Extended Trading

One can buy/sell assets past the regular trading hours of a particular exchange through (ECNs).

What is Extended Trading?

Extended trading refers to extended trading hours, where one can buy/sell assets past the regular trading hours of a particular exchange through electronic communication networks (ECNs).

It is known for and used when applied to stock markets like the New York Stock Exchange or the Tokyo Stock Exchange, but there are other markets/exchanges present too, which include:

-

Bonds

-

Commodities

-

Cryptocurrency

-

Derivatives

-

Forex

Amongst those, some markets do not close, such as the cryptocurrency and forex markets (it has different hours in different countries, but they overlap, allowing one to trade 24/7). Still, this article will be in the context of stock markets.

Extended-hours trading sessions won't occur on official local holidays where the exchange is closed (like Thanksgiving Day for the US) or when the sales close early.

Over time, with the advancement of technology and the increased demand for trading, stock exchanges have extended their trading hours to capture said markets and better meet the needs of their clients.

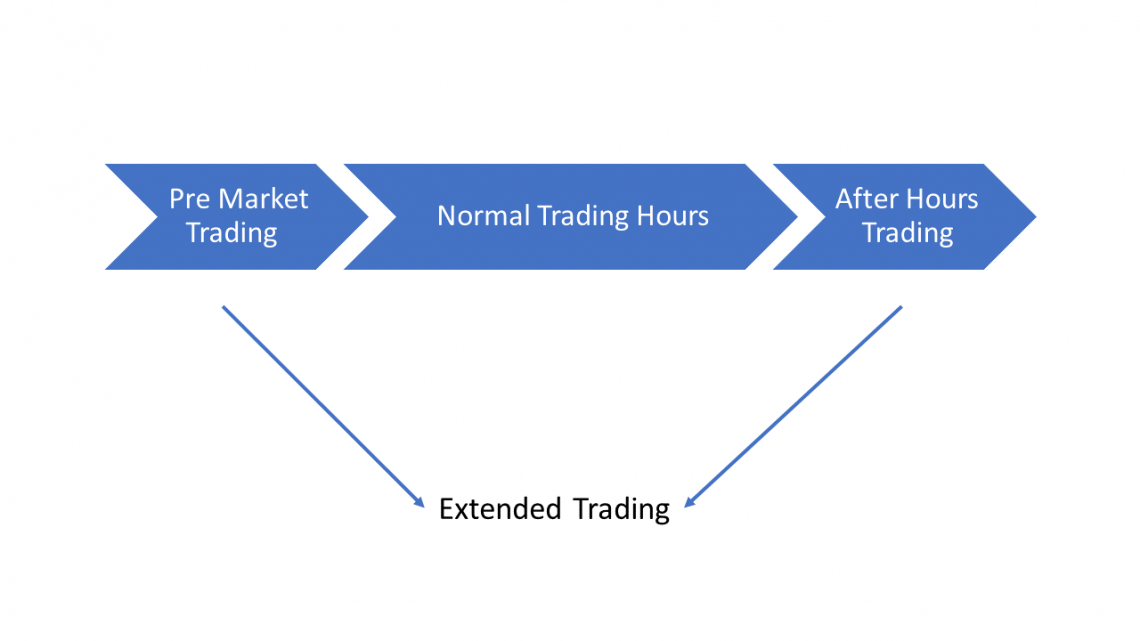

Extended trading has two components, pre-market and after-hours trading, which take place before and after the regular trading hours.

Example of Extended Trading in the Stock Market

The table below shows the standard and extended trading hours on some of the largest exchanges in the world.

| Stock exchange | Trading hours (Local Time) | Extended Hours |

|---|---|---|

| New York Stock Exchange (NYSE) |

9.30 am - 4 pm (no lunch break) (GMT: -4:00) |

Pre-Market: 4 am - 9.30 am After Hours: 4 pm - 8 pm (GMT: -4:00) |

| NASDAQ |

9.30 am - 4 pm (no lunch break) (GMT: -4:00) |

Pre-Market: 4 am - 9.30 am After Hours: 4 pm - 8 pm (GMT: -4:00) |

| Shanghai Stock Exchange (SSE) |

9.30 am - 3 pm (lunch break from 11.30 am - 1 pm) (GMT: +8:00) |

Pre-Market: 9.15 am - 9.25 am After Hours: 3 pm - 3.30 pm (GMT: +8:00) |

| Stock exchange | Trading hours (Local Time) | Extended Hours |

| Hong Kong Stock Exchange (HKEX) |

9.30 am - 4 pm (lunch break from 12 pm - 1 pm) (GMT: +8:00) |

Pre-Market: 9 am - 9.30 am Extended Morning Session: 12 pm - 1 pm After Hours: NA (GMT: +8:00) |

| Tokyo Stock Exchange (TSE) |

9 am - 3 pm (lunch break from 11.30 am - 12.30pm) (GMT: +9:00) |

Pre-Market: NA After Hours: NA (GMT: +9:00) |

| Shenzhen Stock Exchange (SZSE) |

9.30 am - 3 pm (lunch break from 11.30 pm - 1 pm) (GMT: +8:00) |

Pre-Market: 9.15 am - 9.25 am After Hours: N/A (GMT: +8:00) |

| Euronext Paris (PAR) |

9 am - 5.30 pm (no lunch break) (GMT: +2:00) |

Pre-Market: N/A After Hours: 5.35 pm - 5.40 pm (GMT: +2:00) |

| Stock exchange | Trading hours (Local Time) | Extended Hours |

| London Stock Exchange (LSE) |

8 am - 4.30 pm (no lunch break) (GMT: +1:00) |

Pre-Market: 5.05 am - 7.50 am After Hours: 4.40 pm - 5.15 pm (GMT: +1:00) |

| Bombay Stock Exchange India (BSE) |

9.15 am - 3.30 pm (no lunch break) (GMT: +5:30) |

Pre-Market: 9 am - 9.15 am After Hours: 3.40 pm - 4 pm (GMT: +5:30) |

| National Stock Exchange India (NSE) |

9.15 am - 3.30 pm (no lunch break) (GMT: +5:30) |

Pre-Market: N/A After Hours: N/A (GMT: +5:30) |

How does extended trading work?

Most exchanges operate via an electronic market, a fully digital matching service, utilizing Electronic Communication Networks (ECN) that match buy orders with sell orders. Notable examples include NYSE Arca and INET.

Some of the issues that arise during extended-hours trading include:

-

Unfulfilled orders

-

Inaccurate sales and quotes

-

Large price fluctuations

For example, if there are no sell orders for a particular stock displayed on an ECN, an investor who places an order to buy that store must wait for an exact order to sell the stock at a specific price before the order can be appropriately filled.

Buyers and sellers trading through electronic markets may experience significant delays before their orders are filled, and some orders may not be executed at all.

This is due to the lack of liquidity from the lower trading activity, where, coupled with a large number of orders ahead of yours that incoming matching orders will fill, it is highly likely that your order will not be executed at all or only partially completed.

Quotes and last transaction prices across all electronic markets are normally consolidated and displayed. However, that isn't the case for quotes and prices during extended hours, as it may be specific to the one electronic market currently open under extended hours.

Because of limited trading volume during extended hours, the spread (difference) between the available bid (buy) and ask (sell) orders are also very likely to be much more significant compared to regular trading hours.

Higher spreads and low trading volumes result in more volatile prices, making it difficult for individuals to gauge the market and trade successfully at potentially better prices.

Impact of Extended Trading Hours

The stock's opening price does not always match its closing price from the previous trading session, so investors need to be aware that several factors can affect the price of a stock between the market close and open.

Publicly-traded companies only make major news announcements, such as earnings reports or stock splits, when markets are not operating during regular trading hours, like early in the morning or late at night.

Such announcements can significantly affect trading during extended hours and subsequent opening prices.

It is not rare to see stocks tumble significantly in after-hours trading.

Snapchat, for instance, fell 30% during its most recent Q2 2022 earnings report post-market trading hours. It then crashed by 40% the next day when markets reopened.

Institutional traders have been participating in extended-hours trading for many years. In addition to market news and more excellent macroeconomic situation, their extended-hours trading activity can also influence the opening price of a stock.

Orders are placed after the major exchanges have closed overnight, and market makers and other specialists evaluate the supply and demand seen from the charges as part of the factors used in determining the opening price of a stock.

With brokerages bringing a more excellent suite of investing capabilities to retail and individual investors, they can also participate in extended trading hours and, therefore, play a part in price determination.

However, one must remember that many extended-hours traders are backed by large institutions, like hedge funds or banks, and may have access to more current information than individual investors.

This is especially relevant during pre-market hours when the low volume—albeit allowing investors to have an earlier start to react to news and happenings around the world—paints a skewed picture of the market's circumstances.

As mentioned above, the sizeable bid-ask spread and lack of liquidity may make it hard for one to close or open a position correctly or at a favorable price.

After-hours trading is something that investors can take advantage of to react earlier to any news released after the market closes. The stock's performance after hours also serves as a decent gauge of the overall market response.

However, once again, the illiquidity and volatility of after-hours price changes may severely impact investors who do so too. After all, the big players may not choose to participate in extended-hours trading, despite it being the focus of other investors when the market reopens.

That can result in a stock not changing much despite a great earnings report but rocketing the next day exponentially when the market reopens and the crowds start coming in.

Benefits of Extended Trading

Considering all the various factors, let's briefly summarize both the upsides and downsides of extended-hours trading so one can weigh them and make their own decision.

The pros are:

-

Convenience: Extended-hours trading makes it possible for working professionals to participate in the market as their daily work may occupy them during regular trading hours.

-

Early reaction to events: Investors are empowered to trade based on earning reports and other corporate announcements, in addition to worldwide developments, before and past regular trading hours. Knowing a poor earrings report/bad news for the industry allows the "early birds" to liquidate their position and minimize their losses in extended trading instead of when the market opens, and mass selling takes place.

-

Better prices: Due to the volatility and large price fluctuations in extended hours, one can open a position at a lower price point than what may occur during regular trading hours. Similarly, they may be able to close their job at a higher price.

-

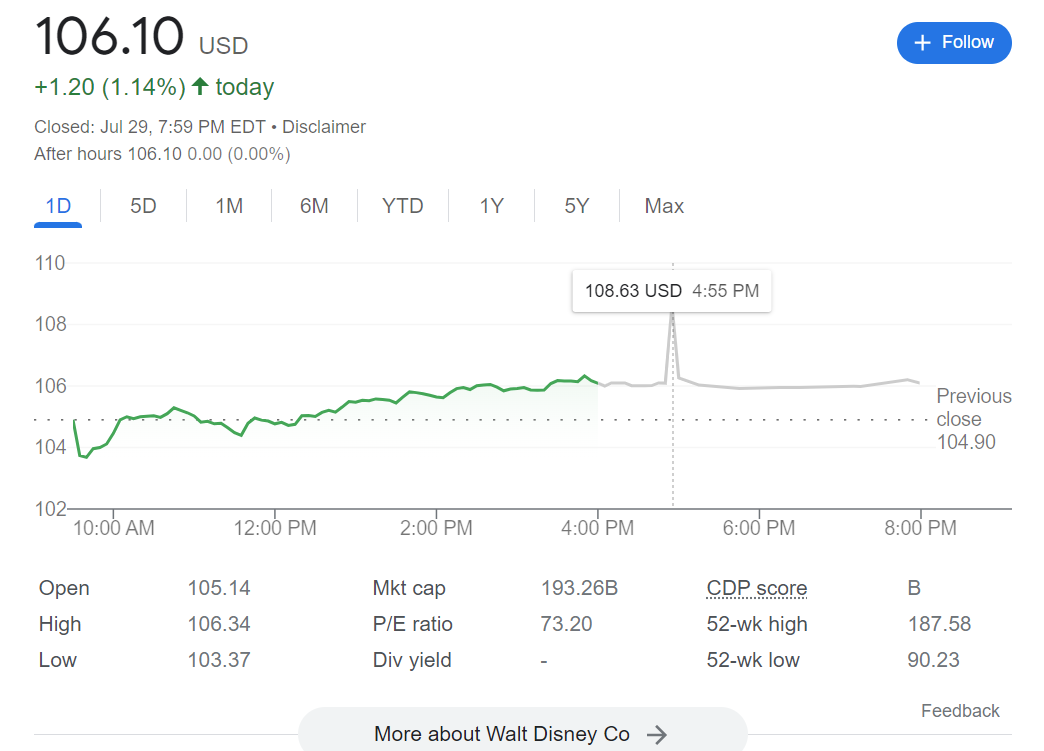

For example, on 29th July, $DIS may trade between $103.37 and $106.34, reaching $108.63 after hours. This can be commonly observed for most stocks in extended trading.

-

Cons of Extended Trading

The cons are:

-

Inability to execute orders: Due to significantly lower liquidity, many orders may not be filled accordingly, and there may only be a partial fulfillment of orders in some instances.

-

Volatility: Due to the limited volume, there is also a wide range of bid-ask prices, resulting in larger spreads and higher price fluctuation. As seen above, it can be a pro, but it can also be a con depending on one's transaction needs.

-

For example, one may be unable to fulfill their order at a specific price point because the price fluctuates too much for their limited orders.

-

-

Lack of order options: Instead of having a full range of orders, such as market orders or stop loss orders, one is limited to limit orders.

-

Inaccurate financial information: There will not be accurate trading volume shown, and the last transaction prices may not reflect the actual cost of the stock due to the large spread between the bid and ask orders available on the ECN provider.

Conclusion

In conclusion, while ECNs may allow traders to react to news items outside of regular trading hours, pre-market and after-hours trading carries several risks, such as illiquidity and price volatility due to the low trading volume and number of market participants.

As such, it is up to an individual investor's risk tolerance and personal needs to determine if they should participate in extended-hours trading. In addition, it comes with a variety of pros and cons, which will be summarized below as well.

One can look into extended-hours trading if they would like to react faster to breaking news and are attempting to open/close a position at better prices.

However, they must consider the lack of order options, which may not allow them to palace the trades they want, and the inability to fill said orders wholly or timely. Thus, the high volatility is a double-edged sword.

Lastly, retail investors need to ensure that they are not led astray by the price action in extended hours and are wary when trading, as many institutional players with better information and knowledge may be selling simultaneously.

or Want to Sign up with your social account?