Venture Capital Fund

An investment fund that invests in early- and growth-stage (risky) startups that offer high return potential

What is a Venture Capital Fund?

Nowadays, there are lots of successful publicly-listed companies. Firms with the highest market capitalization are MAMAA companies. MAMAA stands for Meta (Facebook), Apple, Microsoft, Amazon, and Alphabet (Google).

Besides being tech companies, all mentioned above have one common thing: venture funding. So all of them started with sourcing from venture funds.

A venture capital fund - is an investment fund that invests in early- and growth-stage (risky) startups that offer high return potential. The venture capital firm manages the fund, while the fund investors are typically HNWIs and institutional investors.

VC firms invest their own money into the fund and manage others' investments in the fund. In addition, the firm is responsible for finding investment opportunities and generating substantial returns for the investors.

First, we will discuss the role of VC funds in startup growth. Next, we must cover the differences between VC and private equity. Then, we explore how VC funds make money.

Furthermore, we look at the advantages and disadvantages of VC for investors and founders. So, let's dive into the role of VC funds in startup growth.

Key Takeaways

- A venture capital fund is an investment fund that invests in early- and growth-stage (risky) startups that offer high return potential.

- VC focuses on early-stage, innovative startups with equity financing, while private equity targets mature companies, often using debt for control.

- VC funds generate profits by investing in startups and achieving returns through exits, primarily via IPOs.

- Founders benefit from capital and expertise but may lose ownership, while investors gain diversification and potential high returns but face risks and limited liquidity.

- Venture investment occurs across multiple stages, including angel investors, seed funding, series A, series B, series C, and subsequent rounds.

How do Venture Capital Funds Help Startups?

VC fund is crucial for the success of the startup. VC funds provide financial capital through infrastructural investments (manufacturing, marketing sales, fixed assets, etc.). The other necessary capital funds are the industry expertise and guidance for founders (hiring, customer acquisition, and other challenges).

The fund's financial capital and industry expertise help startups grow faster than organic growth (using internal funding of the startup). In other words, it's easier for a startup to scale using VC funding and expertise.

The startup couldn't achieve tremendous results with its cash and expertise. Thus startups use VC to scale their businesses. They use VC funding on different funding rounds: seed, series A, series B, series C, series D, series E, and F.

The VC fund is investing in startups to maximize return on investment. The fund makes money by selling the startup via IPO. The expected return is usually 5x, 10x, 10,000x, etc.

venture capital Vs private equity

Let's talk about the distinction between the VC fund from the private equity fund.

Venture funds tend to invest in risky, early-stage, growth firms. They typically use only equity to finance their transactions and acquire only minority ownership in the company.

VC funding is primarily accessible to businesses operating in innovative industries like tech, biotech, fintech, etc. Venture funds use diversification as a tool to lower the risk.

For example, they might invest in 100 companies. Only one of those companies can succeed, cover all the previous expenses, and bring huge returns.

Private Equity Funds invest in mature, established companies. They usually use debt and high leverage to acquire 51% or more controlling company shares. The typical fund concentrates on a few companies and thus bears the considerable risk.

However, the maturity of the portfolio firms decreases the risk since mature companies are less susceptible to failure.

How do Venture Capital Funds Make Money?

The fund invests in a company, involves the company's operations, and finally exits from that deal by selling it to a public or strategic buyer. The primary investment philosophy of the fund is Barbel or power-law distribution.

The fund invests in many small startups that can potentially generate high returns. However, only 1 out of 10 startups will survive in five years, and only 1 out of those ten survived startups will grow in 10 years.

The fund expects that at least one or two successful startup deals will cover all the expenses of failed startup investments and even bring enormous profits for the fund.

Pros and Cons of VCFs

The advantages and disadvantages vary depending on how you're looking at VC. Let's discuss the benefits and drawbacks of VC for both founders and investors.

The founders can use both financial capital and industry expertise. Moreover, they can boost their sales and marketing to expand into new markets using the knowledge of the fund.

In addition, the incredible network of other experts, investors, and clients will make the odds in favor of the founders.

However, many founders lose their ownership after several funding rounds. Also, equity financing is the most expensive financing option for a business compared with debt or internal cash. The high expectations might put additional pressure on the company's growth.

Not all startups are innovative and operate in the tech field. For many, VC might be an inappropriate funding option.

Investors consider VC an alternative investment uncorrelated with the public securities market. Thus, it's a great way to decrease the overall portfolio risks. Also, VC investing provides a decent return potential (100,000x in a good deal).

However, investors have to keep in mind that it's a risky investment and can lose all their invested money. Also, VC is illiquid. Investors can invest only through limited partnerships.

It means that investors have no rights to the fund manager's operations and have to put the capital forward for five years with no withdrawal rights. That might be inappropriate for investors with short-term goals or with liquidity needs.

What are the Different Stages of Venture Investment?

The funds vary based on their industry, geography, funding stage, or a combination of those variables. For example, the fund may focus on early-stage biotech startups in the Asia-Pacific region. Let's now talk about the financing stages of startups.

1. Funding stages of venture investment

VC is an umbrella term for all stages of funding. However, there are many times when a fund may invest in a company's lifecycle.

Some have separate funds that specialize in each of the following stages since the needs of the businesses are different.

2. Angel investors

An angel investor typically provides financing for small enterprises before the official equity funding starts.

At this stage, friends or family of the entrepreneur invest their own money into the business. Subsequently, angel investors often take a more hands-on approach to their investments.

3. Seed funding

Investors fund the development of an idea into an actual business that generates revenue. Seed funding is often the first stage in which venture capitalists get involved.

Usually, friends and family close to the founders give founders funds in exchange for an equity stake in the company or a share in the profits made from its products. At this stage, they are developing a track record of growing revenue.

4. Series A funding

At the Series A financing round, businesses can expand:

- Into additional markets

- Its user base and product offering with a focus on increasing sales

The Series, A round investors are commonly from more traditional VC funds, which generally contribute from $1 M to $10 M.

Management uses that money to execute the business plan and enhance its business model to generate long-term profit. The main goal of the business is to achieve a maturity level.

5. Series B funding

The Series B funding round is focused on passing the company to another degree of development.

Series B is similar to Series A regarding the processes and investors. However, a new wave of investment firms specializing in later-stage investing may enter the stage.

The investments range from $7 million to $10 million, with the primary purpose of ramping up talent acquisition to equip the company with the critical players necessary to execute its business plan.

6. Series C: Expansion stage

Series C funding aims to give a business the capital to perfect its business model. At this point, the business concept is considered proven and less risky.

Raised capital ranges from $1 million to $100 million. Businesses can use it for various goals, such as acquiring competitors for geographic expansion, intellectual property, or talent.

7. Series D, E, F: Bridge stage

A portfolio company might choose to offer additional funding rounds for different reasons. Frequently, it's in efforts to scale their business to new heights. Commonly, each subsequent round is represented by the following letter.

The Life Cycle of a Venture Capital Fund

The typical lifecycle of the fund is ten years. The reason for that is the long-term nature of the investments. For example, regular investment in startups requires 2-3 years, and the funding for those startups must be completed in 5 years.

In 7-10 years, successful startup deals must be closed, and all the funds returned to the investors.

Who Can Invest in a Venture Capital Fund?

The individual investor must be an accredited investor to invest in such funds. In other words, the investors must satisfy one of the following conditions:

- Individual income > $200,000/year OR Household income > $300,000 in each of the past two years

- Net worth > $1,000,000 (excluding primary residence)

- An insider in the company the person is investing (being a general partner, CEO, executive, managing partner, director, etc.)

- Accredited family office

- Licensed investment professionals holding Series 7, 65, 82

- "Knowledgeable employee" of the fund

For the legal entities, depending on the entity, the requirements are the following:

- Owning investments > $5,000,000

- Assets > $5,000,000

- All equity owners are accredited

- Investment advisers / SEC-registered broker-dealers

- Financial entities (bank, insurance company, registered investment company, etc.)

minimum amount of money needed to invest

The minimum investment amount depends on the fund requirements. So it's not standardized and is a measure depending on many other variables. So the investor has to check the fund's website or ask their investment adviser or broker about the investment requirements.

While there is no one-size-fits-all answer, many venture capital funds require a substantial initial investment, often ranging from $100,000 to $1 million or more. Some funds may have lower minimums for individual investors, such as accredited investors, but this varies widely.

However, it is crucial for potential investors to carefully review the fund's offering documents, such as the Private Placement Memorandum, to determine the exact minimum investment requirement and any eligibility criteria.

Consulting with a financial advisor is advisable to make informed investment decisions in the venture capital space.

Top Venture Funds

Let us take a look at some of the top VCFs below:

Sequoia Capital is a renowned US firm founded in 1972 that partners with companies in early- and late-growth stages across all sectors. They have focused on the internet, mobile, healthcare, financial, and energy companies.

Sequoia Capital turned its $60 million investment in WhatsApp into $3 billion after Facebook's $22 billion acquisition in 2014. It is the largest private acquisition of a VC-backed company ever at that time.

2. Accel

Accel, founded in 1983, is a US firm operating in California, London, China, and India. It primarily invests in early and growth-stage technology companies. A small portion of the fund's portfolio is invested in seed-stage companies.

Accel is an early investor in Facebook and co-leaded it with $12.7 million in Series A in 2005 with a 15% stake. After Facebook's IPO in 2012, Accel's shares were worth $9 billion. Overall, Accel earned a 700x ROI.

3. Kleiner Perkins

Kleiner Perkins is an American firm. It's based in Silicon Valley and was founded in 1972. It invests in incubation, early-stage, and growth companies in the technology sector.

Kleiner Perkins funded $12.5 million to Google in Series B round in 1999. The fund was an early investor in Google. After Google's IPO in 2004, Kleiner Perkins' stake was worth about $4.3 billion - a 300x return.

4. Andreessen Horowitz

Andreessen Horowitz was founded in 2009 by Ben Horowitz, Marc Andreessen. Its headquarter is in Menlo Park, California. It mainly backs seed- and late-stage tech firms. It specializes in consumer, enterprise, bio/healthcare, crypto, and fintech space investments.

Andreessen Horowitz is the biggest investor in a cryptocurrency exchange platform - Coinbase. The VC firm led a $25 million Series B round, securing shares at $1 apiece. As a result, when Coinbase went public in April 2021, its stake was worth almost $10 billion - 400x ROI.

5. Benchmark

Benchmark is a San Francisco-based investment firm. It was founded in 1995. The fund concentrates on early-stage investing in several markets, including financial services, enterprise services and software, and communications.

Benchmark provided $13.5 million in Snap Inc's Series A as the sole investor in the round in February 2013.

At a $25B valuation, Snap Inc. went public in March 2017. It is the second-highest valuation on the exit of any social media and messaging company since 1999. Benchmark's stake was at about $3.2 billion.

Peter Thiel's Founders Fund, founded in 2005, is a San Francisco-based firm investing in science and technology companies building revolutionary technologies.

The firm invests in all stages across various industries, such as consumer internet, artificial intelligence, and aerospace. Founders Fund invested $200 million into a small biotech startup called Stemcentrx. Subsequently, Stemcentrx created innovative cancer healing therapy.

AbbVie, the drug company, paid $1.9B in cash and $3B in stock to buy Stemcentrx in April 2016. Founders Fund, the company's largest investor, received $1.7 billion.

NEA is a US-based firm founded in 1977 that focuses on seed to growth-stage companies in technology and healthcare.

NEA put $4.8 million in Groupon in Series A round in 2008. Since Google's IPO in 2007, Groupon's IPO in 2011 was the biggest IPO by a US web company. NEA's 14.7% share was worth about $2.5 billion.

Union Square Ventures was founded in 2003 in New York City. USV focuses on early-stage, growth capital, late-stage, and startup firms. The most famous deals were with Coinbase, Stripe, and Tumblr.

In 2007, USV invested $5 million in Twitter in Series A. USV beat the social media network competition from Insight Venture Partners, Benchmark, Kleiner Perkins, and CRV.

In 2013, Twitter's IPO valued the company at $14.2 billion. Union Square Ventures' stake was worth $863 million - a 170x return.

Greylock Partners is one of the oldest funds in Silicon Valley. It was founded in 1965. They invest in seed-, early-and later-stage software, SaaS, heath-tech, artificial intelligence, and other technology sector companies.

Greylock Partners invested $80 million into Workday, a financial management and HR software vendor. The fund's stake was worth $700 million, a 9x ROI when the company went public in 2012. It was the highest-priced venture-backed IPO since Facebook's $637 million IPO.

First Round Capital is a San Francisco-based firm specializing in seed-stage technology businesses. Specifically, it targets technology companies in healthcare, consumer, hardware, enterprise, and fintech.

As an early seed investor, First Round Capital funded $510,000 in Uber while Uber was valued at $4 million. In May 2019, the company's value at IPO was $75.5 billion. First Round Capital's stake was worth $2.5 billion, a 4,900x return for the fund.

As of today, these are the top VC firms. To find out more about each company and the VC world, use the WSO Company Database.

Operating a venture capital fund

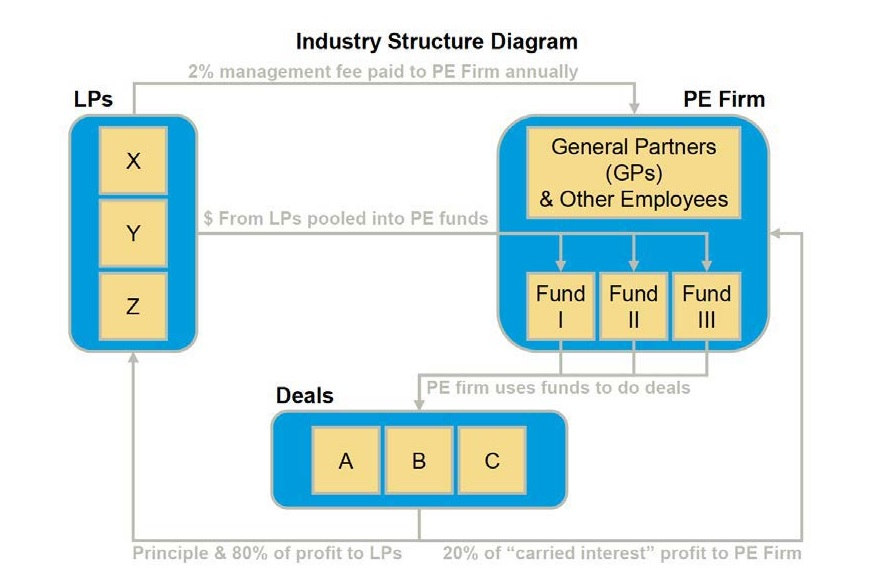

How is a venture capital fund structured? The fund's structure is a limited partnership: the VC firm is a general partner, and investors are limited partners.

The limited partners are usually sovereign wealth funds, mutual funds, pension funds, endowment funds, insurance companies, etc. All the partners claim the ownership stake in the fund. Still, only the general partner, a VC firm, manages the partnership.

Venture Capital Fund Documentation

Requirements are varied depending on the jurisdiction of the fund. Still, typically there are three types of documents that the fund needs for its operations:

-

They have a limited partnership agreement. This document specifies the fund's general partner(s) and the limited partners and determines the operation's detail.

-

Private placement memorandum. Like a prospectus in a mutual fund, it's a disclosure document given to investors.

-

Subscription agreement. Specify the limited partners' financial commitment and how the fund uses those contributions.

Also, the fund needs deal-specific documents:

-

Term sheet. The general partner's (GP's) agreement terms to invest in the company.

-

Stock purchase agreement (SPA). Determines how stocks are sold to investors.

-

Disclosure schedule for SPA. Exceptions and explanations for representations and warranties agreed on SPA.

-

Voting agreement. The voting requirements, in some instances, are for shareholders.

-

Investor rights agreement (IRA). The rights and privileges of stockholders.

-

Right of first refusal / co-sale agreement. Grants the right to purchase stocks from the seller investor before anyone else.

-

Certificate of incorporation. A legal document specifying the company's formation (in this case, portfolio company).

Tax-related documents:

-

Schedule K-1. It is used to report the income and losses of the fund's limited partners.

-

Form 1065, Return of Partnership Income. Used to document the income and losses of the fund.

Venture Capital Fund Regulations

Venture capital funds are regulated by the Securities Exchange Commission (SEC). Since a VC fund is considered a private equity fund from a legal perspective, the VC firm must register with the SEC and report its activities.

There is one exception. If the fund is considered a qualified VC (assets under management < $150 million), those requirements don't apply.

Bank secrecy act (BSA) reporting requirements and other anti-money laundering regulations apply to institutional VC investors. The BSA is curated explicitly by the Financial Crimes Enforcement Network (FinCEN) of the US Treasury Department.

Also, the US Patriot Act specifies the know-your-customer (KYC) regulations for VC firms. In other words, KYC requires funds to identify, verify, and report the information to the government to prevent money laundering, financial fraud, and other financial crimes.

Insider trading regulations are another central point. Since the employees in VC firms operate in the portfolio company's business as an insider (being on a board of directors, shareholders, etc.), they possess a massive amount of insider data. That creates a regulatory risk.

The fund must prevent employees from any use of material nonpublic information (insider data) for illegal purposes, such as giving "tips" to friends or using the information to their advantage (open positions before dissemination of data).

The modern definition Venture Capital Fund by the SEC

In 2020, the reformed rules under Investment Adviser Act by SEC. These reforms were aimed at modernizing the rules and addressing the current issues. According to the new regulations, the VC fund definition has been changed, and here are the details.

SEC's fund definition background: Initially, SEC required all hedge funds and private equity funds to be registered investment advisors (RIA) with no exception. However, Congress decided to permit VC funds to register as exempt reporting advisors (ERA), which eased the reporting requirements.

The reasons for that decision are two:

1) it's uncommon for the VC funds to take control of portfolio companies, and those funds never use leverage;

2) second, VC funds finance innovation by supporting startups with all the resources and expertise.

ERA: What does it mean? Exempt Reporting Advisor (ERA) has SEC's biased reporting and compliance requirements. As a result, it substantially decreases compliance costs and increases the investment freedom of VC funds. In addition, SEC doesn't require any routine audits.

The cost goes down considerably under this condition. For example, the legal costs decreases from $42,500 to $13,000, staff compliance efforts compensation go down from $225,000 to $28,500.

Criteria of the VC fund definition: The fund must satisfy these criteria to be registered as an ERA:

- Representation. It must show that it's targeting only VC strategy. All investor and marketing materials must speak for it.

- Leverage limitations. The fund must not use any leverage at any funding stage in any portfolio company.

- Redemptions. Investors must not do any annual rescue.

- Qualifying investments. 80% or more of the funds must be invested into qualified assets (private companies).

Non-qualifying investments are the following:

- Investments in other funds

- Post-IPO biotech financing

- Secondary investments

How do Venture Capital Funds Raise Capital?

First, the fund sets a particular target investment. Fundraising can take months to years, depending on the fund's reputation, strategy, and market situation. Once the target investment is raised, the fund is usually closed to new investors.

1. The investing process

The next important thing for the fund is to invest in startups for three to five years. The main goal here is to provide as many resources as possible. The resources include financial capital, industry knowledge, sales enhancement, product development, etc.

In the business financing round, it's common to have one "leading" fund investor the round. Often that investor (in our case fund) sets the key terms and negotiates the prices.

2. Generation and distribution of returns

The fund generates returns through exit opportunities. In general, there are three exit scenarios for portfolio companies:

- Direct share sale to another entity

- Merger with or Acquisition by the strategic buyer or private equity fund

- Initial Public Offering (IPO) on a public stock exchange

Funds might distribute returns either after they close all of their deals or after each agreement.

There are two fees that LPs must pay for GP (the fund manager firm):

- Management fee. The annual payment is used to cover the operational expenses of the fund. The common industry standard is 2%

- Carried interest (carry). The performance-based fee earned by VCs. Usually set to 20% of the profits

Venture Capital Fund Management Fees

An analyst is the most junior role in a VC firm. Analysts are typically MBA students pursuing an internship or fresh university graduates. The primary responsibility is to:

- Conduct market research

- Study the company

- Research the conquerors

Analysts attend conferences and try to scout deals that might lie within the investment strategy or thesis of the venture fund based on which the firm is investing. As a result, an analyst is expected to make $80K - $150K in yearly compensation.

Associates are in more dominant positions than analysts. There are two types of associates: juniors and seniors. The majority tend to come with a financial background with powerful skills in building relationships.

They don't make investment decisions in a firm but work closely with those who do. An associate is expected to get a $130K - $250K yearly salary.

The next position is principal. Principals can make investment decisions, but they don't have the executive authority of the firm's overall strategy. A principal makes around $500K - $700K in yearly salary and a bonus of $1M - 2M in carrying.

Partner is the most senior role within a firm. There are two types of partners: general or managing, depending on whether the individual has authority in investment or operational arrangements.

Besides making investments, partners are also responsible for fundraising for the VC firm. The partner can make more than $1M in salary with around $3M - 9M in bonuses.

Similar to PE, VC funds' compensation also includes a carry bonus. Depending on the firm's performance, the payout can be pretty significant.

Learn more about careers and compensation in VC by visiting our:

1. Guide to Private Equity Careers & Venture Capital Careers

2. Venture Capital Salary & Compensation, Average Bonus in Venture Capital.

Analysts' Daily work

Analysts mainly do research, modeling, and other miscellaneous things. Your daily tasks will change as long as you climb the career ranks. Here is some insight from @Associate1 about working at a VC firm.

"It depends on week-to-week. On average, sourcing could be 25-30% of the job. Many follow-up works are involved when sourcing (i.e., light DD). DD gets more intense if you decide to move forward (research, memo writing, customer calls, talking to other investors, etc.)

I also don't do much cold calling. My network, the network of friendly investors, accelerators, things that the partners ask me to look at, etc., are my sourcing channels.

That eliminates the headache/time hassle associated with banging your head against the wall doing only cold sourcing."

What do the working hours look like at the firm? Do those hours vary by the firm? @care1g answers to all of those questions.

"Depends on the stage of the fund and the firm's "reputation." Top late-stage / growth equity fund associates often work very long. They work long hours because their deal flow is top-notch, and they see every opportunity.

VC is also a role where creativity starts from the bottom. First, associates have to build thematic market maps. Then, they are constantly sourcing/finding new deals in their spare time.

Generally, though, the hours are less than hours in classic PE. Term-sheet and other processes in VC are faster than in private equity. Occasionally, the decision to proceed with the deal is made within weeks. In classic PE, it takes months.

People who previously worked in the private equity space believe that the work hours are between 40-60 per week, and weekends are usually light in this industry. However, the workload goes up significantly during live deals.

If you want but don't know how to break into VC, check out our VC Course. Here is a sample video to kickstart your journey into the VC space.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?