Stagflation

It is an economic condition where the inflation rate is high

What is stagflation?

Stagflation is an economic condition where the inflation rate is high, the pace of economic growth decreases, and unemployment stays high.

It has the following attributes:

-

Salaries are unable to keep up with growing prices, resulting in real income declines.

-

A commodity price spike, such as oil, is a common source of inflationary recession.

-

Policymakers have a tough time dealing with recession inflation as they will be unable to address both inflation and unemployment simultaneously.

-

Usually, recession inflation is the step before a full-blown economic recession or an economic slowdown.

Stagflation in Economic History

There are few records regarding depression along with inflation throughout history except for the first one in the 1970s.

1. Obsolete academic belief in an inflationary recession

Recession inflation was considered unattainable for a long time because economic theories that dominated academic and policy circles built it out of their models, owning the Phillips curve's foundation.

The Phillips Curve economic theory, which is included in the framework of Keynesian economics, depicted macroeconomic policy as a trade-off between unemployment and inflation, which means it is impossible to increase both unemployment and inflation.

After the Great Depression and the rise of Keynesian economics in the twentieth century, economists became preoccupied with the dangers of deflation.

It argues that most policies at lowering inflation make life more difficult for the unemployed while policies easing unemployment raise inflation.

Nonetheless, recession-inflation swept the developed world in the mid-twentieth century and demonstrated that this was not the case.

As a result, recession inflation is an excellent example of how real-world economic facts may override commonly held economic theories and policy prescriptions.

2. A new belief

Since then, inflation has remained a prevalent norm, even during weak or negative economic development. Every proclaimed recession in the United States over the last 50 years has witnessed a year-on-year increase in consumer prices.

2008 financial crisis is the only exception, and even then, the price decrease was limited to energy costs, while other consumer prices continued to rise.

Measuring stagflation

Two leading indicators explaining it are the Phillips curve and the Misery Index:

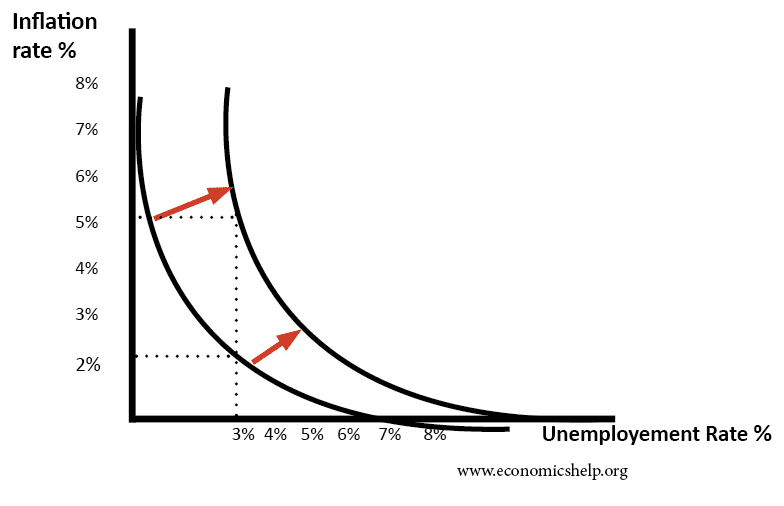

1. Phillips Curve

The Phillips curve describes the relationship between unemployment and inflation.

According to the Phillips curve, unemployment and inflation are inversely related: as unemployment falls, inflation rises.

The connection, on the other hand, is not a straight line. When the unemployment rate is on the x-axis and the inflation rate is on the y-axis, the short-run Phillips curve follows an L-shape graphically.

On the other hand, stagflation might be viewed as a worse trade-off. The Phillips curve has moved to the right in effect.

The Phillps curve was a popular theory in the economic field. Nonetheless, after President Nixon eradicated the remaining linkages between the currency and gold, the United States underwent many years of recession-inflation.

The Phillips curve was no longer valid to explain the situation.

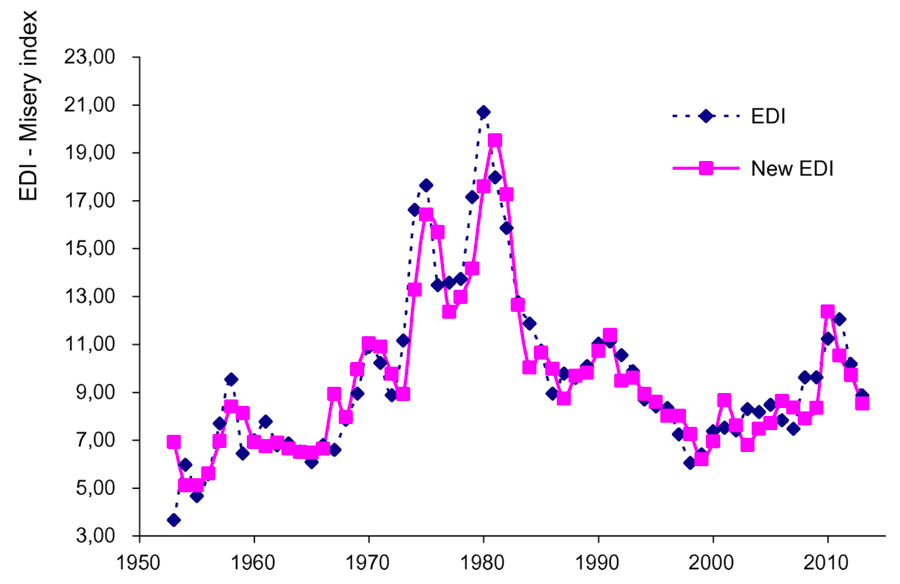

2. Misery index

The misery index is computed by adding the unemployment and inflation rates.

The index was invented by an American Economist, Arthur Okun, who owned that the Phillips curve was no longer capable of explaining the economic situation.

The misery index is intended to evaluate the level of economic pain experienced by ordinary people due to the threat of joblessness paired with rising living costs. It is regarded as an indicator to show the relative health of an economy.

It causes both unemployment and inflation to grow. Hence a high misery index implies a recession-inflation time.

The limitations of the Misery Index are:

The misery index appears to be a handy shorthand for economic difficulties at first glance. Still, there are a few reasons why it should not be regarded as a reliable indicator of financial health.

For one thing, the misery index's two components have built-in blind spots. The unemployment rate only includes people actively seeking a job; it does not include those who have given up looking for work, as may be the case during protracted periods of unemployment.

On the other hand, low inflation might be accompanied by unanticipated suffering. No inflation or deflation can indicate a stagnating economy, but it would result in a low misery index.

Economists have been critical of the Okun misery index. Some argue that it isn't a strong predictor of economic performance since it excludes statistics on economic growth.

By focusing solely on current unemployment and inflation rates as a measure of personal economic hardship, the misery index may underestimate the significance of expectations and uncertainty when most of the stress individuals experience is from the future outlook.

The unemployment rate, in particular, is often regarded as a lagging indicator that understates unhappiness experienced early in depression and overestimates it even after the recession has ended.

What causes stagflation?

There is always a heated debate about the reasons for recession inflation among economists. It can be deduced into two fundamental driving forces of an economy: the supply side and monetary policies.

We have the following supply-side factors that may result in depression with inflation:

1. Supply shock

According to the supply shock hypothesis, recession-inflation happens when an economy experiences a sudden increase or reduction in the supply of a commodity or service (supply shock), such as a quick rise in oil prices.

Prices rise in such a setting, making the output more expensive and less lucrative, slowing economic development.

Examples:

-

After the price of oil tripled in the 1970s, recession-inflation developed.

-

Following the surge in oil prices and the commencement of the global crisis in 2008, there was some recession inflation.

2. Influential trade unions

If labor unions have considerable negotiating power, they may be capable of negotiating for more significant salaries even while the economy is slowing down.

Inflation is mainly caused by rising salaries, as it increases the cost of production and reduces output.

3. Decreasing productivity due to other factors

When an economy's productivity falls due to other factors such as political instability, wars, and natural disasters, production becomes more inefficient or even disrupted. As a result, costs rise, and output falls.

Stagflation Case Study: Nixon Shock

Nixon Shock is a term used to characterize the aftermath of former President Richard Nixon's economic policies, which he promoted in 1971, and it is considered the catalyst for the 1970s U.S. stagflation.

President Nixon's New Economic Policy was executed in the post-Vietnam War age. The main point of the speech was that the United States would focus on domestic issues, which has three key objectives:

-

Better job creation

-

Keeping the cost of living from rising

-

The U.S. dollar is being protected against international money speculators

What were the initiatives of Nixon's policies?

-

To launch wage-price controls

-

To end the Gold standard

To launch wage-price controls

Nixon ordered a 90-day freeze on all prices and wages throughout the United States.

After the 1972 election, he established a Pay Board and Price Commission to keep the hike of prices under control.

In a free-market economy, wage and price regulations are ineffective. Workers are no longer eligible for raises, which means they have less money to spend on products and services.

This situation reduces demand. Prices cannot be reduced to increase demand. The sellers are also unable to boost pricing, despite the rising costs of imported materials. Also, the producers can't slash pay, so they cut hiring and demand for labor as a result.

To end the Bretton Woods Agreement

Nixon's initiatives included the effective ending of the Bretton Woods Agreement and the ability of U.S. dollar-gold conversion.

Since then, the U.S. dollar and most other international currencies have been on a fiat foundation, removing most practical limitations on monetary expansion and currency depreciation.

What were the effects of the Nixon Shock?

-

An increase in double-digit interest rates

-

An attribute of 1970s stagflation

First, Nixon's actions were the fundamental cause of the situation in the 1970s.

-

An attribute to the volatility of U.S. dollars

It also contributed to the volatility of floating currencies, as the U.S. dollar fell by a third in the 1970s. The U.S. dollar has been anything from stable over the last 40 years, with multiple episodes of extreme volatility.

The U.S. dollar value index, for example, dropped by 34% between 1985 and 1995. From 2002 until mid-2011, it declined steeply again after quickly recovering.

Stagflation Challenges

Monetary policies are crucial to combat this downturn. Nonetheless, it is also often criticized for being a contributor to recession inflation.

Rising interest rate to combat inflation

Increased interest rates raise the cost of borrowing, lowering aggregate demand (A.D.). This act will help lower inflation but result in a more considerable drop in GDP.

As a result, recession-inflation might happen if the general price level does not go down after the interest rate increases, causing more significant damage to the economic output.

Adjusting money supply

Implementing Quantitative Easing, i.e., increasing the money supply, could promote business expansion as it encourages lending and investment, yet it prompts higher inflation.

Quantitative easing often creates an asset bubble as investors tend to be involved in more speculation activities when receiving a higher income.

On the other side, Quantitative Tampering, i.e., decreasing the money supply, could bring down inflation. Still, it will worsen the employment rates due to an increase in the cost of borrowing.

These fiscal policies are helpful when the economy merely faces one problem, as they have side effects when implemented.

Then, solutions on the supply side might be another option than monetary policies.

Boost aggregate supply (AS)

Boosting aggregate supply (AS) through supply-side strategies like privatization and deregulation to increase efficiency and lower manufacturing costs is one way to combat recession inflation.

These policies, on the other hand, will take a long time.

Furthermore, if cost-push inflation develops due to a worldwide increase in oil and food prices, the government would have little control over the situation as it is imported inflation.

However, cost-push inflation is frequently a transient phenomenon; for example, increased energy prices may not last indefinitely.

Wage control

Rising salaries contributed to some of the inflation-recession of the 1970s because of the rise of powerful trade unions).

Wage control — government involvement to curb wage increases – was one approach that was explored. Limiting salary increases, in principle, can assist in breaking the cycle of wage inflation and strengthen the economy.

Wage regulation is a tricky concept to practice, owing to other political reasons, and it has had little success in alleviating recession inflation.

Stagflation Examples

This downturn is complex and expensive to eradicate in both social and fiscal terms. Merely a few instances may be found throughout history. The most famous happened in the United States in the 1970s.

The 1970s U.S. inflationary recession

In the 1960s, the Federal Reserve took a loose monetary policy to keep unemployment low and stimulate broad demand for goods and services.

However, the decade's deficient unemployment generated what's known as a wage-price spiral, which means an increase in wages due to employees' expectations of inflation, causing an increase in production cost.

The 1973 OPEC oil embargo played a significant role in the unwelcome economic occurrence in the United States.

Unreasonably high oil costs and shortages harmed industries across the country, and demand had dropped to new lows; as a result, industrial production declined.

High inflation caused increased cost and demand due to a loose money supply policy. At the same time, the industrial output was reduced due to a rise in production costs.

The postwar economic boom slowed down, and inflation led to a rise in unemployment. As a result, an inflationary recession emerged.

For a variety of reasons, recession-inflation was a significant turning point in global economic history.

The Keynesian consensus of the postwar period was questioned. Until the 1970s, the government and the Federal Reserve seemed to be able to control the economic cycle.

However, in the 1970s, both unemployment and inflation increased, and traditional fiscal and monetary policy could not handle the dual issues.

The economic issues of the 1970s gave rise to monetarists like Milton Friedman. In the early 1980s, the U.K. and the U.S. implemented monetarist policies with the primary objective of reducing inflation while ignoring the short-term consequences of unemployment.

2. Potential inflationary recession in 2022

There is a great chance that the global economy might face a potential inflationary recession in 2022. Here are a few reasons that account for it.

1. The highest inflation rate in 40 years

On March 10, 2022, the U.S. Bureau of Labor Statistics announced that inflation hit a new 40-year high in February, with the Consumer Price Index (CPI) rising to 7.9%.

2. Oil prices pushed up due to the Russia-Ukraine War

Due to the Russian-Ukraine war, the crude oil supply has been disturbed, pushing the price up by nearly 40%.

The consequent increase in oil prices in March will boost inflation by increasing energy costs which pushes up the consumer and business expenditures, therefore lowering demand on both sides - business and consumer.

3. Sanctions on Russia

The knock-off effect of the sanctions on Russia in response to its invasion of Ukraine might worsen the U.S. economy by harming U.S. companies' profits. The U.S. corporates are leaving the Russian market for political reasons.

For instance, McDonald's announced in March that it was temporarily closing its 850 locations in Russia, and its restaurants in Russia and Ukraine contributed 9% of its annual revenue, or about $2 billion.

4. The Federal Reserve's plans for rate hikes

The Federal Reserve plans to hike interest rates to a neutral rate in 2022, estimated to be between 2 and 3.5%

5. China Shanghai full-on lockdown

The Shanghai lockdown in 2022 China has caused another global supply chain disruption.

Stagflation vs. Inflation

There are a couple of differences between the two.

By definition, inflationary recession means stagnant economic growth plus inflation; on the other hand, inflation only means an increase in the general price for a given period.

In short, inflation is a part of recession inflation.

The distinctions between inflation and recession-inflation are minor, yet they are significant. Inflation is defined as a gradual increase in the prices of goods and services in a given economy.

Low and consistent inflation has historically been linked to low unemployment, low-interest rates, and a mixed investment climate.

A period of high inflation, high unemployment, and a stagnating economy is known as stagflation.

Historically, the investing climate has been unfavorable during inflationary depression since higher input prices combined with reduced sales have resulted in poorer profitability per share for firms.

Before the inflationary recession, usually inflation advents because when the economy is affected by uncontrolled inflation, the economy slows down.

Why Is Stagflation Bad?

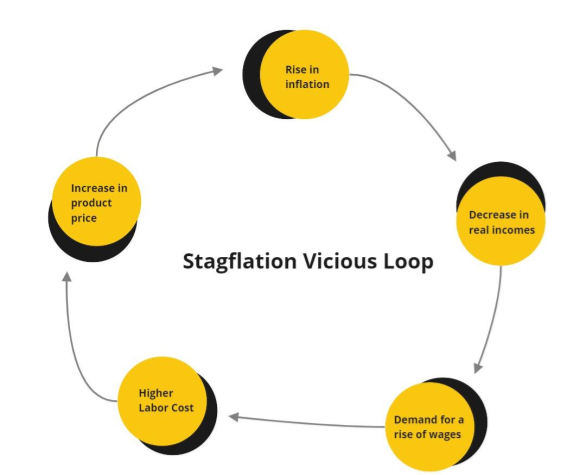

An inflationary recession is a paradox since slow economic development will almost certainly result in a rise in unemployment, yet it should not end in price increases.

However, ineffective monetary policies might directly contribute to inflation, which causes inflation and unemployment to co-exist.

A rise in unemployment results in a drop in consumer purchasing power, as people have less income to spend, which is why this phenomenon is unfavorable.

When you factor in rampant inflation, what money people have is losing value over time—there is less money to spend, and the currency's value is falling.

Workers will ask for a raise in their salary, which increases production costs. As a result, the price of goods is pushed up. On the other hand, sales volume dries up due to declining economic demand.

In other words, the economy will be trapped in a vicious cycle in which individuals will have less money to spend, the price of goods will continue to rise, and overall social productivity will fall.

These elements will directly impact social stability; if not managed properly, they may result in social unrest, wreaking havoc on the social and economic structures.

In most circumstances, the government prefers to take measures and avoid bringing the economy into an inflationary recession, as this is a complex problem to tackle alone by monetary policy.

What Is the Cure for Stagflation?

It is not an easy problem to tackle, but here are the possible solutions:

1. Interest rate adjustment

Monetary policy can lower inflation by setting higher interest rates or boost economic growth by cutting interest rates. However, inflation and recession cannot be solved simultaneously by monetary policy.

This is because an important factor leading to it is not only high inflation but worsening economic growth, and that cannot be solved by raising interest rates. If anything, it will lead to a sharper decrease in the economic productivity of a country.

Therefore, central banks must be careful when using interest rate tools to tackle it.

2. Oil price monitoring

Consumer products (necessities of the public) are heavily influenced by oil prices; hence a high oil price can lead to inflation.

Thus, oil price monitoring could be a possible solution to it. The U.S. government could adopt corresponding policies to adjust the oil price, for instance, releasing oil from Strategic Petroleum Reserve.

3. Wages Control

In a free-market economy, wage and price regulations are ineffective. With lower pay rates, workers reduce the demand for goods and services, which results in a slowdown of economic growth, causing a wage-price spiral.

Stagflation FAQs

Cost-push inflation, according to this theory, causes recession inflation. When a force or situation increases the cost of manufacturing, this is known as cost-push inflation.

Government measures (such as taxation) or completely external reasons (such as a scarcity of natural resources or a war) might be blamed.

Money loses its purchasing value, and the economy slows dramatically, resulting in high unemployment.

You may have heard a lot about recession-inflation in the United States in the 1970s, when energy costs rose owing to an OPEC-led embargo, with oil prices tripling from 1973 to 1975.

These factors resulted in high inflation and recession in nations that imported vast amounts of oil.

Keynesian economists had to reassess their paradigm because a period of poor economic development was followed by more significant inflation in the 1970s.

Milton Friedman restored the Federal Reserve's reputation by assisting in the conclusion of the stagflationary period.

Inflation is defined as the increase in goods and services prices in a given economy. Inflation-recession is an economy with high unemployment, inflation, and a slow or static pace of economic growth.

Stagflation is defined as a period of rapidly rising inflation combined with weak economic development and high unemployment.

Deflation occurs when prices fall sharply due to an excessively high money supply or a decrease in consumer spending; reduced costs mean corporations earn less and may have to lay off workers.

Researched and authored by Ka Chun CHIU | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?