Course Overview

17 Modules to Master Venture Capital

Secure your spot in the top 1% of VC applicants with this course. Master venture capital inside out, gaining exclusive insights into this exciting field. Finish the course ready to be an asset to your team from day one.

Who is this Course for?

Motivated college students, and MBA students looking to break into Venture Capital

Professionals looking to prepare for the recruiting process and transition to a career in Venture Capital

Key Outcomes

Master ALL of the Venture Capital Concepts

By the end of the course, you will possess all VC skills and knowledge necessary to be valuable to your team on day one.

Unlocking the Door to Venture Capital Success

By the end of this course, you will be able to slot in as an Analyst or Associate at any fund on Sand Hill Road or simply become a savvier founder as you continue your startup journey.

Boost Your Confidence and Earnings Potential

Once you finish this course, you'll understand VC as well as get prepared for an interview, which will increase your odds of a move to the buy-side and earning a higher salary.

This course has helped our students and young professionals land and thrive at positions across all top Venture Capital firms, including:

WHAT’S INCLUDED

A step-by-step course to help you master Venture Capital

Module 1: Introduction

This module includes lessons introducing venture capital, covering topics like capital, fund structure, and roles.

Module 2: History of VC to Today

In this module, we include examples of the most successful VC-backed companies.

Module 3: Fund Structures

In this module, we break down how a traditional venture fund is structured and discuss how a fund operates and how money flows through it.

Module 4: Various Roles in VC

In this module, we explain the various roles within a Venture Capital Fund. This module will also discuss the skills and duties of each position.

Module 5: Early-Stage Financial Instruments

In this module, we teach you different kinds of venture capital financial instruments. Learn about priced rounds and valuations, convertible debt, convertible equity, venture debt, etc.

Module 6: Term Sheet (Control + Econ)

In this module, we show you what a term sheet represents and you will understand the uses and differences of Economics and Control when it comes to term sheets.

Module 7: Term Sheet (Modeling)

In this module, we go through some important topics of term sheet, like pre-money valuation, ESOP, founder vesting, dividends, liquidation preference, Optional/Automatic Conversion, and anti-dilution.

Module 8: Term Sheet (Rights + Provisions)

In this module, we dive deep into important points that need to be considered in the term sheet, like voting rights, protective provisions, redemption and management rights, registration, among others.

Module 9: Due Diligence (Must-haves)

In this module, we explain how the process of due diligence works, and the must-have points, like the product, value proposition, business model, market, team, and evidence.

Module 10: Due Diligence (Finer Points)

This module uses 12 video lessons to take deep dive into the process of due diligence, highlighting ARR builds, B2B software, and cohort analysis.

Module 11: Due Diligence (Deep Dive)

This module uses 10 video lessons to take deep dive into ARR Build, B2B Software Segment, Cohort Analysis, and Unit Economics.

Module 12: Post-Investment Management

You'll learn about post-investment management, including handling board matters, evaluating follow-on discussions, considering opportunity cost, and measuring portfolio performance.

Module 13: Exit Options

In this module, we explore the exit funnel, IPO process, IPO waterfall, WeWork case study, M&A, and wind-down/bankruptcy (worst-case scenarios for VC exits).

Module 14: Startup Fundraising

Learn how to raise money for a startup. Learn effective pitching techniques, craft compelling pitch decks. You will also see some sample pitch decks from successful startups and get tips on how to avoid common mistakes.

Module 15: Waterfall Analysis

You will learn the ideal lifecycle of a VC-financed company, exit proceeds allocation, waterfall calculation steps, key concepts and terms in waterfall analysis, a company's waterfall analysis example, and using sensitivity analysis to evaluate the impact of exit valuation.

Module 16: Fund Economics

In this module, we will discuss the economics associated with the fund. From revenue streams, track records, and the distinction between gross returns and net returns.

Module 17: VC Sourcing

This module teaches finding and approaching potential portfolio companies. Learn inbound and outbound sourcing, use cold and warm outreach effectively, track networking activities, and stay organized in the sourcing process.

Don’t Take Our Word For It

Hear From Our Students

Wall Street Oasis has trained over 63,000 students at elite corporate and educational institutions for over a decade.

I've been hailed by my boss and colleagues at work, trident insurance co.ltd finance department,I used the knowledge also in PowerPoint and word ,these hotkeys apply almost in ppt,word and excel. I've been so efficient yet I'm still in campus.

A local leather turning firm also gave me a role in finance and accounting and it's been a lovely experience, I've actually recoup the money I paid wall street oasis for the course and in fact I got a massive discount, Patrick didn't sell it to me$497 dollars if I remember. The PowerPoint course could improved though,it only gives tricks but does not teach one how to actually create a full presentation or pitchbook. I'm sorry that I have to write my review away from home, I saw the email from Patrick and had planned to do this at home unfortunately my schedule with university,exams have Started and work reasons left me with no time,so seeing the second email I had to pull over and give at least something back by the roadside. If one is keen on a career in finance WSO is the place, it's worth it and the discussion section will broaden your commercial awareness. Thank you WSO.

Finally you'll get to the modeling, and you'll cover that in reasonable depth to understand what you're doing.

The course is well laid out with exams at the end of every module. The files you keep from this are a great future reference if you ever forget how exactly to do something. One last thing that I found excellent: the instructor is not just an Excel instructor, but also clearly works in finance. This shows up in additional tips throughout the course on best practices and how best to present your models.

I've done Excel courses before like this but with no practice, so only little of what I learned actually stuck. Practice makes perfect so I'm gonna head back to that :D

However, despite this being of second nature to me, I decided to check out the WSO financial statement modeling course as part of the Elite Modeling package while planning my move to investment advisory. Needless to say, like the other WSO courses, this was a well-planned out course from which even a seasoned professional like me could take away a lot. Knowing various standards that are used in the finance and investment community helps to blend in with the pros.

Would definitely recommend getting not just this but the whole elite modeling package if that's still on offer. Thanks WSO team! :)

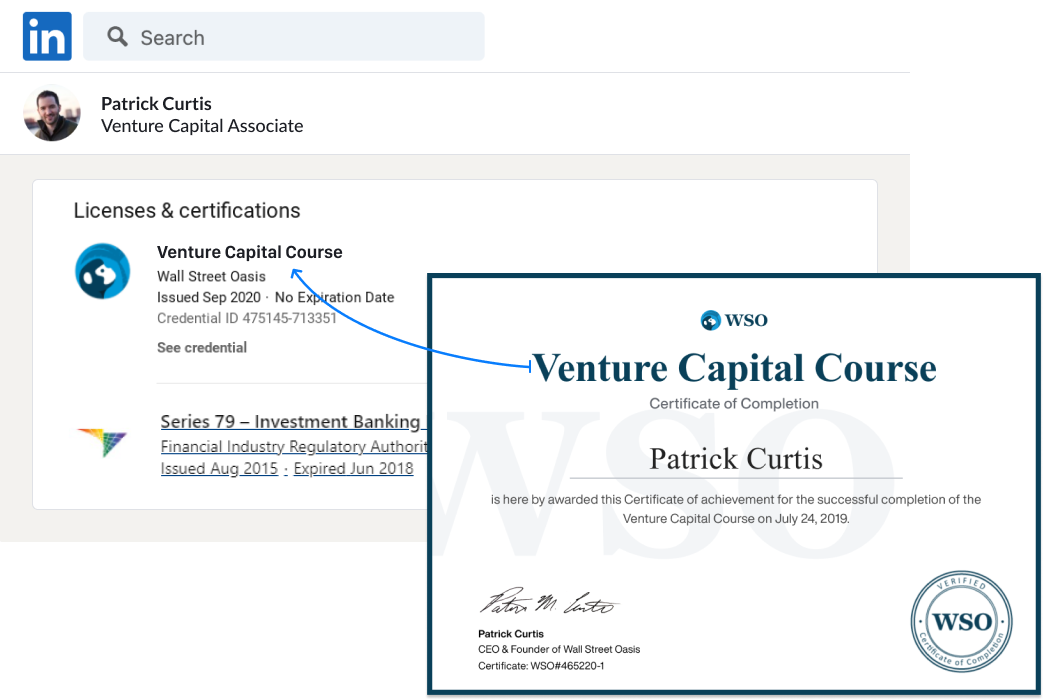

Certificates

Get The Venture Capital Course Certification

After completing the course, all students will be granted the WSO Venture Capital Course Certification. Use this certificate as a signal to employers that you have the technical VC skills to immediately add value to your team.

Demonstrate that you have put in the work outside of university courses to make yourself more knowledgeable and master the most critical skills for success in venture capital. Easily share to LinkedIn and other social media sites to highlight your skills and strengthen your profile as a candidate.

Course Benefits

How much is the Venture Capital Course Worth?

What You Get |

Value |

|---|---|

Venture Capital Course (Unlimited Lifetime Access) 110+ video lessons across 15 Modules created by a team of elite venture capitalists... |

$500 |

Interactive Exercises + Cap Table Modeling Gain realistic practice drilling the concepts taught to actual VCs so that you can hit the ground running Day 1... |

$450 |

24 Months of Unlimited Elite Support from Actual Finance Pros Have a technical question? Easily drop a comment into any lesson and get a response from a pro within 48hrs. |

$300 |

Total Value |

$1,250 |

Consider this your first investment in a long career...

After all, you've likely already spent tens of thousands of dollars on college (and perhaps tens of thousands more on an MBA)...

When you start your coveted finance job, you'll be making well over $200,000...

...over $350,000 if you have an MBA...

And that's just the beginning of a long and very lucrative career that could easily net you millions...

Even at thousands of dollars and your ROI would still be huge…

At a fraction of that price, the ROI is even better... When you do the math, it's a no brainer.

And that doesn't include the time you'd have to spend figuring all of this out and the hours of sleep these courses will save you.

Even if you used the free info online, you'd still have to find it, organize it, vet it and test it to get it to work. That would take months… and at that point, you may have missed your window.

The WSO Venture Capital Course gives you everything you need to be super-efficient and master venture capital… quickly and easily.

But we're not going to charge you thousands...

We won't even ask for half of that...

Get Unlimited Lifetime Access To The Venture Capital Course For

This offer (+bonuses) is limited-time only

12 Month Money-Back Guarantee

Your investment is protected by our 12-Month Risk-Free Guarantee -- easily the most generous in the market.

If, for any reason (or no reason), you don't think the WSO Venture Capital Course is right for you, just do the following within 365 days of your enrollment:

- Email [email protected] letting us know

- That's it!

We'll refund every penny. No questions asked. We bear the risk and will eat the transaction fees because we're that confident you'll love it.

Course Reviews

Here’s what professionals like you think of the course.

FAQ

Answers to popular questions

About

Top professionals with many years of Venture Capital experience

- MBA Students and Business Undergraduates

- Current IB Analysts

- Corporate Finance Professionals

- Anyone trying to break into Venture Capital

- Professionals looking to lateral into high finance

- Video-based self-study online courses from elite faculty (all current or previous finance professionals from top VC firms)

- Interactive quizzes

- Gamification to make more engaging

- 24 months elite support

ENQUIRIES

Any other questions?

We’re here to help.

We're confident you'll love the program and happy to answer any questions you have! E-mail [email protected] at any time and we'll get back to you within a few hours.