Form 20-F

SEC filing issued by and submitted to the U.S. Securities and Exchange Commission

What Is The SEC Form 20-F?

Form 20-F is an SEC filing issued by and submitted to the U.S. Securities and Exchange Commission that must be filed by all "foreign private issuers" with listed equity shares on exchanges in the U.S. to provide information.

A company is only eligible to file a 20-F if less than 50% of the shares are traded on the U.S. exchange. Once they breach that threshold, the company must file the same statements as a U.S. company (10K, 10Q, 8K, etc.).

The purpose of the form is to standardize the reports of foreign businesses for the markets within the U.S.

Form 20-F submission of an annual report should be within four months of the end of a company's fiscal year. The notice must also be made publicly available to shareholders through their company's website.

By filing it, the company provides the SEC with a deeper understanding of the company and its securities (or intentions to sell) on U.S. exchanges.

The reporting and eligibility requirements for Form 20-F are stated in the Securities Exchange Act of 1934.

Key Takeaways

- Foreign companies listed on U.S. exchanges submit Form 20-F to the SEC for standardized reporting.

- Companies qualify for Form 20-F if their U.S. exchange-traded shares are under 50%; exceeding this mandates U.S. reporting.

- Form 20-F streamlines reporting for foreign businesses in U.S. markets, facilitating evaluation by investors.

- Annual Form 20-F filing is due within 4 months of fiscal year-end and must be publicly available on the company's website.

- Filing Form 20-F offers the SEC deeper insights into foreign companies and their activities on U.S. exchanges.

The benefit of filling the SEC Form 20-F

The form is to standardize the reporting requirements of foreign-based companies so investors can evaluate these investments alongside domestic equities.

The form contains the company's annual report with financials and other details such as management information. It is required from foreign, non-U.S., and non-Canadian companies whose securities are traded in the U.S markets.

Under the New York Stock Exchange (NYSE) rules and regulations, a company must make the filing report available to its shareholders through its website and make shareholders aware the information has been released via a press release.

A failure to file the form with the SEC within the proper time frame of the listed company to procedures under section 802.01E.

After the exchange gives notice, there is generally a six-month "cure period" where the exchange monitors the situation. Additional time may be provided after this time elapses, or delisting may commence.

When to file the SEC Form 20-F

If a company is based outside the U.S., then they can use Form 20-F when:

- Filing an annual report is required annually and within four months of the company's fiscal year's end.

- If a foreign company (Non-U.S. and Non-Canadian companies) decides to list its equity shares on U.S. exchanges, it must file Form 20-F with the SEC.

- Registering types of securities or an investment company with the SEC.

- Filing a transition report is only required when changing the business's fiscal year-end date.

Example:

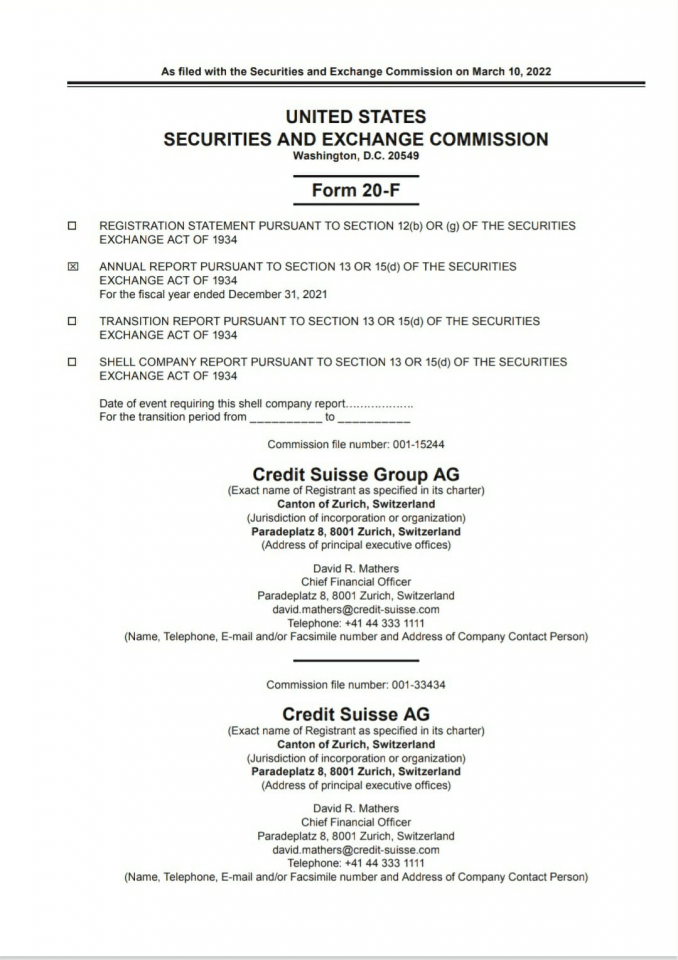

- Credit Suisse Group AG is a global investment bank and financial services firm founded and based in Switzerland. Headquartered in Zürich,

- Credit Suisse Group AG files an annual Form 20-f with the SEC. Its latest year ended on December 31, 2021, and the filing was on March 10, 2022.

- The filing has several sections, including crucial information on the company, operating/financial review/prospects, directors/senior management, and employees. The numbers, including the financials, are given in euros.

SEC Form 20-F FAQs

Yes, filing it is mandatory.

No, only non-U.S. and non-Canadian companies must fill it annually.

No, these are documents that are made publicly available, free of cost.

You can expect the following information about your company's finances, involved parties, and organization. For example:

• Audited financial statements and disclosures

• Financial condition, capitalization, indebtedness, and risk factors

• Liquidity and capital resources

• Directors and management team

• History, development, and structure

• Operating results

• Employees (including directors) and their compensation

• Major shareholders

U.S. and Canadian companies are exempted because instead of filing it, they point to SEC Form 10 K and 40 F, respectively.

or Want to Sign up with your social account?