Negative Equity

When the value of an asset currently owned is worth less than the total amount of debt taken to finance its purchase

What is Negative Equity?

Negative equity refers to the current state of being "underwater." This essentially means that the value of the asset currently owned is worth less than the total amount of debt taken to finance its purchase.

Negative equity can have significant consequences for homeowners. When the market value of a property falls below the amount borrowed to finance its purchase, individuals find themselves in a precarious situation.

Not only does this mean that selling the property would fail to cover the outstanding debt, but it also restricts their ability to move or refinance. One of the main challenges of negative equity is its impact on financial stability.

Homeowners may face difficulties meeting their mortgage obligations, as the asset's value no longer serves as sufficient collateral. Furthermore, negative equity traps homeowners in their current residences, limiting their mobility options.

Key Takeaways

- Negative equity refers to a situation where the value of an asset is less than the amount of debt taken to finance its purchase.

- Negative equity is commonly associated with real estate, where falling property prices can result in homeowners owing more on their mortgage than the value of their property.

- Negative equity in real estate can limit a person's ability to sell or refinance the property and harm their credit score.

- Negative shareholders' equity refers to a company's liabilities exceeding its assets, indicating financial distress and potential insolvency.

- Poor financial management, operating losses, or a decline in asset values can cause negative shareholder equity.

- Negative shareholder equity can also occur when a company engages in share buybacks, using its funds to purchase its shares.

- Stock buybacks can be seen as positive developments, increasing shareholder value and providing employee benefits.

- Negative equity and negative shareholder equity are more relevant in the contexts of personal finance and real estate and corporate finance and investing, respectively.

How Negative Equity Works

In a dynamic job market where relocation may be necessary for career advancement or better opportunities, being "underwater" can impede professional growth and hinder economic mobility.

Individuals may be unable to seize new job prospects or relocate to areas with a lower cost of living, exacerbating the financial strain and potentially prolonging the recovery from negative equity.

This situation can lead to increased defaults and foreclosures, putting further downward pressure on property prices and exacerbating the housing market crisis.

Moreover, negative equity traps individuals in their current homes, limiting their mobility options. In a dynamic job market, where relocation might be necessary for career opportunities, being "underwater" can impede professional growth and hinder economic mobility.

Addressing negative equity requires a multifaceted approach, including targeted government interventions, lender cooperation, and initiatives to stimulate the housing market.

By alleviating the burden of negative equity, individuals can regain their financial freedom and contribute to a more resilient and vibrant housing sector.

Given the prevalent "mark-to-market" value, the proceeds would be insufficient. Therefore, they would not cover the existing amount loaned for the asset purchase if the asset were to be sold immediately.

The term "negative asset" is commonly used concerning housing prices. When property prices go down, and the homeowner borrows an amount higher than the house's market value, he is said to be "underwater."

Numerically, assume that the homeowner borrows 1 million to purchase the residential property. However, a housing crisis caused the prices of houses in his estate to devalue by 10%. Now that the market value of his house is $900,000, the homeowner has more debt than what the asset is worth.

Negative Equity in Real Estate

Property mortgages usually take a large proportion of a person's wealth, and this is because property prices are so substantial that individuals need to devote a large portion of their income to invest in residence or otherwise.

Should property prices fall, the individual would find themselves unable to sell the property price at the original value purchased. Selling at a loss might result in great financial loss due to the high property prices as a percentage of a person's wealth.

This might be caused by:

- Timing the market wrongly (buying at a market high)

- Missing payments early on in the loan term and having interest payments accumulate.

To counteract this, several companies might decide against a full purchase of commercial property and may instead opt to rent a property.

For instance:

1. Banks use "mark-to-market" to revalue their assets as it holds many stocks, bonds, and derivatives with a value that changes quickly. Hence, this accounts for the holding of these items and ensures that its balance sheets are more accurate.

2. Therefore, banks would see their property prices as very volatile since it measures their assets via mark-to-market. This contrasts conventional businesses, which might only amortize their property assets instead of the property market swings.

3. Hence, banks would instead opt to rent a property. Measuring property as a mark-to-market asset in their balance sheet would make it very volatile, impacted by short-term property market volatility.

This also gives the bank financial flexibility, allowing it to allocate its capital to other core business activities rather than having money tying up its funds in real estate.

Santander Bank, for one, leases 10,000 sqm of its property, which would improve and offer greater financial transparency on its books.

Negative shareholders' equity

Negative shareholders' equity also has a place in the balance sheets of the business world. In balance sheets, negative equity refers to the company's liability exceeding its assets.

Negative shareholders' equity can have severe business implications, signaling financial distress and potential insolvency. When a company's liabilities surpass its assets, it creates an imbalance that hampers its long-term viability and ability to meet its obligations.

This puts the company at risk of insolvency in the long run, as it shows that it is not generating sufficient profits to cover its obligations of normal business operations.

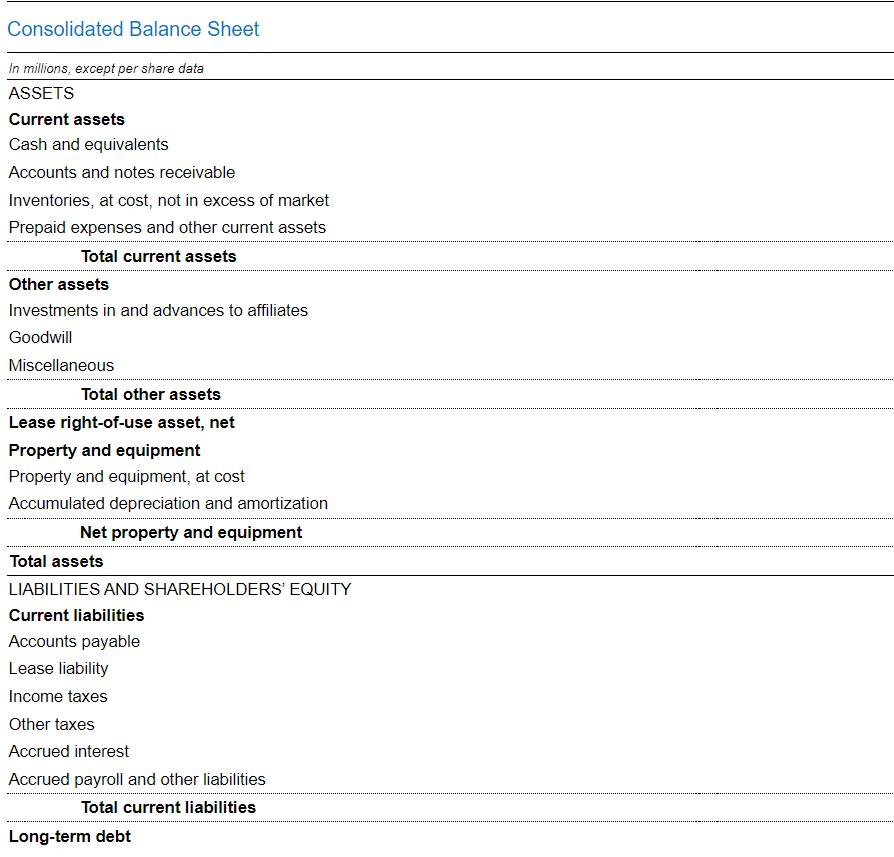

A sample 10K from the US security exchange commission's website.

Therefore, as the formula goes, it is intuitive to understand negative equity as the difference between assets and liabilities, with liabilities being more than assets.

Equity = Assets - Liabilities

This highly indicates financial distress. Firms who face this should quickly find mitigating manners by which they can turn positive, either by cutting liabilities or increasing assets.

Shareholder's equity is defined as the total dollar amount left over if all the company's assets were to be sold (liquidation) and all its liabilities paid off, returned to shareholders. Conversely, negative shareholder's equity means the company's assets are insufficient to pay off all its liabilities.

To rectify negative equity, businesses must take proactive measures to restore a positive financial position.

This involves carefully assessing liabilities and assets and seeking ways to reduce liabilities through debt restructuring, cost-cutting measures, or strategic divestments.

The company should also increase assets by exploring growth opportunities, improving operational efficiency, and enhancing revenue streams.

Negative shareholder's equity signifies a critical situation where a company's assets are insufficient to settle all outstanding liabilities.

Diligent financial management, strategic decision-making, and a concerted effort to restore the company's financial stability are needed to solve this. By addressing negative equity promptly and effectively, businesses can regain the confidence of shareholders and stakeholders alike.

Negative equity vs. negative shareholder's equity

Now, this definition is different from negative equity. This is because negative shareholder's equity uses the definition of assets minus liabilities and having liabilities more than assets. In contrast, negative equity refers to assets being worth less than debts at the current time.

The key difference here lies in the terms "liabilities" and "debts":

| Basis | Negative Equity | Negative Shareholder's Equity |

|---|---|---|

| Definition | When the value of an asset is less than the number of debts owed on it. | When a company's liabilities exceed its assets. |

| Focus | Individual’s financial situation | Company's financial situation. |

| Impact | May limit an individual's ability to sell or refinance the asset or get a good credit score. | Can indicate that the company is insolvent or at risk of bankruptcy. |

| Relevance | More relevant in the context of personal finance and real estate. | More relevant in the context of corporate finance and investing. |

- Liabilities: Obligations of what a company owes to others.

- Debts: Money that a company has borrowed and needs to repay.

- Debt is a subset of liabilities: Liabilities are not always debts but can sometimes be.

Examples of liabilities that are not debts

There are various examples of liabilities that are not part of the debt. These include but are not extensive to

- Deferred/unearned revenue: The company received payment from a customer but has yet to deliver goods/services. Once the company delivers the goods/service, this is removed from the liabilities in the balance sheet. This has nothing to do with cash.

- Warranty liability: If a good is sold with warranties, the company must repair or replace the product if it spoils. Warranties are obligations to customers and do not deal with cash.

- Accrued expenses: Expenses a company has accrued and has already taken on costs but have yet to be paid by clients or invoiced. If a company were to rent, it would chalk its expense in this section instead of debt.

- Income taxes payable: A company will owe taxes to the government based on taxable income. However, since it is obligatory to pay taxes, and the company does not take on money, this is not debt. Ultimately, liabilities represent what the company owes to other companies, its employees, customers, or the government. As long as it does not represent financing an operation through cash or borrowing money, it is not a debt.

What causes negative shareholder equity?

Negative shareholder equity could occur due to poor financial management. For example, the company's management might have taken on more debts than it could sustain.

Operating losses and a decline in the value of assets could also lead to negative shareholders' equity. Both of these items increase the liabilities portion of the balance sheet, hence could cause the numerical value of liabilities to be more than the value of assets.

However, there are certain instances where negative shareholder equity is a good thing. For example, McDonald's did take on negative shareholder equity in 2016. However, most analysts perceive it as a positive development.

When the corporation engages in share buybacks, it will use its money to purchase and store its shares in inventory. This was what McDonald's did in 2016. McDonald's participated in share-buybacks.

In accounting terms, this would result in a debit from treasury stock in terms of the asset base.

Example of how a change in treasury stock will affect accounting books

| Assets | Liabilities and Equity |

|---|---|

| Cash - $400,000 | Total liabilities - $1,200,000 |

| Accounts receivable - $250,000 | Shareholder’s equity - $ 200,000 |

| Inventory - $150,000 | |

| Fixed assets - $200,000 | |

| Total Assets - $1,000,000 | Total liabilities and equity - $1,000,000 |

Given that the company used $100,000 of its cash amount to purchase its shares:

| Cash before purchase of stock | - $400,000 |

| Treasury stock | ($100,000) |

| Cash after purchase of stock | - $300,000 |

As shareholder's equity is assets - liabilities, and asset base decreases, shareholders' equity likewise decreases.

Afterward:

| Assets | Liabilities and Equity |

|---|---|

| Cash - $300,000 | Total liabilities - $1,200,000 |

| Accounts receivable - $250,000 | Shareholders’ Equity - $ 300,000 |

| Inventory - $150,000 | |

| Fixed assets - $200,000 | |

| Total assets - $900,000 | Total liabilities and equity - $900,000 |

McDonald's 10K statement from the security exchange commission's website for 2016:

For McDonald's Corporation in 2016, its cash inventory was reduced by a significant amount after it started its stock buyback program.

Other cases where negative shareholder's equity is still tolerable is when the company is in a growth stage/ restructuring. The company might be willing to take losses for a limited time.

For instance, a telecommunications company might experience high negative shareholders' equity and take on losses to develop its infrastructure which, although it might be costly initially, would be able to recoup a large amount after attaining substantial market share.

Liabilities are also lowered after the infrastructure is built in. As a result, the company would only spend to maintain its infrastructure but would see no need to expand after it, for instance, achieves its growth targets to cover broadband access to the entire country.

Why choose to engage in stock buybacks?

Generally, stock buybacks are usually seen as good things. This is because these are the only positive developments for a company that experiences negative shareholder's equity.

Stock buybacks strongly indicate the company's large cash base and sufficient funds to purchase its shares. Buying its shares is also indicative of a few other factors:

1. Increasing shareholder value

With less outstanding stock in the market, after the corporation engages in share buyback, this will result in a return on assets (as the assets base decrease) and earnings per share(EPS) increases.

This could lead to an impression that the stock is undervalued, possibly leading to greater demand. Since the supply of outstanding shares reduces, this possibly increases the share price.

Companies engage in this as a better way of rewarding shareholders than through dividends. Dividends are still tax-liable; however, share buybacks would increase the stock price while not being affected by the tax.

2. Employee benefits

When the company engages in share buybacks, it can provide equity to its employees as part of its employee benefits.

By allowing its employees to hold their shares as part of company remuneration policies, employees may be incentivized to work harder. Any positive performance on their end would also bring profit for the company, increasing their share of the stock.

Note

Employees can also be accorded stock based on the employee stock options policy by the company. The company might offer the employee stock at a discount (through employee stock purchase plans); hence, buybacks would help decrease stock dilution effects.

3. Defense against hostile takeovers

Especially during turbulent periods when the company might come under risk from other companies who declare an intention to take over the company, it could opt to engage in share buybacks to store its shares in inventory.

This would ensure that other companies, despite buying a majority of outstanding shares, will be unable to take over as some of its shares will now be in inventory instead of outstanding. Therefore, the company will not be taken over despite the lowered equity value.

4. The perception that shares price is undervalued

If the company feels its stock is undervalued, it could engage in stock buybacks and keep a portion of its outstanding shares in inventory. When the stock price returns to normalcy/a high, the company could reissue the stock and receive a tidy profit.

Why is negative equity viewed as bad?

Should borrowers want to sell the asset to refinance the debt, they might quickly see themselves needing help paying off the full fee and the shortfall between the asset's market price and how much is borrowed.

An individual's financial risk increases because it can make it harder to keep up with payments or meet unexpected expenses. If the owner cannot make payments or defaults on the loan, the lender may repossess the asset or foreclose on the property.

Borrowers might need help to attain additional credit. Banks and other retail banking outlets might hesitate to loan individuals with negative equity as they are unlikely to repay their debts.

Likewise, negative (shareholder) equity is also negative, showing that the company has more liabilities than assets.

Increased liabilities could come in a few forms, but the most concerning reason surrounds long-term losses. In this, companies are incurring a cumulative loss since inception and, therefore, would spell trouble as the business costs more than how much it makes.

It could also mean the company is drawing from an excess dividend pull that it cannot finance. Many companies try to upkeep their dividend values to give the impression that the company is profiting well, as a break in stable dividend returns is seen as poor performance.

To ensure this, companies might draw on more dividends (liabilities) than they can afford regarding asset countermeasures. This might not be concerning, but if a company does this in the long term, it might not be sustainable to invest in.

This is a negative picture to paint to investors who might not see the company as sustainable and bringing in profits, and it will be harder for the company to raise capital or obtain credit.

How can companies change this trend?

Negative equity is highly based on market conditions that cause the asset's market value to plummet and cannot be easily controlled by the individual.

In the example of residential housing, as shown above, the individual cannot easily control the market value if, for instance, interest rates increase. With higher borrowing costs, fewer individuals would be interested in buying a house (demand falls).

This would cause the prices of houses to fall, resulting in the market value for housing. Negative equity results as asset value (mark to market) has reduced while the debt remains unchanged (assuming the homeowner has fixed interest rates for the loan).

However, negative shareholder's equity can be acted upon. Companies can implement certain policies to counteract this change as they just need to ensure that total asset value is more than total liabilities to make shareholder's equity positive.

Companies could consider increasing the asset value as shown:

- Increase revenue: Increase sales by improving the product or attracting more customers.

- Selling assets: Selling off non-performing/non-essential assets would raise cash and reduce liabilities.

- Investment: Invest a greater cash amount into short/long term investments and attempt to increase a greater return to investments through risker classes.

Alternatively, the company could consider decreasing liabilities amount through:

- Debt reduction: Pay off existing debts or renegotiate payment terms with creditors.

- Cost control: Implement cost-saving measures, such as overhead expenses.

- Equity financing: Issue new stock or equity securities shares to raise capital, reducing liabilities.

This would best mitigate negative shareholder's equity and would be able to position the company better to meet obligations and look better in the eyes of investors and shareholders.

Negative Equity FAQs

Negative equity is when the asset's purchase price is less than its sale price.

Several reasons can cause negative equity. Some examples include a decline in property values, an increase in mortgage interest rates, or taking out a loan with a high loan-to-value ratio.

Homeowners may find it difficult to refinance their mortgage, as lenders may be unwilling to provide a loan that exceeds the property's value. Homeowners may also be forced to sell their property at a loss.

Negative shareholder's equity, a deficit, occurs when a company's liabilities exceed its assets. In other words, the company owes more than it owns. Negative shareholder's equity is a red flag for investors as it suggests that the company may be in financial distress.

Share buybacks can lead to negative shareholder equity if the company uses debt to finance the repurchases. If a company borrows money to buy back shares, it increases its liabilities while reducing its assets (cash). This can lead to negative shareholder's equity if the company's liabilities exceed its assets.

Negative shareholder's equity can signal financial distress and make it difficult for a company to obtain financing or attract investors. It can also lead to a breach of debt covenants, triggering default or bankruptcy. Additionally, negative shareholder equity can limit a company's ability to invest in growth opportunities.

Researched and Authored by Jo Vial | LinkedIn

Reviewed and Edited by Raghav Dharmarajan

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?