Bull Call Spread

An options strategy that requires multiple legs.

What Is The Bull Call Spread?

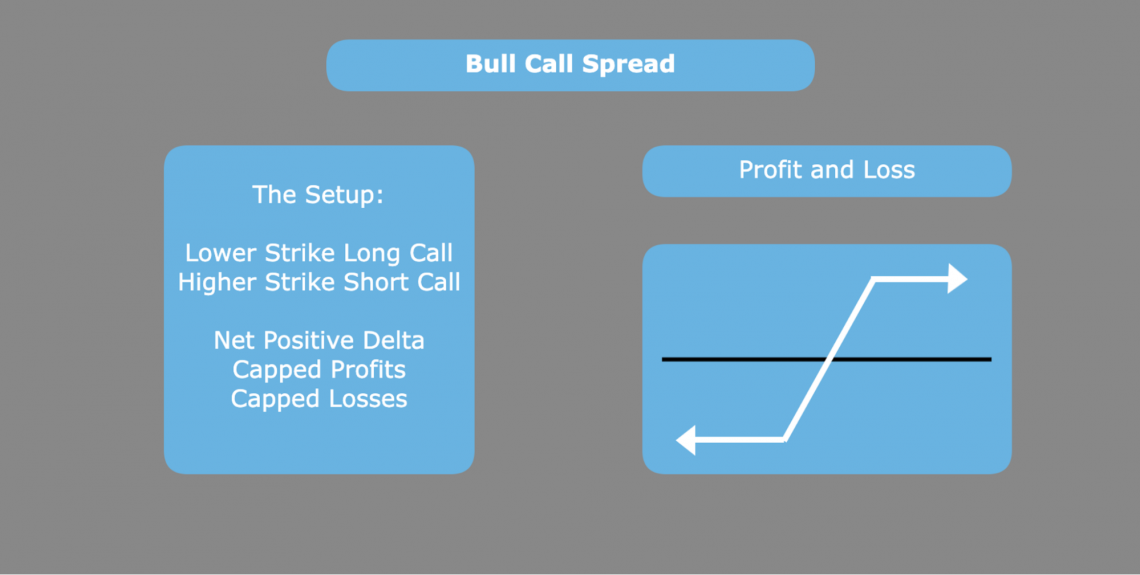

A bull call spread is an options strategy that requires multiple legs. It involves buying and selling a call option at two strike prices that expire on the same date. The bull call spread is considered an advanced options strategy.

In this specific type of call spread, the investor’s long call option is at a lower strike than their short call. Therefore, the price to enter the trade is the difference between the premium paid for the long call option and the premium collected for selling the short call option.

Because investors begin to see returns once the long call is far enough in the money, choosing to use this strategy demonstrates a mildly bullish outlook on the underlying stock. It can also be said that the spread as a whole has a net positive delta.

Compared to a simple long call, which reflects a more bullish outlook, this strategy is considered mildly bullish because the short call position caps the profits.

Investors can think of the short call leg as strategic because it lowers the break-even point and maximum loss on the trade.

The investor gains value from the passage of time due to the short call option instead of only losing time value from holding a long call.

Furthermore, the long post covers the typical risk of holding a naked short position.

The main things to remember about the bullish version of a call spread are the following:

- The strategy reflects a mildly bullish outlook rather than an utterly bullish one

- The investor pays a premium to enter the spread

- Both losses and profits are capped

Relevant Options Details

When trading using advanced options strategies such as spreads, investors must understand the core components of options contracts. However, beyond just the basics, this strategy hinges on a solid sense of the options of the greek delta.

For any given options trade, there is both a long and short position. For a given call option, these two positions have the following rights and responsibilities:

- Long post - due to buy

- Temporary position - buying/fulfillment obligation

Traders on the buy side of a call option pay a premium to purchase the contract. Ownership of the agreement gives the buyer the right to buy 100 shares of the underlying security at the strike price at or before the expiration date.

On the sell side of the trade, the seller writes the contract and collects the premium from the buyer. In return, they take on the risk of the work.

In this case, the risk is a fulfillment obligation to the buyer. This would be selling the shares of the underlying stock to the buyer of the contract for the specified strike price up until the contract's expiration date.

Because the bull call strategy involves buying and selling call options at different strike prices, each leg of the contract gains or loses value at different rates.

In an option contract, the Greek delta tells us how much the premium of the option contract changes for each dollar shift in the price of the underlying stock.

Call options have a positive delta, and put options have a negative delta. That is because call options gain value with a price rise, while put options decline in weight with a price rise.

For options contracts sold, we reverse the delta. This is because the goal for sellers is a worthless contract expiration. Increasing the premium would mean repurchasing the contract, and closing the position is more expensive.

We look at the net delta for an option contract with multiple legs, such as the spread we created. This tells us how the price of the space overall changes concerning the difference in the underlying.

Because the long call position has a lower strike, the delta will be higher. Therefore, for call options, price increases in the underlying have a greater probability of impacting the lower strike option than the higher strike option.

As we can see in the option chain for VOO, strikes closer to the last price of 375.21 have a higher delta than the highlighted 400 hits Oct 21, 2022 call option. This highlighted call has a delta of .25. As the strike moves closer to the underlying price, the delta increases.

Because this lower strike delta is higher than the short position (which we established has a negative delta), the net delta of the spread is positive. This is how we confirm that the strategy is, in fact, mildly bullish.

Bull Call Spread Example

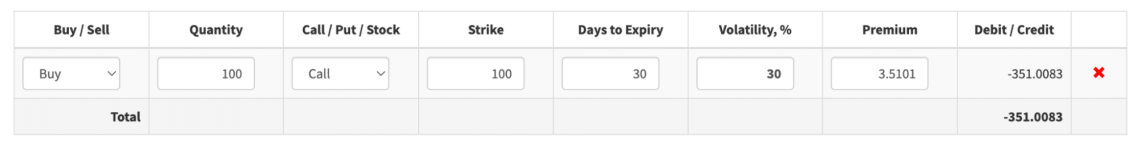

In this example, bull put spread; the investor is purchasing a call at the 100 strikes and selling a call at the 105 strikes. Both options expire in 30 days, and the pricing model assumes implied volatility of 30. The current price of the underlying is $100.

As we can see, the cost for the long position is roughly $351. This cost is higher than the total premium collected for selling the 105 strike option, which earned the investor around $161.37. This leaves the investor with a net cost of around $189.64.

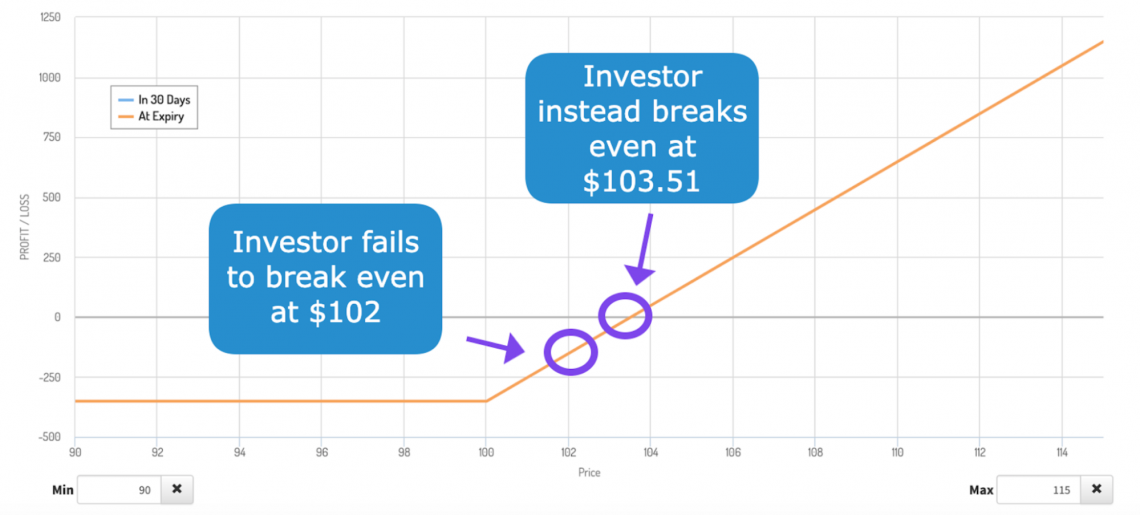

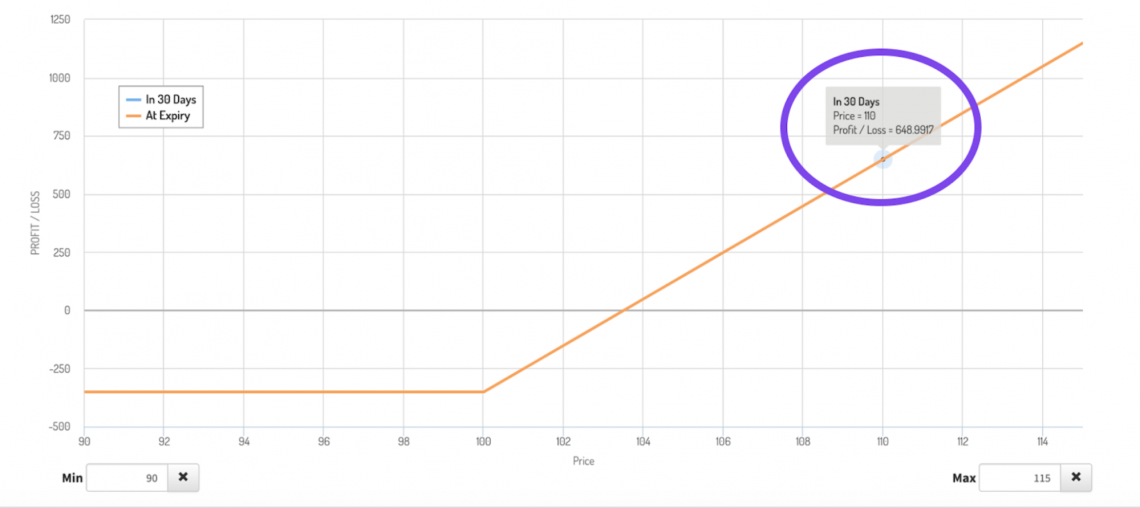

Looking at the profit and loss graph, the mildly bullish investor outlook becomes apparent. However, for the investor to break even, the stock price must have a moderate rise to around $101.90.

The amount the stock must rise to break even is equivalent to the original premium of the spread, which is expressed as a cost per share.

Note that the premium is 1/100th of the total cost, as this contract represents 100 shares. The investor paid around $190 total, meaning the price must rise to $1.90.

Break Even = Long Strike + Net Spread Premium

The max loss also relates to the premium, as the tip determines the price to enter the position.

Max Loss = Spread Price = Premium x 100

The premium also determines the maximum profit but includes the distance between strikes.

Max Profit = (Short Strike - Long Strike) x 100 - Spread Price.

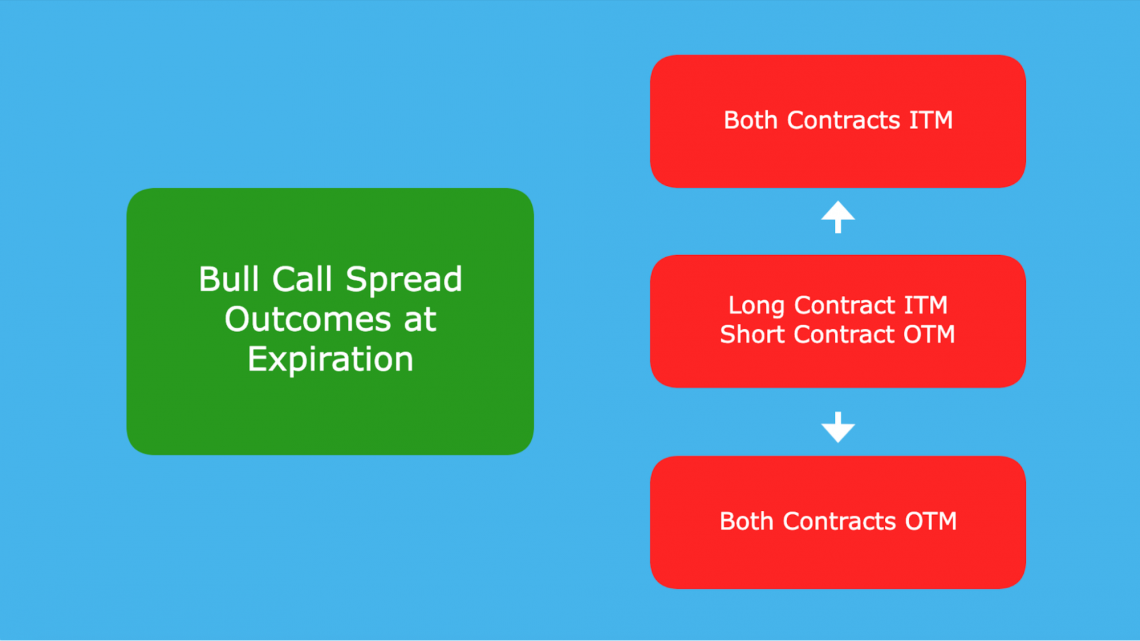

We can see exactly why each of these specific price points makes sense by looking at different expiration price scenarios.

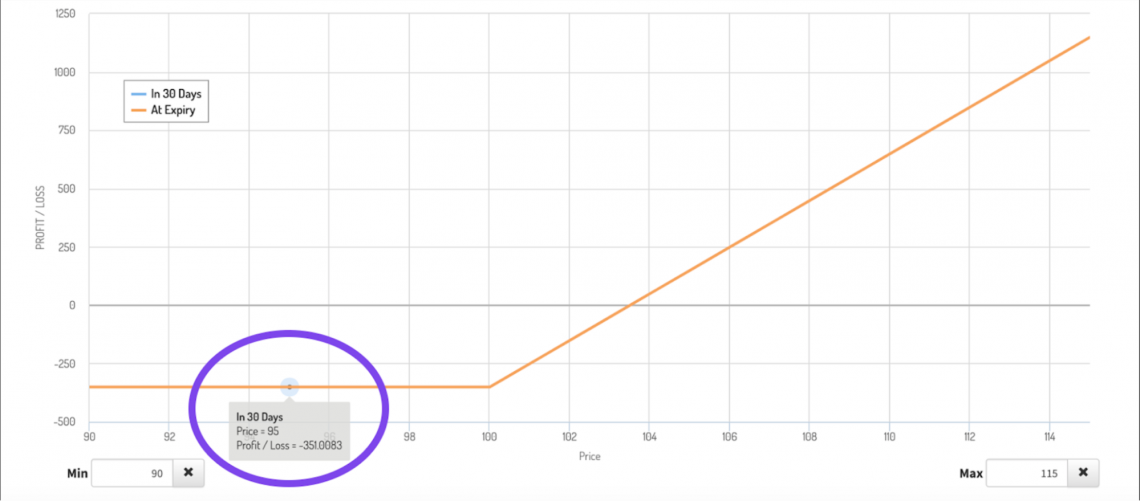

Consider a situation where the price at expiration drops to $95, meaning that it is below the strike price of the extended position.

The investor’s long position expires worthless; it is not exercised. The investor’s short situation also passes worthless; it is not exercised. This means that the investor is left with a loss equivalent to the net cost of the two contracts, around $189.64.

As we can see, this loss is less than that of a simple long-call trade, which would be an alternative bullish setup the investor could construct.

Instead of losing a total of $351 for entering only the extended position (as shown in the graph), the investor has offset part of their losses by selling the 105 calls.

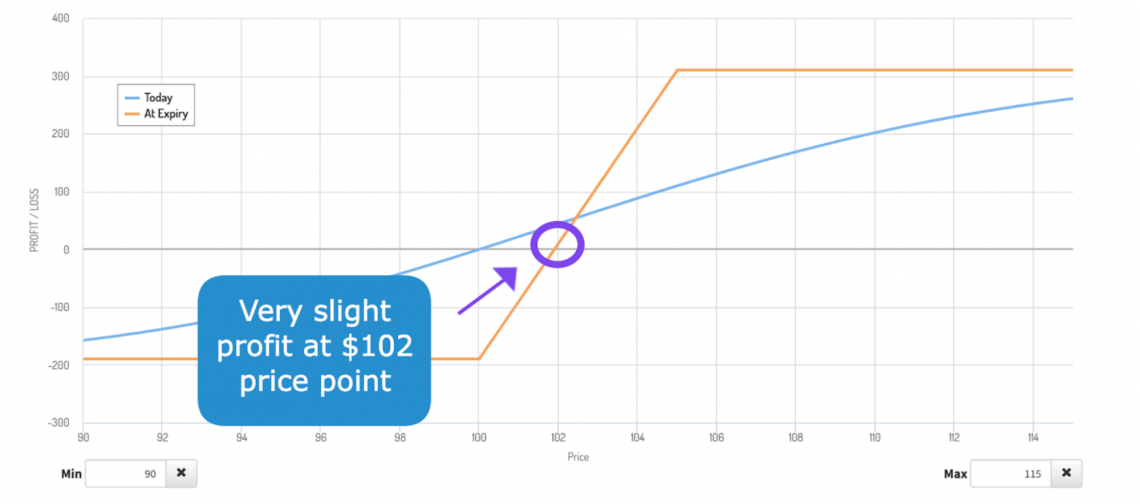

Another possibility is the underlying strike price at expiration is between the two strikes, in this case, between 100 and 105. So let's say the closing price is $102.

In this situation, the long call is in the money and, thus, is exercised. The investor can buy 100 shares for $100 and sell them for $102. The investor makes $200 from the 2-dollar price difference.

The short call is out-of-the-money, so the investor has no fulfillment obligation. Considering the net cost of the two contracts, the investor is left with a profit of about $10.36.

Compared to the long call counterpart, the investor using the bull call spread is more profitable. If the investor had only purchased the 100 calls, they would have failed to break even on the trade as the contract price is greater than the market and strike price differential at expiration.

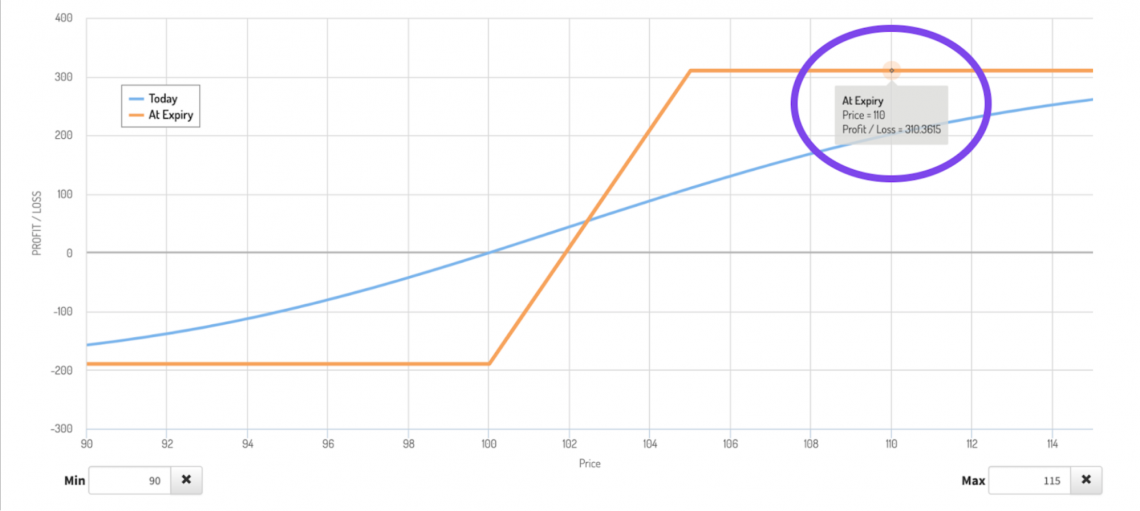

The outcome is where the underlying market price is above the short call strike option, in this case, above $105. Let's assume that the market price is $110.

Because both calls are in the money, they are both exercised. As a result, the investor who purchased the spread cannot take advantage of the total price difference between the market price and their long call.

The long call is exercised, meaning the investor can purchase 100 shares at the $100 price point. However, because the investor sold the $105 call, they are obligated to sell shares to another investor for $105. This difference from the spread leads to $500 in revenue.

When the investor takes into account the original cost of the trade, they are left with around $310.36 in profit.

The thinking is the same at any point above the short call. The investor no longer benefits from the price difference between their long call and the market price. They are liable for 100 shares at their quick call strike price and only profit on the difference in strikes.

For this reason, the investor has capped profits. This is disadvantageous compared to a simple long call at specific price points, as the long call has the potential for unlimited profits.

In this case, the long-call counterpart would have earned much more, around $649.

Bull Call Spread: Final Considerations

As we can see from the above profit and loss comparisons, the bull call spread is strategic because it lowers a trader's maximum loss, break-even points, and maximum profits compared to a simple long call setup.

Because extreme price movements are less common than smaller price movements, it can be said that the probability of profiting when using a bull call spread is higher than that of a long call.

Beyond just the differences in the chance of a profitable exit of the trade, the investor has to take into account increased risk and responsibility for having a short leg in their investment strategy.

While it is true that the long call position hedges the risk associated with the short post, the possibility of an assignment before the expiration of the option is possible.

This is most notable in cases where the underlying stock has a divided payment scheduled before the expiration of the call contract. If the time value remaining in the contract is less than the expected divided, the contract holder may choose to exercise to collect the dividend.

If the investor holding the spread is not paying attention, they may not realize that the assignment is likely. Forgetting to close their position by completing the entire space or repurchasing the short leg (leaving the long-standing open) leaves an investor with fulfillment obligations.

In this situation, a short position is created on the investor's account. Shares must either be repurchased to close this position, or the long call must be exercised. In some cases where the trader is using margin, a margin call could be triggered, leading to the account liquidation.

These extra considerations and the complexity of details associated with price movement are important reasons this strategy is recommended for advanced traders.

Many brokerages will not allow investors to use this strategy without first verifying the investor's familiarity with options and other financial information.

As with all options strategies, a greater degree of risk is associated with increased leverage when using a bull call spread. Beyond just understanding the setup, investors should have an understanding of equity valuation based on fundamentals.

Due diligence on the underlying and a firm conviction of price movement is a must-have when using strategies susceptible to extra volatility.

or Want to Sign up with your social account?