Fed Balance Sheet

It generates a variety of assets and liabilities as part of conducting monetary policy and is calculated and released every week.

What Is the Fed Balance Sheet?

The U.S. central bank, the Federal Reserve (Fed), generates a variety of assets and liabilities as part of conducting monetary policy. These are listed on its balance sheet.

Congress established the Federal Reserve in 1913 with the following objectives:

- to protect the value of the U.S. dollar, manage interest rates and inflation

- to avoid catastrophic economic downturns

- to guarantee the financial and banking institutions of the United States remain stable during times of crisis

The Federal Reserve’s balance sheet is similar to traditional banks’ balance sheets since they are both comprised of assets and liabilities.

Unlike firms, The Fed's balance sheet is calculated and released every week, as opposed to quarterly or yearly.

The Fed releases its current balance sheet every Thursday, often known as the Fed's H.4.1 statement.

Economic researchers, market watchers, and investors keep an eye on the Federal Reserve's balance sheet to determine the central bank’s policy stance.

Unlike any other organization, the central bank is in charge of conducting monetary policy. The Fed has a “dual mandate”, two simultaneous goals - to achieve maximum employment and price stability.

The Federal Reserve also controls about 90% of the U.S. monetary base, as it is the sole institution with authority to print U.S. dollars. Note that the U.S. Treasury can issue coins.

Key Takeaways

- Fed Balance Sheet is the U.S. Central Bank’s balance sheet, made up of assets and liabilities.

- It is calculated and released every week, as opposed to quarterly or yearly, for other institutions or firms.

- It can be expanded by purchasing assets with newly printed assets, as the Fed has the sole power to print USD notes.

- The Fed's balance sheet has vastly expanded since 2008 with the emergence of quantitative easing.

- As of October 19, 2022, the Federal Reserve has $8.75 trillion in assets on its balance sheet.

- In 2022, the Fed announced its plan to shrink the balance sheet and raise interest rates.

Assets and Liabilities in the Fed’s Balance Sheet

This graph depicts the changes in the Fed’s total assets from the end of 2002 through 2022.

Federal Reserve’s assets consist of the following:

- Securities

- Mortgage-backed securities (MBS)

- Other Federal agency financial instruments

- Loans to U.S. banks (discount loans) and other business

Securities

The Federal Reserve's assets are mostly securities, most of which are U.S. Treasury bonds. The Federal Reserve's assets are mostly Treasury securities.

About two-thirds of these Treasury securities are shorter-term Treasury bills, notes, and bonds.

Mortgage-Backed Securities (MBS)

During the Global Financial Crisis, the Fed began purchasing MBS for the first time.

The Fed announced it would purchase corporate bonds through the Secondary Market Corporate Credit Facility on March 23, 2020.

Other Federal Agency Financial Instruments

The Federal agency debts refer to two types of bonds:

- Bonds issued or guaranteed by federal government agencies.

- Bonds issued by government-sponsored enterprises (GSEs)—corporations founded by Congress to promote a public purpose, such as affordable housing

Loans To U.S. Banks And Other Business

The Fed's other assets include outstanding loans to U.S. banks and other businesses. The Fed offers loans directly to banks through the discount window. These loans are offered at a higher interest rate (the discount rate) than those that come with interbank loans (federal funds rate).

In such cases, the Fed acts as the lender of last resort.

Financial institutions that can’t access these loans are eligible for other types of liquidity support, such as through the standing repo facility.

During periods of crisis, the Fed may open facilities to help certain markets. Like with the purchase of MBS, the goal is to stabilize these markets. Additionally, the Fed may be looking to support firms.

An example of this is the Primary Market Corporate Credit Facility and discount window, both of which were used during the pandemic.

Liabilities In Fed's Balance Sheet

The graph above shows the change in the Fed’s total liabilities from the end of 2002 through 2022.

The Fed’s liabilities are:

- All U.S. money in the economy that the Fed does not hold is often called “currency in circulation.”

- The portion of deposits held by banks and financial institutions in Federal Reserve accounts. These are called reserves and earn interest on reserve balances. Reserves are made up of:

- The portion of deposits that must be held according to the Federal Reserve’s

- “Reserve requirement”. These are required reserves.

- Excess reserves are the number of reserves voluntarily held on top of required reserves.

Open Market Operations (OMO)

In order to change the supply of reserves in the economy and expand or contract the money supply, the Fed uses OMO. It can print money and then inject that money into the economy by purchasing securities from banks.

The Fed can sell securities in return for reserves to directly contract the monetary base.

Quantitative Easing (QE) and the Fed Balance Sheet

The Fed seeks to undertake certain recovery measures whenever there is an economic crisis to keep the economic engine going. Economic conditions dictate the measures it can take. Here we will discuss quantitative easing.

The 2008 Financial Crisis gripped markets and rendered many conventional monetary policy tools ineffective as markets failed to allocate funds effectively.

At that point, the Fed had already cut interest rates to almost zero on its balance sheet for the first time in history.

The Federal Reserve came up with quantitative easing to lower long-term interest rates and encourage investment.

Since then, the Fed's balance sheet has had an important role in regulating the monetary base to keep the U.S. economy running smoothly.

What Is Quantitative Easing?

Quantitative easing, abbreviated as Q.E., is a technique in which the Federal Reserve buys huge amounts of assets in the open capital markets to achieve the following:

- to boost the money supply;

- to keep long-term interest rates low and promote lending by banks and investment by firms and individuals;

to support economic growth beyond what could be achieved by lowering short-term interest rates to zero.

An increase in the monetary base, in turn, increases the money supply. A growing money supply typically promotes economic growth, despite the danger of inflation.

Since the Global Financial Crisis of 2008, the Federal Reserve's balance sheet has highlighted how the Fed conducts what has become known as "quantitative easing," which has become a crafty solution to economic and credit crises.

The strategy has garnered political criticism for favoring certain markets, but other than the Fed, the European Central Bank and the Bank of Japan also use it.

The Fed actually used a fourth round of Q.E. during the onset of the COVID-19 pandemic.

Emergency Measures during the 2020 COVID Crisis

During the COVID-19 pandemic, the U.S. economy plummeted.

Retail sales fell 8.7% from February to March 2020, the greatest monthly drop since the Census Bureau began recording the data.

To avert a recession, the Fed adopted some intense measures:

- 0 - 0.25% Fed fund rate and the interest paid on excess and reserve balance (IORB, for funds held at the Fed) to 0.1% and large-scale asset purchasing (Q.E. 4)

- Purchasing certain corporate bonds for the first time ever

- Emergency lending facilities

Zero Federal Funds Rate And Large-Scale Asset Purchasing

The Fed decided to slash interest rates to zero in an emergency meeting on March 15, 2020, aiming to provide more accessible lending.

The Fed also announced that it would acquire at least $500 billion in Treasury bonds and $200 billion in agency mortgage-backed securities on the same day.

The Federal Reserve stated in June 2020 that it would begin monthly purchases of $80 billion in Treasury securities and $40 billion in mortgage-backed assets.

Beginning To Purchase Corporate Bonds

The Fed began to purchase municipal (issued by cities or towns) bonds and corporate debt for the first time in Fed history.

In a groundbreaking move, the Fed made municipal securities eligible for the Commercial Paper Funding Facility, which allowed it to buy municipal debt from state and local governments themselves.

These securities were also made eligible for the Money Market Mutual Fund Liquidity Facility. This allowed the Fed to make loans to banks secured by municipal securities.

These securities expanded the Fed's portfolio.

Emergency Lending Alternatives

The Fed also created various emergency lending facilities and programs in response to the COVID-19 epidemic to prevent problems in prominent markets and assist state and local governments.

The new credit facilities include the following:

- Corporate Credit Facilities for both the primary and secondary markets

- Commercial Paper Funding Facility,

- Money Market Mutual Fund Liquidity Facility

- Municipal Liquidity Facility for state and municipal governments

Main Street lending program provided funding to hard-hit businesses that were left out of existing government programs.

There were three involved programs for businesses - the Main Street New Loan Facility, the Main Street Expanded Loan Facility, and the Main Street Priority Loan Facility:

- Their eligibility requirements are all having fewer than 15,000 employees or less than $5 billion in revenues in 2019.

- Maturity is five years, and they have a balloon payment of 70% at the end of the fifth year.

- They all vary in minimum and maximum loan size.

The Balance Sheet As An Economic Indicator

Following the 2008 Global Financial Crisis, the Fed's balance sheet was massively expanded, and then again in response to the COVID-19 pandemic in 2020.

The Fed's balance sheet was around $870 billion before the 2008 financial crisis. The balance sheet is currently worth almost $9 trillion.

The significant growth in the Fed's balance sheet implies that the central bank may undertake even greater purchases and sales of assets in the open market in the future. It also reflects the introduction and subsequent use of quantitative easing.

Since then, the balance sheet has provided more information to observers about the extent and scale of the Fed's open market operations. Most of these holdings are in the System Open Market Account.

Criticism of the Federal Reserve

It is also worth remembering that many critics argue that the Fed never achieved any of its stated goals and may have actually made some financial crises worse.

By former Fed Chairman Ben Bernanke’s admission, the Fed failed during the Great Depression. At the time, the Fed was decentralized, and different districts had different views about what should be done.

Some Federal Reserve bank governors thought they should loan funds to needy banks during financial crises. In contrast, others felt it was best to provide more funds when the economy was growing and less when it was contracting.

The Fed also didn’t increase the monetary base when the money supply collapsed from 1930 to 1933 and failed to act as a lender of last resort for banks.

The Fed struggled with managing hyperinflation in the 1970s – and its initiatives did not stop the real estate market from collapsing during the 2008 Global Financial Crisis.

Due to the rising inflation caused by the stimulus package implemented during the 2019 COVID-19 crisis, individuals have been looking for safe-haven assets.

As a result, sellers of bonds have begun to outnumber purchasers in many parts of the financial system, raising interest rates and making it more difficult for banks to provide new loans with limited liquidity in the market.

The Fed's purchasing policies increased demand for assets that had been more difficult to exchange.

When the Fed prints more money to support its economic recovery scheme, inflation results, and the value of the U.S. dollar depreciates.

The Fed’s Balance Sheet Tightening in 2022

According to Fed Chair Jerome Powell's speech following the Federal Open Market Committee (FOMC) meeting in

,the Federal Reserve decided to begin reducing the size of its balance sheet, which confirms the Fed’s contractionary monetary policy stance.

When Was The Fed’s Balance Sheet Expanded?

The Fed purchased U.S. Treasury securities and agency mortgage-backed securities (MBS) between March 2020 and March 2022 to promote smooth markets after damage caused by the COVID-19 shock.

The pandemic and shutdowns generated substantial financial market volatility and induced economic anxiety.

From June 2020 to December 2021, monthly purchases of Treasury securities averaged $80 billion, and agency MBS averaged $40 billion as part of its quantitative easing strategy.

As illustrated in the Federal Reserve System assets graph, securities holdings more than doubled from $3.9 trillion in early March 2020 to $8.5 trillion in May 2022.

How Will The Fed Shrink Its Balance Sheet?

The FOMC has raised its policy target interest rate a couple of times in response to the economy's tight labor market and strong inflation, and it will begin decreasing the balance sheet in June 2022.

The Fed will shrink its securities holdings mechanically by not reinvesting cash from maturing securities, diminishing the quantity of the Fed's securities holdings and the size of its balance sheet.

When the Fed buys securities, it injects money into the banking system. By not reinvesting the proceeds from holdings, the Fed can reverse the process and tighten monetary policy.

How Is The Normalization Plan Going To Be Executed?

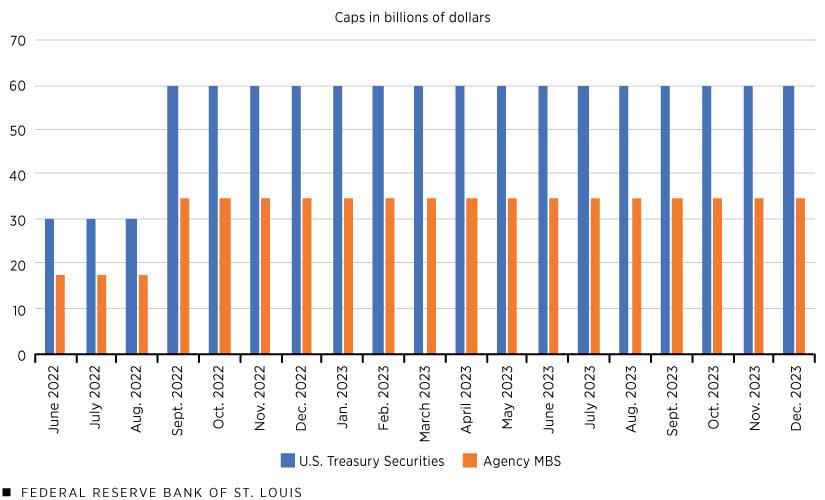

To provide a seamless transition to the runoffs and avoid causing shocks to the market, the Fed set a monthly maximum cap for quantitative tightening sales :

- $60 billion for Treasuries

- $35 billion for Agency MBS

The caps will be phased in, starting at half their peak levels in June and increasing to their higher levels in September, as illustrated below.

By How Much Will The Securities Holdings Be Reduced?

The FOMC issued a statement in January 2022 outlining its strategy for shrinking the Federal Reserve's balance sheet.

The statement revealed how the FOMC is looking to maintain an optimally sized securities portfolio that allows the Fed to affect monetary policy and maintain enough reserves in the banking system.

This practice means the Fed will drastically decrease securities holdings and the balance sheet from current levels.

Note that reserve balances decline as securities holdings decrease, all things held equal. The Fed will need to manage reserve balances by adjusting its securities holdings.

Fed Balance Sheet FAQs

The Federal Reserve System's assets and liabilities are listed on the Fed balance sheet. The Fed publishes details of its balance sheet in a weekly report called "Factors Affecting Reserve Balances."

Global investors keep an eye on the Fed’s balance sheet because it impacts the world’s market.

As of October 19, 2022, the Federal Reserve has $8.75 trillion in assets on its balance sheet, up from $4.17 trillion on February 19, 2020.

It was in 2019. The Fed's balance sheet decreased at a maximum monthly rate of $60 billion in treasuries and $35 billion in mortgage-backed securities.

The Fed started letting its securities expire on June 15, 2022, which means the Fed has started reducing the balance sheet since then.

Tightening refers to the implementation of tight monetary policy, whereas tapering refers to the reversal of one part of a loose monetary policy, i.e., Q.E.

In simple words, tightening policy means the contracting monetary policy, while tampering means the slowdown of expansionary monetary policy.

Tightening usually signifies a shift toward contracting monetary policy, which is favorable for the currency. This is because contractionary monetary policy is conducted by increasing interest rates, meaning investors receive more return on investment.

Therefore, foreign investors create demand for the USD and supply their currency in foreign exchange markets. This strengthens the USD and weakens foreign currencies.

Hence the U.S. currency appreciates when short-term domestic rates rise, so markets are pricing higher rates as the Fed continues to tighten.

or Want to Sign up with your social account?