firm founded in 1968. The company invests in firms operating in the technology, healthcare, financial services, consumer, and business services industries. Over 50+ years, TA raised $47.5 billion.

The firm has over 100 employees operating in:

- North America (Boston (MA)

- Menlo Park(CA))

- Europe (London)

- Asia (Hong Kong, Mumbai)

TA Associates works as an active investor supporting the portfolio companies with its expertise, network, and value-add capabilities. The strategic Resources Group and Capital Markets Group divisions of the firm support companies with organic and acquisitive growth guidelines. In addition, those divisions provide:

- Targeted strategic consulting

- Assistance structuring

- Financing transactions

TA enhances the culture of entrepreneurship, transparency, and meritocracy among the management team of the portfolio companies.

Summit Partners

Summit Partners is an international alternative investment firm founded in 1984. It has $39 billion in assets under management dedicated to GE investing. The firm also has credit and public equity investing products.

Summit Partners invested in over 500 companies in technology, healthcare, consumer, e-commerce, and financial services. As a result, 175 completed the initial public offerings, while 200 were acquired by or merged with strategic buyers.

General Atlantic

General Atlantic is an international firm founded in 1980 by Chuck Feeney.

The firm invested in more than 445 growth companies operating in:

- Financial services

- Consumer

- Healthcare

- Climate tech

- Technology

- Life sciences

Today, General Atlantic has $84 billion in assets under management and 191 portfolio companies. The investment firm has 14 offices in five regions:

-

United States: New York, Palo Alto, and Stamford.

-

China: Beijing, Shanghai, and Hong Kong,

-

EMEA: Amsterdam, London, Munich, and Tel Aviv.

-

Latin America: Mexico City, So Paulo.

-

India & Southeast Asia: Jakarta, Mumbai, and Singapore.

JMI Equity

JMI Equity is an investment firm founded in 1992. The firm focuses on investing in software companies and is considered an investment leader in this sector. Over 30 years, the firm has done 170 investments, 110 exits, and 19 IPOs.

The typical investment range of the firm is $20M-$200M. The most notable companies of the firm are:

Insight Partners

Insight Partners is a venture capital & private equity investment firm founded in 1995. The firm's primary focus is investing in high-growth tech and ScaleUp software businesses disrupting the industries they operate.

As of February 24th, 2022, the firm founded more than 600 companies globally and successfully exited 55 companies through IPO. As of today, the firm has $30B+ in committed capital.

The firm's competitive advantage is its pattern recognition in scaling up companies. The other distinction of Insight Partners is its Insight Onsite.

Insight Onsite is the firm's division that helps founders and management teams execute strategic growth initiatives. The division consists of over 100 operators and works with portfolio companies in areas such as:

- Product & tech

- Sales & marketing

- Strategy

- Talent

- Business development

All these help are designed to make custom solutions for portfolio companies in the software industry.

Careers in Growth Equity: Opportunities and Insights

The daily work of a GE analyst is similar to that of a private equity analyst.

The work consists of:

-

Sourcing

-

Market research

-

Deal work

-

Portfolio company work

-

Financial modeling

The main differences between the work in GE and work in PE are the following:

-

Sourcing: In some firms, Junior analysts have to do primarily cold calls and cold emails all day. Deals are simpler than PE deals; thus, finding a great company first is a winning strategy.

-

Financial modeling: There is no heavy financial modeling as in the LBO, but still, you have to do 3-statement models, valuation models, and add-on acquisition models.

-

Management interaction: Since the growth equity will not have controlling ownership, the interaction with the management team in GE is less than that in PE.

-

Due diligence requirements: Minority ownership also means less due diligence work in deals. In PE, you have to do heavy due diligence because PE acquires 100% of the target firm and must ensure that the company will be profitable.

-

Interaction with bankers: The target companies of the GE fund will less likely be marketed by bankers and other public market players. In PE, it's the opposite.

Most of the time spent on interaction with the management team and bankers, financial modeling, and due diligence will go straight to sourcing and market research. The titles and responsibilities in GE are pretty similar to PE ones.

Salaries & Compensation

The salary and compensation vary across regions and countries. However, the wages are generally considered lower than in private equity.

Here are the average numbers in North America (as of 2019).

| Title | Salary | Bonus | Total (Salary + Bonus) | High Totals |

|---|---|---|---|---|

| Associate | $118,000 | $116,000 | $234,000 | $420,000 |

| Vice President (VP) | $182,000 | $210,000 | $392,000 | $925,000 |

| Principal | $273,000 | $335,000 | $608,000 | $1,750,000 |

| Managing Director / Partner | $473,000 | $614,000 | $1,087,000 | $2,650,000 |

Recruiting: What to Expect

Recruiting is also very similar to that of private equity.

There are two types of recruiting in GE:

- On-cycle

- Off-cycle

The on-cycle recruiting starts in July and ends in October for analyst positions. If the analysts are accepted, they can start working only after 1.5-2 years. For example, let's say you are accepted in 2022. It means that you can start working only in 2024.

The off-cycle recruitment starts after the on-cycle recruitment in December and ends in February.

The candidates start working in the accepted position after 1.5-2 years, just like on-cycle one. However, if the analysts apply for an urgent role, they can start instantly.

The main difference is that most GE firms recruit off-cycle. Sure there are some exceptions. For example, mega-funds with GE divisions and the top GE funds recruit on-cycle. However, it's still easier to get into smaller funds relying on networking.

Also, the candidate pool is quite broad than the candidate pool in private equity. So you can move to the industry from more general background like

How to break into the industry

There are two common ways to go into GE:

1. From Investment Banking (IB) to GE

The most beaten path for GE is through exiting investment banking. The on-cycle recruitment is designed for

- Bulge bracket

- Middle market

- Elite boutique bankers

The off-cycle option is for those positions in small GE funds and need-based positions for bankers.

2. From a GE internship to an analyst position

This way is quite competitive and usually targets the Analyst position at mega-funds. However, the number of places is limited. Thus the funds hire only "one in a million". The ideal candidate has:

- Great Resume

- Work experience at bulge bracket banks or boutique private equity

- Effective networking

Interview Process

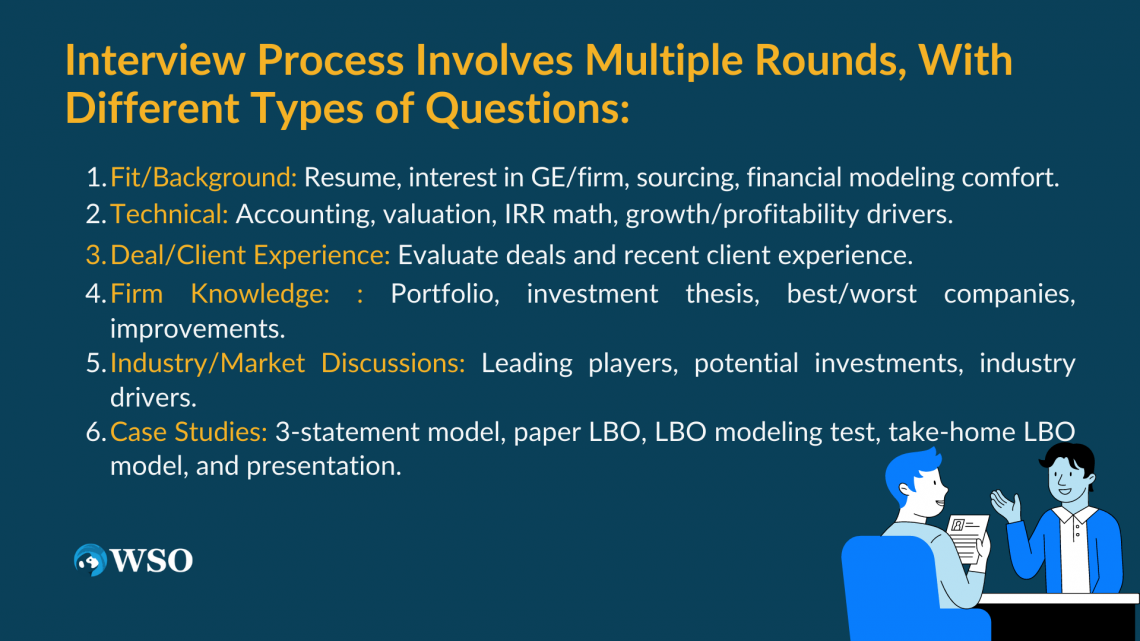

The interview process has multiple rounds. For example, most firms have 2-3 interview rounds for analysts & associates. However, some firms might have even 4-5 interview rounds for candidates. These numbers are pretty low for an internship position: typically 1, maximum of two rounds.

During each round, interviewers check the candidate. For example, in the first round, the interviewer will check whether the candidate fits the organization and ask the respective questions. There are six types of questions:

1. Fit/Background: Walk me through your resume. Why growth equity/this firm/position? Are you comfortable with sourcing and financial modeling?

2. Technical: Questions are related to accounting, valuation, quick IRR math, and growth/profitability drivers.

3. Deal/Client Experience: Evaluate the deal and decide, whether would you invest in this deal or not. Tell me about your recent client in your experience.

4. Firm Knowledge: What's our firm's current portfolio? What is our investment thesis? Tell me about the best and worst companies and what would you do differently.

5. Industry/Market Discussions: What are the leading players in this industry? What firm would you invest in? What are the growth drivers, risks, and opportunities of the industry?

These are more weighted questions than in the interview process in PE, so prepare well.

6. Case Studies: Firms often ask a candidate to do a 3-statement model by focusing on the drivers of revenues and expenses.

Sometimes they might ask the candidate to do paper LBO, 1-3 hours of LBO modeling test, or even take-home LBO model and presentation.

Is It A Good Fit For You?

The most important question: does this job makes sense to me?

The answer is yes if you are:

-

Competitive

-

Willing to work long hours

-

Attentive to detail

-

Keen on working with deals in private markets

-

Interested in investing, operations, and using critical thinking to boost the firm's growth

-

Persistent working on long-term projects (building a portfolio company over the years)

-

Open to non-deal work (company operating and underwriting)

The answer is no if you:

-

Want work-life balance

-

Can't work under high pressure

-

Have no interest in investing

If you want to break into the GE field, but don’t know how, please check our Intro to Growth Equity course.

or Want to Sign up with your social account?