Market Dynamics

Forces that impact prices and the behavior of producers and consumers.

What Are Market Dynamics?

Market dynamics are forces that impact prices and the behavior of producers and consumers. These dynamic forces create market signals that result from the changes in the demand and supply of goods and services.

Human emotions are a factor in addition to price, demand, and supply. These dynamics are the basis of many theories and economic models. The policymaker’s objective is to determine the most appropriate use of financial tools to stimulate the economy.

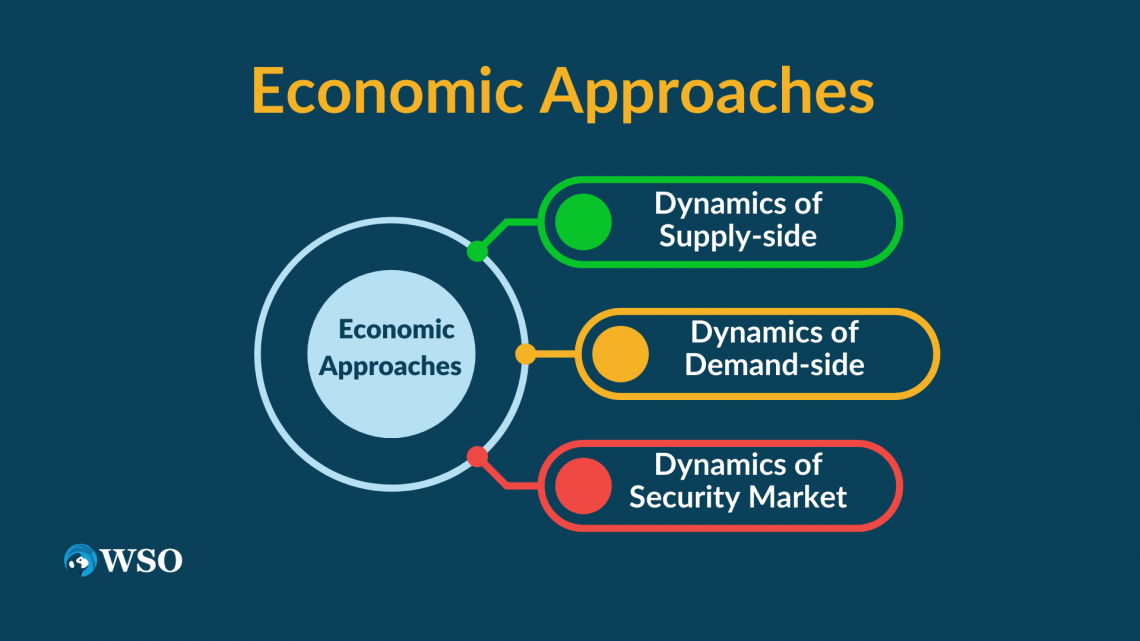

The following are the main economic strategies that aim to have an impact on the economy:

1. Dynamics of supply-side economics

Trickle-down or supply-side economics is based on three pillars. This includes tax policy, monetary policy, and regulatory policy, with the overall concept of supply being the most important determinant of economic growth.

They are based on the theory that incentives for investors in the form of an increased supply of goods to an economy come from significant tax cuts for corporations, investors, and entrepreneurs.

2. Dynamics of demand-side economics

Contrary to supply-side economics, demand-side economics emphasizes that economic growth results from high demand for goods and services.

Aggregate demand and economic growth are stimulated by higher employment levels, which come from high demand for goods and services, increased consumer spending, business expansion, and the need for additional workers.

Instead of tax cuts, demand-side economics focuses on the increase in government spending for the growth of economies, which encourages additional employment opportunities.

3. Dynamics of the security market

Besides the two quantifiable quantities, i.e., demand and supply, there is one more market called the security market.

In security or financial markets, decision-making is not as rational as in the markets for physical goods and services.

This is caused by the presence of the human element of emotions, which makes it challenging and chaotic to quantify their effects, increasing market volatility.

Key Takeaways

-

Market dynamics are influenced by factors such as price, demand, supply, and human emotions. Policymakers aim to use financial tools to stimulate the economy based on these dynamics.

-

Two main economic approaches are supply-side economics, which focuses on incentives for investors and tax cuts, and demand-side economics, which emphasizes high demand and increased government spending.

-

The security market is characterized by irrational decision-making influenced by human emotions, leading to market volatility.

-

Six key market dynamics include customers, product quality, timing, competition, finance, and a competitive team. Understanding and addressing these dynamics are essential for success in the market.

-

Market growth depends on factors such as end-user demand, customer preferences, and market attractiveness based on forces like supply and demand, government influence, and macroeconomic conditions. Evaluating these factors helps identify growth opportunities.

The six market dynamics

The following are the main six market dynamics:

1. Customers

The biggest influencers in the market are customers. An ideal customer possesses unsatisfied desires and needs. To meet their requirements and deliver satisfaction to them, it is essential to consider the market size.

Real value can be created, and customer assistance is made possible by sustainable business control over customer supply. Therefore, it is important to look for the monopolistic manipulations of the markets.

2. Product

Every customer is concerned about the product. The product's high quality ensures a direct and favorable response to the unmet needs and desires of the customer.

Business professionals design a product to create value by addressing the customer's needs. Generally, a customer is hesitant about adopting a new product.

Financial impact, money, invested time, etcetera; are all important considerations made by a customer before investing in a new product launched in the market.

Note

To persuade a customer to purchase this product, it must produce sufficient value to overcome its costs

3. Timing

The life cycle of a market is driven by innovation and circumstances. Therefore, it is crucial to keep an eye out for any new interest or demand for anything that was once thought impossible.

4. Competition

Any business needs to avoid being marginalized by excessive competition. A business should develop products whose markets are underserved and have the potential to evolve as a sustainable competitive advantage.

5. Finance

A company in good financial condition or profile demonstrates the position of the company in the market. Opportunities to increase returns must be created without the incorporation of capital risk.

With minimal capital commitment, a low-cost start enables the realization of margin through scaling-up efforts.

6. Team

A competitive team possesses the knowledge, resources, and technical skills to succeed in the market.

Market Dynamics Example

An example to showcase what we have been talking about is the 'Johnson & Johnson' case. J&J developed the first working 'stent.' A stent is a small medical implement used for patients with artery blockage instead of open-heart surgery.

Beginning in the late 1980s and continuing into the early 1990s, J&J made investments in the stent's research and development and took all the necessary steps to obtain regulatory approval.

Though the product was a success, J&J had to face various challenges after introducing it to the market. For instance, J&J experienced problems with the demand being significantly greater than the supply, conflict in the mergers that were made to increase production, and difficulties with reimbursement.

1. Customer response

While doctors and patients were happy, the hospital administration had difficulty with the cost. Despite high pressure from the hospitals, J&J did not compromise with the set prices. As a result, the hospital felt gouged and a hostage to J&J's pricing power.

2. Market learning

The company was unable to respond to the suggestions given by the doctors for the improvement of the first-generation stent in terms of size and flexibility as their focus was on increasing capacity, lobbying the insurance industry, and integrating firms.

3. Competitor response

Being the first mover innovator, J&J had to pay higher prices to gain an advantage in the stent market. This is accomplished by building a knowledge base that requires significant time and money to develop.

This gave the other market participants the chance to catch up quickly without having to make a large initial capital investment.

While J&J was busy prioritizing other goals, the competitors in the market paid close attention to the feedback from doctors instead, such as the size of the stent and the bare-metal J&J stent. So, using J&J's research and feedback from the market, Guidant developed a more flexible stent.

4. Understanding the needs of the market

There was a drastic loss of market share due to the significant store of resentment and the inability to address the physicians' concerns regarding the ease of use and the flexibility of the stent.

The lack of responsiveness from J&J's end reflected their inability to understand the market's needs. As a result, even though they have continued to innovate and effectively compete in the market, they lost their position due to their mistakes.

Market Dynamics - Questions to address

Aside from deciding 'which market to pursue,' that is, whether to pursue the market they are already in, an adjacent market, or a new market, organizations must make important decisions to promote organic growth.

Market growth tests enable the evaluation of growth options through industry trends, customer needs, and the competitive environment. The market dynamics test evaluates all-embracing dynamics to determine the availability of growth opportunities.

There are 3 important questions:

1. Are end-user demand and customers in the market growing?

Market expansion is determined by the need for offerings and considering whether that need is growing or not. Therefore, market research should produce a report on the chosen industry to determine the market's growth.

Market signals that indicate growth are also being observed. For instance, the movement towards increasing investment and capacity expansion is an indication given by the acquisition of smaller companies by larger companies.

Focus groups are a valuable method for initial determination of the customers' enthusiasm, the need for the offerings, and for exploring the factors affecting the market position that was not considered in the past.

2. What drives current demand?

The taste and preferences of the customer and end-user also influence demand, in addition to price and customer experience.

Note

A product or service will perform better if there is a strong preference for it.

Income is also important because it helps to ascertain if the price of a product or service is excessive. The performance and position of a product depend on the price of the related goods, the number of buyers in the market, and advertising expenses.

3. The attractiveness of the market is based on which forces?

The dynamics that affect a market are supply and demand, international transactions, government influence, speculation, and expectations. In addition, macroeconomic forces impact the markets by affecting interest rates and prices.

It is important to look at how customers, politicians, and investors react to the projections made for a market's future by priming the market, spending money within a market, and investing in companies.

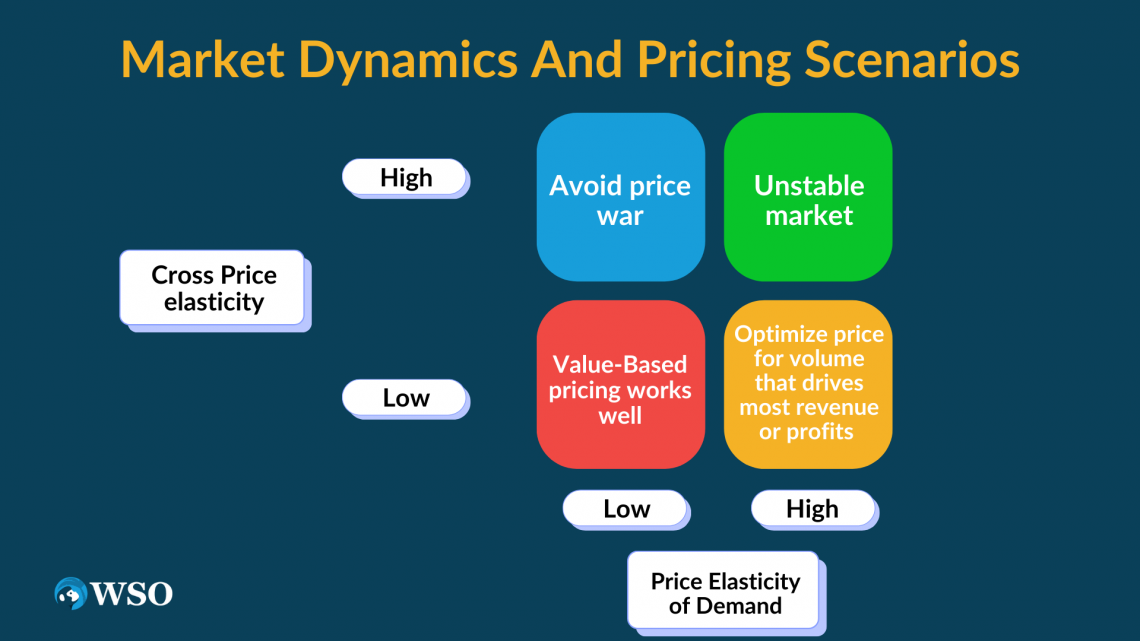

Market dynamics and pricing scenarios

The standard framing is in terms of cross-price elasticity (CPE) and the price elasticity of demand (PED). Their interaction defines the market dynamics and puts constraints on the pricing strategy.

Generally, the four results from the interaction are:

| S. No | Cost-price elasticity | Price elasticity of demand |

|---|---|---|

|

1 |

High |

Low |

|

2 |

High |

High |

|

3 |

Low |

Low |

|

4 |

Low |

High |

There could be an additional 16 examples of responses to the economic shutdown. The economic shutdown is an extreme market condition that impacts different sectors differently.

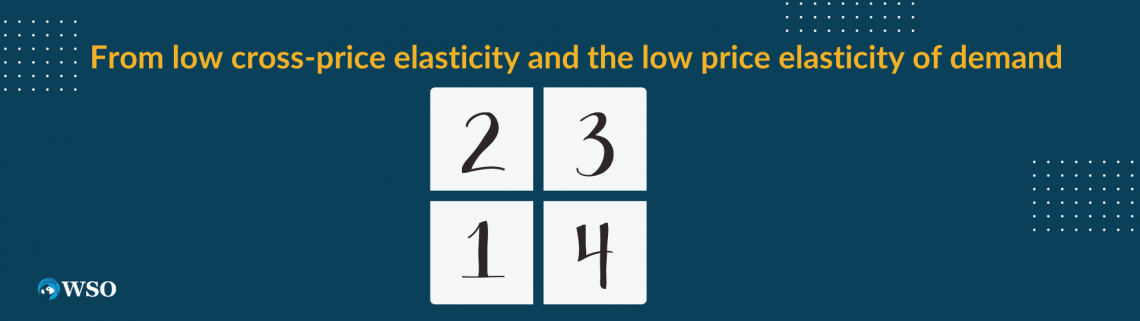

A: From low cross-price elasticity and the low price elasticity of demand

(movement from points 1 to 2, 3, and 4)

- In the best segment with pure value-based pricing, customers do not easily switch in response to changes in price.

- Drop in prices will not increase the demand. It can be attractive to other competitors' customers.

- On entering the commodity market, customers are no longer in the position to enjoy the differentiating functionality of the down market. The market forces set prices.

- If prices are lower, demand increases, and the risk of a price war arises.

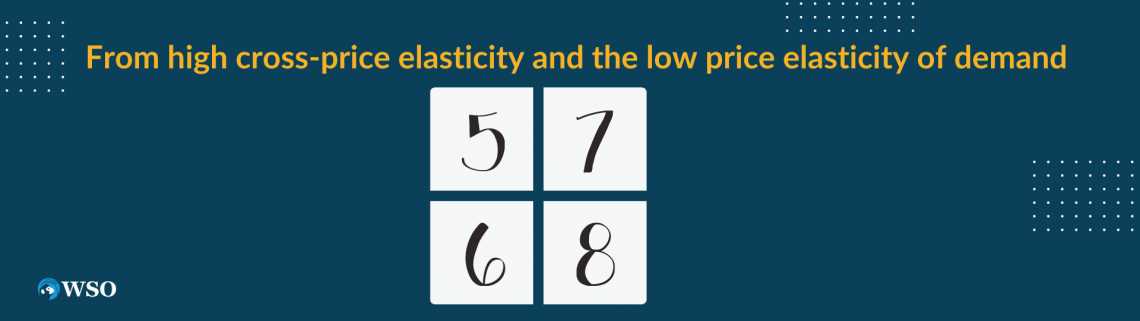

B: From high cross-price elasticity and the low price elasticity of demand

(Movement from points 5 to 6, 7, and 8)

- Here, the overall demand does not respond to the price change. The buyers agree to switch vendors.

- Customers are not willing to change the vendors.

- In this unparalleled time, many products that previously had meaningful differentiation are now being downgraded to commodity status.

- Market participants try to punish the companies that take advantage of the difficulty by responding to changes in price by changing the overall demand.

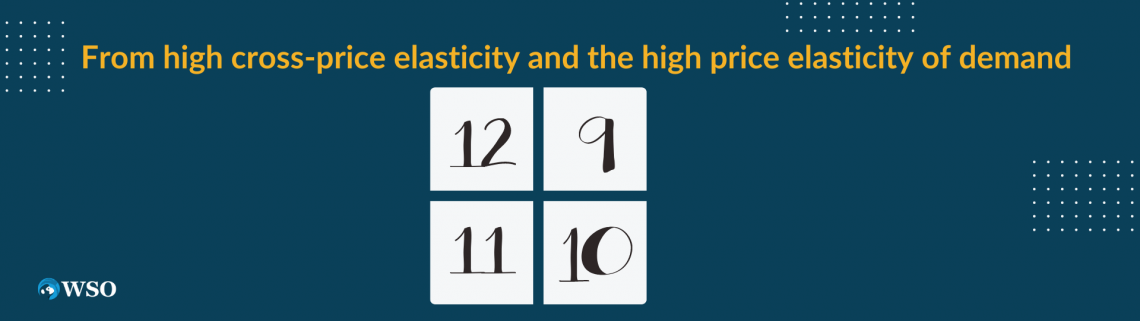

C: From high cross-price elasticity and the high price elasticity of demand

(movement from points 9 to 10, 11, and 12)

- This represents a commodity market where demand responds to price changes and buyers switch vendors according to their willingness.

- Customers are less willing to switch vendors. People's attitudes are less likely to change in times of economic shutdown.

- Ideal conditions for value-based pricing are created, and the inclusion of subscription components is seen as adjusting subscription pricing is advocated.

- A fall in price elasticity of demand is observed as there is little demand, for example, luxuries and travel. On the other hand, people are willing to buy all that they can and from whoever is willing to sell.

D. From low cross-price elasticity and the high price elasticity of demand

(movement from points 13 to 14, 15, and 16)

- Prices are optimized in this quadrant, and volumes enable the achievement of goals. Here, goals refer to volume, profit, or revenue operations.

- Here, some customers lose pricing power due to differences in the sensitivity toward price change and are subject to adjusting the prices to match the market.

- This is the worst-case scenario as there is a risk of price war and long-term damage to the market.

- Ideal value-based pricing results from a reduction in the price elasticity of demand, suggesting weak underlying demand.

The reason for changes in the dynamics of many companies is the result of radical changes in demand. Therefore, the breakage of the normal relationship between price and demand is due to an extreme increase or decrease in demand.

Researched and authored by Parul Gupta | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?