Centerview vs. Jane Street vs. Meta

I am a rising junior in CS and have offers for a 2023 internship at all three. The roles are Tech M&A for Centerview, Quant Trader for Jane Street, and SWE for Meta. I have talked to a couple people in the tech space and want some other opinions/discussions on the three somewhat different "industries". I'm currently trying to weigh WLB / Compensation / Career Growth / Future Career Change Opportunities. Thanks in advance!

Edit: Preference towards JS right now. Will have to think about CVP vs. JS a bit more but thanks for all the comments!

Edit: Took the JS offer, thanks all!

Gotta be between js and CVP.

Yep, that being said, return offers at JS are sparse. They basically rank you alongside each other through games and the bottom half get cut.

That's good to know. Thanks!

That's not a problem. If you can get an internship at JS, you'll get full time for sure at other top prop shops.

That's not a problem. If you can get an internship at JS, you'll get full time for sure at other top prop shops.

Meta

Can you elaborate a bit?

Good WLB, benefits and competitive/scalable pay

meta

Any particular reason?

simply for the fact that you said that you were trying to take WLB into account. if you didnt include that and just wanted future comp CVP or JS is the way to go. You could live a comfortable life at Meta with a very chill work schedule and enjoy the perks of a being at a MANGA. Yeah sure youl have a higher ceiling at JS/CVP but at what cost. Is it worth sacrificing your 20's for some MD to rip you a new one every waking hour? Thats a question that you have to ask yourself but since you mentioned WLB id go with Meta

what the hell is meta even doing on this list lmao might as well add wendy’s cook to the post while you’re at it

You don’t want to sell emojis to 12 year olds for $0.50 each?

Hahaha to echo this guy, depends if you’re trying to pull of working in meta world. If you’re interested in being more successful in this one - CVP or Jane might be a better

I would go JS/CVP purely from a perspective of what keeps the most doors open.

JS/CVP >> Meta is magnitudes easier to do than going the other way. Whether you do the internship at JS/CVP or start your career there, Meta will always be an option. Same cannot he said if you start your career at Meta or even intern there.

TLDR; Try JS/CVP at internship level and go from there.

I agree, would you choose JS or CVP? Is there anything that should convince me to choose one or the other?

Don’t think you can go wrong either way. Really depends on which interest you more, they are really different jobs.

In keeping doors open, if you’re smart enough to land JS/Meta internship you can likely do it again down the line. These are very IQ/skills based roles, you have already established you have both to the level necessary to do this role now or in the future.

I would strongly encourage you to use your internship to try CVP. CVP is extremely difficult to land and not just about being smart (think IQ/Skills/EQ). Further, it should show you very quickly if banking satisfies you or if you’d prefer more quantitative roles like JS/Meta.

Just my $0.02 as someone who did STEM ugrad but went into EB.

Based on the above comment about return offers at JS, I would take CVP, get the return offer and decide at that point if you want to re-recruit for trading shops.

If you're enough of a double threat to get both offers, I would imagine trading is still an available option after your SA. That said, I think my bias towards risk aversion (I'm an incoming FT in banking) might be influencing my thoughts here.

If you like the markets = Jane Street

If you want traditional corporate finance and don’t mind working on models until 1 am = Centerview

lol what JS all the way, if you're smart enough to break into JS you take it. Take it from someone who's a CVP banker. My best friend from HS (smartest guy I know) works at JS and makes 2x as much as me and works less than half the hours. Please take JS, banking is banking, CVP isn't some gloryland where we're doing god's work.

I’m going to take the opposite position here and say very seriously consider CVP. Quant is not at all the paradise that a lot of people on this forum make it out to be. It’s an amazing opportunity to have, absolutely, but tenures are short and exits sparse — CVP can offer better opportunities following your stint if and when you get tired of your first full-time position. You have some great offers in front of you, I would think carefully about JS and CVP. Don’t think Meta merits much discussion.

Edit: to add, considering the fact that you already have an offer from JS in hand, you can always interview again and get a fresh offer from them whenever you want (within reason obviously). As for CVP, you only get one chance at an offer unless you’re willing to spend time and money on an MBA, and it doesn’t seem like you want to do that. If I were in your shoes, I’d take CVP, see if you like it or if you like any of the exit opportunities. If you don’t, interview again for JS and start working there.

Totally agree. The only time to break into ibanking is undergrad, and it can be a life-long foundation for your career. You can exit to PE mega funds and earn stable cash of millions without risk of getting fired. You could always go from CVP to Jane street as long as you have what it takes to clear the math interviews (which you obviously have), but Jane Street -> CVP is gonna be nearly impossible. If you decline CVP now, you miss the one golden ticket to PE mega fund career, and it’s probably gonna be your only ticket because PE exclusively hires from pre-MBA analysts. If you miss this golden opportunity, you’ll have to waste two years in MBA to get back into the industry.

Also, Jane Street quant trading is very risky and unstable. The top outlier can earn 500k out of undergrad, but it’s gonna be a one-time luck thing. Once the market trend changes, your old trading strategy will make you lose money, and you’ll find yourself constantly preying to God that the market won’t go against you. The amount of mental stress and anxiety is just unbelievable. Also, the low performers get straightforwardly fired. Who become those low performers are often an act of God (due to pure luck and market fluctuations).

Don’t listen to these people who vote for Jane street, they either never worked in prop trading, or they are just pushing competition out of ibanking so that they have better chance of breaking-in.

How do you have all 3 right now at the same time? Thought offers explode quickly and that Meta aren’t taking interns for 2023… I’m a rising sophomore so would be super glad to hear the timelines of those places and how it could overlap.

Meta is still taking return interns, just very few. From what I heard, interns need at least a "Greatly Exceeds Expectations" review and the manager advocating for you (though of course, it varies from team to team). The Centerview offer does not seem to have a deadline to it so I'm assuming it doesn't explode like most others. The JS offer does indeed have a deadline 2 weeks from now which is why I'm asking for advice right now.

Makes sense, thanks!

Congrats, Centerview is still recruiting? Also, how did you manage to prepare for all eee processes?

I went through university recruiting, so I believe yes.

I'll add another for team JS here. Gotta be super sharp to land there (congrats), and can't imagine the WLB is terrible but have no direct knowledge there.

Thanks!

As someone that has worked at 2 of these places I will say JS is the obvious answer. You would be utterly insane to not take it.

Noted, thank you.

.

625k seems preposterous. Glassdoor has like 31 inputs and says ~220k. I don’t doubt there may be a few individuals who do so well that maybe their profit sharing is that high but…

Disclaimer: Don’t work at a HF nor do I know anyone there lol

I would not trust Glassdoor. I know people working across IMC, Optiver, SIG, JS, Citadel. $400k is standard first year for SIG/Optiver. JS pays through the nose.

Jane Street isn’t a hedge fund…

Dude JS all the way

I am confused how no one is mentioning that once you have FAANG (or MAANG) on your resume, you can exit to a unicorn startup in a few years and make more than a CVP exit. Of course, if you worked at JS, everyone would know you're pretty intelligent and would be willing to give you a short (although I consider JS to be the final exit), but to say that Meta doesn't have good exits is simply untrue. While I would take JS if I ever received an offer from them, if WLB was my main priority I would go with Meta knowing that I would have the skills and name that other tech companies value.

I keep hearing this stuff about unicorns on this forum but what does this even mean? Asking as someone who works at a FAANG. I feel like you guys think we’re just like oh okay let me join a unicorn and poof a million dollars appears in my bank account lol

Lol might as well delete this post since prestige whore IB prospects can't accept that a cushy life at FAANG can generate more income than top IB positions

The traditional meaning is a startup that gained a +$1B valuation.

Kid's 21 and is already a BSD. Those offers slap, good job!

Thanks! If you don’t mind me asking, what’s BSD?

https://slate.com/business/2008/09/the-end-of-the-bsd.html

Berkeley/Stanford?

Berkeley, why ask?

Go bears ;)

Roll on you bears indeed

I’m begging you to take JS

I’m begging you to take JS

I’m begging you to take JS

lol I probably will!

I’m begging you to take JS

Surprised this is even a question being asked. Jane Street TC is over 500k… you’re earning more than MFPE associates ffs in your first year of work. Do you really want to spend your 20s formatting PowerPoint and sifting through excel doing mind numbingly boring work?

people talk a lot about exits which I find strange. IBD definitely has more breadth and you can end up in some interesting roles but from a comp perspective no exit will be better than working at JS. You’ll be earning way more than any other shop assuming you can stay there and perform. This isn’t too hard as JS has refined their program so that tenure of the people that get hired is decent. Less job security for sure but… the money you’ll be making in your career is worth the risk…live a little. The work is actually interesting (imo) too.

you’re earning circ 600k when you start, where will that figure be by the time you’re 35? Depends on you but this is one of the few industries where getting regular 7-8 figure pay days is definitely doable and you have a colossal advantage by getting this internship so young.

Not accurate, over-optimistic about Jane Street earning prospect.

Prop trading is an area where salary don’t have stable increase as your experience goes up.

ibanking, on the other hand, has stable increase in salary over years. VP level is stable 700k, MD level is stable 1-2 million, not to mention buyside which give people 1-10 millions of carry.

That’s why I said it depends on them and their ability. 1-2 million when you’re in your 30s and have given up years of your life doing simple work is ok, but JS gives you the opportunity to make much more.

i said opportunity; people in this forum are seriously risk averse. OP shouldn’t be. PE is also incredibly boring and the comp only gets decent when you’re old as shit.

take risks if you want it all.

Yeah this is accurate. JS pays way more out of undergrad because they hire people with actual hard quantitative/coding skills whereas IB/PE hires anyone and trains them up. People look at JS comp and think it scales like IB but this isn't the case. The top fundamental HFs usually make more than the top quant shops. Obviously JS is still a top way to make a ton of money but its not like its a level above the PE/HF route.

FTP (140k base btw)

My buddy works remotely at Meta for 9-3 or 4 pm for $500k. So encourage you to go to tech

JS has a more relaxed culture compared to some of the other Quant shops but still maintains a top reputation in the industry and extraordinarily higher pay than Centerview. As a CS major myself and Quant Trader who did a summer in IB I felt like QT was significantly more aligned with my interests and academic backgrounds compared to banking, so I would do some soul searching and think about what you want to actually be doing for 10+ hours of your life every day. If you have a passion for markets and solving complex problems then I’d go with QT, but if you want something more traditional finance and people oriented then IB may be the route for you. Also if you do QT you can go to FAANG afterwards but will be tougher to do the other way around unless you want to be a quant dev.

This is between JS and CVP. You can always go to Meta later.

Fair

Damn...if this is a real post, congrats dude, that's extremely impressive.

IMO, this is a no-brainer decision...take Jane Street and run. That shit will literally set you up for life. I'm talking making 7 figures in just a couple of years and work-life-balance is much better than at those other 2 places.

Also, since we are on WSO "prestige" should be taken into consideration and quant traders at Jane Street are viewed as some of the best, although you won't have that much layman prestige, but who cares about that tbh.

Edit: wanna give a quick shout-out to the guy that went ahead and just downvoted about 10 of my comments across random topics/threads, thanks buddy

I see, thanks for the opinion! I agree that JS seems to be the more appealing option right now, but I’m still figuring out if I’ll truly enjoy the day to day work.

Same my man. People on this forum can't accept that a much harder to break position at JS (where you might earn half a milli your first year while working half the hours) is better than a top IBD position (where you'll constantly get your cheeks clapped and have constant anxiety for every second you are away from outlook)

Just comes to show how deluded the WSO monkeys are. Centerview isn’t going to maintain optionality for any career options that this CS kid (who’s smarter than me and ~95% of the people on this forum) might consider down the line. Take the fat paycheck at JS (or meta if you really want a chill experience) and run.

I wouldn’t be starting a first year analyst stint at an EB right now if I’d had the same options as this person!

Take JS. Majority of the people advising to take CVP are in banking or PE, and CVP / Megafunds are the paths to unabated paradise apparently. Generally, bankers or bankers-turned-PE are risk averse and not the most creative in their pursuits towards income, so it's understandable that they would push CVP.

That makes sense, thanks

Congrats. Do you have any tips on getting better at math?

Hmm, I did a lot of competitive math in high school so that definitely helped. I’d say take some probability theory or stochastic processes classes if possible? Problem solving is always useful. Good luck!

Dude is this even a question. It's 1000000% Jane Street. JS is Platinum, CVP is Gold, and Meta is baby vomit. The ONLY place in the quant world that is better is RenTech. TwoSigma is likely tied with JS. You will be set for life man

Also to FlyingBoat who's accusing people of pointing you to JS just because they want lower competition -- I would NEVER work in IB, ever. Mid-20s and very happy to stay in AM forever. How in the world is saying JS is better than CVP somehow a terrible thing? CVP will grind you (granted, less than some other IBs) and the 'exit opp' thing is merely a way for people who don't make independent decisions to justify their choices

Edit: Lmao some sad loser got so angry that I said exit opps were for people who can't make independent decisions that he MS'd me with a bunch of alternate accounts (I saw the notifications appear one after another in 20min even though I made the comment yesterday). I stand by my words 100% you little shit, keep em coming

Disagree. The top rainmakers in finance will always be fundamental hedge funds and PE partners, not math nerds. Math nerds can get very well-off, but not on top of the pyramid. CVP ibanking lays the foundations for all high finance with fundamental methodology, and in high finance, quants aren’t even comparable to bankers and investors.

You could always pick up math skills by attending a phd program, but ibanking is the only place where you can learn the secrete recipe of wealth — M&A synergy, valuation, leverage finance. Ibanking will give you access to real generational wealth and connections with higher-up executives or even political figures. It’s a different social class.

Quant trading is essentially using math techniques to cheat the whole finance hierarchy system. Yes, it’s a shortcut to 400k TC right out of undergrad, but taking shortcuts will always cost you in some other ways. When you age and you brain power declines, your math acumen will always fall short of young folks in their 20s, and you’ll find it really hard to even go back to your prime days, not to mention gaining steady pay raise. You’ll regret that you went for that 400k quick money instead of a long-term steady career growth.

Yeah, I appreciate both of your comments. I’ll have to figure out what my goal is / what I prefer, thanks!

Lol my 'old' uncle is a PM at a prominent quant firm (think JS, DE Shaw, Tower Research) and he has had enough money to retire for over 10 years when most people in PE are waiting for their carry to be anything substantial. You can't pick up math skills out of nowhere and top PhD programs don't accept just anyone. People who go into quant trading/research do so because they enjoy math. You'll likely have to get a PhD down the line to move from quant trading to research where you can earn much more than a trader, but with JS on the resume I assume getting into a good PhD program wouldn't be that hard.

You have to ask yourself what you enjoy more OP. Do you want to listen to these twats tell you that your math skills make you a nerd and you won't be part of the same "social class" or do you want to be the like of Jim Simons who has consistently beaten the market because of his and other nerds' math skills. If you enjoy math and don't want to have 30+ years of career with assholes telling you how great they are, while they consistently try to backstab you (this is what they call "type A personality" at banks), take JS. If you really think that this guy's words have any merit and want to be part of the "zoo" (in the words of Grigori Perelman) where 18 year old college finance/business majors might one day jerk off to your name, enjoy being an asshole.

-

You clearly know very little about the quant world lmao. JS > 2S by almost any estimation.

A friend sent me this and I literally made an account just to beg you to take JS. You likely already know your starting TC will be almost 3x higher at JS. In my experience, your pay will scale very nicely in most cases, wlb will be great (definitely MUCH better than banking), and attrition is much lower in the industry than people make it out to be. I would be more worried about intern --> FT conversion than FT trainee --> junior trader. Getting JS is an incredibly difficult accomplishment, just off personal experience I'd say it's a fraction of a percentage likelihood a priori. Also, there's no non-compete at JS for FT, the downside is incredibly minimal.

Edit: Also if you don't cop a return, JS is a good enough name on your resume to get your interviews with other top shops

Right, I understand. Thanks for the heads up regarding the FT conversion!

You got an offer at jane street so You have a pretty good idea what the expected value of each choice is long term so I wont get into that.

At the end of the day, these are very different jobs, if you want to go into private markets and enjoy corp finance take CVP but if you want to go public markets and enjoy trading then take JS. Both are crème of the crop.

I had to choose between a BB IBD vs BB trading offer and chose trading because I was more passionate about markets and found the role stimulating, I couldn’t see myself in banking. You should know what type of person you are.

Meta is such a beta name. A bunch of isolated geeks in their echo chamber thought the metaverse is actually a good idea.

Can’t wait to watch FB go bankrupt in the next decade or so.

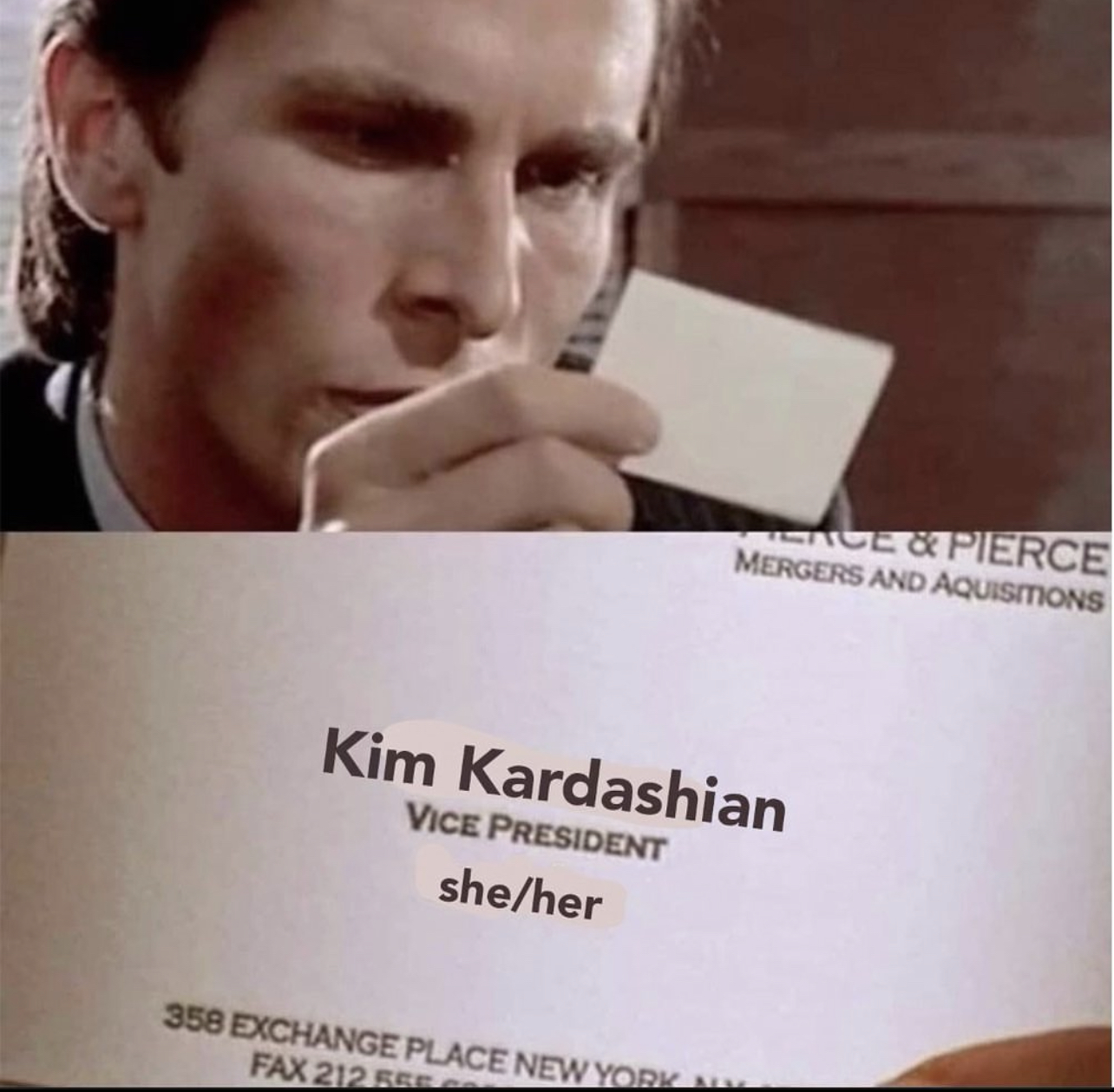

Intern at Jane Street then go work fulltime at Kim Kardashian’s PE firm and become a Partner in less than 3 years.

Is it just me or are 90% of these accounts bots? Jane Street is amazing, but it is not “obviously” the better choice. JS and CVP offer two very different career paths in terms of scope and day-to-days (although I will say that JS from CVP is an option) and it is up to you to decide what kind of work you are more interested in. If you legitimately enjoy quantitative research, and you can get a sense of whether or not this is true from academic research opportunities at your school, then Jane Street may be the better fit for you. If research is not a key obsession for you, CVP may offer a wider range of future opportunities that you might find more fulfilling.

I would not base your decision off of starting compensation. There is a lot of misinformation in this thread (seriously, “guaranteed” 8-figure years at JS? Its like I’m over-hearing hyper-stimulated math club kids in a high school cafeteria). Over a period of 10-15 years, the two opportunities will net you a very similar sum of money. You should focus on the depth of your interest in scientific research-based labor because you can and will burn out fast if that style of work is not your cup of tea.

Yeah, totally agree. I’m not a huge fan of academic research, but I don’t know if I’ll enjoy the life of a banker better. Thanks for the comment!

Just so you know, your choice is not quantitative trader vs. banker. It is in fact: the career path that follows from a stint in banking vs. the career path that follows from a stint in quantitative trading. You don’t have to be a career banker by taking the CVP offer. A very, very large number of former CVP analysts go on to work at premiere hedge funds, growth equity shops, you name it. I would not let the idea of becoming a career banker (which I agree, I personally would not have wanted to do) cloud your judgement here.

The median pay for traders at JS 3 years in is low 7 figures. It does tend to cap around there too, though.

I am not very knowledgeable about Centerview, so take any references I make to it with a grain of salt. I also agree with what everyone says that you should go with what you truly see yourself doing.

No disrespect intended to the real bankers for my incoming advice that will border on arrogance, but this is just to offer conviction to help a kid on the fence decide.

If it is truly a toss-up, I wanted to emphasize the contrarian take that JS is actually the LEAST risky option. I am always annoyed when people parrot catch-all advice on prop trading firms to it. It's advice like that that mistakenly dissuaded me in my own career decisions earlier.

First: Your SHORT-TERM CAREER will be more stable. Unless I'm ridiculously out of touch, I'm pretty sure JS is one of the prop trading exceptions where you are NOT likely to get fired right away. Many/most prop trading shops are cut-throat. Almost every other elite one (almost as selective/well-known) hire a ton of kids just to fire them. As far as I knew/know, Jane Street is NOT one of those places; they look to get it right at the beginning. You'll get paid a lot because you'll make a lot. It's a highly collaborative place that has built a money printing machine where its talent is its people. Most likely you will make a lot right out of the gate, continue to make more than you would anywhere else, but still make them many more multiples what you actually get paid... ie, theoretically if you were somewhere else doing the same thing with a big cut, you could be getting paid more, but that's assuming that place has a good enough infrastructure to pull it off, that you have the same calibre of coworkers, etc. Now I can't speak for Centerview (which may or may not be up-and-out), but if you don't royally screw up at JS, I think you're pretty safe because the firm is that good, and they do not have the churn-through-juniors mentality that others do as part of the design of their business model.

Second: Your OPTIONALITY is higher. You can EASILY go from JS to Meta more so than in reverse, not just as a SWE, but also as a quant trader, because you'll be more than sufficiently technical in your role. You're telling me someone who passed JS's legendary battery of interviews, who uses a functional programming language (OCaml) all day and is constantly solving problems, can't leetcode their way through some easier technical interviews in whatever the language du jour is? I can't speak to CVP <-> JS as that's not very common, but I would imagine bankers have more respect for the intelligence of a quant trader than vice versa, and bankers would think a quant trader has less social skills (not that they care, and not that that's always accurate). I would imagine it would be at least as difficult to convince JS you're a technically smart banker than it is to convince CVP you're a highly social and hardworking quant trader who can crank in the meantime, and one day earn fees for them. People are acting like you can just come right back and recruit for JS. I'm going to say I doubt that, if you're not already in the space. There are several prestigious prop trading firms that are unlikely to give a banker candidate a look, because they have so many hundreds or thousands of cheaper, hungrier college grads that they can be picking from.

Third: Your LIFESTYLE is better. Meta might be nice now, but I think a lot of the day-to-day is very boring, dealing with standups and the BS of a large company in order to get free food or work remotely or whatever. But I bet the perks drop off from there way sooner than they drop off at JS if it hits the fan. I think there's no chance the lifestyle at Centerview is better or even close. I don't know a single trader at my level who wishes he would've went into banking, and generally we all feel we have it the best of any comparable career we could've picked as an employee. It isn't "ah well the money's slightly less but at least we have a better lifestyle"... it's like, no contest, I had a barely-worse-lifestyle compared with tech while having the outsized comp of finance, and having brilliant peers to boot while building a transferable skill set, and thank God I had the aptitude for this. Yes, your next step might not be trading, but your technical skills will suit you well for a working world that is becoming increasingly quantitative and programmatic.

Finally: Your LONG-TERM prospects are likely better. You won't need to "waste" two years at business school, you don't need to restart joining a new firm and building new skills as a new cog. If you crank hard, in your late twenties, you can have enough money to start your own business. I became a millionaire in my mid-late twenties in a high cost of living city and it was not "hard," the "hard" part was all of the work I did up until this point in my life becoming a person that a quant trading firm would want to employ when I finally discovered what that world was. Then it was about putting in the work with the opportunity I was given until it was time to take the next step. You're already there, so you should take it.

Once again, if you can honestly see yourself as a banker, go for it. I had thought that too in college because I was significantly more social than the other math majors. In hindsight, it wasn't even close, I would've been a crappy banker, and instead I became the outlier that my peers told me I couldn't hope to be. Don't let people talk you out of JS for it being "too risky." The real risk is that you don't live the best life YOU can because you're getting talked out of it by others who never had that choice to begin with.

this. this thread is filled with people who never could've gotten JS offers trying not to feel bad about having missed out on it, living vicariously through you by telling you to take CVP

Thanks, imo this is the most insightful and helpful comment so far. I did my internship this year at Meta, was alright but not super exciting. I cannot envision myself as a career banker, but mostly since I’m not familiar with the banking industry. I agree with everything you said, and I think after hearing so many different opinions, it’s really difficult to pass up the JS offer. I appreciate the time you took to respond to a stranger’s comment on the internet!

You really shouldn’t trust people on the internet. You would base the most important decision that sets the direction for your whole career on the opinions of some anonymous strangers on the internet? Go talk to your alumni in Wall Street. They will all vote for CVP ibanking.

Notice FlyingBoat is commenting a ridiculous amount of times to get you to drop JS -- talk about ulterior motives. I'm not going to push my thoughts on you again, I've said my piece above earlier so you take everything into consideration and make a decision. Best of luck, you're going to have a bright future

why can't he spend 2 years at JS hate it then apply to be a first year at an EB. If you take CVP...grave mistake

EB won’t take you without previous ibanking experiences. The undergrad internship is the one and only path to full-time ibanking. They recruit 80% of their full-time hires from their own internships, the rest of 20% are laterals from other banks’ internship programs. You have close to zero shot if you don’t have an ibanking internship.

Jane Street, on the other hand, quiz you with math puzzles, and they’ll take anyone who clear their math interviews without looking at their internship experiences. You can always get into Jane Street as long as you have the math skills, but you cannot get into CVP without concrete ibanking experiences and connections.

Meta obviously shouldn't be on this list. I don't agree with some of the CVP > JS responses...

I'll concede the point that FT at CVP is probably harder than JS without an internship.

That said, there are plenty of comparable experiences in banking at other shops and many banks have recently been more lenient hiring into FT roles without banking internships. There are maybe a handful of JS peers whereas there are far more EB / BB banks (and spots).

I say JS internship (even if return offers are sparse your odds are still marginally better) > CVP (yeah, you probably won't break into CVP but you'll have more comparable options).

A lot has already been said but do realize that Jane Street Quant Trading return offer rate is pretty low.

Even if you are a top candidate right now, you will be competing against a lot of other top candidates for the 50-60% return offer rate.

As someone who also comes from a tech background, I'd advise you to take CVP here UNLESS you value wlb a lot. CVP wins out in everything else you mentioned even compensation. The amount of people who can earn millions in tc in hft firms is far less than the amount of people who can earn millions in PE and fundamental funds.

As someone who’s worked at CVP, NOT true for higher compensation. The information on this site, which is geared towards recruiting for investment banking, will always try to point you to a career in investment banking. Take Jane Street for better WLB and comp.

Maybe true. If you're a top performer at jane street you would definitely have better career earnings than if you spent your career at centerview, but you have to realize that you are competing against tier 2 (most tier 1 math/cs students I've seen go to do phd) with some tier 1 math/cs students. Its no easy feat and just putting in the hours or work won't cut it. Its not easy and even getting the return offer is not a cakewalk. When you're competition is as high as it is in js qt then the 50-60% return offer rate is relatively risky. Of course OP could then re recruit for basically anything but its still something to take into consideration.

Take JS. People saying to go to banking instead are out of their mind.

Another conspiracy to push competitors out of ibanking industry. If you genuinely think JS is better, then why are you in PE right now ? If JS is indeed better, then why are people asking about “how to get into ibanking“ all the time instead of “how to get into Jane Street” ?

Literally everyone on this site is grinding top schools & grades for ibanking, yet most of them point you to Jane Street, which proves my point: people are pushing away strong competitors like you to other industry so that they can snatch an offer !

Also, a lot of top math major students who have absolute perfect grades end up choosing ibanking. Anyone who studies hard for one or two advanced statistics / calculus course can go through Jane Street, but only the top few elite students who are well-rounded, athletic, out-spoken, sociable and likable can break into ibanking.

LOL

My brother in Christ. I’m already working at a PE firm; I have no incentive to try to mislead a college kid on WSO to save a spot for me at the paradise that is centerview partners, don’t worry.

You seem unhinged. You’ve commented several times on this thread already accusing people of this, your entire post history is absurd, and you obsessively post about finance even though you apparently are in law school and don’t even work in finance/never have worked in finance ???

OP, ignore this guy. From someone who actually knows what they’re talking about and has worked in the industry, JS is just a superior position unless you hate math. Way better hours, way more interesting work, and way better pay. Plus a lot of JS people do cool stuff after; a lot of interesting companies founded in ML/fintech.

I hope you are going because you sound like a total twat, and are borderline delusional.

Jane Street is categorically, infinitely, genuinely 100x harder to get into than ANY bank. I’ve seen multiple people who are their smartest for their age (think top of their class at top 5 universities globally) get rejected from JS multiple times over.

The average investment banker can only dream of getting into Jane Street, albeit passing their first or many rounds. They are simply too stupid. Myself included - I am in IB and could never dream of getting into Jane Street.

If you know you’re more than competitive in the quant space, then pursue that. Jane pays extremely well, and it’s exciting work

How would I know I’m more than competitive in the quant space? I’ve heard it’s very performance driven and I’m not sure if I’ll be able to out perform my peers…

The only way to find out is to try lol. And the name will look great on your resume even if you don’t get the return and you can go to another shop like IMC and still make bank. Or go the Faang route if you want to chill

Let me give you an analogue between company and college

CVP - Amherst

Jane Street - Stanford

Meta - UC Berkeley

Your choice.

Btw, the comments made by that FlyingBoat guy do have some valid arguments , but his motivation is very questionable.

Do you think he’s on the JS waitlist or bitter he couldn’t get in?

Also, why does your post already have 10 MS.

Probably because the colleges analogy is dumb AF.

Wow--congratulations first of all! You're sitting in my dream spot. 1000000% CVP or JS--in regards to exit opps, def CVP. Yes, banking is banking but CVP's culture is known to be one of the best within banking. Really can't go wrong with either, especially with Tech M&A CVP. However, look into return offers and where past interns in the exact position as you ended up. Reach out to previous interns at both and speak to them about their experiences--especially those who didn't return (either they chose somewhere else or didn't get the return offer).

Great advice, thank you!

I would take Jane Street. If you're slaving away at CVP is that JS offer there later on? Who knows. But even if you realize JS isn't for you going back to IB is going to be much easier, even if you have to start fresh as an AN1.

Like look, I know I'm not smart enough to work at Jane Street but banking is well, banking.

I see, thanks!

If you are actually a good programmer I would take meta. You can coast and make significant amount of money. If you are average I would just take centerview.

Just curious, why not JS?

Can speak from experience, CVP tech will grind you hard.

If you have the opportunity I would take the better work-life balance and enjoy the beauty the country has to offer instead of coming out of the office every day only to see the sun in the morning on the way to work.

Fair point!

I'd pick JS any day of the week.

But if you want more a "traditional path" go CVP.

Hmm, I’m not sure what I want to do though :(

Jane Street by a mile, CVP second, Meta third. Congrats on some excellent offers

Thanks!

Meta without a doubt. EB’s and BB’s treat their Software Engineers like 2nd class citizens.

What do you think about Meta in the current climate though? Why not JS?

OP’s resume has to be insane

Not really lol

Take JS, that is 10x harder to get than CVP and similarly more desirable imo

Really? Is JS harder to get into than CVP? I feel like if I were to do it again I’ll have a higher chance at JS just because I’m a CS major without much finance knowledge…

Really? Is JS harder to get into than CVP? I feel like if I were to do it again I’ll have a higher chance at JS just because I’m a CS major without much finance knowledge…

Yep, Jane Street is really hard to get into and I believe more so than CVP. Literal quantitative prodigies. I could be reborn 5 times and I don't think I would be born with enough talent to get in tbh.

JS. If you’re looking for longevity and street cred and

long term upside. Meta is just a name. It doesn’t compare.

Okay, thanks

.

Without going into much detail, I have an intimate understanding of both places.

These are very different places.

At CVP, you'll find extremely polished, well-spoken, well-rounded, hardworking people. A person at CVP went to a top prep school, is well-dressed, was the captain of the Yale fencing team or past high school debate champion and has a dad on the board of a Fortune 500 company. They studied something like economics at Dartmouth. You'll meet someone who, if you're lucky, will invite you to their parents place on the Hamptons on the weekend. Or, maybe, you'll meet the kid from the state school that can grind but also gets drunk on the weekend (or you'll be that person yourself and wonder: am I in the wrong place?). Half of your colleagues are female and you can't help but notice how everyone there is more good looking than the folks at Deutsche Bank or UBS. You'll find a kid that has a trust fund but decided to get a job anyway due to their ambition, but also the kid whose parents grew up on a farm and is living the American Dream. You'll meet someone there that ignores you and treats you like a peasant because their dad runs an M&A arb fund, but also someone who got a need-based full-ride at an Ivy and somehow knows the answer to every question in Jeopardy. The founders of CVP are among the most impressive and inspiring people you'll ever meet and, even if you don't like investment banking, you can still appreciate truly remarkable leadership in starting what is one of the best places to learn M&A on Wall Street. Blair is charismatic and cares about his people. He's the most brilliant, passionate and effective dealmaker on Wall Street and would have been treasury secretary had Hillary Clinton been elected. Somehow the guy eats Fig Newtons for lunch every day but is still is an energizer bunny with no signs of aging at 50. Does he have good genes? Is he an alien? Does he take an IV every morning with special chemicals that make him a god among men? The world will never know. The VPs and Directors will generally all be sociopaths like at most banks and you'll work until 2am on most nights. If you get out early at 11pm, you'll call your mother one day and silently think about how you want to kill yourself when she tells you she'd love you even if you quit your job there. Your mental health will suffer and you'll visibly age from a lack of sleep and excessive use of Adderall. Every deal you work on will industry changing and involve billions of dollars of money and after you leave you'll be almost certain to get an excellent job at a top upper-middle market PE fund or $1-10B AUM hedge fund. Every month, you or one of your friends will work on a deal that is on the front page of the New York Times or Wall Street Journal. Part of you will think about the fact these HF/PE investors don't really beat the market risk adjusted and that M&A often destroys value for acquirers Your first year you'll out earn $200K all-in including their signing bonus which will make you outearn all the other banking analysts on Wall Street. Afterwards, you'll edge your way up to $400K over the next 4 years. If you go to business school, it's HBS, Stanford or Wharton.

At Jane Street, you'll find utterly brilliant, quirky, quick-thinking and borderline-autistic people. This person was among the best 1,000 math students in the world in high school. They are poorly dressed and wear cargo shorts. They studied a real degree like applied math or physics at a real college like MIT or Princeton. They have an awkward laugh and like playing Settlers of Catan. On the weekend, they might train a computer to play Go and compete worldwide in an artificial intelligence competition. The person that sits next to you might be worth $100M, but you'll never know since salaries and even titles are kept top secret. The person on the other side of you will have a PhD from Stanford and smell so bad that you feel nauseous at work sometimes. You're afraid to say anything, because what if he also is worth $100M and is, like, really important? Everyone is betting on everything all of the time. Some kid will be wearing a sailors cap because they lost a bet and they shaved their whole head. Another will have to wear pajamas all year as punishment for the same crime. In the morning the trading floor will make a casino sound quiet. You will go to the bathroom and some guy will be there without his shoes on while the kid beside him in the stall is reading SlatestarCodex or an old LessWrong article. You'll silently wonder how the autistic kid got the job after hearing him make wookie noises, but you're too polite to actually say this. Then you'll hear him actually speak about a linear differential equation and you'll see why -- how is everyone here so brilliant? Honestly, good for him. You'll be proud to be at a firm that celebrates neurodiversity. Some kids there will looks patrician and you figure they probably went to Phillips Exeter Academy or something, but you know he got the job on merit - everyone did. It's a highly meritocratic place.

He'll afterwards sit next to you in trading simulation but he'll get up and leave, exasperated that he couldn't use Linux the linux shell terminal and Windows powershell. Ugh, nobody likes powershell! The founder of the firm wears black combat boots and has long ponytail. He doesn't sit in a corner office, but sits alongside some 26 year old that trades an obscure European derivatives product. He doesn't even have a title, but you know he's a badass and is easily a multi-billionaire (which somehow has remained a secret to the world). According to him, the unofficial motto of the firm is "we suck," which is ironic for one of the most successful proprietary trading firms in human history. The firm often prides itself in having humble people. This probably isn't true. They know they are not just smart, but fucking smart. At JS, you'll have a good life. You don't get fired because the IP of the firm is too valuable and you don't leave because you just make too much money. You don't get grinded and if your mental health suffers it'll be due to insecurity, not overwork. You'll do a homework assignment on options pricing and your teaching assistant will look at you like you're a complete idiot if you don't remember partial differential calculus from college. Sometimes you're embarrassed to show up to work, but you're also energized by how ridiculously brilliant everyone is. Your work probably doesn't matter morally - you are "making markets more efficient" whatever the fuck that means. You're taught that you winning doesn't always mean someone else loses and trading isn't zero sum, but in reality you know you're mostly just playing a game. Your impact on the world is making a bid/ask spread a bit tighter than it would be otherwise, making it slightly easier for others to trade. I mean honestly - who gives a fuck. You try not to think about it. Or you decide to be one of the effective altruists there that donate all their money. Probably you don't care about your impact since you just make SO much fucking money, more than any other job in finance, full stop. Your first year, you'll make what you'll make 4-5 years into your career if you start at CVP. Once you are 5-7 years into your career, you will with HIGH PROBABILITY make compensation similar to a senior analyst at a Tiger Cub or a MD / partner megafund PE firm. There are partners there that are 26 years old, including (and particularly ones) that are kids just like you. You'll wish you were him sometimes, but you'll know you can't be - not because he has family connections you don't have but because he's probably just better than you. There is a compensation flatline at JS about $1.5M, but that also exists at even the best HF/PE firms. To make past this amount, you need to have special balls that honestly you won't know if you have until 10 years from now.

Also, don't take Meta. This is clearly the dumb option and you would be a true fucking idiot to work there given the other options.

This is amazing!

Wow, this is the best of all time. Amazing.

This is awesome. I agree with most everything said.

I was almost exactly in your shoes not too long ago. They are two great firms but for very different reasons. As someone who is very much both of the personas described above folded into one, I wonder from time to time if I made the right choice (but know if I was in the other seat I’d be asking myself the same thing). I still do machine learning and quant trading on the side for what it’s worth, and feel like I’ve struck as close to the perfect balance as possible. In the near future I’m even planning to do some entrepreneurial stuff with an ML project I’ve been working on for years. Something I realized is that you can always do the math or programming or quant trading (all that matters is merit/intelligence regardless of age/background), but with banking/PE you really only have one real shot if you have ambitions to land the top seats. Best of luck. You’re in a great spot.

Natus libero ad omnis asperiores. Fugit id voluptatem quo nihil recusandae. Dolores qui cupiditate ducimus ut amet in aperiam velit. Amet quasi excepturi atque.

Est cum hic perferendis sed. Aspernatur aut dignissimos et. Et incidunt repudiandae et.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Atque recusandae perspiciatis non quo aut alias. Blanditiis earum omnis itaque eligendi consequatur et recusandae repellendus. Officiis ut commodi amet. Sit sit ab sit itaque sint.

Ad expedita maiores voluptatem tempora qui. Vero est possimus voluptatibus tempore rem deleniti et. Accusamus culpa vel ipsa rerum dolor blanditiis harum.

Iusto quas occaecati assumenda nihil sed. Laudantium illum aut iusto voluptates quisquam.

Esse dolor consequatur at rerum et. Qui harum sunt non voluptatem qui. Iste nam sint saepe recusandae quia et. Amet et autem nisi dolore velit. Voluptatibus nisi velit sint delectus. Voluptatum nulla est vitae harum repellat explicabo nisi. Placeat id aut voluptatem facere dolores.

Incidunt exercitationem voluptatem tenetur. Rerum nulla vel quis officiis ut sed et officia. Expedita assumenda voluptate beatae amet fugiat aperiam mollitia. Aliquid ipsam velit est.

Molestiae vel cum reiciendis ratione incidunt omnis. Rem aut aliquid cupiditate et. Autem velit tempora omnis at reiciendis non.

Animi veritatis quidem dolorum eligendi. Exercitationem voluptas reiciendis unde natus sed.

Dignissimos reiciendis sapiente aut explicabo voluptatem cum. Eaque repellendus modi eos consequatur quaerat.

Qui quae perspiciatis amet blanditiis. Et necessitatibus adipisci sequi dolorum. Blanditiis est quo quaerat veritatis reiciendis blanditiis deserunt. Laborum veritatis repellat ut sunt recusandae eius.

Atque aperiam ad ex omnis nihil. Doloribus non nemo sunt et consequatur.

Odio minus quod ut nobis. Sed odio occaecati aut nisi tempora nihil rerum.