Prospectus

A formal written document that comes with a new corporate securities offering and is intended to enlighten potential purchasers of that asset.

What Is a Prospectus?

A prospectus is a formal written document that comes with a new corporate securities offering and is intended to enlighten potential purchasers of that asset.

The prospectus is legally binding once published and after the appropriate department has approved the issuer's application for an initial public offering and listing.

The prospectus's disclosure safeguards the investor's right to information and defines the issuer's scope of duty.

Every investor should thoroughly read the issuer's brochure before making an investment choice, understand the issuer thoroughly, and assess the investment value of subscribing for additional shares.

A prospectus is defined in section 2(a)(10) of the Securities Act of 1933 as a “brochure, notice, circular, advertisement, letter, or communication, written or by radio or television, which offers any security for sale or confirms the sale of any security.”

The brochure is an important legal document, and any fraud, misrepresentation, or omission in a brochure is actionable under section 11, 12(a)(2) of the Securities Act.

Why Prospectus?

The document should be prepared by the issuer based on the investment requirements of the investors, and it should contain all the key information that investors need to make informed decisions about their investments and value judgments.

The prospectus should contain all the facts affecting investors' value assessments and choices.

Issuers, sponsors, and attorneys must plan according to the format requirements established by the U.S. Securities Regulatory Commission. In addition, they must revise, supplement, and improve their work in response to the regulatory agencies' review opinions.

Different industries' issuers have slightly different prospects than they have revealed. For example, companies that want to sell bonds or shares to the general public must register with the Securities and Exchange Commission and submit a brochure as part of that procedure.

Companies must submit a preliminary and final brochure, and the SEC has unique requirements for the information that must be included for different securities.

NOTE

The brochure’s extensive information regarding investment or security can assist investors in making more educated investment decisions.

The Companies Act of 2013 lists four different forms of documents:

1. Deemed Prospectus

The deemed document is specified in Section 25 of the Companies Act of 2013 (1). A document is assumed to be a brochure via which an offer is made to the investors when a corporation permits or agrees to issue any of its securities.

By default, the law considers any document that solicits the public to buy securities a brochure.

2. Red Herring Prospectus

It omits some details regarding the prices of the offered securities and the total number of securities that will be issued. In accordance with the laws, the company must provide the registrar with this brochure at least three days before the offer and subscription list open.

3. Shelf Prospectus

Section 31 of the 2013 Companies Act specifies a shelf brochure. A shelf brochure is published when a business or any public financial institution offers one or more securities to the general public.

A corporation must specify the brochure’s validity duration, which should be at most one year. The beginning of the first offer marks the beginning of the validity period. A brochure is not required for additional offerings.

When submitting the shelf brochure, the organization must provide an information memorandum.

4. Abridged Prospectus

An abridged brochure is a memo that includes all of the brochure's key elements as listed by SEBI. This brochure summarizes all the facts to let the investor make additional selections.

A corporation cannot distribute an application form to purchase securities without providing an abbreviated brochure.

Characteristics of the Prospectus

An initial public offering ("IPO") is typically a "one-time" event that culminates years of toil and personal investment for businesses and their owners.

Unquestionably, an IPO is one of the most significant turning points in a company's growth process and significantly alters how it functions and behaves.

Businesses and their owners must thoroughly understand public companies' legal and regulatory requirements and the ongoing compliance difficulties.

NOTE

A prospectus is a disclosure document created to give potential investors all the pertinent details they need to decide whether to invest in a company's stock. I will further describe the characteristics of the prospectus in the following paragraphs.

1. The brochure summary is a statutory information disclosure document

Accordingly, the summary of the brochure shall be submitted to the securities regulatory authority for approval along with the brochure.

As an attachment to the brochure, the summary of the brochure must record statutory content in accordance with legal provisions and securities regulatory agencies’ specifications.

2. The brochure summary is an introductory reading document.

The brochure is a detailed document but takes work for investors to read and understand.

It should be written in a few words to enhance the comprehensibility of the brochure and provide and convey brief information about the stock issuance to public investors as widely and quickly as possible.

NOTE

The brochure summary briefly provides the main contents of the brochure. Under normal circumstances, the summary of the brochure is about 10,000 words.

3. A brochure summary is a non-offering document

According to the current regulations, the following text must be recorded under the title of the brochure summary:

"The purpose of this brochure summary is only to provide the public with a summary of this offering as broadly and quickly as possible. The full text of the brochure is the official announcement of this offering of shares.

Legal documents. Investors should read the brochure's full text carefully before deciding to subscribe for the shares, and use the full text as the basis for investment decisions."

Although the brochure summary is not an offering document, it must not mislead the investors.

Contents of the Prospectus

You must have a thorough understanding of the brochure structure and the components it contains to comprehend its contents completely.

-

Brochure Summary

-

The Company

-

Use of Proceeds

-

Capitalization

-

Dividends

-

Shares Eligible for Future Sale

-

Dilution

-

Selected Financial Data

-

Management’s Discussion and Analysis of Financial Condition and Results of Operations

-

Business

-

Management

-

Certain Transactions

-

Certain Shareholders

-

Selling Shareholders

-

Description of Securities

-

Underwriters

- Legal Opinions

-

Experts

- Appendix

- The contents of the appendix include at least the following items:

- a. Financial statements and their annotations and audit reports;

- b. Financial statement difference reconciliation statement;

- c. Asset appraisal report;

- d. Profit forecast report and opinions of certified public accountants;

- e. Legal opinions;

- f. The issuer's articles of association and by-laws;

- g. The business license of the issuer.

- Documents available for inspection

The content of the documents available for inspection shall include at least the following items:

- The registration documents for the establishment of the issuer;

- Documents issued and listed approved by the competent department and the stock exchange;

- Underwriting agreement;

- The confirmation report of the state-owned assets management department on the asset certification and valuation;

- Other relevant materials on the issuer's reorganization;

- Important contracts;

- Other documents required by the USSRC. At the same time, the reference period (should not be shorter than the issue period) and the place of inspection should also be stated.

These locations should be places that are relatively accessible to investment companies, such as the location of issuers, underwriters, stock exchanges, the Securities Regulatory Commission, etc.

Relevant provisions of the prospectus

The document is regarded as a brochure by which the offer is made to the public if a corporation offering securities for sale to the public allocates or accepts securities.

For all intents and purposes, the document is regarded as a brochure of the corporation, and all of the rules governing its obligations and content apply to it.

Before opening the offer and subscription list, the company must distribute this brochure at least three times to the registrar.

If the company wants to raise money, it must submit a brochure. The prospectus' comprehensive information regarding the securities sold to the general public aids the investors in making educated decisions.

The following three points are the relevant provisions of the brochure:

1. First, the effective date of the brochure is six months, counting from the date when the brochure is signed.

An issuer may not issue shares using an expired brochure. If the issuer fails to issue shares within the validity period of the brochure, it must revise the brochure to supplement the latest financial and other information.

The revised and supplemented information must first be approved by the underwriters, recommenders, and intermediaries related to the information (such as lawyers, certified public accountants, or asset appraisers) and then reported to the United States Securities Regulatory Commission for review before the securities can be issued.

2. The brochure shall not contain the inscriptions of any individuals, institutions, or enterprises, any congratulatory, flattering, or recommending words, and any advertising or promotional terms.

3. Numbers in the brochure shall use Arabic numerals. Unless otherwise specified, information on monetary amounts in the brochure shall refer to the amount in dollars.

How to read the prospectus?

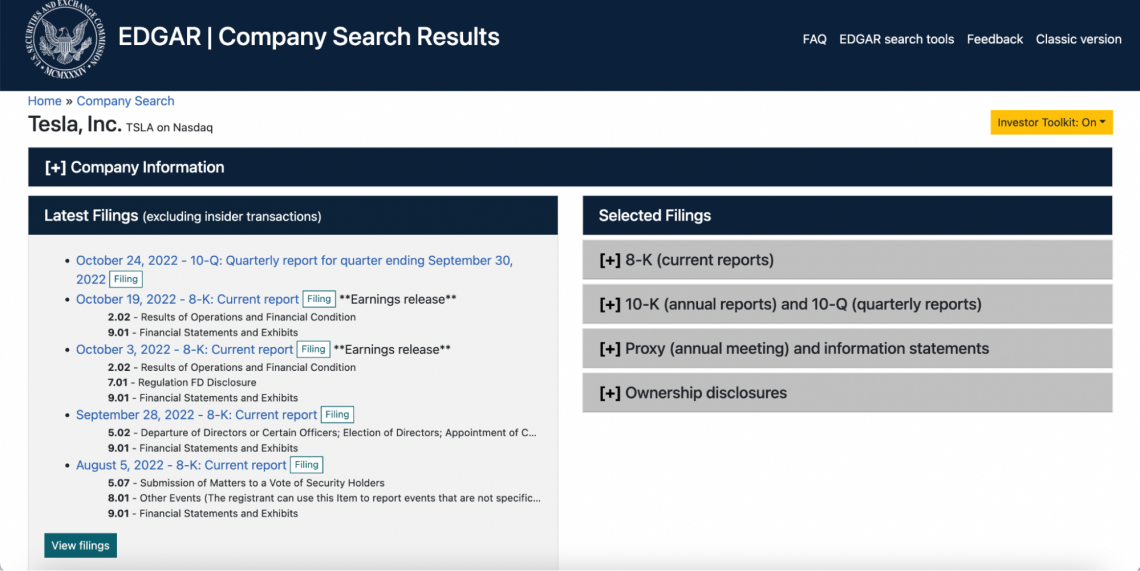

To find a brochure, here is the website of the U.S. Securities and Exchange Commission:

Take Tesla as an example: Type Tesla in the search box, and hit “Search.” The following graph is the result of searching:

A Brochure Summary: A brochure summary, including the company's business description, strength, risk, Corporate Structure (Equity Structure), and, very importantly, the offering (issue information summary).

In the issue information, we can understand the company's issue price, issue scale, financing purpose, and total share capital and calculate the company's market value. Then, in the Brochure Summary, we can focus on reading "Business Summary," "Advantage Summary," and "Company Release Information."

- First Step: Look at the industry the company is in and make a preliminary judgment of what type of company it is;

- Second Step: Look at the company's main business introduction;

- Third Step: Look at the company's industry competition pattern;

- Fourth Step: The company's product gross profit margin and comprehensive gross profit margin.

After opening the company's brochure using the four methods mentioned above, hit and hold CTRL+F and type a phrase into the search bar. For instance, if you type "gross profit margin," you will be taken to the terms associated with that term and the company's gross profit margin.

The following methods for studying risk factors, business and technology, and financial accounting information are introduced as follows:

1. Risk factors

If you believe that the company's research and development capabilities cannot meet customers' needs for rapid product updates and replacements or that emerging technologies will completely subvert the company's core technology, then your valuation of the company will be greatly reduced or even give up investment.

2. Business and technology

It is the main basis for the customers to choose and trust you. Technology is a strong support for businesses and the fundamental driving force for improving businesses.

3. Financial accounting information

It includes the company's balance sheet, income statement, and cash flow statement, as well as the management's analysis of the company's primary financial data, which is the main basis for its valuation.

The financial part will be reflected in two places in the brochure: the Index to Consolidated Financial Statements (financial notes) and the Management Discussion and Analysis.

NOTE

The financial notes will contain the complete financial statements, specifically the balance sheet, income statement, and cash flow statement. Additionally, specific financial topics are noted at the back of the three main statements.

For example, in Management Discussion and Analysis, we will explain the reasons for changes in the main financial subjects and the revenue split.

Most companies will also disclose the profit statements for the past eight consecutive quarters. This part is called "Selected Quarterly Results of Operations."

After reading these three sections, investors can choose to read additional sections based on the company's situation, such as Management and Principal Shareholder, which provides background on management and shareholder information.

Conclusion

Similar to how an employer uses a resume to learn specifics about a job applicant, investors use documents to learn specifics about a company and its shares.

A prospectus is frequently a document that contains information about a public offering. But more often than not, it is a formal document that must be filed with the Securities and Exchange Commission (SEC) and contains information about an investment offering for the general public.

Searching for a company’s brochure before you do investment or industry research is always a great way to understand the industry and its business trends quickly.

By doing the research, investors will easily get familiar with the company’s introduction, its products or services, its competitive advantages, and its shareholder structures. Due to its thoroughness and abundance of information, the brochure is the best research report.

By reading the brochure, you may learn more about the business, get a sense of how the industry it operates in is generally developing, including its policies and development trends, and discover which institutions are routinely tracking the market and publishing reliable statistics.

As a result, in general, when investigating specific stocks, read the brochure first, followed by the annual and semi-annual reports, and then the research report of the securities company and other documents.

The brochure is becoming a more crucial resource for investors, especially companies that have recently gone public. It strives for rigorous expression and extensive substance because it is intended for public investors.

A brochure is typically quite lengthy, which will turn off many readers. Indeed, reading a brochure can be difficult without any systematic direction. Therefore, I'm hoping that this article will assist you in overcoming your brochure anxiety and make reading the document a little less intimidating.

or Want to Sign up with your social account?